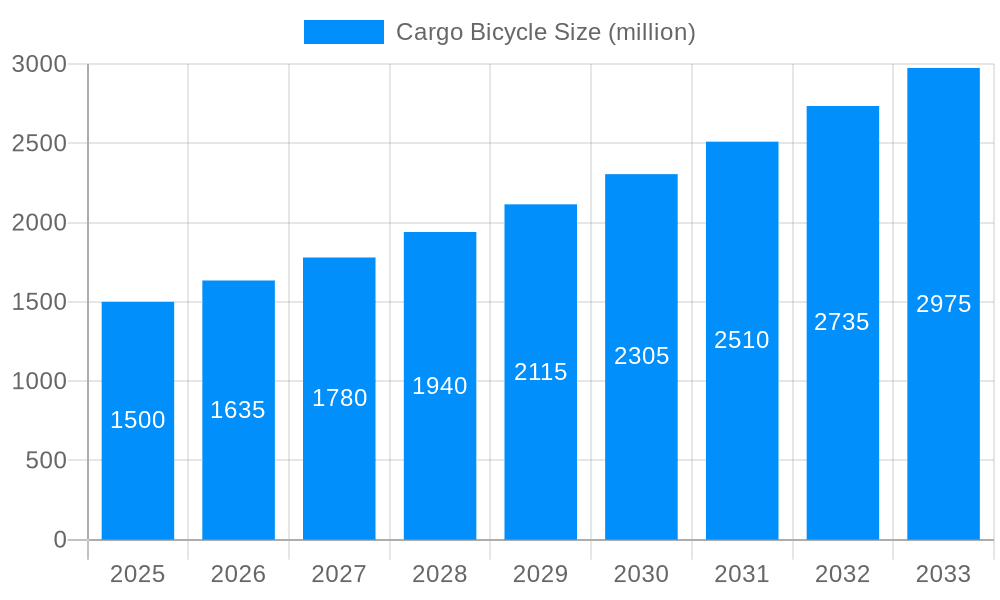

1. What is the projected Compound Annual Growth Rate (CAGR) of the Cargo Bicycle?

The projected CAGR is approximately 10.1%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Cargo Bicycle

Cargo BicycleCargo Bicycle by Type (Electric Cargo Bicycle, Regular Cargo Bicycle, World Cargo Bicycle Production ), by Application (Family, Commercial, World Cargo Bicycle Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

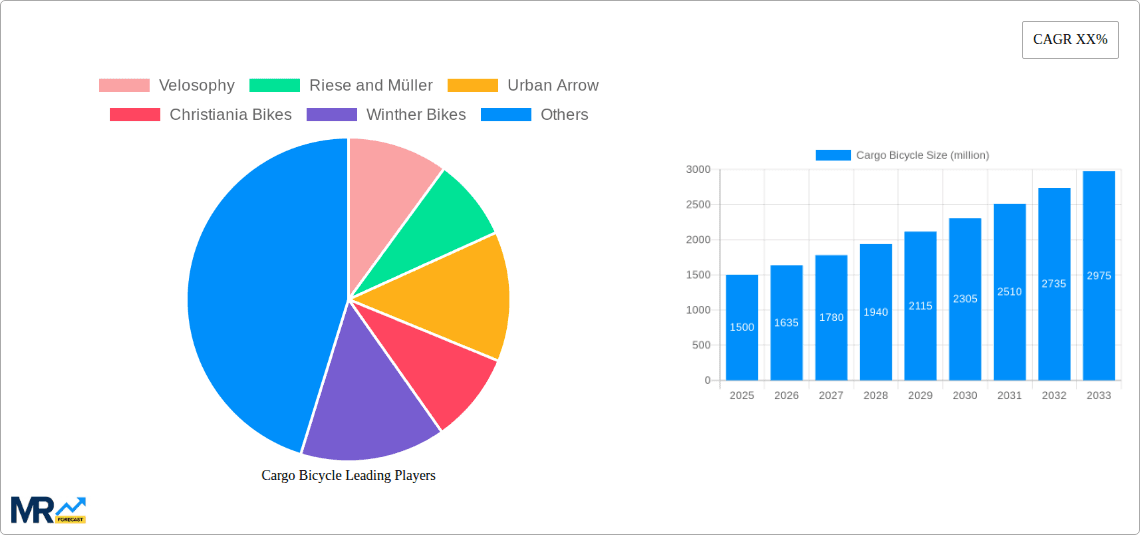

The global cargo bicycle market is experiencing substantial expansion, propelled by escalating urban traffic, heightened environmental consciousness, and the demand for eco-friendly last-mile logistics. The market, presently valued at $84.25 billion in the base year of 2025, is projected to grow at a Compound Annual Growth Rate (CAGR) of 10.1% from 2025 to 2033, reaching an estimated $84.25 billion by 2033. Key growth drivers include government incentives for cycling infrastructure and electric bicycle adoption, alongside the increasing popularity of cargo bikes for both personal and commercial applications. Consumers are increasingly recognizing the efficiency, affordability, and environmental advantages of cargo bikes over traditional vehicles, particularly for transporting children, groceries, and goods within urban settings. Innovations in battery technology and motor integration are further enhancing the utility and appeal of these bicycles. Within market segments, electric cargo bikes are witnessing remarkable growth due to their capacity for heavier loads and extended range. Prominent manufacturers such as Velosophy, Riese and Müller, and Urban Arrow are spearheading innovation and influencing market trends through their varied product lines and expanding distribution channels. While initial acquisition costs and limited range in certain models present challenges, continuous technological advancements and government subsidies are actively addressing these limitations.

