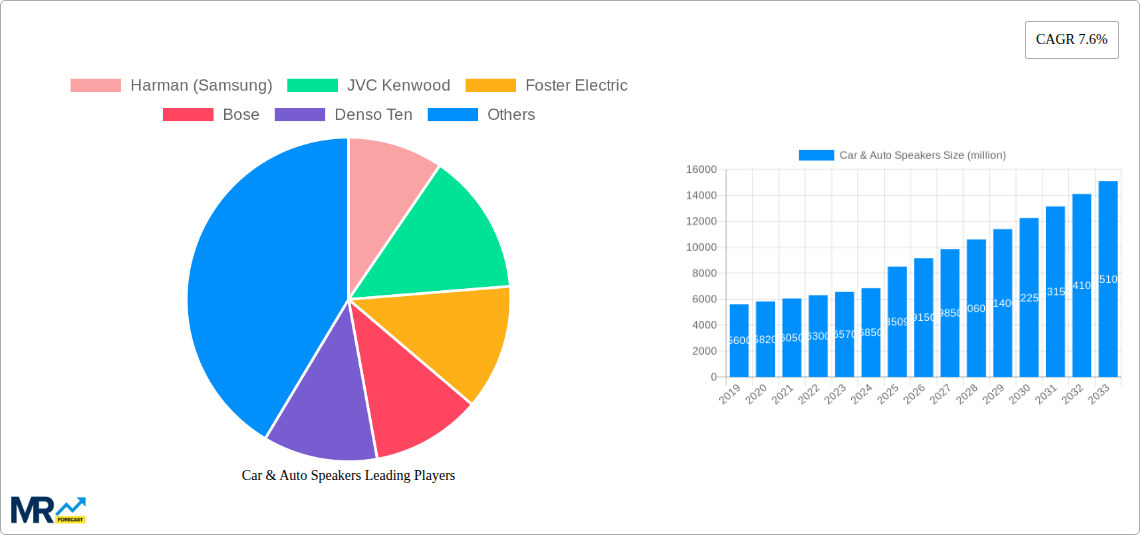

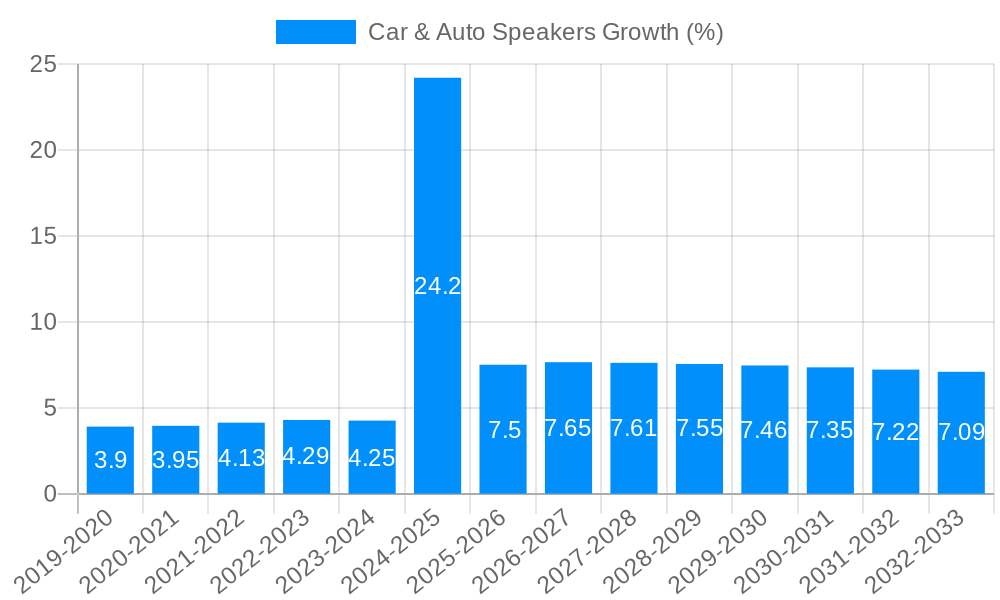

1. What is the projected Compound Annual Growth Rate (CAGR) of the Car & Auto Speakers?

The projected CAGR is approximately 7.6%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Car & Auto Speakers

Car & Auto SpeakersCar & Auto Speakers by Type (Tweeters, Midrange Speakers, Woofers, Full-range Speakers, Subwoofers), by Application (OEM, Aftermarket), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

The global car and auto speaker market is poised for robust growth, projected to reach \$8,509 million by 2025, with a Compound Annual Growth Rate (CAGR) of 7.6% expected to persist through 2033. This expansion is primarily fueled by an increasing consumer demand for enhanced in-car audio experiences, driven by advancements in vehicle infotainment systems and the proliferation of digital music streaming. The market is segmented into various speaker types, including tweeters, midrange speakers, woofers, full-range speakers, and subwoofers, each catering to specific audio frequencies and performance requirements. The OEM segment, where speakers are integrated directly into new vehicles, is expected to dominate, owing to the rising production of cars equipped with sophisticated audio systems as a standard feature. However, the aftermarket segment is also showing significant traction as car owners seek to upgrade their existing audio setups for superior sound quality and personalized listening environments.

