1. What is the projected Compound Annual Growth Rate (CAGR) of the Carbon Fiber Welding Helmet?

The projected CAGR is approximately 5.6%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Carbon Fiber Welding Helmet

Carbon Fiber Welding HelmetCarbon Fiber Welding Helmet by Type (Auto-Darkening Helmet, Non-Auto-Darkening Helmet, World Carbon Fiber Welding Helmet Production ), by Application (Shipbuilding, Energy, Automotive, Infrastructure Construction, Other), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

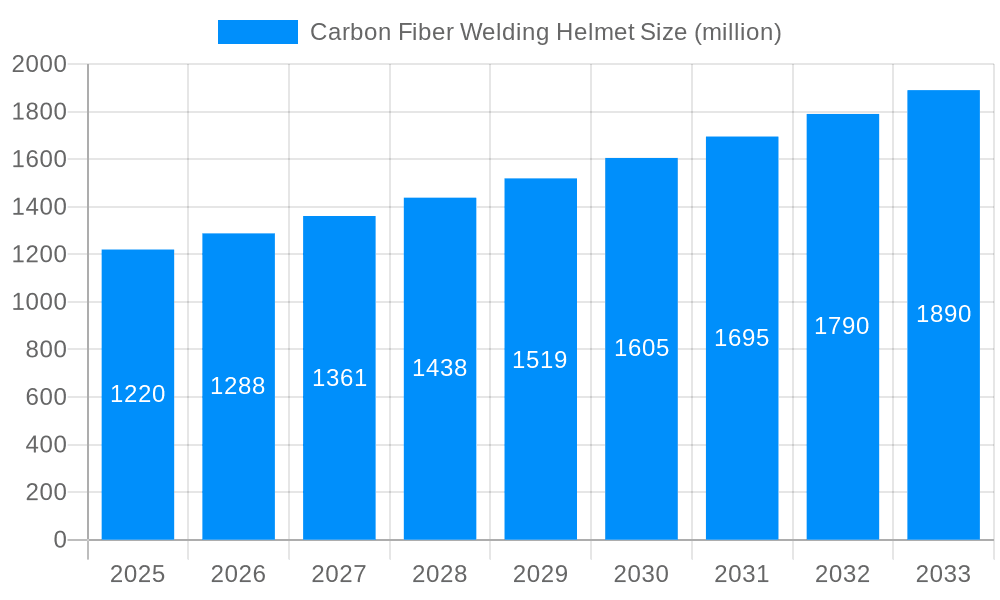

The global carbon fiber welding helmet market is poised for significant expansion, projected to reach a substantial valuation by 2033. With a healthy Compound Annual Growth Rate (CAGR) of 5.6% from its 2025 estimated market size of $1.22 billion, this sector is witnessing robust demand fueled by several key drivers. The increasing adoption of carbon fiber, renowned for its lightweight yet incredibly strong properties, in protective welding gear is a primary catalyst. This material innovation translates to enhanced comfort, reduced fatigue for welders, and improved durability of the helmets themselves. Furthermore, the burgeoning global infrastructure development, particularly in emerging economies, is a major contributor. Large-scale projects in shipbuilding, energy exploration and production, automotive manufacturing, and general construction inherently require extensive welding activities, directly boosting the demand for high-performance welding helmets. The growing emphasis on worker safety and the implementation of stricter occupational health regulations worldwide further reinforce the market's upward trajectory, compelling businesses to invest in superior protective equipment.

