1. What is the projected Compound Annual Growth Rate (CAGR) of the Carbon Footprint Software?

The projected CAGR is approximately 9.77%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Carbon Footprint Software

Carbon Footprint SoftwareCarbon Footprint Software by Type (Cloud-Based, On-Premise), by Application (Power Generation, Iron and Steel, Cement, Chemical, Oil and Gas, Non-Ferrous Metal, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

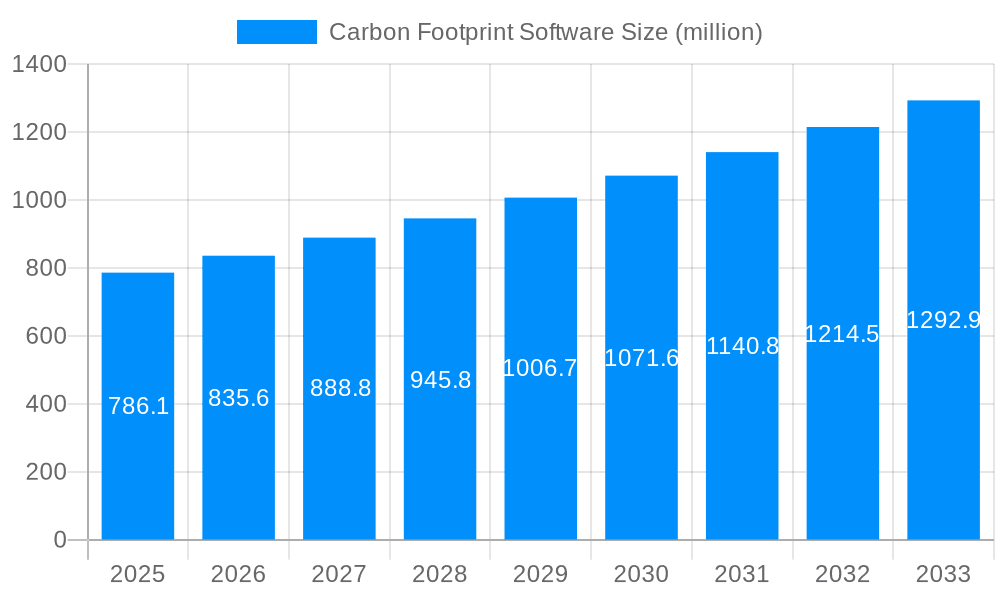

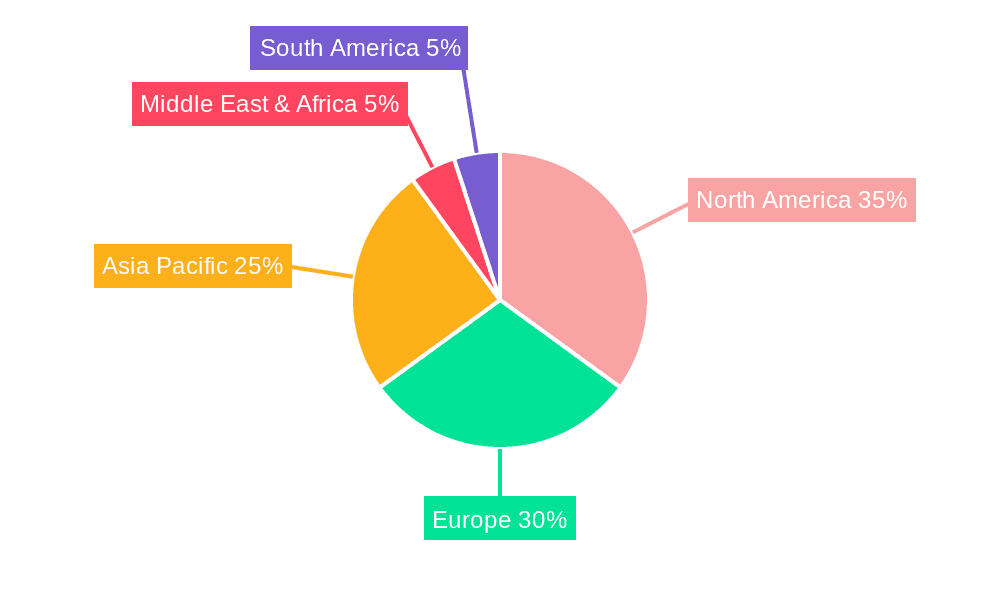

The market for carbon footprint software is experiencing robust growth, with a market size estimated at $1191.8 million in 2025 and projected to expand significantly over the forecast period (2025-2033). While the precise CAGR (Compound Annual Growth Rate) requires further specification from the original data source, several key drivers are fueling this expansion. Increasing regulatory pressure on emissions reporting, coupled with growing corporate social responsibility (CSR) initiatives and investor demand for environmental, social, and governance (ESG) data, are pushing organizations across various sectors to adopt sophisticated carbon accounting solutions. The rising awareness of climate change and the need to mitigate its impacts further accelerate market adoption. Key trends include the shift towards cloud-based solutions for scalability and accessibility, the integration of carbon footprint software with other enterprise resource planning (ERP) systems, and the development of more sophisticated analytics capabilities for data-driven emission reduction strategies. Market segmentation reveals significant demand across diverse industries, including power generation, iron and steel, cement, chemicals, oil and gas, and non-ferrous metals, with the "others" segment representing a broad range of businesses increasingly focused on their environmental footprint. However, restraints on market growth include the high initial investment costs for software implementation and ongoing maintenance, the complexity of accurately measuring and verifying carbon emissions, and the need for skilled personnel to effectively manage and interpret the data generated. Geographical distribution reflects varying levels of regulatory stringency and corporate sustainability awareness, with North America and Europe currently leading in adoption, followed by Asia Pacific, where rapid industrialization is driving demand.

