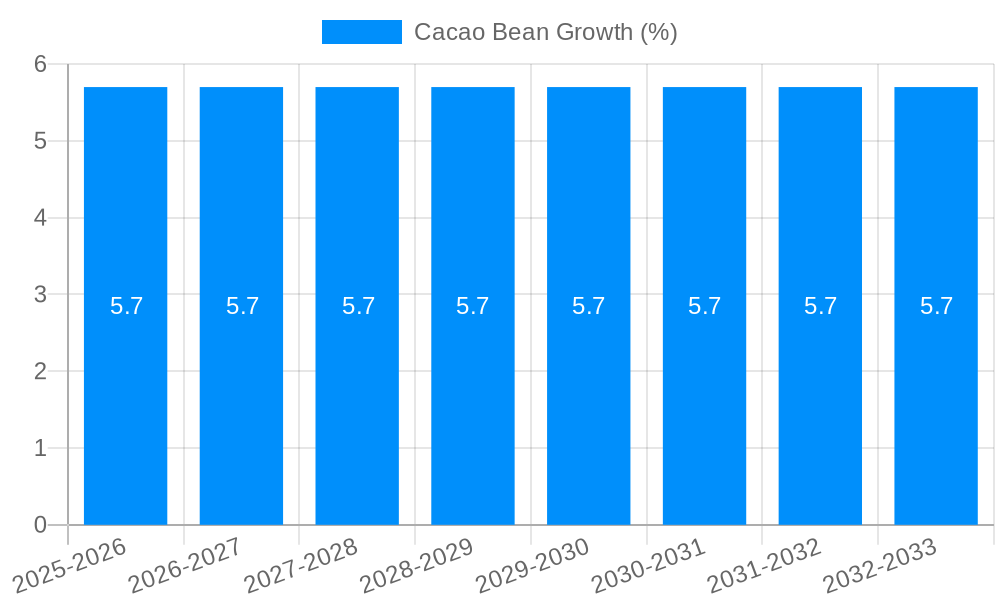

1. What is the projected Compound Annual Growth Rate (CAGR) of the Cacao Bean?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Cacao Bean

Cacao BeanCacao Bean by Type (Forastero, Criollo, World Cacao Bean Production ), by Application (Food and Beverages, Foodservice, World Cacao Bean Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

