1. What is the projected Compound Annual Growth Rate (CAGR) of the Cargo Airship?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Cargo Airship

Cargo AirshipCargo Airship by Type (Rigid, Semi Rigid, Non-rigid), by Application (Oil and Gas, Wind Turbine Parts, Daily Necessities, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

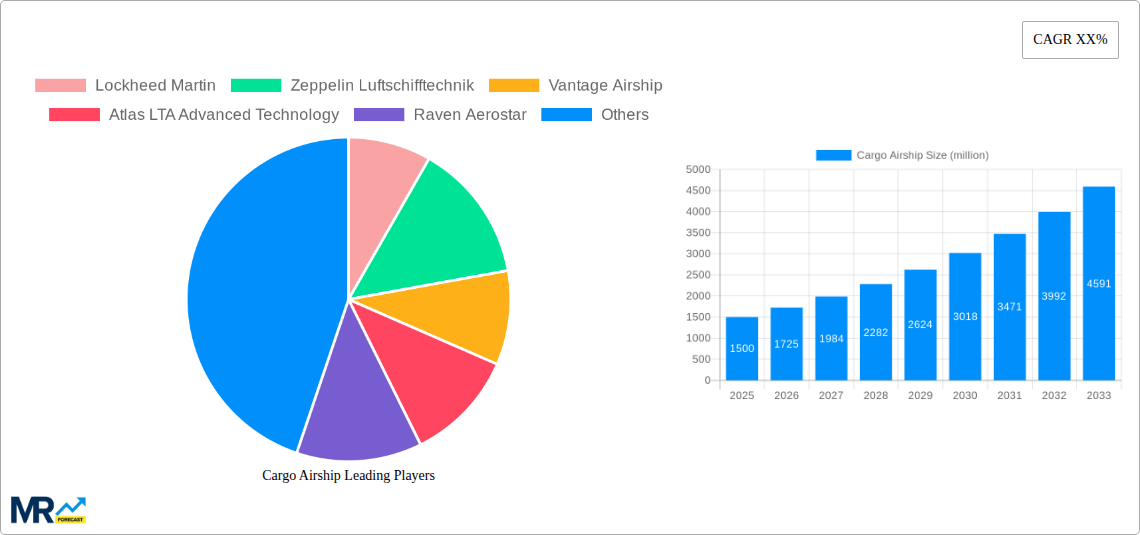

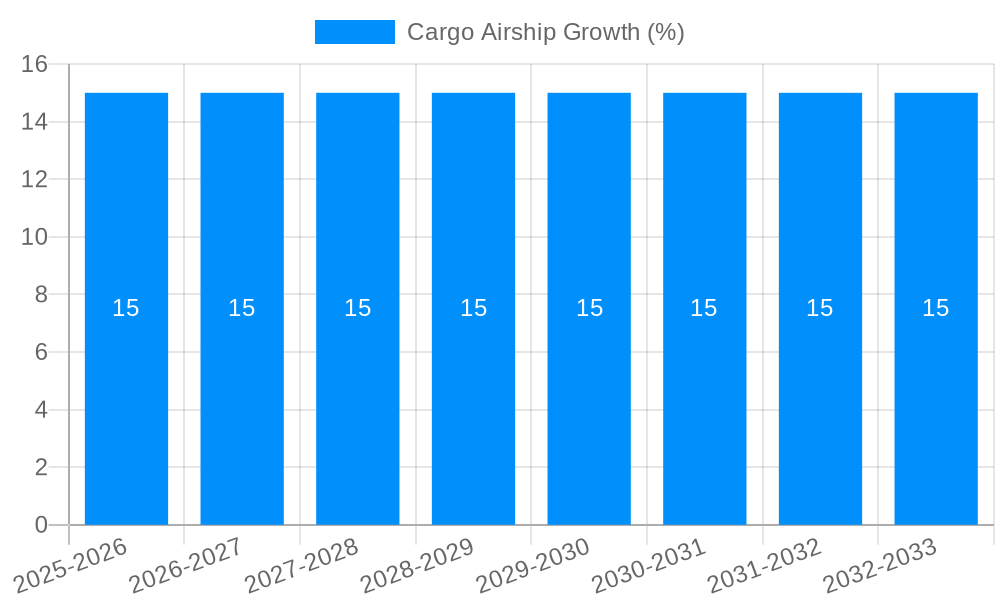

The global Cargo Airship market is poised for substantial growth, projected to reach an estimated market size of $1,500 million by 2025. This surge is fueled by a robust Compound Annual Growth Rate (CAGR) of approximately 15% anticipated throughout the forecast period of 2025-2033. A primary driver behind this expansion is the inherent efficiency of airships in transporting heavy and oversized cargo, particularly in regions with limited or underdeveloped infrastructure. The Oil and Gas sector, requiring the movement of massive equipment to remote drilling sites, is a significant beneficiary. Similarly, the burgeoning wind energy industry, with its increasingly large turbine components, presents a compelling use case for airship logistics. Furthermore, the growing demand for sustainable and eco-friendly transportation solutions positions airships favorably, as they offer a lower carbon footprint compared to traditional air and sea freight. The increasing focus on reducing transportation costs and improving delivery times for specialized goods will continue to propel market penetration.

