1. What is the projected Compound Annual Growth Rate (CAGR) of the Cacao?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Cacao

CacaoCacao by Type (Particles, Powder), by Application (Business, Family, Other), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

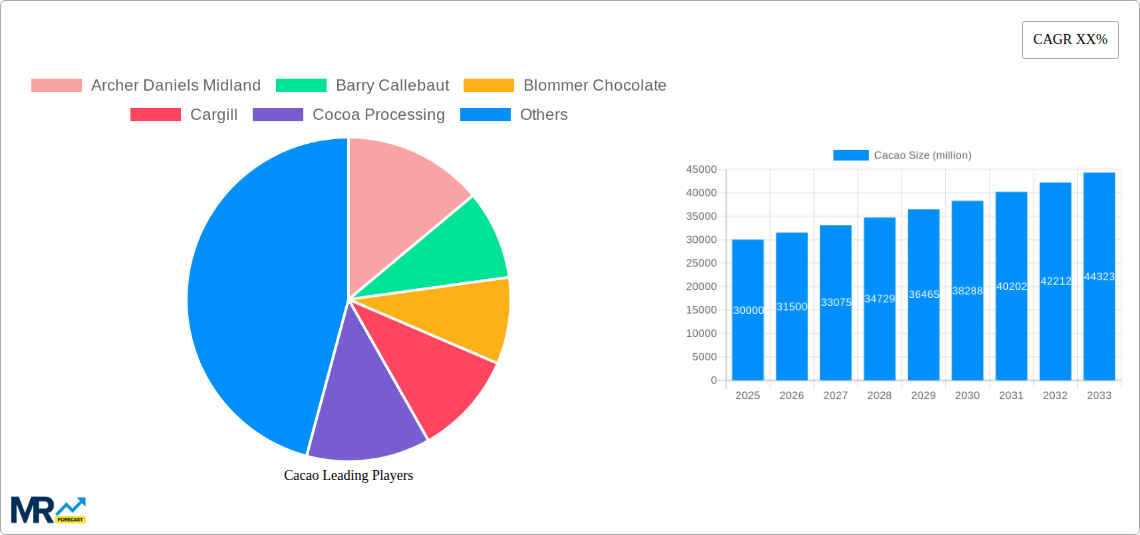

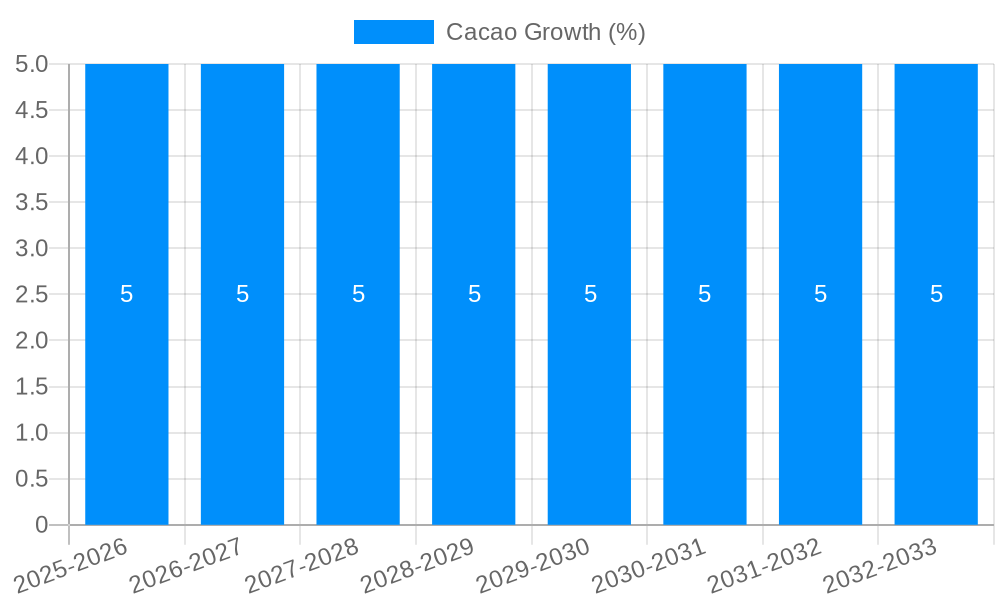

The global Cacao market is projected to reach approximately $30,000 million by 2025, exhibiting a robust Compound Annual Growth Rate (CAGR) of around 5% throughout the forecast period of 2025-2033. This significant expansion is propelled by a confluence of factors, including a burgeoning global demand for chocolate and cocoa-based products, driven by evolving consumer preferences towards premium and ethically sourced ingredients. The increasing awareness of cacao's health benefits, such as its antioxidant properties, is also contributing to its widespread adoption across various food and beverage applications. Furthermore, advancements in cultivation techniques and processing technologies are enhancing product quality and availability, further stimulating market growth. The market is witnessing a strong demand for cacao in its powder and particle forms, catering to diverse applications in the business, family, and other consumer segments.

Key players like Archer Daniels Midland, Barry Callebaut, and Cargill are at the forefront of this market, investing in sustainable sourcing practices and product innovation to capture market share. The market, however, faces certain restraints, including the volatile nature of cocoa bean prices, which are susceptible to climate change, political instability in major producing regions, and crop diseases. Stringent regulations concerning food safety and labeling in developed economies also present challenges. Despite these hurdles, the market's outlook remains highly positive, with emerging economies in the Asia Pacific and Latin America expected to be significant growth drivers. The industry's focus on sustainability and traceability, coupled with innovative product development, will be critical for sustained success in the coming years.

Here is a unique report description on Cacao, incorporating your specified requirements:

