1. What is the projected Compound Annual Growth Rate (CAGR) of the Capacitive Wireless Sensor?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Capacitive Wireless Sensor

Capacitive Wireless SensorCapacitive Wireless Sensor by Type (Absolute Capacitive Sensor, Relative Capacitive Sensor, World Capacitive Wireless Sensor Production ), by Application (Industrial, Environmental Industry, Automotive Industry, Energy Industry, Aerospace Industry, Others, World Capacitive Wireless Sensor Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

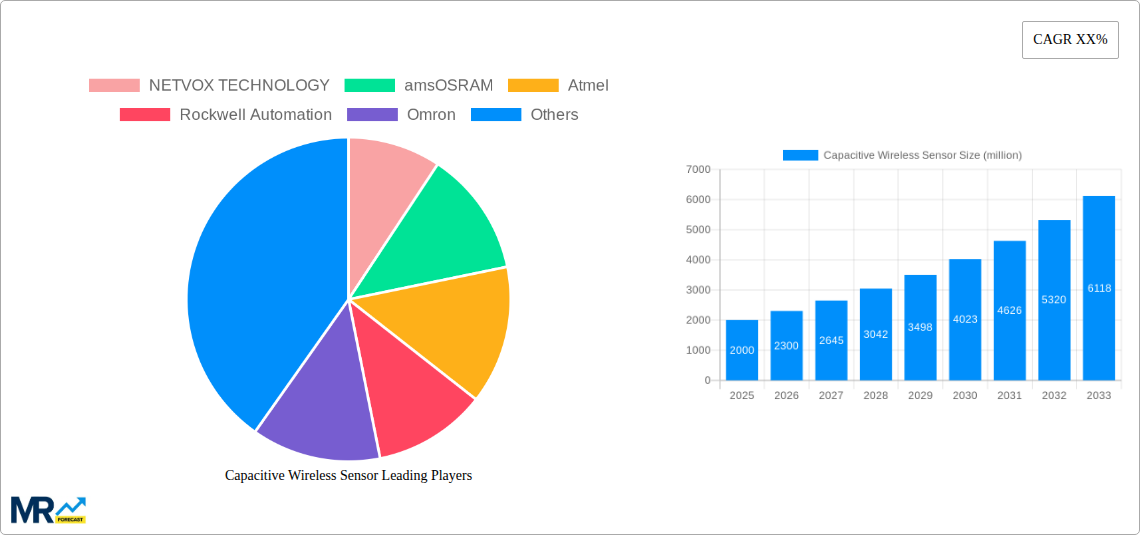

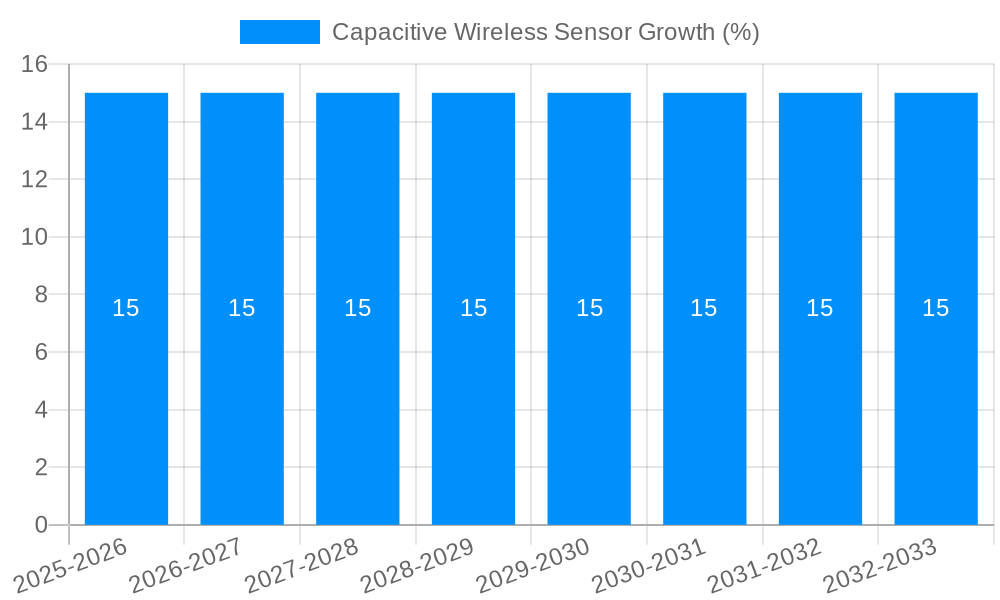

The global Capacitive Wireless Sensor market is poised for significant expansion, projected to reach approximately $2,000 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 15% over the forecast period of 2025-2033. This impressive growth trajectory is primarily fueled by the escalating demand for smart and connected devices across a multitude of industries. The "Internet of Things" (IoT) revolution, in particular, is a major catalyst, driving the adoption of these sensors for real-time data acquisition and monitoring. Key applications in the industrial sector, encompassing automation, predictive maintenance, and process control, are spearheading this adoption due to the inherent advantages of capacitive wireless sensors, such as their non-contact sensing capabilities, durability, and suitability for harsh environments. The environmental monitoring segment also presents substantial opportunities, with sensors being deployed for pollution detection, weather forecasting, and resource management.