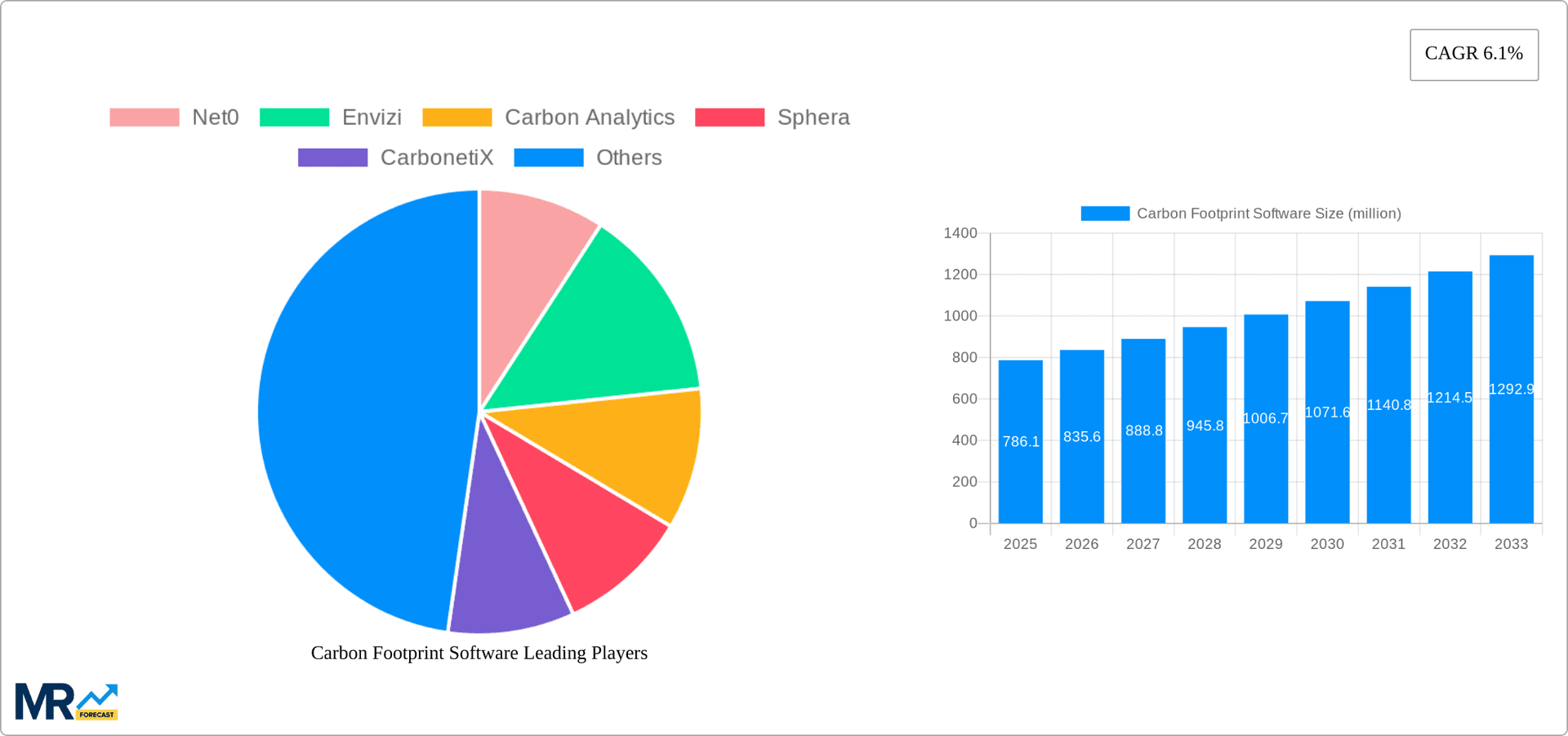

The competitive landscape is fragmented, with a multitude of vendors offering varying levels of functionality and pricing. Major players like Net0, Envizi, and Sphera cater to large enterprises, often providing comprehensive ESG and sustainability management platforms. Smaller companies, such as Carbon Analytics, CarbonetiX, and Emitwise, often specialize in specific niches or offer more affordable solutions for smaller businesses. The market also features several regional players, highlighting the localized needs and regulatory contexts that influence software development. The ongoing evolution of methodologies for carbon accounting, increasing focus on Scope 3 emissions (value chain emissions), and advancements in data analytics will shape future market dynamics. Furthermore, the development of standardized reporting frameworks and data interoperability are crucial for wider market acceptance and growth. Future growth will depend on the continuous improvement of software capabilities, the accessibility of affordable solutions for small and medium-sized enterprises (SMEs), and the ongoing development of robust and reliable carbon emission data sources. The expansion into emerging markets, particularly in Asia Pacific and Africa, presents significant opportunities for growth, contingent on appropriate regulatory support and increased corporate awareness.

The global carbon footprint software market is experiencing explosive growth, projected to reach tens of billions of dollars within the next decade. This surge is fueled by escalating regulatory pressure, growing investor scrutiny of ESG (Environmental, Social, and Governance) performance, and a heightened corporate awareness of climate change's impact on brand reputation and operational resilience. The market is witnessing a shift towards comprehensive, integrated solutions that go beyond simple emissions calculations. Companies are demanding software that not only tracks emissions across their entire value chain but also provides actionable insights to support decarbonization strategies. This includes features such as scenario planning, risk assessment, and data visualization tools enabling effective communication of sustainability initiatives to stakeholders. The increasing adoption of cloud-based solutions reflects the industry's desire for scalability, accessibility, and real-time data updates. Furthermore, the integration of AI and machine learning is enhancing the analytical capabilities of these platforms, enabling more accurate predictions, improved efficiency in data processing, and the identification of previously unseen emission reduction opportunities. The market is witnessing consolidation, with larger players acquiring smaller firms to expand their product portfolios and market reach. Meanwhile, specialized niche players are focusing on specific industry