The global cacao market is poised for significant evolution and expansion throughout the study period of 2019-2033, with 2025 serving as the base and estimated year. During the historical period of 2019-2024, the market witnessed steady growth driven by increasing global demand for chocolate and cocoa-derived products, alongside a growing appreciation for the nuanced flavors and health benefits associated with high-quality cacao. The base year of 2025 is projected to see the market reaching a valuation in the millions of USD, with this trajectory continuing through the forecast period of 2025-2033. Key trends shaping this landscape include the burgeoning demand for premium and artisanal chocolate, which in turn fuels a desire for single-origin and ethically sourced cacao beans. Consumers are increasingly conscious of the origins of their food, leading to a greater emphasis on traceability, sustainability, and fair trade practices within the cacao supply chain. This ethical consumerism is not merely a niche concern but is steadily becoming a mainstream expectation, influencing purchasing decisions across various demographics. Furthermore, the expansion of emerging economies presents a substantial opportunity, as rising disposable incomes in these regions translate into increased consumption of confectionery and other cocoa-based goods. The versatility of cacao also plays a pivotal role, extending its application beyond traditional confectionery to include beverages, baked goods, dairy products, and even savory dishes. Innovations in processing techniques are also contributing to market dynamism, enabling the creation of novel cocoa ingredients with enhanced functional properties and unique flavor profiles. The industry is also observing a gradual shift towards healthier formulations, with an increased focus on dark chocolate and products with reduced sugar content, aligning with global wellness trends. The sheer volume of cacao processed globally underscores its importance as a fundamental agricultural commodity and a key ingredient in numerous consumer products, with market participants continually innovating to meet evolving consumer preferences and regulatory landscapes. The market's resilience, even amidst occasional supply chain disruptions, speaks to the enduring appeal and economic significance of cacao.