Further propelling market growth are advancements in wireless communication technologies, enabling more efficient and reliable data transmission from these sensors. Innovations in miniaturization and power efficiency are also contributing to wider adoption, making these sensors more versatile and cost-effective. While the market is broadly segmented into Absolute Capacitive Sensors and Relative Capacitive Sensors, the trend towards increasingly sophisticated applications within the Automotive Industry (for advanced driver-assistance systems and in-cabin monitoring), Energy Industry (for smart grids and asset management), and Aerospace Industry (for structural health monitoring and environmental control) indicates a diversified and expanding market landscape. Despite these promising growth factors, potential restraints include the initial implementation costs and the ongoing need for robust cybersecurity measures to protect the vast amounts of data generated. However, the pervasive benefits of enhanced efficiency, improved safety, and data-driven decision-making are expected to outweigh these challenges.

This comprehensive report delves into the intricate dynamics of the Capacitive Wireless Sensor market, spanning the historical period of 2019-2024 and extending to a detailed forecast through 2033, with the base and estimated year set at 2025. The report offers an in-depth analysis of market trends, driving forces, challenges, and future growth catalysts, providing a holistic view for industry stakeholders. With an estimated market size projected to reach several tens of millions of units by 2025, the report meticulously examines the production and application landscape of both Absolute and Relative Capacitive Sensors, alongside broader World Capacitive Wireless Sensor Production figures. Key industry segments analyzed include Industrial, Environmental, Automotive, Energy, Aerospace, and Others, offering granular insights into demand across diverse applications. The report also highlights significant industry developments and identifies the leading players shaping the future of this rapidly evolving sector.

The Capacitive Wireless Sensor market is experiencing a period of significant evolution, driven by a confluence of technological advancements and burgeoning application demands. Within the Study Period of 2019-2033, and particularly around the Base Year of 2025, the market is witnessing an accelerating adoption of these sensors across a multitude of industries. A key trend is the increasing integration of these sensors into the Industrial sector, where their non-contact sensing capabilities and robustness are proving invaluable for automation, predictive maintenance, and process optimization. The demand for precise measurement in harsh environments, where traditional contact sensors might fail, is a substantial driver. Furthermore, the Environmental Industry is increasingly leveraging capacitive wireless sensors for real-time monitoring of parameters such as humidity, liquid levels, and proximity in applications ranging from smart agriculture to water management systems, contributing to a projected market value in the millions.

The Automotive Industry is another significant area of growth. With the proliferation of advanced driver-assistance systems (ADAS) and the ongoing transition towards electric vehicles (EVs), capacitive wireless sensors are finding applications in object detection, occupant sensing, and battery management systems. Their ability to operate reliably in the presence of dirt, dust, and moisture makes them ideal for automotive environments. Similarly, the Energy Industry is benefiting from these sensors in smart grids, renewable energy infrastructure monitoring (e.g., wind turbines, solar panels), and oil and gas exploration. The drive for enhanced efficiency, safety, and reduced downtime in these critical sectors fuels the demand.

Looking towards the Forecast Period of 2025-2033, the market is expected to see a continued upward trajectory, with projections indicating a substantial increase in the World Capacitive Wireless Sensor Production volume, potentially reaching tens of millions of units annually. This growth will be fueled by miniaturization, improved power efficiency, and enhanced communication protocols, enabling more sophisticated and widespread deployment. The trend towards Industry 4.0 and the Internet of Things (IoT) is a overarching theme, where capacitive wireless sensors act as crucial nodes for data acquisition and transmission, contributing to the creation of smarter, more connected ecosystems. The increasing sophistication of Absolute Capacitive Sensor technology, offering precise displacement and position measurement, alongside the continued demand for Relative Capacitive Sensor solutions for proximity and level detection, will diversify the market offerings. The report will meticulously analyze these trends, providing valuable market insights into the expected expansion and segmentation.