sectors, offering tailored solutions and expertise to address unique emission challenges. This dynamic environment fosters competition and drives continuous innovation within the carbon footprint software sector. The adoption rate is particularly high among large multinational corporations and enterprises with complex supply chains, demanding sophisticated solutions for accurate and comprehensive emissions accounting. This demonstrates a clear need for these tools in managing complex environmental risks, mitigating regulatory penalties, and meeting corporate sustainability goals. The rise of carbon offsetting markets further strengthens the demand for accurate carbon footprint quantification, making software that enables precise emission measurement and verification crucial for credible offsetting programs. Consequently, the market shows substantial potential for sustained growth, driven by technological advancements, evolving regulatory frameworks, and an increasing global focus on sustainability.

Several key factors are accelerating the adoption of carbon footprint software. Firstly, stringent government regulations worldwide are imposing mandatory carbon reporting and emissions reduction targets on businesses. This regulatory pressure necessitates the use of accurate and reliable software to comply with evolving compliance standards, potentially avoiding significant financial penalties. Secondly, growing investor and consumer demand for ESG (Environmental, Social, and Governance) transparency is compelling companies to demonstrate their commitment to sustainability. Investors increasingly consider ESG factors in their investment decisions, making a strong sustainability profile crucial for attracting capital and enhancing corporate valuation. Thirdly, corporate social responsibility (CSR) initiatives are driving the adoption of carbon footprint software. Businesses are recognizing the importance of reducing their environmental impact to protect their brand reputation, improve stakeholder relations, and attract and retain talent. The growing awareness among consumers regarding the environmental consequences of products and services is encouraging companies to adopt sustainable practices and disclose their carbon footprint. Furthermore, technological advancements in data analytics and cloud computing are making carbon footprint software more accessible, user-friendly, and cost-effective. This makes the implementation of the technology more feasible for businesses of all sizes. Finally, the increasing availability of carbon pricing mechanisms, such as carbon taxes and emissions trading schemes, incentivizes companies to reduce their emissions and invest in carbon management solutions, including specialized software. The convergence of these factors indicates a strong and sustained upward trajectory for the carbon footprint software market in the coming years.