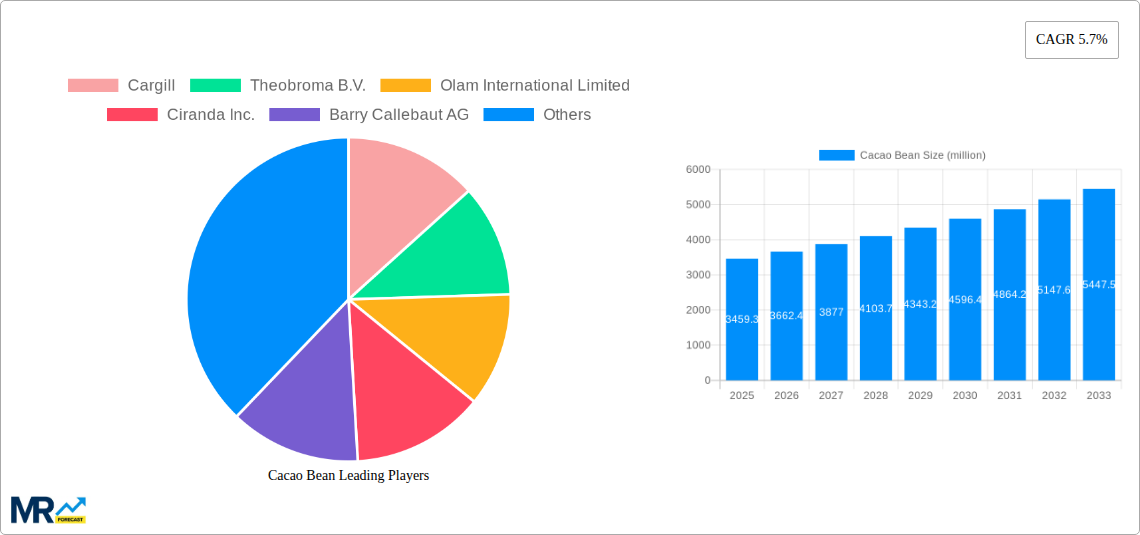

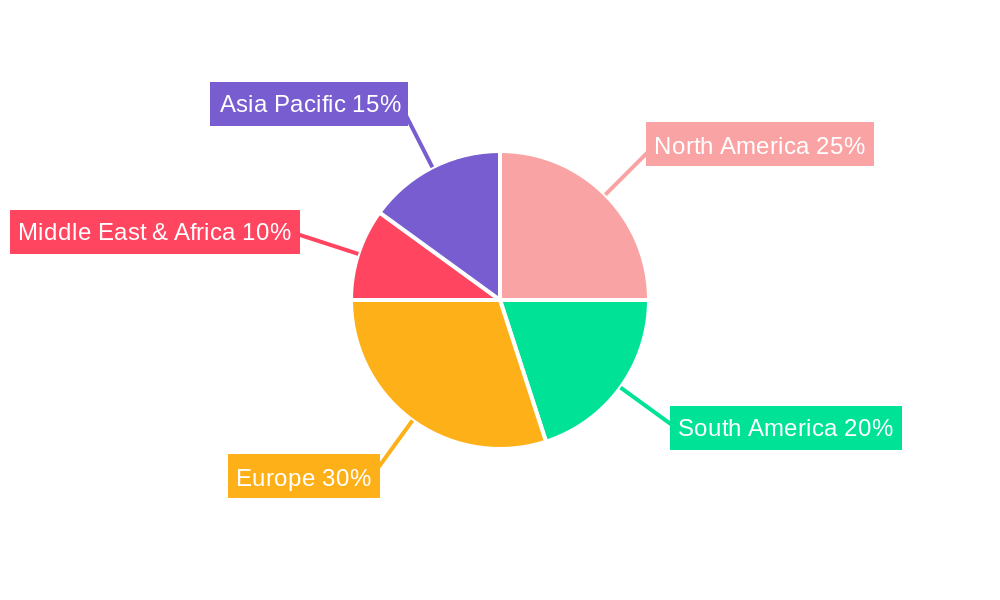

The global cacao bean market, valued at $5,113.6 million in 2025, is poised for significant growth over the forecast period (2025-2033). While the exact CAGR is not provided, considering the rising demand for chocolate and cocoa products globally, coupled with increasing consumer spending in emerging markets, a conservative estimate of a 5% annual growth rate appears reasonable. This growth is fueled by several key drivers, including the increasing popularity of chocolate confectionery, the expanding use of cocoa in the food and beverage industry (including health and wellness products incorporating cocoa), and the growing preference for premium and specialty cocoa products. Furthermore, innovations in cocoa processing and product development, such as single-origin chocolate and sustainably sourced cocoa, are contributing to market expansion. However, the market faces challenges such as volatile cocoa prices, susceptibility to climate change impacting crop yields, and increasing competition from substitute ingredients. Regional growth will vary, with North America and Europe maintaining strong positions due to established consumer markets and high consumption rates. However, faster growth is anticipated in Asia-Pacific regions driven by rising disposable incomes and increasing chocolate consumption.

The market segmentation reveals strong demand across various applications, with food and beverages holding the largest share. Within this segment, the growth of the foodservice sector is particularly notable, with increasing chocolate and cocoa-based offerings in restaurants and cafes. The type of cacao bean, specifically Forastero and Criollo, influences market dynamics. Forastero, being more widely available and cost-effective, dominates production volume. However, the demand for higher-quality Criollo beans is steadily rising, driven by the increasing popularity of gourmet chocolate. Key players like Cargill, Barry Callebaut, and Olam International are strategically positioning themselves to leverage these trends through vertical integration, sustainable sourcing initiatives, and product diversification. The competitive landscape is marked by a mix of large multinational corporations and smaller niche players, creating a dynamic environment characterized by both consolidation and innovation.

The global cacao bean market, valued at approximately $XXX million in 2025, is projected to witness robust growth throughout the forecast period (2025-2033). Driven by escalating consumer demand for chocolate and cocoa-based products, particularly in developing economies, the market exhibits a positive trajectory. The historical period (2019-2024) showcased fluctuating growth rates influenced by factors such as climatic conditions impacting crop yields and global economic shifts. However, the market's inherent resilience, fueled by the enduring popularity of chocolate and its versatility across various food and beverage applications, suggests sustained expansion. The estimated year 2025 serves as a pivotal point, reflecting a stabilization and consolidation phase after periods of volatility. Looking ahead to 2033, projections indicate a substantial increase in market size, driven by innovation in product development, expanding distribution channels, and a growing awareness of cocoa's health benefits (in moderation). Furthermore, the increasing demand for sustainable and ethically sourced cacao beans is pushing manufacturers to prioritize transparency and traceability, creating new opportunities for premium, high-quality products commanding higher price points. This trend towards premiumization influences overall market value growth beyond mere volume increases. The shift towards healthier lifestyles and the incorporation of cacao into functional foods and beverages also contribute to this positive outlook. However, the market remains susceptible to factors such as disease outbreaks and climate change, necessitating sustainable agricultural practices and robust supply chain management. Market segmentation by type (Forastero and Criollo) and application (food and beverages, foodservice) reveals diverse growth patterns, with Forastero, due to its higher yield and cost-effectiveness, dominating the market volume, while Criollo, with its superior flavor profile, commands a premium segment.