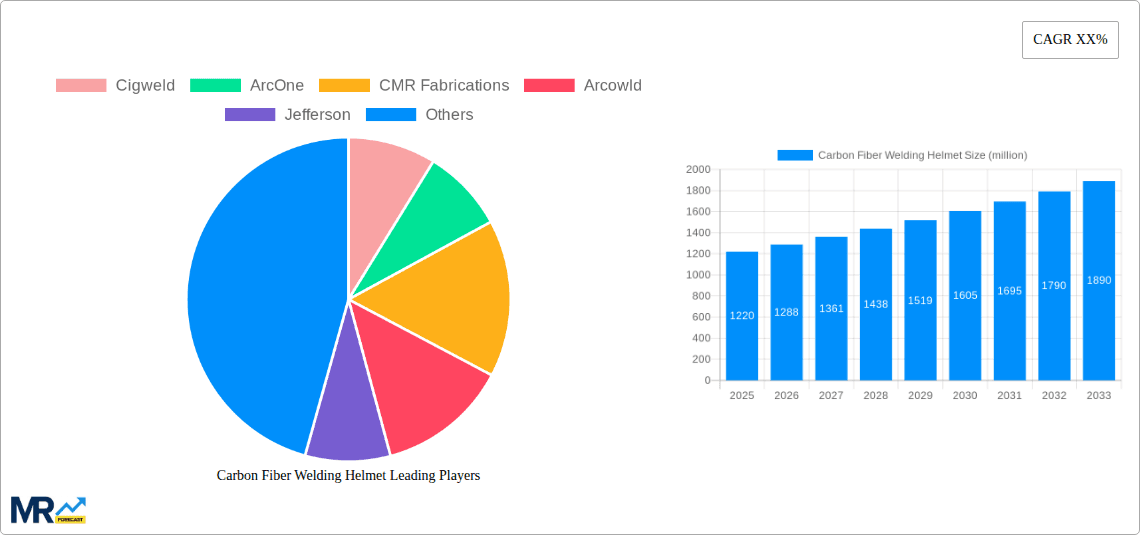

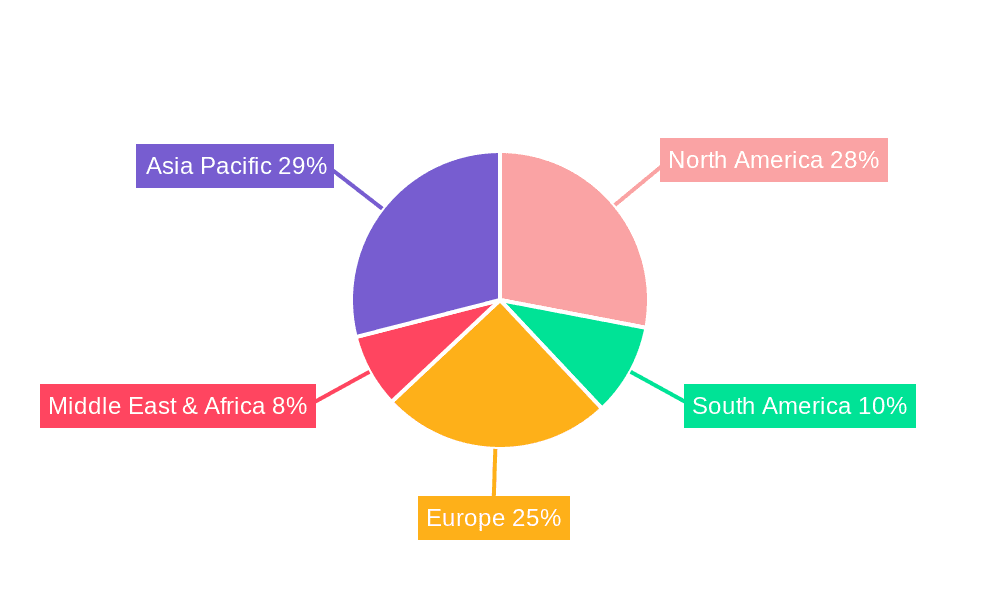

The market is segmented into Auto-Darkening Helmets and Non-Auto-Darkening Helmets, with the former expected to dominate due to advanced features like automatic lens darkening, offering superior eye protection and operational efficiency. Key applications driving this growth include shipbuilding, where durable and lightweight gear is paramount; the energy sector, encompassing oil, gas, and renewable energy projects; the automotive industry, with its increasing reliance on advanced welding techniques; and widespread infrastructure construction. Regionally, Asia Pacific, led by China and India, is anticipated to emerge as a dominant market owing to rapid industrialization and significant infrastructure investments. North America and Europe, with their established industrial bases and stringent safety standards, will continue to be significant markets. While the lightweight and durable nature of carbon fiber offers distinct advantages, the relatively higher cost compared to traditional materials may present a restraint, although the long-term benefits of reduced worker injury and increased productivity are expected to outweigh this factor. Leading companies such as Cigweld, ArcOne, and CMR Fabrications are at the forefront, innovating and expanding their product offerings to cater to the evolving demands of this dynamic market.