Despite the significant growth potential, the carbon footprint software market faces several challenges. Data accuracy and completeness remain critical issues, particularly when dealing with complex supply chains. Inaccurate or incomplete data can lead to flawed emissions calculations and undermine the effectiveness of decarbonization efforts. Data integration across different systems and departments can also be complex and time-consuming. The lack of standardized methodologies for carbon accounting creates inconsistencies across different software platforms, hindering the comparability of results. Moreover, the high cost of implementation, especially for sophisticated solutions, can be a barrier to entry for smaller companies. The need for specialized expertise to effectively use and interpret the data generated by the software can also pose a challenge, particularly for organizations lacking internal sustainability expertise. Another significant hurdle is ensuring data security and privacy, especially when dealing with sensitive business data. The constant evolution of sustainability regulations necessitates regular software updates and adaptations, requiring ongoing investment and resources. Finally, the lack of user-friendly interfaces and readily available training resources can hinder the effective utilization of the software, particularly among non-technical users. Addressing these challenges requires collaboration between software developers, regulators, and industry stakeholders to improve data standardization, reduce implementation costs, and enhance user experience.

The cloud-based segment is projected to dominate the carbon footprint software market. Its scalability, accessibility, and cost-effectiveness make it particularly attractive to businesses of all sizes. The ease of integration with existing IT infrastructure, automated updates, and real-time data access further enhance its appeal. Many companies opt for cloud-based platforms due to lower upfront investment costs compared to on-premise solutions. The flexibility and accessibility offered by cloud platforms also allow for easy scaling of operations, making them suitable for businesses experiencing rapid growth. Furthermore, reliable data backups and disaster recovery services are often included in cloud-based solutions, minimizing the risk of data loss and ensuring business continuity.

North America and Europe are currently leading the market due to stringent environmental regulations, strong investor focus on ESG factors, and a high level of corporate social responsibility. The regions' robust IT infrastructure and technological advancement also contribute to their dominance.

Within industry applications, the Power Generation sector is a key driver, facing increasing pressure to reduce greenhouse gas emissions. The industry's complexity demands comprehensive software capable of tracking emissions from various sources across the entire value chain. Accurate emission monitoring is crucial for compliance with increasingly stringent regulations. This sector's high emission intensity makes efficient carbon management a priority, driving demand for sophisticated software solutions. The significant investment needed for transitioning to renewable energy also underscores the need for precise monitoring and reporting of carbon footprint reductions.

The Chemical industry, known for its high carbon footprint, is also a significant user of carbon footprint software. The complexity of chemical processes and their extensive supply chains require robust software to accurately track and manage emissions across various stages of production and distribution.

The significant adoption within these segments indicates that robust regulatory environments, the need for transparent reporting, and the high carbon intensity of these industries are powerful drivers of market growth. The ability of carbon footprint software to provide critical data for improved decision-making and emissions reduction strategies strengthens its importance in these key areas.

Several factors are poised to propel the growth of the carbon footprint software market: Increased regulatory compliance requirements, stronger ESG investor focus, rising consumer awareness of environmental issues, technological advancements enabling more sophisticated analytics, and expansion into developing economies seeking improved environmental management.

Recent developments include increased integration of AI and machine learning for improved data analysis and emission prediction, the emergence of specialized solutions tailored to specific industries, and a growing focus on software that integrates with carbon offsetting platforms. Consolidation within the market is also a notable trend.

This report provides a detailed analysis of the carbon footprint software market, covering market size, trends, driving forces, challenges, key players, and future growth prospects. It includes a comprehensive assessment of various segments, including cloud-based vs. on-premise solutions and applications across different industries. The report is designed to assist businesses, investors, and policymakers in understanding the dynamics of this rapidly evolving market. The detailed insights provided will support informed decision-making regarding the adoption and implementation of carbon footprint software solutions. The market size estimations provided are based on rigorous research and analysis of various industry sources.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.77% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 9.77%.

Key companies in the market include Net0, Envizi, Carbon Analytics, Sphera, CarbonetiX, BraveGen, The Carbon Accounting Company, Normative, Emitwise, Planetly, Pangolin Associates, Plan A, Evalue8, GaBi, Solid Forest, CleanMetrics, SimaPro, iPoint, Carbon Footprint Ltd, Carbonstop, Carbonbase, Anhui Donggao, .

The market segments include Type, Application.

The market size is estimated to be USD XXX N/A as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in N/A.

Yes, the market keyword associated with the report is "Carbon Footprint Software," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Carbon Footprint Software, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.