1. What is the projected Compound Annual Growth Rate (CAGR) of the Carbon Neutrality Expenditure?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Carbon Neutrality Expenditure

Carbon Neutrality ExpenditureCarbon Neutrality Expenditure by Type (Enterprise, Government), by Application (Power Generation, Iron and Steel, Cement, Chemical, Oil and Gas, Non-Ferrous Metal, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

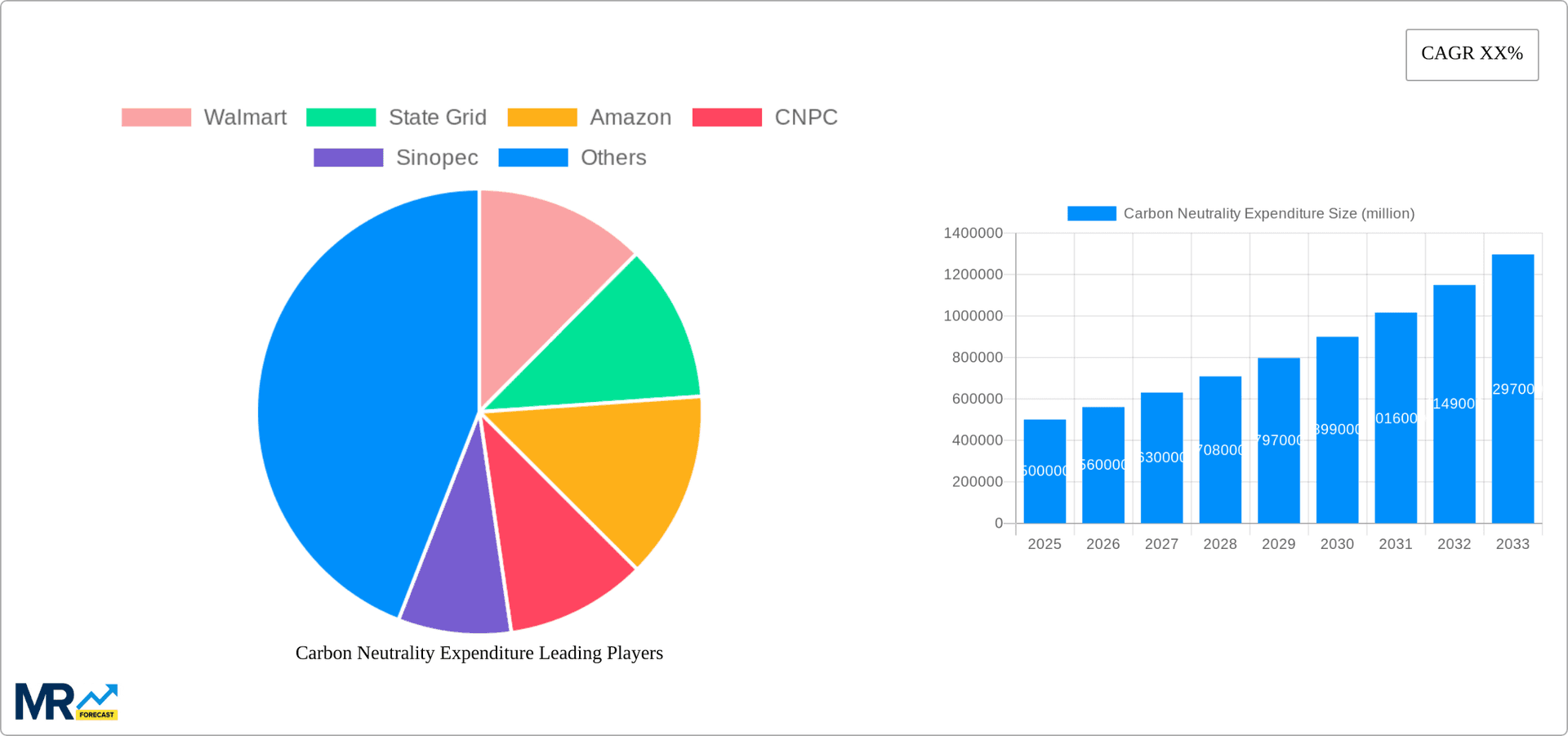

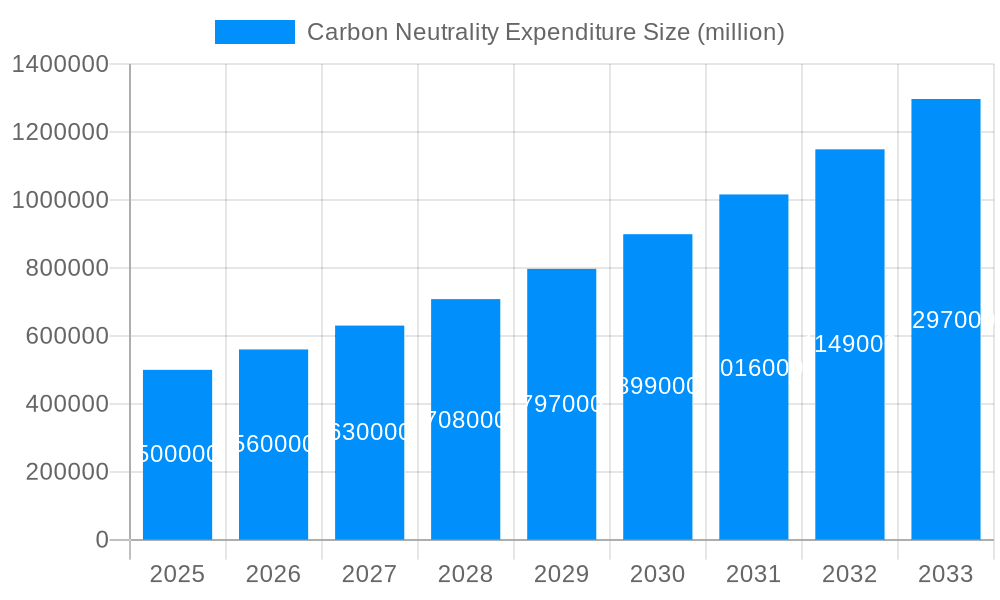

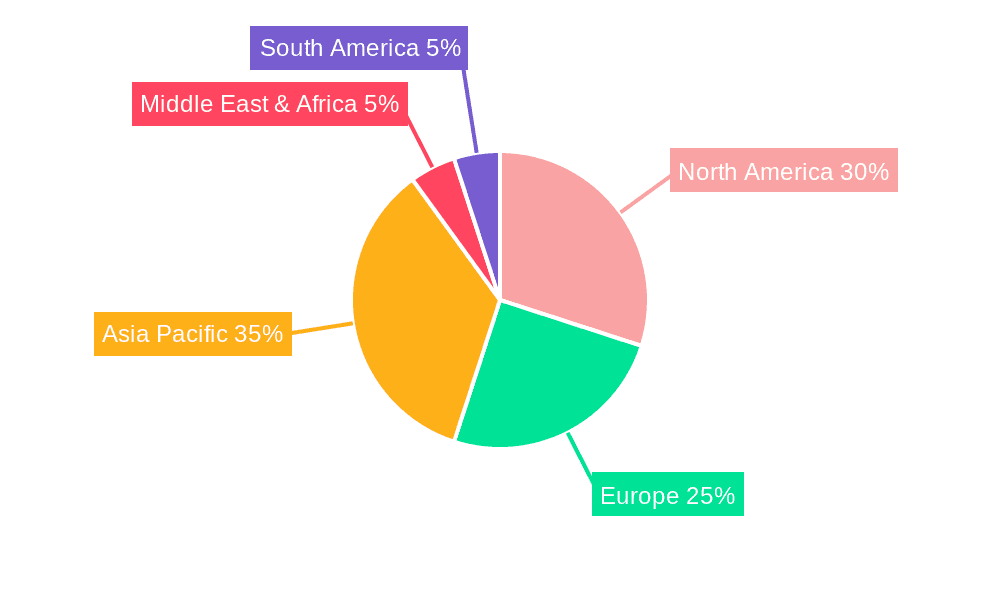

The global carbon neutrality expenditure market is experiencing robust growth, driven by escalating concerns about climate change and the increasing adoption of stringent environmental regulations worldwide. Market size estimations (replace XXX with actual data) reveal a substantial market valued in millions, exhibiting a Compound Annual Growth Rate (CAGR) of XX% during the study period (2019-2033). Key drivers include government incentives and policies promoting renewable energy sources and carbon capture technologies, rising corporate social responsibility initiatives among large enterprises (like Walmart, Amazon, Apple, and others listed), and growing consumer awareness of environmental issues. Significant trends shaping the market include the increasing adoption of carbon offsetting programs, advancements in carbon capture, utilization, and storage (CCUS) technologies, and the development of innovative renewable energy solutions. The market is segmented by type (Enterprise and Government) and application (Power Generation, Iron and Steel, Cement, Chemical, Oil and Gas, Non-Ferrous Metal, and Others), reflecting the diverse sectors contributing to and benefiting from carbon neutrality efforts. Geographic segmentation reveals strong regional variations, with North America, Europe, and Asia Pacific (particularly China and India) representing major market