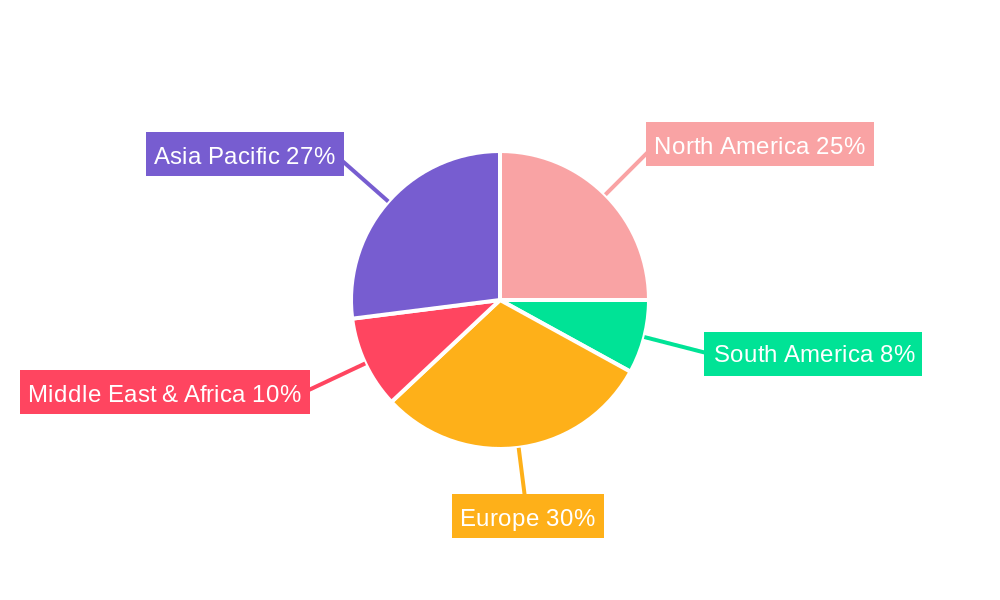

Geographically, Asia Pacific is anticipated to lead market expansion, propelled by the burgeoning automotive industry in China, India, and South Korea, coupled with a growing disposable income among consumers. North America and Europe are also substantial markets, characterized by a mature automotive sector and a strong consumer appreciation for high-fidelity audio. Key market drivers include the continuous innovation in speaker technologies, such as the development of lighter, more durable materials and advanced acoustic designs, alongside the integration of smart audio features. Despite this optimistic outlook, the market faces certain restraints, including the rising cost of raw materials and the complexity of integrating advanced audio systems into increasingly space-constrained vehicle interiors. Nevertheless, the relentless pursuit of an immersive and premium auditory experience within vehicles is expected to underpin sustained growth in the car and auto speaker market for the foreseeable future.

This comprehensive report offers an in-depth analysis of the global Car & Auto Speakers market, spanning a study period from 2019 to 2033, with a base year of 2025 and a detailed forecast for the period 2025-2033. The historical period of 2019-2024 provides crucial context for understanding current market dynamics. Leveraging unit sales in the millions, this report delves into the intricate landscape of automotive audio systems, examining key market insights, driving forces, challenges, regional dominance, and future growth catalysts. It meticulously analyzes various speaker types, including Tweeters, Midrange Speakers, Woofers, Full-range Speakers, and Subwoofers, alongside their segmentation across OEM and Aftermarket applications.

The global car and auto speaker market is undergoing a significant transformation driven by evolving consumer expectations for in-car audio experiences and rapid advancements in automotive technology. XXX The demand for premium, immersive audio systems is no longer confined to luxury vehicles; it is increasingly becoming a standard feature sought after by a broader consumer base. This trend is further amplified by the integration of advanced digital signal processing (DSP) and artificial intelligence (AI) within automotive sound systems, enabling personalized audio profiles and adaptive sound environments. The proliferation of electric vehicles (EVs) also presents a unique opportunity and challenge. While EVs offer a quieter cabin, making audio quality more pronounced, they also require lighter and more energy-efficient speaker components. The market is witnessing a surge in the adoption of compact yet powerful speaker designs and the exploration of novel materials to reduce weight and power consumption. Furthermore, the aftermarket segment is experiencing robust growth, fueled by a desire among vehicle owners to upgrade their existing audio systems for enhanced performance and customization. This includes the increasing popularity of multi-component systems and high-fidelity solutions. The rise of connected car technologies, enabling over-the-air software updates for audio systems, also points towards a future where audio performance can be continuously improved and tailored. The overarching trend is towards a more sophisticated, personalized, and seamlessly integrated audio experience within the automotive cabin, moving beyond mere functionality to become a key differentiator in vehicle appeal. The market is projected to witness substantial unit sales, exceeding [Insert Value in Millions Here] units in 2025, with consistent growth anticipated throughout the forecast period. The adoption of new acoustic technologies, such as beamforming audio and spatial audio, is also on the horizon, promising to redefine the in-car listening experience.