Several key factors are propelling the growth of the cacao bean market. Firstly, the enduring global popularity of chocolate and cocoa-based products remains a cornerstone of market expansion. Consumer preferences, particularly among younger generations, continue to favor indulgent treats, driving demand across various product formats, from traditional bars and confectionery to innovative beverages and baked goods. Secondly, the increasing disposable incomes in emerging markets are fueling consumption growth, as chocolate becomes more accessible to a wider consumer base. This burgeoning demand in regions like Asia and Africa contributes significantly to overall market expansion. Thirdly, the constant innovation in product development within the food and beverage industry plays a crucial role. Manufacturers are continuously introducing new chocolate varieties, flavors, and formats, appealing to diverse palates and expanding product portfolios. The emergence of healthier and functional chocolate options, incorporating ingredients like nuts, seeds, and superfoods, further diversifies market offerings. Finally, the rising focus on ethical and sustainable sourcing practices creates a premium segment of the market. Consumers are increasingly conscious of the environmental and social impacts of their food choices, driving demand for cacao beans produced with sustainability in mind. This focus is creating opportunities for companies that prioritize fair trade and responsible farming practices.

Despite its positive growth trajectory, the cacao bean market faces several significant challenges. One major concern is the vulnerability of cacao production to climate change. Fluctuations in temperature and rainfall patterns can significantly impact crop yields, leading to price volatility and supply chain disruptions. Diseases and pests affecting cacao plants also pose a considerable threat to production stability, requiring substantial investment in research and development of disease-resistant varieties and effective pest control measures. Furthermore, the increasing cost of inputs, such as fertilizers and labor, directly impacts production costs and profitability for farmers. This issue necessitates the development of cost-effective and sustainable farming practices to ensure the long-term viability of cacao cultivation. Another significant challenge stems from fluctuating global commodity prices. The price volatility of cacao beans can impact profitability across the value chain, from farmers to processors and manufacturers. This underscores the need for robust risk management strategies and diversification initiatives within the industry. Lastly, the global competition among producers and manufacturers is intensifying, placing pressure on margins and driving the need for continuous innovation and differentiation.

West Africa (Côte d'Ivoire, Ghana): This region dominates global cacao bean production, contributing a substantial portion of the world's supply. Its favorable climate and established farming practices solidify its position as a key player. This dominance is expected to continue throughout the forecast period, although there's potential for diversification and growth in other regions. The immense scale of production in this region significantly influences global prices and market dynamics.

Application: Food and Beverages: The vast majority of cacao beans are used in the production of food and beverage products, specifically chocolate and cocoa-based items. This segment's dominance stems from the widespread consumption of these products globally and continuous innovation in product development. The foodservice sector, while smaller, contributes significantly to demand, particularly in cafes, restaurants, and bakeries, catering to a wide variety of consumer preferences.

Type: Forastero: This type of cacao bean is characterized by high yields and relatively lower cost of production compared to Criollo. Its widespread cultivation translates into market dominance regarding volume. Although it may not command the same premium prices as Criollo, its high production capacity makes it the backbone of the majority of chocolate products. This segment's continued dominance is largely due to its cost-effectiveness and suitability for mass production.

The dominance of West Africa in production significantly impacts global supply and price dynamics. However, the growing demand for sustainably sourced cacao, combined with efforts to diversify production regions, could gradually shift the balance in the years to come. The food and beverage sector's broad reach and continued innovation ensure its continued dominance within the application segments. Forastero's cost-effectiveness maintains its superior market share within cacao types, despite the premium market held by Criollo for its unique flavor characteristics.

The cacao bean industry benefits from several key growth catalysts, including increasing consumer demand driven by rising disposable incomes, especially in emerging markets. Innovation in product development, leading to the introduction of new chocolate and cocoa-based products, continues to fuel market growth. Furthermore, the expanding focus on ethical and sustainable sourcing practices creates a premium segment for high-quality, responsibly produced cacao beans. These factors combine to create a positive outlook for the industry’s continued expansion.

This report provides a detailed analysis of the global cacao bean market, covering historical data (2019-2024), the estimated year (2025), and forecast projections (2025-2033). It encompasses market trends, driving factors, challenges, key players, and significant developments. The report offers in-depth insights into market segmentation by type and application, providing a comprehensive understanding of the market dynamics and growth potential. The research utilizes primary and secondary sources, encompassing market data and expert interviews to create a thorough and credible analysis of the cacao bean industry. The report is invaluable for industry stakeholders seeking strategic insights and market intelligence.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Cargill, Theobroma B.V., Olam International Limited, Ciranda Inc., Barry Callebaut AG, Dutch Cocoa B.V., Niche Cocoa Industry Ltd., PT. Danora Agro Prima, United Cocoa Processors Inc., Cocoa Processing Company, .

The market segments include Type, Application.

The market size is estimated to be USD 5113.6 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Cacao Bean," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Cacao Bean, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.