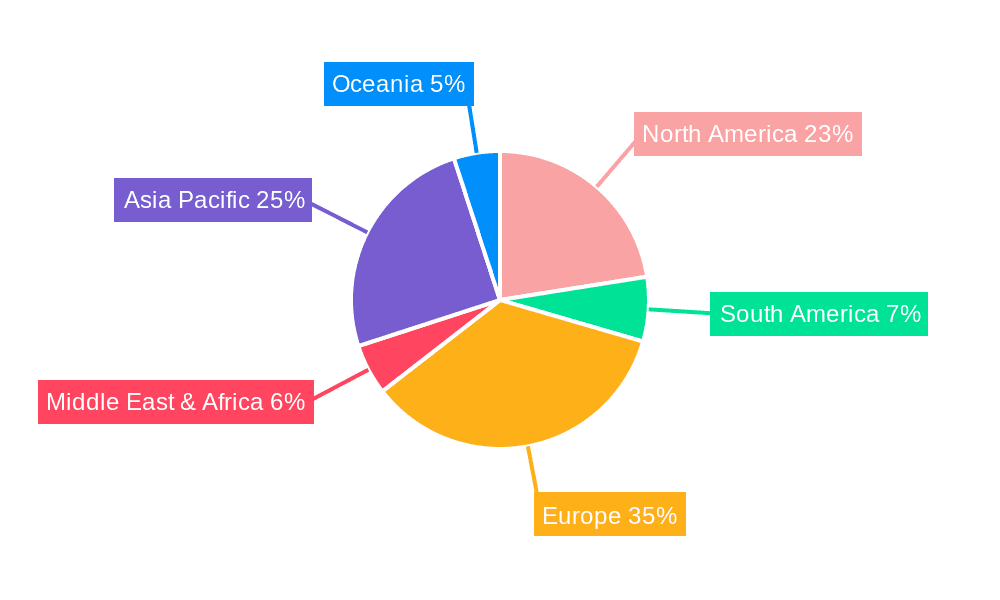

The competitive environment features a mix of established companies and innovative startups, fostering a dynamic market characterized by ongoing innovation and product variety. Regional market dynamics vary, with North America and Europe currently leading, although significant growth is anticipated in the Asia-Pacific region, driven by urbanization and government support for sustainable transport. Research and development initiatives are concentrating on refining cargo bike designs for enhanced ergonomics, safety, and expanded functionality, leading to broader applications beyond personal use, including last-mile delivery, courier services, and specialized uses in tourism and hospitality. The long-term forecast for the cargo bicycle market is highly optimistic, supported by consistent demand and the escalating global focus on sustainable urban mobility solutions.

The global cargo bicycle market is experiencing remarkable growth, projected to reach multi-million unit sales by 2033. The study period of 2019-2033 reveals a significant upward trajectory, with the base year of 2025 serving as a crucial point of analysis. Our estimations for 2025 indicate a substantial market size, foreshadowing even greater expansion during the forecast period (2025-2033). Analysis of the historical period (2019-2024) shows a consistent increase in demand, driven by several key factors detailed below. The market's evolution is characterized by increasing diversification in bicycle types, including electric-assist models and variations catering to specific needs like long-distance commuting, delivery services, and family transport. Innovative designs are also emerging, focusing on enhanced safety features, improved storage capacity, and greater user comfort. This trend signifies a shift towards more sustainable urban transportation solutions and a growing awareness of the environmental and health benefits of cycling. The increasing adoption of e-cargo bikes, particularly in densely populated urban areas, is a notable aspect of this trend. This is fueled by governments’ initiatives to promote cycling and reduce reliance on automobiles, which are crucial for accelerating the market growth. Furthermore, rising fuel prices and increasing concerns about carbon emissions are also playing a significant role in boosting the demand for eco-friendly transportation alternatives, directly impacting the sales of cargo bicycles. This shift in consumer preferences towards sustainability is reflected in the steady increase in the market share of electric cargo bikes, which are increasingly preferred for their ability to navigate challenging terrains and carry heavier loads with ease. The evolving market landscape is witnessing new partnerships and strategic alliances between manufacturers, suppliers, and retailers, contributing further to its growth trajectory.