The sustained growth and potential of the cacao market are underpinned by a confluence of powerful driving forces. Foremost among these is the unflagging global consumer appetite for chocolate and cocoa-based products. This demand is not static; it is evolving, with a pronounced shift towards premium and artisanal offerings. Consumers are no longer content with mass-produced options; they seek out unique flavor profiles, ethically sourced beans, and compelling brand stories, all of which elevate the perceived value of high-quality cacao. This premiumization trend is a significant catalyst, pushing manufacturers to source superior beans and invest in sophisticated processing techniques. Concurrently, the expanding middle class in emerging economies represents a vast and largely untapped market. As disposable incomes rise in these regions, so too does the consumption of discretionary goods, with chocolate and cocoa products being significant beneficiaries. This demographic shift is a critical engine for market expansion, opening up new avenues for revenue and growth. Moreover, the inherent health benefits associated with cacao, particularly dark chocolate, are increasingly recognized and promoted. Rich in antioxidants and other beneficial compounds, cacao is being incorporated into a wider range of health-conscious food and beverage products, appealing to a growing segment of consumers prioritizing wellness. The versatility of cacao as an ingredient cannot be overstated; its application extends far beyond traditional confectionery, finding its way into beverages, baked goods, dairy products, and even gourmet savory dishes, broadening its market reach and utility. Finally, continuous innovation in processing and product development by leading companies, such as Archer Daniels Midland and Barry Callebaut, is crucial. These innovations cater to evolving consumer tastes, dietary trends, and functional requirements, ensuring the continued relevance and appeal of cacao-derived products in a competitive marketplace.

Despite its robust growth prospects, the cacao industry is not without its significant challenges and restraints. One of the most persistent issues revolves around supply chain volatility. Cacao cultivation is highly dependent on specific climatic conditions, making it susceptible to extreme weather events, pests, and diseases, which can lead to unpredictable harvests and price fluctuations. The geographical concentration of cacao production in a few key regions also exacerbates this vulnerability. Furthermore, ethical concerns surrounding labor practices, particularly child labor and low wages for farmers, continue to cast a shadow over the industry. While significant strides have been made in sustainability initiatives, the sheer scale of the market means that ensuring fair and ethical treatment throughout the entire supply chain remains an ongoing and complex undertaking. Price volatility is another major restraint, directly impacting manufacturers and consumers alike. Fluctuations in the global commodity markets, driven by factors such as supply, demand, and speculative trading, can significantly affect the cost of raw cacao, leading to uncertainty for businesses and potential price increases for consumers. The environmental impact of cacao cultivation, including deforestation and soil degradation, is also drawing increasing scrutiny. Sustainable farming practices are essential for long-term viability, but their widespread adoption can be costly and time-consuming for farmers. Regulatory hurdles and evolving food safety standards across different regions can also pose challenges for international trade and market access. Finally, the increasing competition from alternative sweeteners and flavors, as well as the growing trend towards plant-based diets and reduced sugar consumption, can present some degree of restraint, requiring continuous adaptation and product innovation from the industry.