contributors. However, restraints to market growth include the high initial investment costs associated with carbon neutrality initiatives, technological limitations in certain sectors (e.g., heavy industries), and the potential for inconsistent policy implementation across different regions.

The forecast period (2025-2033) anticipates continued market expansion, propelled by technological advancements and strengthened regulatory frameworks. Companies like State Grid, CNPC, Sinopec, Volkswagen, Toyota, Saudi Aramco, Samsung, and Shell are actively investing in carbon neutrality projects, reflecting the market's strategic importance. Future growth will be significantly influenced by the success of international collaborations in climate mitigation, advancements in carbon pricing mechanisms, and the increasing availability of cost-effective green technologies. Competition among companies providing carbon neutrality solutions will intensify, driving innovation and potentially lowering costs. Regional disparities in investment and policy implementation will likely persist, impacting market penetration rates across different geographic segments. Furthermore, the market's evolution will depend on the effectiveness of carbon accounting and verification systems, ensuring transparency and accountability in carbon emission reduction efforts. Specific focus will likely be on achieving carbon neutrality in hard-to-abate sectors like cement, iron and steel, and oil and gas, necessitating breakthroughs in CCUS and other innovative technologies. The interplay of these factors will determine the overall trajectory of the carbon neutrality expenditure market in the coming years.