Several factors are driving the growth of the cargo bicycle market. Firstly, the increasing awareness of environmental concerns and the need for sustainable transportation solutions is a primary driver. Consumers are increasingly seeking eco-friendly alternatives to cars, and cargo bikes offer a practical and sustainable solution for transporting goods and people within urban areas. Secondly, the rising popularity of cycling as a form of exercise and recreation is also boosting the market. Cargo bikes offer a versatile option for both transportation and leisure activities, appealing to a broader range of consumers. Thirdly, government initiatives and supportive policies aimed at promoting cycling infrastructure and reducing traffic congestion are providing a positive impetus. Many cities are investing in dedicated cycle lanes and providing financial incentives for purchasing cargo bikes, making them a more accessible and attractive option. Fourthly, advancements in technology, such as the integration of electric assist motors and improved battery technology, are significantly enhancing the functionality and appeal of cargo bikes. Electric assist models are particularly popular due to their ability to overcome hills and carry heavier loads with ease. Finally, the growing demand for last-mile delivery solutions in e-commerce is creating a significant market for cargo bikes used by businesses for efficient and eco-friendly delivery services. This factor is particularly significant in densely populated urban environments.

Despite the promising growth trajectory, the cargo bicycle market faces certain challenges. High initial purchase costs compared to traditional bicycles or motor vehicles can be a significant barrier to entry for many consumers. This is especially true for electric-assist models which often command a higher price point. Furthermore, limited storage space and the need for secure parking are constraints in urban environments. Finding suitable and secure parking can be challenging, and the bulky nature of cargo bikes can make storage difficult for those living in apartments or houses with limited space. Safety concerns, particularly related to cycling in traffic, also pose a challenge, with many potential users hesitant due to risks associated with navigating busy roads and intersections. The lack of standardized infrastructure, such as dedicated bike lanes and secure parking facilities, can hinder widespread adoption. Finally, the relatively high weight and size of cargo bicycles compared to regular bicycles can present difficulties for riders with limited physical strength or maneuverability. These challenges necessitate a multi-pronged approach to mitigate the restraints and further unlock the market's full potential.

Europe (particularly the Netherlands, Germany, and Denmark): These countries have a strong cycling culture and well-developed cycling infrastructure, resulting in high demand for cargo bikes. Government initiatives promoting cycling further boost the market. The Netherlands, in particular, shows exceptionally high penetration of cargo bikes, particularly among families and businesses, setting a global standard.

North America (especially urban areas in the US and Canada): Growing environmental awareness and increasing traffic congestion are fueling demand in urban centers. However, challenges remain in creating a safer cycling infrastructure and overcoming the higher purchase price.

Asia (specifically Japan, China, and South Korea): Rapid urbanization and increasing concerns about air quality are driving growth. However, varying infrastructure developments and cultural differences impact market penetration rates.

Electric-Assist Cargo Bikes: This segment is experiencing the fastest growth rate due to the enhanced capabilities and convenience offered by electric motors. These bikes overcome the limitations of hills and heavy loads, making them more appealing to a broader range of users.

Family Cargo Bikes: The demand for family-oriented cargo bikes is steadily increasing, driven by a growing preference for sustainable and healthy family transport solutions. This segment is increasingly being catered to with dedicated designs and enhanced features.

The paragraph below summarizes the market dominance: The European market, particularly the Netherlands, Germany, and Denmark, is currently leading the global cargo bicycle market due to strong government support, well-established cycling culture, and advanced infrastructure. However, the electric-assist segment is experiencing the fastest growth rate globally, as it addresses the physical limitations of traditional cargo bikes and enhances their versatility. This makes the electric-assist segment a significant focus for future market projections.

Several factors are catalyzing growth in the cargo bicycle industry. These include increasing government incentives and subsidies promoting cycling, the development of advanced electric-assist technology improving performance and range, and the rising demand for sustainable last-mile delivery solutions in the burgeoning e-commerce sector. Further growth is supported by manufacturers innovating with stylish designs and enhanced features that appeal to a broader range of consumers.

This report provides a comprehensive analysis of the cargo bicycle market, covering historical data, current market trends, and future projections. The report identifies key market drivers, challenges, and growth opportunities, providing insights into the leading players and significant developments in the sector. Detailed segment analysis, geographic breakdown, and future market forecasts are included, offering a valuable resource for stakeholders in the cargo bicycle industry.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.1% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 10.1%.

Key companies in the market include Velosophy, Riese and Müller, Urban Arrow, Christiania Bikes, Winther Bikes, Rad Power Bikes, Xtracycle, Bakfiets.nl, Larry vs Harry, Tern, Pedego Electric Bikes, Yuba, Butchers & Bicycles, Gomier, DOUZE Cycles, Kocass Ebikes, Madsen Cycles, Jxcycle.

The market segments include Type, Application.

The market size is estimated to be USD 84.25 billion as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in billion and volume, measured in K.

Yes, the market keyword associated with the report is "Cargo Bicycle," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Cargo Bicycle, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.