1. What is the projected Compound Annual Growth Rate (CAGR) of the Car Braking Device?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Car Braking Device

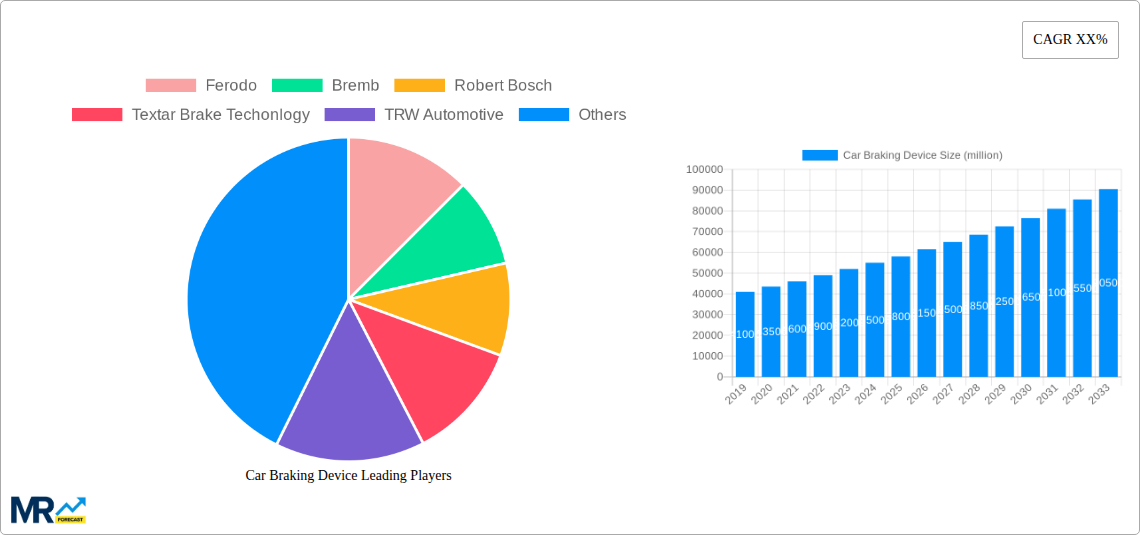

Car Braking DeviceCar Braking Device by Type (Two-Box System, One-Box System), by Application (Passenger Car, Commercial Vehicle), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