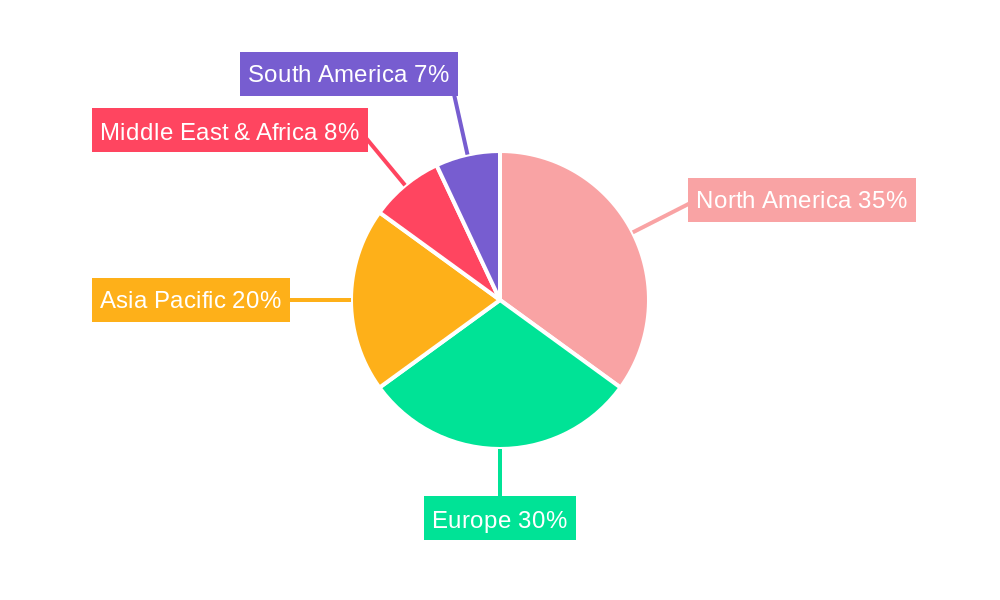

The market is experiencing a dynamic shift with advancements in rigid and semi-rigid airship designs, enhancing payload capacity and operational efficiency. While non-rigid designs continue to hold a niche, the innovation in structural integrity for larger vessels is a key trend. However, challenges such as initial capital investment for fleet acquisition and the need for specialized infrastructure for mooring and maintenance could temper the growth trajectory. Regulatory hurdles and public perception also represent potential restraints, though increasing governmental and industry support for innovative logistics solutions are beginning to address these. Geographically, North America, particularly the United States, is expected to lead the market due to established aerospace capabilities and early adoption of novel transport technologies. Europe, with its strong focus on green initiatives and its own wind energy sector, also presents significant opportunities. The Asia Pacific region, with its vast landmass and developing infrastructure, holds considerable long-term potential as adoption rates increase.

Here is a unique report description on Cargo Airships, incorporating your specified details and formatting:

The global cargo airship market is poised for significant expansion, projected to surge from an estimated $250 million in the base year of 2025 to a robust $800 million by the end of the forecast period in 2033. This growth trajectory is underpinned by a confluence of technological advancements, a renewed focus on sustainable logistics, and the increasing demand for versatile cargo transportation solutions. Throughout the study period of 2019-2033, the market has witnessed a gradual but steady adoption of airship technology, with the historical period of 2019-2024 laying the groundwork for this accelerated growth. The year 2025, serving as both the estimated and base year, highlights the current momentum and anticipated scaling of the market. Rigid airships, characterized by their robust internal structure, are expected to lead the pack in terms of market share, driven by their inherent stability and capacity for carrying heavy payloads. Semi-rigid airships, offering a balance between structural integrity and aerodynamic efficiency, will also carve out a substantial niche, particularly for medium-to-heavy lift applications. Non-rigid airships, while historically associated with lighter payloads, are seeing innovation in materials and propulsion, potentially unlocking new cargo opportunities. The demand for airships in the oil and gas sector, particularly for remote exploration and pipeline monitoring, is a significant driver, as is the burgeoning need for efficient transport of large, bulky items like wind turbine components. The "Others" category, encompassing a diverse range of applications from disaster relief to specialized industrial transport, is also anticipated to contribute significantly to the market's expansion, showcasing the adaptability of this mature yet re-emerging technology. The market's evolution is not merely about increased volume but also about the strategic deployment of airships to address specific logistical bottlenecks and environmental concerns, setting the stage for a transformative decade.