The automotive speaker market is being propelled by a confluence of factors that are fundamentally reshaping the in-car audio landscape. A primary driver is the escalating consumer demand for enhanced in-car entertainment and a more sophisticated audio experience. As vehicles become more connected and digital, occupants expect audio systems that can rival high-end home entertainment setups. This aspiration fuels the demand for premium audio solutions, including advanced sound processing, noise cancellation technologies, and immersive audio formats like Dolby Atmos and DTS:X. The automotive industry's own evolution, particularly the rapid growth of the electric vehicle (EV) segment, acts as another significant catalyst. The inherent quietness of EV cabins provides an unadulterated canvas for audio, making speaker quality and clarity paramount. This has pushed manufacturers to develop more efficient, lighter, and acoustically superior speaker components that do not compromise battery range. Moreover, the increasing prevalence of advanced driver-assistance systems (ADAS) and in-car infotainment systems necessitates robust and high-quality audio for alerts, notifications, and seamless integration with digital services. The aftermarket segment, in particular, is experiencing a boom as consumers seek to personalize their vehicles and upgrade from factory-fitted systems to achieve superior sound fidelity. This desire for personalization and superior performance is a constant impetus for innovation and market expansion.

Despite the robust growth trajectory, the car and auto speakers market faces several significant challenges and restraints that could temper its expansion. A primary concern is the escalating cost of raw materials and components, including rare earth magnets, specialized polymers, and sophisticated electronic components. Fluctuations in global supply chains and geopolitical uncertainties can exacerbate these cost pressures, impacting profit margins for manufacturers and potentially leading to higher prices for consumers. Furthermore, the intricate nature of automotive electrical systems and the stringent safety regulations within the automotive industry pose significant design and integration challenges. Developing speakers that meet all acoustic performance requirements while adhering to strict electromagnetic compatibility (EMC) standards and safety protocols demands considerable engineering expertise and investment. The increasing complexity of vehicle architectures also means that speaker integration needs to be highly precise, with limited space and specific mounting requirements in modern vehicle designs. Another restraint is the market saturation in certain segments, particularly in developed regions where penetration rates for premium audio systems are already high. While there is still room for growth, the pace of expansion in these mature markets might be slower compared to emerging economies. The rapid pace of technological obsolescence also presents a challenge, as manufacturers must constantly innovate to keep pace with emerging audio technologies and consumer preferences, requiring continuous R&D investment.

The global car and auto speakers market is characterized by distinct regional dynamics and segment preferences. The Aftermarket segment, across various speaker types, is projected to be a significant growth engine, driven by a universal consumer desire for personalized and superior audio experiences.

Dominant Segments:

Key Dominating Regions/Countries:

The car and auto speakers industry is poised for significant growth, propelled by several key catalysts. The relentless pursuit of enhanced in-car audio experiences by consumers is a primary driver, pushing manufacturers to integrate more sophisticated sound technologies and premium speaker components. The accelerating adoption of electric vehicles (EVs) offers a dual advantage: their quieter cabins highlight the importance of audio quality, while the need for energy efficiency encourages innovation in lighter, more powerful speaker designs. Furthermore, the continuous evolution of automotive infotainment systems and the increasing prevalence of advanced driver-assistance systems (ADAS) necessitate high-fidelity audio for alerts and communication, thereby boosting speaker demand.

This report provides a holistic view of the car and auto speakers market, offering granular analysis across various segments, regions, and timeframes. It delves into the intricate interplay of technological advancements, consumer preferences, and market dynamics that are shaping the future of automotive audio. The detailed examination of trends, driving forces, and challenges equips stakeholders with the insights needed to navigate this evolving landscape. Furthermore, the identification of key growth catalysts and leading players offers a strategic roadmap for capitalizing on emerging opportunities. This comprehensive coverage ensures that businesses, investors, and researchers gain a deep understanding of the market's present state and future potential, enabling informed decision-making and strategic planning.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.6% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 7.6%.

Key companies in the market include Harman (Samsung), JVC Kenwood, Foster Electric, Bose, Denso Ten, Pioneer, Sonavox, Premium Sound Solutions (AAC), Alpine (Alps Electric), Elettromedia S.p.A., Tianjin Bodun Electronics, Sony, Dainty Gemmy, Jilin Hangsheng, Polk Audio (Masimo), DLS, Dynaudio A/S, MTX Audio, KICKER (Stillwater Designs), Rockford Fosgate, JL Audio, Focal, Rainbow.

The market segments include Type, Application.

The market size is estimated to be USD 8509 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Car & Auto Speakers," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Car & Auto Speakers, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.