Global carbon neutrality expenditure is experiencing exponential growth, driven by escalating climate change concerns, tightening environmental regulations, and increasing corporate social responsibility initiatives. Spending is projected to surpass $XXX billion by 2030, representing a Compound Annual Growth Rate (CAGR) of XX%. This surge reflects a significant shift across various sectors, with enterprises, governments, and industries actively investing in decarbonization strategies. Early adopters like Walmart, Apple, and Volkswagen are demonstrating leadership through substantial investments in renewable energy sources, carbon capture technologies, and efficiency improvements, setting benchmarks for their respective industries. However, the distribution of expenditure remains uneven. While developed nations like those in Europe and North America lead in terms of absolute spending, developing economies are witnessing rapid growth, particularly in sectors like power generation and manufacturing, driven by both internal policy changes and external pressure from investors and consumers. This disparity highlights the significant opportunities in emerging markets, where considerable potential exists for technological advancements and large-scale deployment of carbon-reducing solutions. The ongoing energy transition is a crucial element, with a major focus on renewable energy infrastructure like solar and wind farms, impacting energy-intensive industries like steel and cement. Furthermore, the burgeoning carbon offset market is playing a significant role, providing avenues for companies to offset their emissions while stimulating investment in carbon sequestration projects. The overall trend indicates a continued, albeit complex, expansion of expenditure, shaped by technological advancements, policy frameworks, and evolving consumer preferences. The report further delves into the granular aspects of this expansion across different sectors and geographies, providing a comprehensive overview of the market's dynamic nature. This analysis encompasses market size projections, segment-specific growth rates, and critical factors driving market expansion.