The expansion of the Capacitive Wireless Sensor market is underpinned by a robust set of driving forces, each contributing to its increasing adoption across various industries. A primary catalyst is the relentless pursuit of automation and efficiency in industrial settings. Capacitive sensors, with their non-contact sensing capabilities and ability to operate in challenging environments, are instrumental in enabling smart manufacturing processes. They facilitate precise measurement of position, proximity, and level, which are critical for robotic systems, assembly lines, and material handling, contributing to productivity gains valued in the millions.

The growing imperative for environmental monitoring and resource management also plays a pivotal role. As concerns about climate change and sustainability intensify, the demand for accurate and real-time data on environmental parameters such as soil moisture, water levels, and air quality escalates. Capacitive wireless sensors provide a cost-effective and scalable solution for deploying vast networks of monitoring devices, aiding in precision agriculture, smart cities, and conservation efforts. The increasing focus on safety and security across sectors like automotive and industrial automation further fuels demand. Capacitive sensors are integral to the development of advanced safety systems, including occupant detection, collision avoidance, and intrusion detection, thereby enhancing human well-being and mitigating risks.

Furthermore, the pervasive influence of the Internet of Things (IoT) and the broader digital transformation trend are significant propellers. Capacitive wireless sensors serve as essential building blocks for IoT ecosystems, collecting critical data that can be transmitted wirelessly for analysis and actionable insights. This enables the creation of smart devices, connected infrastructure, and data-driven decision-making, opening up new market opportunities and driving the adoption of these sensors into previously untapped areas. The continuous innovation in sensor technology, leading to smaller, more power-efficient, and cost-effective solutions, also directly contributes to their wider market penetration.

Despite the promising growth trajectory, the Capacitive Wireless Sensor market is not without its challenges and restraints. One of the primary hurdles is the sensitivity to environmental factors and interference. While robust in many aspects, capacitive sensors can be affected by changes in dielectric constant of the surrounding medium, humidity, and the presence of conductive materials, which can lead to erroneous readings. This necessitates careful calibration and environmental sealing in certain applications, adding to the overall cost and complexity of deployment.

Another significant restraint is the power consumption associated with wireless transmission. While ongoing advancements are improving battery life and reducing power footprints, for long-term, large-scale deployments, particularly in remote or inaccessible locations, continuous power management remains a concern. This can limit the deployment frequency and the overall lifespan of sensor nodes, requiring consideration of alternative power sources or more frequent maintenance cycles. The initial cost of implementation, especially for sophisticated systems with numerous sensors and associated communication infrastructure, can also be a deterrent for some smaller businesses or budget-constrained projects.

Furthermore, interoperability and standardization issues within the wireless communication protocols can pose challenges. Ensuring seamless integration of sensors from different manufacturers into a unified network requires adherence to common standards, which are still evolving in some areas. The availability of skilled personnel for installation, configuration, and maintenance of wireless sensor networks can also be a limiting factor in certain regions or industries. Finally, data security and privacy concerns associated with transmitting sensitive data wirelessly are becoming increasingly important, requiring robust encryption and security measures to build user trust and ensure compliance with regulations. Overcoming these restraints will be crucial for unlocking the full market potential.