This comprehensive report delves into the burgeoning global market for carbon fiber welding helmets, projecting a market valuation set to reach over 5 billion USD by the close of the forecast period. The study meticulously analyzes market dynamics from the historical period of 2019-2024, establishing a baseline in 2025 with an estimated market value of around 3 billion USD, and charting a growth trajectory through to 2033. This in-depth analysis provides invaluable insights for stakeholders navigating this evolving industry, covering production, application, and technological advancements.

The global carbon fiber welding helmet market is experiencing a remarkable upward surge, driven by a confluence of technological innovation, increasing demand for enhanced safety, and the inherent superior properties of carbon fiber. Over the historical period of 2019-2024, the market witnessed steady growth, laying the groundwork for an accelerated expansion in the coming decade. The base year of 2025 is estimated to see the market value surpass 3 billion USD, a significant leap from its earlier stages. This growth is fundamentally linked to the increasing adoption of advanced welding technologies across diverse industrial sectors, where the lightweight yet incredibly durable nature of carbon fiber welding helmets offers unparalleled benefits. Welders are increasingly prioritizing personal protective equipment (PPE) that not only meets stringent safety standards but also minimizes fatigue and enhances comfort during prolonged use. Carbon fiber's inherent strength-to-weight ratio directly addresses these concerns, making it a material of choice for premium welding helmets. Furthermore, the market is witnessing a pronounced shift towards auto-darkening helmet technology, which offers seamless transitions and immediate protection against arc flash, significantly improving welding efficiency and reducing the risk of eye strain and injury. This trend is further amplified by advancements in sensor technology and optical clarity, making these helmets indispensable tools for professional welders. The projected growth through 2033, with estimations pointing towards a market valuation exceeding 5 billion USD, underscores the sustained demand and the continuous innovation within this sector. Manufacturers are investing heavily in research and development to integrate smart features, improve ergonomic designs, and optimize the cost-effectiveness of carbon fiber helmet production, thereby widening their appeal across a broader spectrum of users and applications. The integration of sophisticated optical filters and adjustable shade settings within these helmets also contributes to their increasing popularity, catering to the specific needs of various welding processes.

The escalating adoption of carbon fiber welding helmets is underpinned by several powerful driving forces that are collectively shaping the market's trajectory. Foremost among these is the undeniable superiority of carbon fiber as a material for welding PPE. Its exceptional strength-to-weight ratio translates into helmets that are both incredibly robust and remarkably lightweight, a critical factor in reducing welder fatigue and improving overall comfort during extended work shifts. This ergonomic advantage directly translates to increased productivity and a safer working environment, making carbon fiber helmets a highly sought-after upgrade. Concurrently, the global emphasis on workplace safety regulations and standards is intensifying, compelling industries to invest in advanced and reliable protective equipment. Carbon fiber welding helmets, with their inherent durability and resistance to impact and heat, are perfectly aligned with these stringent requirements. The continuous technological advancements in welding processes, such as the increasing prevalence of high-intensity arc welding and specialized applications, necessitate protective gear that can withstand extreme conditions. Carbon fiber's resilience makes it an ideal material to meet these demands, offering superior protection against UV and IR radiation, sparks, and molten metal splatter. The growing awareness among professional welders about the long-term health implications of inadequate eye and face protection is also a significant contributor. As a result, there's a discernible preference for premium-grade helmets that offer comprehensive safeguarding, further fueling the demand for carbon fiber solutions. The market is also benefiting from the increasing affordability and accessibility of carbon fiber materials and manufacturing techniques, making these advanced helmets more attainable for a wider range of industries and individual welders.