Several powerful forces are accelerating carbon neutrality expenditure. Firstly, the escalating urgency of climate change is undeniable, pushing governments and businesses to implement ambitious decarbonization targets. International agreements like the Paris Agreement are setting binding goals, triggering significant investments in emission reduction technologies and strategies. Secondly, stricter environmental regulations and carbon pricing mechanisms are creating economic incentives for companies to reduce their carbon footprint. Carbon taxes, emissions trading schemes, and increasingly stringent environmental regulations are making polluting activities more expensive, incentivizing investment in cleaner alternatives. Thirdly, growing consumer awareness and demand for environmentally friendly products and services are exerting pressure on companies to adopt sustainable practices. Consumers are increasingly scrutinizing a company's environmental performance, favoring businesses committed to sustainability, impacting brand reputation and market share. Fourthly, increased investor interest in ESG (environmental, social, and governance) factors is driving capital flows towards companies with strong sustainability credentials. Investors are increasingly integrating ESG considerations into their investment decisions, rewarding companies with robust decarbonization strategies and penalizing those lacking such initiatives. Finally, technological advancements in renewable energy, carbon capture, and storage technologies are continuously reducing costs and improving efficiency, making carbon neutrality solutions more accessible and financially viable for a wider range of businesses and organizations.

Despite the considerable momentum, several challenges and restraints hinder rapid progress in achieving carbon neutrality. High upfront capital costs associated with transitioning to cleaner energy sources and implementing carbon capture technologies pose a significant barrier, particularly for smaller businesses and developing economies. Technological limitations also remain, with some sectors lacking readily available and cost-effective solutions for complete decarbonization. Furthermore, the lack of standardized carbon accounting methodologies and the complexities involved in accurately measuring and verifying emissions can complicate investment decisions and hinder progress. Intermittency in renewable energy sources like solar and wind power presents operational challenges, requiring substantial investments in energy storage solutions. Policy uncertainty and inconsistent regulatory frameworks across different regions can create uncertainty for investors and impede the development of large-scale carbon neutrality projects. Finally, a lack of skilled labor and expertise in implementing and managing carbon neutrality initiatives can create bottlenecks in project implementation and adoption. Addressing these challenges requires a concerted effort from governments, businesses, and research institutions to foster technological innovation, streamline regulatory frameworks, and promote capacity building.

The Power Generation segment is poised to dominate the carbon neutrality expenditure market, driven by the urgent need to transition from fossil fuels to renewable energy sources. This is especially true in regions like Europe and North America, where robust regulatory frameworks and significant government incentives have already spurred substantial investments in wind, solar, and other renewable energy technologies. The expenditure is further fuelled by:

While the Enterprise segment is also a major contributor, representing significant spending on internal decarbonization efforts, the sheer scale of transformation needed within the power generation sector ensures its dominance. Asia, specifically China, is also a significant player, though the focus may shift towards specific sub-segments such as grid modernization and smart grids to integrate renewable energy efficiently. The investment scale in the power generation sector is expected to far outweigh other sectors in the foreseeable future, driving overall market growth.

Several factors are expected to accelerate the growth of the carbon neutrality expenditure industry. Firstly, increasing government regulations and carbon pricing mechanisms will continue to incentivize companies to adopt cleaner technologies and reduce their carbon emissions. Secondly, ongoing technological advancements will drive down the costs and improve the efficiency of renewable energy sources and carbon capture technologies, making them more accessible and financially viable. Thirdly, growing consumer demand for sustainable products and services will exert further pressure on companies to invest in carbon neutrality initiatives. Fourthly, increasing investor interest in ESG factors will continue to direct capital flows towards companies with strong sustainability credentials. Finally, international collaboration and knowledge sharing will facilitate the deployment of carbon neutrality solutions globally.

Recent significant developments include the increasing adoption of carbon pricing mechanisms globally, accelerated deployment of renewable energy technologies, the emergence of innovative carbon capture and storage solutions, and the growth of the carbon offset market.

This report provides a comprehensive overview of the global carbon neutrality expenditure market, including detailed analysis of market trends, driving forces, challenges, key players, and future growth prospects. It offers valuable insights for businesses, investors, policymakers, and other stakeholders interested in understanding and participating in this rapidly evolving market. The report's detailed segmentation allows for in-depth analysis of specific market niches, enabling informed decision-making and strategic planning. The report also incorporates projections for future market growth, providing a forward-looking perspective on the industry's trajectory.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of XX% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Walmart, State Grid, Amazon, CNPC, Sinopec, Apple, Volkswagen, Toyota, Saudi Aramco, Samsung, Shell, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Carbon Neutrality Expenditure," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Carbon Neutrality Expenditure, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.