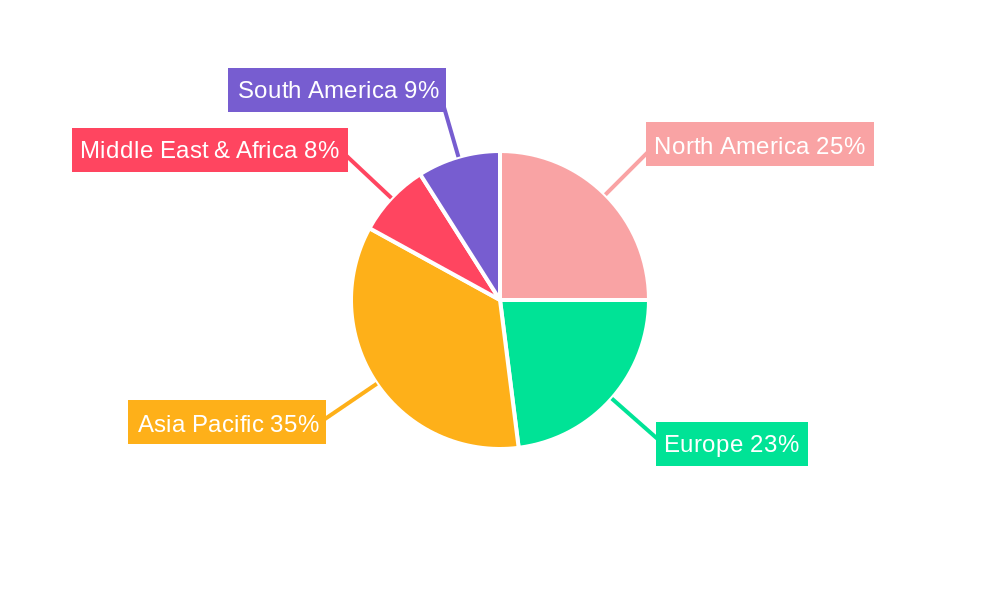

The Capacitive Wireless Sensor market is characterized by regional and segmental dominance driven by specific industrial demands, technological adoption rates, and economic factors. Across the Study Period of 2019-2033, with a Base Year of 2025 and Forecast Period of 2025-2033, the Industrial segment is poised to maintain a leading position due to its broad application scope and the continuous drive for automation and Industry 4.0 initiatives. Within this segment, the demand for both Absolute Capacitive Sensors and Relative Capacitive Sensors will be substantial, catering to diverse measurement needs.

North America and Europe are anticipated to be the dominant regions, largely due to their mature industrial bases, high levels of technological adoption, and significant investments in smart manufacturing and automation. Countries like the United States and Germany are at the forefront, with a strong presence of key players such as Rockwell Automation, Siemens AG, Honeywell, and Omron. These regions exhibit a high demand for precision sensing in sectors such as automotive manufacturing, aerospace, and heavy machinery. The focus on predictive maintenance and operational efficiency in these established industries fuels the adoption of advanced sensor technologies, including capacitive wireless sensors.

The Asia-Pacific region, particularly China, is expected to emerge as a rapidly growing market and potentially a dominant force in terms of production volume. The region's burgeoning manufacturing sector, coupled with government initiatives promoting technological innovation and smart city development, is driving significant demand. Companies like NETVOX TECHNOLOGY and Panasonic are playing a crucial role in supplying these markets. The increasing adoption of IoT solutions in manufacturing, smart agriculture, and environmental monitoring in countries like China and India will contribute significantly to the overall World Capacitive Wireless Sensor Production figures, potentially reaching tens of millions of units.

The Automotive Industry is another segment that will exert significant influence on market dominance, particularly in regions with a strong automotive manufacturing presence like North America, Europe, and Asia. The trend towards electric vehicles (EVs) and autonomous driving necessitates advanced sensing solutions for battery management, occupant detection, and safety systems. Companies such as amsOSRAM and NXP Semiconductors are key players in providing components for these automotive applications.

The Energy Industry also presents a compelling case for dominance, especially in regions with substantial investments in renewable energy infrastructure. Monitoring wind turbines, solar farms, and smart grids requires robust and reliable sensing capabilities, where capacitive wireless sensors can offer a significant advantage. Countries actively pursuing energy independence and sustainability will drive demand in this segment.

The dominance of a particular region or segment is often intertwined. For instance, the industrial dominance in North America and Europe is often driven by the automotive and aerospace sectors. Similarly, the rapid growth in Asia-Pacific is largely fueled by its massive industrial output and increasing adoption of smart technologies across various applications, including consumer electronics and industrial automation. The report will provide a detailed quantitative analysis of these regional and segmental contributions to the overall market dynamics, highlighting the significant market share and growth potential.

The Capacitive Wireless Sensor industry is experiencing several key growth catalysts that are propelling its expansion. The escalating adoption of the Internet of Things (IoT) and the subsequent demand for interconnected devices are a primary driver, as these sensors form the foundational data acquisition layer for many IoT applications. The ongoing advancements in miniaturization and power efficiency of these sensors are making them more accessible and suitable for a wider array of applications, including those with stringent size and energy constraints. Furthermore, the increasing focus on predictive maintenance and condition monitoring across industries, from manufacturing to energy, is creating a significant demand for real-time, accurate sensor data, which capacitive wireless sensors are well-positioned to provide.

This report provides an all-encompassing analysis of the Capacitive Wireless Sensor market, offering deep insights into its current landscape and future trajectory. It meticulously examines market trends, identifying key growth areas and emerging opportunities. The report further dissects the fundamental drivers propelling the market forward, alongside the inherent challenges and restraints that stakeholders must navigate. A significant focus is placed on identifying dominant regions and key market segments, offering a granular understanding of where the market is headed. The report also highlights crucial growth catalysts, such as the proliferation of IoT and the demand for predictive maintenance, that are shaping the industry's future. Leading companies influencing the market and significant recent developments are also detailed, providing a holistic view for informed decision-making.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include NETVOX TECHNOLOGY, amsOSRAM, Atmel, Rockwell Automation, Omron, Panasonic, NXP Semiconductors, Balluff, Honeywell, Festo, Fargo Controls, Pepperl+Fuchs GmbH, Siemens AG, Broadcom Limited, Standex Electronics GmbH.

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Capacitive Wireless Sensor," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Capacitive Wireless Sensor, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.