1. What is the projected Compound Annual Growth Rate (CAGR) of the Caramel Flavored Whiskey?

The projected CAGR is approximately 7.3%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Caramel Flavored Whiskey

Caramel Flavored WhiskeyCaramel Flavored Whiskey by Type (5%-20%Vol, 20.1%-40%Vol, 40.1%-60%Vol), by Application (Hotel, Restaurant, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

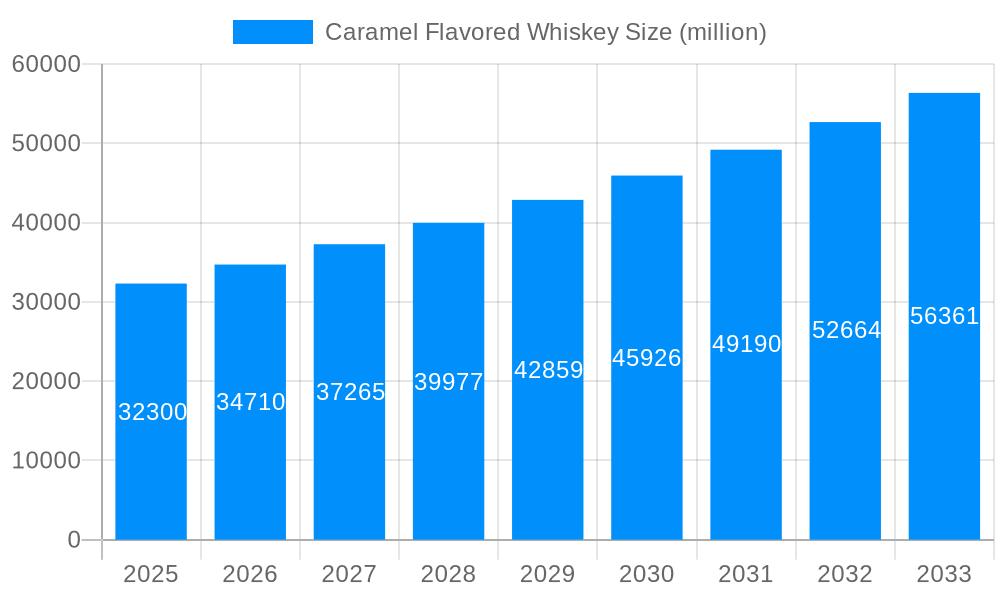

The global caramel flavored whiskey market is poised for significant expansion, with a current market size estimated at $32.3 billion and a projected Compound Annual Growth Rate (CAGR) of 7.3% from 2025 to 2033. This robust growth trajectory is primarily fueled by evolving consumer preferences towards flavored spirits and a burgeoning demand for premium, accessible cocktails. The inherent sweetness and approachable profile of caramel, coupled with the warmth of whiskey, creates a highly appealing product for both seasoned whiskey drinkers and those new to the spirit. This trend is particularly evident in North America and Europe, where cocktail culture is deeply ingrained and consumers actively seek out innovative and enjoyable beverage experiences. The increasing availability of caramel flavored whiskey through various sales channels, including e-commerce platforms and specialized liquor stores, further contributes to its accessibility and market penetration.

The market is segmented by alcohol by volume (ABV) into 5%-20% Vol, 20.1%-40% Vol, and 40.1%-60% Vol, with a significant portion of consumer preference leaning towards the more accessible lower and mid-range ABV categories. Applications span across hotels, restaurants, and other diverse settings, highlighting the versatility of caramel flavored whiskey as a key ingredient in both casual and upscale beverages. While growth is strong, potential restraints include increasing competition from other flavored spirit categories and fluctuating raw material costs. However, strategic marketing initiatives focusing on product innovation, diverse flavor profiles, and targeted consumer engagement are expected to mitigate these challenges, ensuring continued market dominance and expansion for caramel flavored whiskey. Key players are actively investing in new product development and expanding their distribution networks to capture a larger market share.

This report provides an in-depth analysis of the global Caramel Flavored Whiskey market, forecasting significant growth and identifying key trends, drivers, and challenges. The study encompasses a comprehensive Study Period: 2019-2033, with a Base Year: 2025 and an Estimated Year: 2025, followed by an extensive Forecast Period: 2025-2033. The Historical Period: 2019-2024 provides crucial context for understanding market evolution. Projections indicate a robust market value reaching several billion dollars by the end of the forecast period, driven by evolving consumer preferences and innovative product development. The market is characterized by a dynamic interplay of established spirit manufacturers and emerging artisanal producers, all vying for a share of this increasingly popular segment. The report will delve into the intricate details of market segmentation by alcohol by volume (ABV) and application, providing granular insights into the performance of each sub-segment. Furthermore, it will highlight significant industry developments and the strategic initiatives undertaken by leading players, offering a holistic view of the market landscape.