Several key factors are collectively propelling the cargo airship market forward. Foremost among these is the growing global imperative for sustainable and environmentally friendly logistics. With increasing scrutiny on carbon emissions, airships offer a significantly lower carbon footprint compared to traditional air and sea freight, particularly for specific cargo types and routes. Their ability to operate with minimal ground infrastructure, including the absence of the need for extensive runways, makes them ideal for accessing remote or underserved regions, thereby opening up new trade corridors and facilitating economic development. Furthermore, the inherent payload capacity and the potential for direct point-to-point delivery, bypassing congested ports and road networks, address the increasing demand for efficient and timely cargo movement. Advancements in materials science, propulsion systems, and navigation technology are making these airships more reliable, efficient, and cost-effective than ever before, thereby addressing historical limitations and reigniting interest from a diverse range of industries. The increasing complexity of global supply chains and the need for greater resilience are also bolstering the appeal of airships as a complementary mode of transport.

Despite the promising outlook, the cargo airship market faces several significant challenges and restraints that could temper its growth. The perception of airships as being slow and weather-dependent, a legacy from earlier eras, continues to be a hurdle, requiring significant public relations and marketing efforts to counter. The initial capital investment for developing and manufacturing modern cargo airships is substantial, which can be a deterrent for companies with limited financial resources. Regulatory frameworks for airship operations, particularly for commercial cargo transport, are still evolving in many regions, creating uncertainty and potential delays in deployment. The availability of skilled personnel for operating and maintaining these advanced airships is another concern, necessitating investment in training and education programs. Moreover, the competition from established and highly optimized traditional transportation modes like container shipping and air cargo remains fierce, requiring airships to demonstrate a clear and compelling value proposition. Lastly, the limited historical data and operational experience with contemporary cargo airships can lead to perceived risks for potential investors and operators.

The Semi-Rigid segment, particularly within the Oil and Gas application, is poised to dominate the cargo airship market, with North America emerging as a key region for this dominance.

Semi-Rigid Airships: This segment offers a compelling balance of structural integrity and payload capacity, making them highly suitable for the demanding requirements of the oil and gas industry. Their ability to carry substantial loads while maintaining maneuverability and stability in various weather conditions is a significant advantage. The design of semi-rigid airships allows for larger cargo bays and more efficient use of lifting gas compared to non-rigid counterparts, while being more cost-effective to construct and operate than fully rigid designs for certain applications. This segment is expected to capture a substantial share of the market during the forecast period.

Oil and Gas Application: The oil and gas sector presents a unique set of logistical challenges that cargo airships are exceptionally well-suited to address. These include:

North America: North America, with its vast geographical expanse, significant oil and gas reserves (particularly in Alaska, Canada, and the Gulf of Mexico), and advanced technological infrastructure, is expected to be a leading region for cargo airship adoption.

The synergy between the versatile capabilities of semi-rigid airships and the specific logistical needs of the oil and gas industry, coupled with the robust economic and technological landscape of North America, positions this combination as a dominant force in the global cargo airship market.

The cargo airship industry is propelled by several potent growth catalysts. Increased global focus on reducing carbon emissions and achieving sustainability targets in logistics is a primary driver, as airships offer a significantly lower environmental impact. The growing demand for efficient transportation of oversized and heavy cargo, such as wind turbine components and infrastructure materials, plays a crucial role. Furthermore, advancements in materials, propulsion, and autonomous navigation technologies are enhancing the reliability, speed, and operational cost-effectiveness of airships. The potential to access remote and underserved regions with minimal ground infrastructure opens up new markets and logistical possibilities.

This comprehensive report delves deep into the multifaceted cargo airship market, providing granular insights from the historical period of 2019-2024 through to robust projections for 2033. With 2025 serving as the crucial base and estimated year, the analysis meticulously charts market dynamics, key trends, and underlying growth drivers. It offers an in-depth examination of the technological evolution, from rigid to semi-rigid and non-rigid designs, and their specific applications across vital sectors like oil and gas, wind turbine parts, and daily necessities. The report identifies and quantifies market opportunities, challenges, and the strategic initiatives of leading players like Lockheed Martin and Hybrid Air Vehicles, painting a complete picture for stakeholders.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Lockheed Martin, Zeppelin Luftschifftechnik, Vantage Airship, Atlas LTA Advanced Technology, Raven Aerostar, Hemeria, Alvalon, Kelluu, Challenger Aerospace, Hybrid Air Vehicles, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Cargo Airship," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Cargo Airship, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.