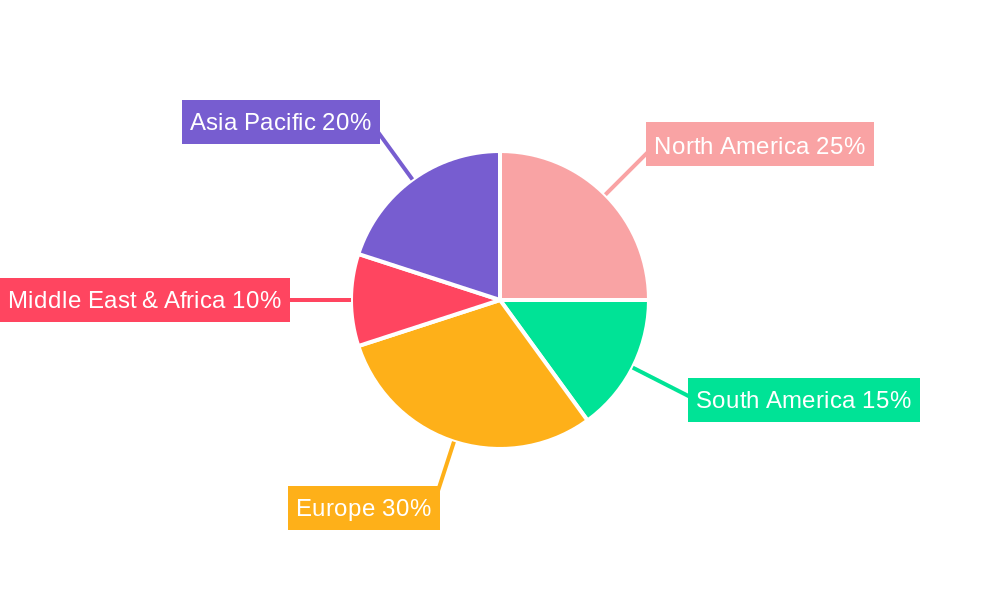

The cacao market is characterized by distinct regional dominance and segment-specific growth. In terms of geographical regions, Africa, particularly West Africa (comprising countries like Ivory Coast and Ghana), currently dominates global cacao production, accounting for over 70% of the world's supply. This dominance stems from favorable agro-climatic conditions and a long history of cultivation. However, Asia-Pacific is emerging as a significant growth region due to rising disposable incomes and increasing demand for chocolate products, with countries like Indonesia playing a crucial role in production and consumption.

When examining the Type segment, Powder is poised to maintain a dominant position throughout the forecast period. Cacao powder is a fundamental ingredient in a vast array of applications, from baked goods and beverages to confectionery and dairy products. Its versatility, cost-effectiveness, and ease of incorporation into various formulations make it a staple for both industrial manufacturers and home bakers. The consistent demand for chocolate-flavored products, whether in the form of hot chocolate, chocolate milk, cakes, cookies, or ice cream, directly translates to sustained and robust demand for cacao powder. Furthermore, innovations in the types of cacao powder available, such as Dutch-processed or natural, cater to specific functional and flavor requirements, further solidifying its market share. The growing trend towards health-conscious consumption also benefits cacao powder, as it is a key component in many dark chocolate products, which are often perceived as healthier due to their higher antioxidant content.

In terms of Application, the Business segment is projected to be the primary driver of market value. This segment encompasses the industrial use of cacao by large-scale food and beverage manufacturers, confectionery companies, and bakeries. The sheer volume of cacao powder and other cacao derivatives consumed by these businesses for mass production of chocolate bars, candies, beverages, and baked goods significantly outweighs that of individual consumers or smaller-scale operations. Companies like The Hershey, along with global giants such as Archer Daniels Midland and Cargill, are the major players within this segment, procuring vast quantities of cacao to meet their production demands. The growth in this segment is intrinsically linked to the overall expansion of the global food and beverage industry, particularly the confectionery sector. As populations grow and economies develop, the demand for mass-produced, accessible chocolate products increases, directly fueling the consumption of cacao by businesses.

Several key growth catalysts are poised to propel the cacao industry forward. The persistent and growing global demand for chocolate and cocoa-based products, driven by increasing disposable incomes and evolving consumer preferences for premium and artisanal offerings, remains a primary driver. Furthermore, the recognition of cacao's inherent health benefits, particularly its antioxidant properties, is leading to its incorporation into a wider array of health-conscious food and beverage products. The expanding middle class in emerging economies presents a substantial untapped market, as these consumers increasingly adopt Western dietary habits and seek out indulgent treats. Innovations in processing techniques and the development of novel cacao-derived ingredients are also crucial, catering to diverse market needs and driving product differentiation.

This comprehensive report delves deep into the global cacao market, offering an in-depth analysis from 2019 to 2033, with a focused estimation for 2025. It provides a holistic view of market dynamics, identifying key trends, driving forces, and significant challenges that shape the industry's trajectory. The report meticulously examines dominant regions and segments, particularly the pivotal role of cacao powder in the Business application, highlighting their substantial contributions to market value and volume. Leading players are profiled, alongside a detailed account of significant industry developments and innovations, offering valuable insights for strategic decision-making. This report serves as an indispensable resource for stakeholders seeking to navigate and capitalize on the evolving global cacao landscape.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Archer Daniels Midland, Barry Callebaut, Blommer Chocolate, Cargill, Cocoa Processing, Olam, CEMOI, Daarnhouwer, Dutch Cocoa, Newtown Foods, Puratos, The Hershey, United Cocoa Processor, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Cacao," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Cacao, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.