The global Caramel Flavored Whiskey market is experiencing a sweet surge, driven by a confluence of evolving consumer palates and the innovative spirit of distillers. The historical trajectory from 2019-2024 has laid a strong foundation, with consumers increasingly seeking flavored spirits that offer a more accessible and palatable entry point into the whiskey category. This trend is particularly pronounced among younger demographics and those who may find traditional, unflavored whiskies too intense or complex. The sweetness and familiar taste profile of caramel appeal to a broader audience, acting as a gateway to exploring other whiskey variants. Looking ahead, the Estimated Year: 2025 marks a pivotal point, with projections suggesting a market valuation in the billions of dollars. The Forecast Period: 2025-2033 is expected to witness sustained double-digit growth. Key insights reveal a rising demand for premium and craft caramel-flavored whiskies, indicating a move beyond mass-market offerings. Consumers are actively seeking out products with nuanced caramel notes, often infused with complementary flavors like vanilla, toffee, or even subtle spice. This elevates caramel-flavored whiskey from a novelty to a sophisticated beverage choice. The influence of social media and online beverage influencers is also a significant trend, shaping consumer perceptions and driving product discovery. Cocktail culture continues to play a crucial role, with caramel-flavored whiskies proving to be versatile ingredients in a wide array of sweet and warming mixed drinks, further cementing their place in bars and homes alike. The report will detail how this trend is projected to unfold, impacting production volumes, marketing strategies, and the overall competitive landscape, with an estimated market value set to reach substantial figures in the billions of dollars.

The ascension of caramel-flavored whiskey is fueled by a potent combination of evolving consumer preferences and a strategic expansion of the whiskey category. A primary driver is the growing demand for accessible and approachable spirits, particularly among consumers who are new to whiskey or prefer a sweeter flavor profile. The familiar and comforting taste of caramel acts as a bridge, making whiskey less intimidating and more enjoyable. This has opened up new market segments and attracted a broader consumer base than traditional whiskey might reach. Furthermore, the rise of a sophisticated cocktail culture has significantly boosted the appeal of flavored spirits. Caramel-flavored whiskey is a natural fit for a multitude of sweet, dessert-inspired, and warming cocktails, offering mixologists a versatile ingredient that adds depth and sweetness without overpowering other flavors. The increasing popularity of at-home entertaining and the "craft cocktail" movement have further amplified this trend. Beyond taste preferences, industry innovation plays a crucial role. Distilleries are investing in research and development to create high-quality caramel-flavored whiskies that offer complex flavor profiles beyond simple sweetness. This includes exploring different aging techniques, infusion methods, and combinations with other complementary flavors, thereby elevating the perception of flavored spirits. The report will further elaborate on how these factors contribute to the projected multi-billion dollar market valuation, especially as we move from the Base Year: 2025 into the Forecast Period: 2025-2033.

Despite its burgeoning popularity, the caramel-flavored whiskey market is not without its hurdles. One significant challenge is the perception of artificiality or over-sweetness among traditional whiskey connoisseurs. Some consumers may view flavored whiskies as less authentic or of lower quality compared to their unflavored counterparts, potentially limiting market penetration among this discerning demographic. Maintaining consistent quality and a balanced flavor profile across different batches and brands can also be a challenge for manufacturers. Achieving a nuanced caramel flavor that complements, rather than masks, the underlying whiskey can be a delicate balancing act. Regulatory landscapes, particularly concerning labeling and marketing of flavored alcoholic beverages, can also pose restrictions, potentially impacting advertising claims and product positioning. Furthermore, the competitive nature of the spirits market means that new entrants and established players alike must continually innovate to stand out. High marketing and distribution costs associated with launching and sustaining a product in this crowded space can also act as a restraint, especially for smaller producers. The report will delve deeper into how these factors might influence the projected market growth, even within the substantial multi-billion dollar forecast from 2025-2033.

The global Caramel Flavored Whiskey market presents a dynamic landscape with certain regions and segments poised for significant dominance. Within the Type: 5%-20%Vol segment, the market is expected to witness substantial growth across North America, particularly the United States, driven by its robust spirits culture and early adoption of flavored whiskey trends observed during the Historical Period: 2019-2024. The accessibility and lower alcohol content of this segment make it highly appealing to a broad demographic, including casual drinkers and those seeking milder alternatives. The convenience of purchasing these products from large retail chains like BevMo and Drizly, alongside specialty stores such as The Party Source and TOAST Wine + Spirits, further fuels their popularity.