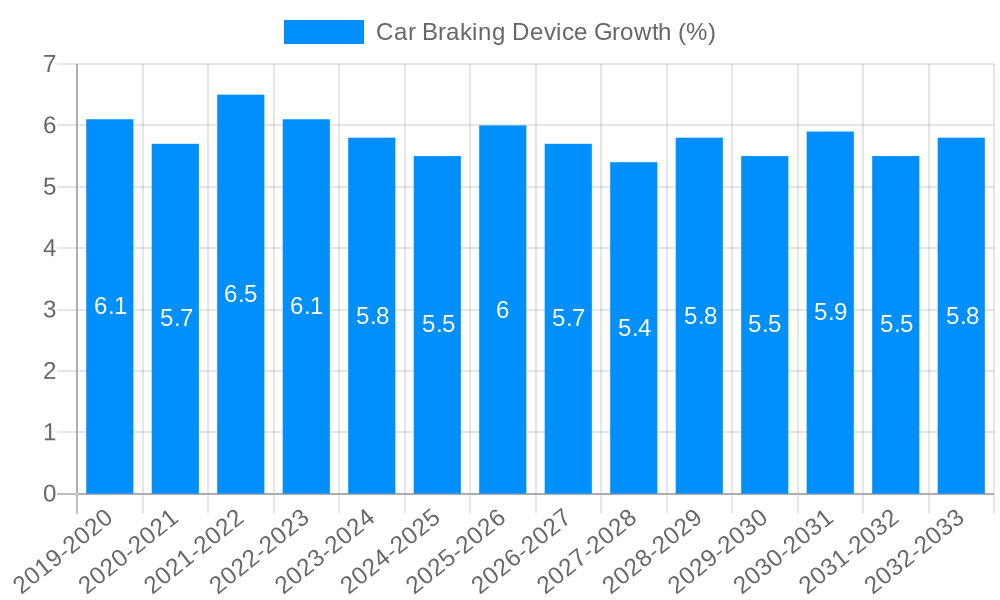

The global car braking device market is poised for substantial growth, projected to reach a market size of approximately $58 billion by 2025, with an estimated Compound Annual Growth Rate (CAGR) of 6.5% throughout the forecast period ending in 2033. This expansion is primarily fueled by the increasing global vehicle production, a rising emphasis on automotive safety features, and the growing adoption of advanced braking technologies such as Anti-lock Braking Systems (ABS), Electronic Stability Control (ESC), and regenerative braking in electric and hybrid vehicles. The "Two-Box System" segment is expected to dominate the market due to its widespread application in conventional vehicles, while the "One-Box System" is anticipated to witness significant growth driven by the evolution of integrated braking solutions and the increasing demand for lighter and more efficient systems. Passenger cars represent the largest application segment, but the commercial vehicle segment is exhibiting robust growth owing to stringent safety regulations and the increasing fleet sizes of commercial transportation.

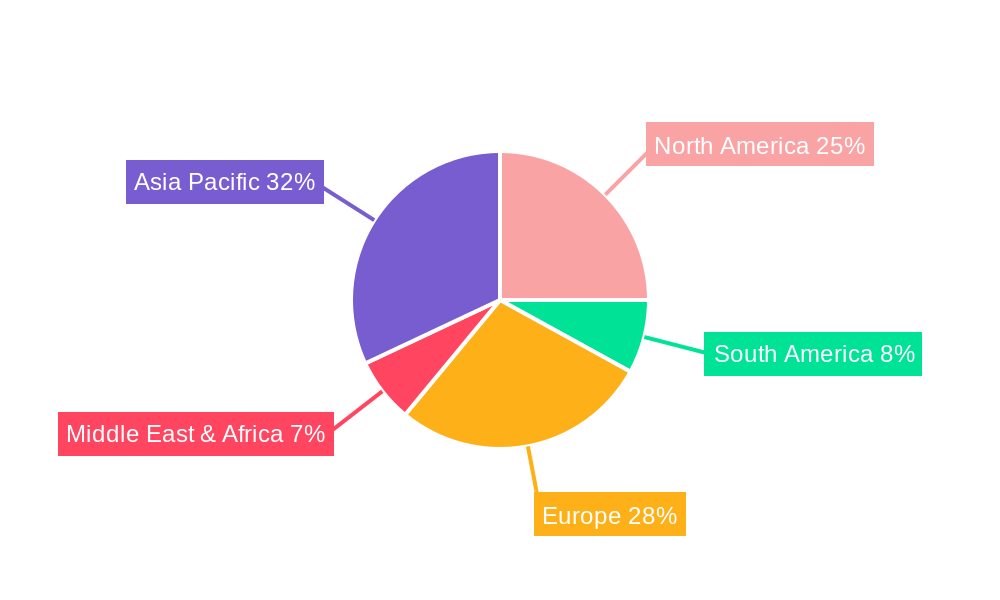

The market's trajectory is further shaped by several key trends, including the integration of AI and machine learning for predictive braking maintenance, the development of lightweight and high-performance materials to improve fuel efficiency and braking performance, and the increasing demand for sophisticated braking systems in electric and autonomous vehicles. However, the market faces certain restraints, such as the high cost of advanced braking technologies and the need for skilled labor for installation and maintenance, which could temper rapid adoption in certain regions. Geographically, the Asia Pacific region is expected to lead the market in terms of both revenue and growth, driven by the burgeoning automotive industry in China and India, coupled with increasing consumer awareness regarding vehicle safety. North America and Europe also represent significant markets due to the presence of major automotive manufacturers and a strong regulatory framework promoting safety.

This report offers an in-depth analysis of the global Car Braking Device market, meticulously examining trends, drivers, challenges, and future projections. The study encompasses a comprehensive Study Period of 2019-2033, with a Base Year and Estimated Year of 2025. The Forecast Period extends from 2025 to 2033, building upon the Historical Period of 2019-2024. This detailed examination provides actionable insights for stakeholders seeking to understand and capitalize on the evolving landscape of automotive braking systems, with an estimated market value projected to reach over 150 million units by 2025 and continue its upward trajectory. The report delves into the intricate interplay of technological advancements, regulatory landscapes, and consumer demands that are shaping the trajectory of this critical automotive component. Furthermore, it provides a granular view of market segmentation across different system types, vehicle applications, and key industry developments, offering a holistic perspective on the market's present state and future potential.