Despite the robust growth and promising outlook, the carbon fiber welding helmet market is not without its challenges and restraints. A primary hurdle remains the initial cost of production. Carbon fiber, while offering superior performance, is inherently more expensive to manufacture compared to traditional materials like ABS plastic or fiberglass. This higher cost can translate to a higher retail price for carbon fiber helmets, potentially limiting their adoption among budget-conscious consumers or in industries where cost is a paramount consideration. The complexity of manufacturing processes associated with carbon fiber composites can also pose a challenge, requiring specialized equipment and skilled labor, which can further add to the overall expense and potentially create supply chain bottlenecks. Furthermore, the availability and recycling of carbon fiber are emerging concerns. While carbon fiber offers exceptional durability, its end-of-life management and the development of efficient recycling processes are still in their nascent stages. The environmental impact of manufacturing and disposal needs to be carefully considered as the market expands. Another restraint could be the perceived obsolescence of existing non-carbon fiber helmets. Many welders currently possess functional helmets made from traditional materials, and the incentive to upgrade might be slow for those who do not perceive a significant immediate benefit or are hesitant due to cost. Finally, limited consumer awareness regarding the specific advantages of carbon fiber over other materials, beyond a general understanding of its strength, could also hinder widespread adoption, requiring concerted marketing and educational efforts from manufacturers.

The global carbon fiber welding helmet market is poised for significant growth across various regions and segments. However, certain areas and product types are anticipated to lead this expansion.

Dominant Segments:

Auto-Darkening Helmets: This segment is unequivocally set to dominate the market. The projected market share for auto-darkening helmets is estimated to be over 70% of the total carbon fiber welding helmet market by 2033. This dominance is driven by their inherent technological advantage, offering immediate arc protection, eliminating the need to flip down the welding shield, and thereby significantly improving welding efficiency and reducing the risk of eye strain and injury.

Application: Shipbuilding and Energy: These two application sectors are projected to be the strongest growth drivers.

Dominant Regions/Countries:

North America: This region is anticipated to maintain its leading position, driven by a strong existing industrial base, high adoption rates of advanced technologies, and stringent safety regulations. The presence of major players in the automotive, energy, and aerospace sectors fuels the demand for high-performance welding equipment. The market size in North America is projected to reach over 2 billion USD by 2033.

Asia Pacific: This region is expected to witness the most rapid growth rate. The burgeoning manufacturing sector, significant investments in infrastructure development, and increasing awareness of workplace safety are key drivers. Countries like China, India, and South Korea are expanding their industrial capacities, leading to a surge in demand for welding equipment across various applications. The market in Asia Pacific is forecast to reach approximately 1.8 billion USD by 2033.

Several key factors are acting as potent growth catalysts for the carbon fiber welding helmet industry. The continuous push for enhanced workplace safety, driven by both regulatory bodies and employer responsibility, is paramount. As industries recognize the long-term costs associated with welding-related injuries, the investment in superior protective gear like carbon fiber helmets becomes a clear economic imperative. Furthermore, the ongoing technological evolution within the welding field itself, demanding more specialized and resilient PPE, is a significant driver. The lightweight yet incredibly strong nature of carbon fiber perfectly aligns with the need for enhanced welder comfort and reduced fatigue, directly contributing to increased productivity and job satisfaction.

This report provides an exhaustive analysis of the global carbon fiber welding helmet market, offering a detailed exploration of its intricate landscape. It meticulously covers market trends, identifies the key driving forces behind its growth, and critically examines the challenges and restraints that may influence its trajectory. The report further pinpoints the dominant regions and segments that are poised to lead the market, along with a comprehensive overview of the growth catalysts fueling this expansion. A detailed list of leading players and a timeline of significant sector developments are also included, providing stakeholders with a holistic understanding of the market's present and future. This detailed coverage ensures that businesses can make informed strategic decisions, capitalize on emerging opportunities, and effectively navigate the competitive environment of the carbon fiber welding helmet industry.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.6% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 5.6%.

Key companies in the market include Cigweld, ArcOne, CMR Fabrications, Arcowld, Jefferson, Powerbuilt, CastleWeld, CMR Fabrications.

The market segments include Type, Application.

The market size is estimated to be USD XXX N/A as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in N/A and volume, measured in K.

Yes, the market keyword associated with the report is "Carbon Fiber Welding Helmet," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Carbon Fiber Welding Helmet, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.