North America (United States): This region is a powerhouse, fueled by a high per capita consumption of spirits and a strong affinity for flavored beverages. The presence of numerous craft distilleries and established brands like Duke&Dame, Ole Smoky Moonshine, and Bird Dog Whiskey, alongside major players like Crown Royal, ensures a competitive and innovative market. The ease of access through online retailers and physical liquor stores further solidifies its leading position.

Asia-Pacific (China, Japan): While currently nascent, the Asia-Pacific region holds immense potential for growth. As consumer tastes evolve and disposable incomes rise, the demand for Western spirits, including flavored whiskeys, is expected to surge during the Forecast Period: 2025-2033. Early adoption by premium bars and a growing interest in mixology in countries like China and Japan will be key drivers.

Europe (United Kingdom, Germany): The European market, particularly the UK and Germany, shows promising growth. Established whiskey-drinking cultures combined with an increasing openness to flavored spirits will contribute to market expansion. The presence of distributors like Feast + West and retailers like New Hampshire Liquor (though geographically misplaced, represents the type of channel) and Lebanon Wine & Spirits (similarly, indicating channel type) will play a role in market penetration.

In terms of Application, the Restaurant segment is anticipated to be a significant contributor to the market's overall value, projected to reach billions of dollars by the end of the Forecast Period: 2025-2033. Restaurants, especially those focusing on casual dining and trendy bars, are increasingly incorporating caramel-flavored whiskeys into their cocktail menus and offering them as unique beverage options. The ability to experiment with new flavor combinations and cater to evolving customer preferences makes this segment a fertile ground for market growth. The Hotel segment also presents a strong opportunity, with hotel bars often serving as introductions to new spirits for travelers. The convenience of readily available and appealing flavored options can enhance the guest experience and drive sales. The Others category, encompassing home consumption, online sales, and specialty retailers like Del Mesa Liquor and Royal Batch, will continue to be a substantial driver, reflecting the growing trend of at-home entertaining and the direct-to-consumer (DTC) model facilitated by platforms like Drizly and 1000 Corks. This diversified application landscape ensures sustained demand across various consumption channels.

Several key factors are poised to act as significant growth catalysts for the Caramel Flavored Whiskey industry. The continuous innovation in flavor profiles, moving beyond simple caramel to include complementary notes like vanilla, toffee, and even fruit, will attract a wider consumer base. The expansion of online retail and direct-to-consumer sales channels, facilitated by platforms like Drizly, will enhance accessibility and convenience for consumers across all regions. Furthermore, the increasing popularity of mixology and craft cocktails will drive demand as bartenders explore new and exciting flavor combinations using caramel-flavored whiskeys. The strategic marketing efforts by companies like Duke&Dame and Crown Royal, focusing on lifestyle and occasion-based consumption, will also play a vital role in shaping consumer perceptions and driving adoption.

This comprehensive report offers an exhaustive analysis of the Caramel Flavored Whiskey market, spanning from 2019 to 2033, with a keen focus on the Base Year: 2025. It delves into the intricate details of market dynamics, identifying key growth catalysts such as innovative flavor development, expansion of online retail, and the burgeoning mixology trend. The report provides detailed projections, estimating the market value to reach significant figures in the billions of dollars by the end of the Forecast Period: 2025-2033. It meticulously examines market segmentation by ABV and application, highlighting the dominance of specific segments and regions. Furthermore, the report offers an in-depth look at the challenges and restraints faced by the industry, alongside strategic insights into the leading players and their significant developments, providing a holistic view of this dynamic and evolving market.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.3% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 7.3%.

Key companies in the market include Duke&Dame, Ole Smoky Moonshine, Bird Dog Whiskey, Crown Royal, R6 DISTILLERY, Ballotin Chocolate Whiskey, Whiskeysmith, Barrel Station, The Party Source, BevMo, Drizly, TOAST Wine + Spirits, Feast + West, New Hampshire Liquor, Lebanon Wine & Spirits, Del Mesa Liquor, Royal Batch, 1000 Corks, .

The market segments include Type, Application.

The market size is estimated to be USD XXX N/A as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in N/A and volume, measured in K.

Yes, the market keyword associated with the report is "Caramel Flavored Whiskey," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Caramel Flavored Whiskey, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.