The global Car Braking Device market is witnessing a significant evolution driven by a confluence of technological innovation and increasing safety mandates. A paramount trend is the pervasive integration of advanced braking technologies, moving beyond traditional friction-based systems. The increasing adoption of electronic braking systems (EBS) and regenerative braking in electric and hybrid vehicles is reshaping the market. These systems not only enhance braking efficiency and performance but also contribute to energy recovery, a critical aspect for the sustainability of electric mobility. The demand for enhanced safety features, such as Anti-lock Braking Systems (ABS), Electronic Stability Control (ESC), and Automatic Emergency Braking (AEB), is a persistent driver, fueled by stringent safety regulations worldwide and growing consumer awareness. The market is also observing a pronounced shift towards lightweight and high-performance materials for brake components, aiming to reduce vehicle weight, improve fuel efficiency, and enhance overall performance. This includes the growing use of ceramic composites and advanced alloys. Furthermore, the miniaturization and integration of braking components are gaining traction, enabling more compact and efficient vehicle designs. The aftermarket segment is also experiencing robust growth, driven by the increasing vehicle parc and the demand for reliable replacement parts. The rise of connected vehicles is also influencing the market, with future braking systems expected to incorporate greater levels of connectivity for diagnostics, predictive maintenance, and enhanced driver assistance features. The market's expansion is further underscored by the estimated market size reaching over 150 million units in 2025, with projections indicating sustained growth throughout the Forecast Period of 2025-2033. This indicates a robust demand for braking solutions that prioritize safety, efficiency, and advanced functionality, reflecting the broader automotive industry's pursuit of smarter and more sustainable mobility solutions. The ongoing research and development efforts by key players are continuously introducing novel solutions that address evolving consumer needs and regulatory requirements, ensuring the dynamism and growth of the Car Braking Device market.

The Car Braking Device market is propelled by a multifaceted array of driving forces that are fundamentally reshaping its landscape. Foremost among these is the unwavering commitment to enhancing vehicle safety. Increasingly stringent government regulations worldwide, mandating the inclusion of advanced braking systems like ABS, ESC, and AEB, are a primary catalyst. These regulations directly translate into higher production volumes and a consistent demand for sophisticated braking components. Concurrently, the burgeoning electric vehicle (EV) and hybrid vehicle (HEV) segments are introducing new propulsion paradigms that necessitate advanced braking solutions. Regenerative braking, a key feature of these eco-friendly vehicles, not only contributes to energy efficiency but also influences the design and functionality of traditional braking systems, creating a synergistic demand. Consumer demand for enhanced driving experience and performance also plays a pivotal role. Drivers are increasingly expecting responsive, precise, and reliable braking, pushing manufacturers to develop higher-performing and more technologically advanced braking solutions. Furthermore, the sheer growth in global vehicle production, particularly in emerging economies, directly fuels the demand for braking devices. As more vehicles are manufactured and brought onto the roads, the need for both original equipment manufacturer (OEM) and aftermarket braking components escalates, creating a continuous market expansion. The continuous innovation in material science and manufacturing technologies also contributes significantly, allowing for the development of lighter, more durable, and more cost-effective braking components that further drive adoption and market growth.

Despite the robust growth trajectory, the Car Braking Device market encounters several significant challenges and restraints that warrant careful consideration. One of the primary hurdles is the increasing complexity and cost associated with integrating advanced braking technologies. The development and implementation of sophisticated electronic braking systems, advanced sensors, and control units require substantial investment in research and development, as well as advanced manufacturing capabilities, which can translate into higher component costs. This cost factor can be a significant restraint, particularly in price-sensitive market segments and for lower-tier vehicle models. Another challenge lies in the evolving regulatory landscape. While regulations drive demand, the constant introduction of new safety standards and emissions requirements can necessitate frequent redesigns and retooling, impacting production timelines and increasing operational expenses for manufacturers. Furthermore, the sourcing and supply chain for specialized materials, such as rare earth metals used in some advanced braking systems or high-performance composites, can be subject to volatility, geopolitical risks, and price fluctuations, potentially disrupting production and affecting profitability. The competitive intensity within the market also presents a restraint. A large number of established global players and emerging regional manufacturers vie for market share, leading to price pressures and the need for continuous innovation to maintain a competitive edge. Lastly, the significant capital investment required for establishing and upgrading manufacturing facilities to produce advanced braking systems can be a barrier to entry for new players, consolidating the market amongst well-established entities. The lifecycle management of braking components, particularly in the context of increasingly complex electronics, also presents challenges related to repairability and obsolescence, requiring manufacturers to focus on durable and upgradable solutions.

The global Car Braking Device market exhibits distinct regional dominance and segment preferences, heavily influenced by vehicle production volumes, regulatory frameworks, and technological adoption rates. The Asia Pacific region, particularly China and India, is poised to emerge as a dominant force in terms of volume, driven by its colossal automotive manufacturing base and rapidly expanding domestic vehicle markets. This region accounts for a substantial portion of global passenger car and commercial vehicle production, directly translating into a massive demand for braking devices. The increasing disposable incomes and growing middle class in these countries are further fueling vehicle sales, thereby bolstering the demand for both OEM and aftermarket braking components. Coupled with government initiatives promoting automotive manufacturing and the adoption of advanced technologies, the Asia Pacific is set to be a primary growth engine for the market.

In terms of market segments, the Passenger Car application is projected to hold the largest market share, driven by the sheer volume of passenger vehicles produced globally. The increasing demand for enhanced safety features and improved driving dynamics in passenger cars directly fuels the adoption of advanced braking systems. As a result, technologies like ABS, ESC, and emerging autonomous driving-related braking functions are seeing significant uptake within this segment.

Furthermore, within the types of braking systems, the One-Box System is expected to witness substantial growth and potentially dominate certain sub-segments. One-box systems, which integrate multiple braking functions into a single, compact unit, offer advantages in terms of space-saving, reduced complexity, and potential cost efficiencies. This is particularly relevant for the burgeoning electric and hybrid vehicle market, where space optimization is a critical design consideration. The increasing trend towards electrification and the need for highly integrated vehicle architectures favor the adoption of one-box solutions. The development and refinement of these integrated systems by key players like Robert Bosch and Continental AG are further accelerating their market penetration. The continuous innovation in this segment, aimed at improving performance, reliability, and cost-effectiveness, will solidify its dominant position. The forecast period of 2025-2033 will likely witness a significant shift towards these more integrated and sophisticated braking solutions, especially within the passenger car segment in the Asia Pacific region. The market size for braking devices within this dominant region and segment is estimated to reach tens of millions of units annually, contributing significantly to the overall global market value.

The Car Braking Device industry is propelled by several key growth catalysts. The accelerating global shift towards Electric Vehicles (EVs) and Hybrid Electric Vehicles (HEVs) is a significant driver, necessitating the adoption of advanced braking systems like regenerative braking and sophisticated electronic braking systems. Stringent government regulations worldwide mandating advanced safety features such as ABS, ESC, and AEB directly fuel the demand for these technologies. Furthermore, the increasing consumer awareness and demand for enhanced vehicle safety and driving performance encourage manufacturers to integrate higher-performing and more reliable braking solutions. The robust growth in global vehicle production, especially in emerging economies, also creates a substantial and continuous demand for braking devices across both OEM and aftermarket channels.

This report meticulously details the global Car Braking Device market, offering a holistic perspective on its current state and future trajectory. It provides an in-depth analysis of market trends, driving forces, and challenges, supported by robust data and expert insights. The study covers a comprehensive Study Period of 2019-2033, with a Base Year and Estimated Year of 2025, and a Forecast Period of 2025-2033, building upon the Historical Period of 2019-2024. With an estimated market size exceeding 150 million units in 2025, the report highlights the significant growth potential and key market dynamics. It further segments the market by system type (Two-Box System, One-Box System) and application (Passenger Car, Commercial Vehicle), offering a granular understanding of sector-specific demands. The report also identifies leading players and significant industry developments, providing a valuable resource for stakeholders seeking to navigate and capitalize on the evolving Car Braking Device landscape.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Ferodo, Bremb, Robert Bosch, Textar Brake Techonlogy, TRW Automotive, ATE Brakes, ZF Group, Shandong Gold Phoenix Co.,Ltd, Raybestos, Continental AG, ADVICS Manufacturing Ohio, Inc, Hyundai Mobis, Mando Corporation, Wabco, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Car Braking Device," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Car Braking Device, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.