1. What is the projected Compound Annual Growth Rate (CAGR) of the Cable Retention Testing?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Cable Retention Testing

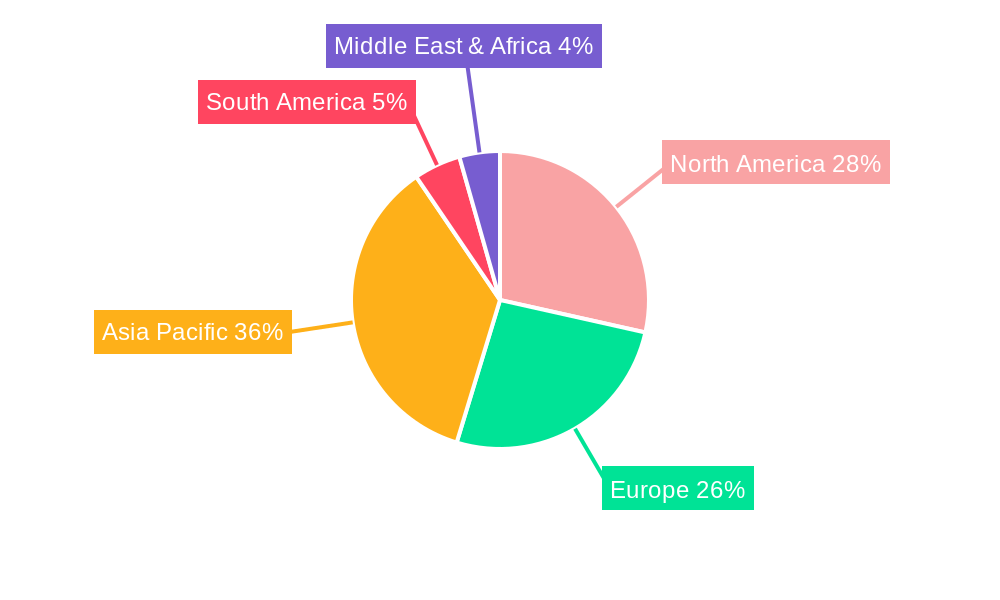

Cable Retention TestingCable Retention Testing by Type (Pointer Type, Digital Display Type), by Application (Electronics Industry, Wire Harness Cable), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

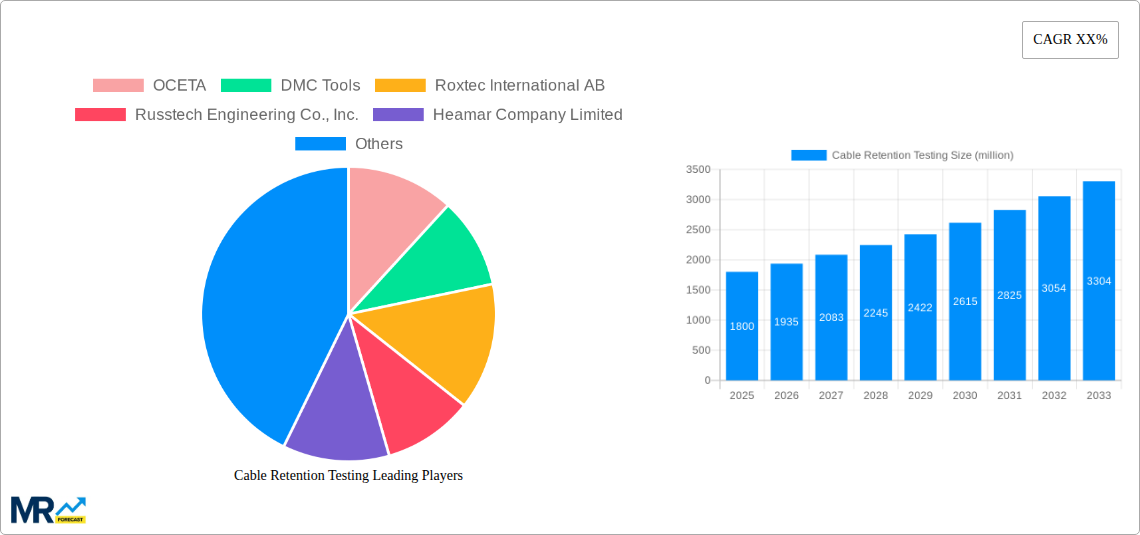

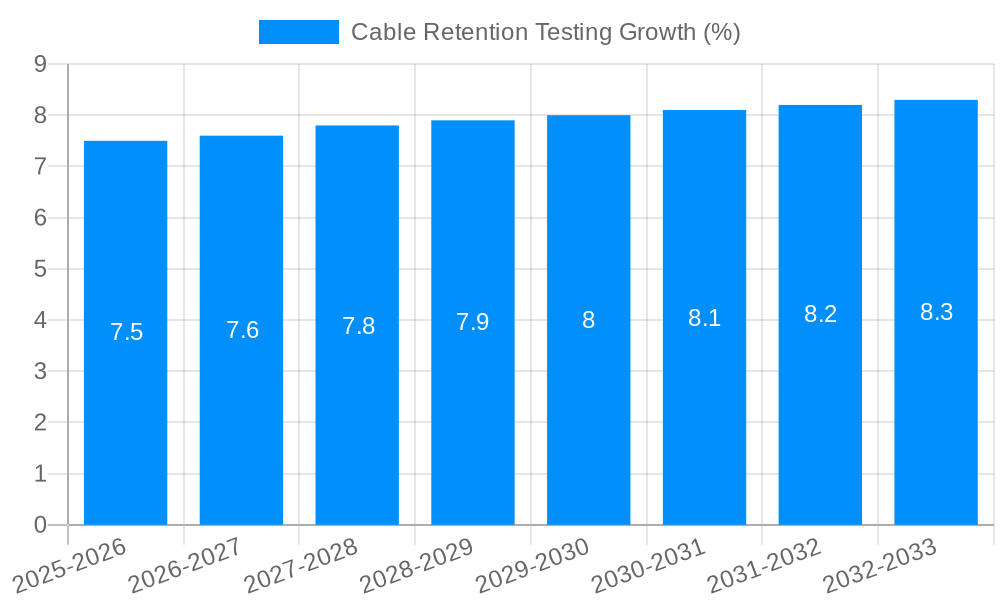

The global Cable Retention Testing market is experiencing robust expansion, projected to reach an estimated market size of approximately $1.8 billion by 2025. This significant growth is fueled by a Compound Annual Growth Rate (CAGR) of around 7.5%, driven by the increasing complexity and critical nature of electrical connections across various industries. The surge in demand for reliable and safe electrical systems, particularly within the burgeoning electronics industry and the indispensable wire harness cable sector, is a primary catalyst. As consumer electronics become more sophisticated and automotive electrification accelerates, the need for stringent testing to ensure the integrity of cable connections intensifies. Furthermore, the growing emphasis on product safety standards and regulatory compliance across North America, Europe, and the rapidly industrializing Asia Pacific region is creating a sustained demand for advanced cable retention testing solutions. This market dynamism is further propelled by technological advancements, including the development of more precise and automated testing equipment that enhances efficiency and accuracy.

The market is characterized by key players like OCETA, DMC Tools, and Roxtec International AB, who are actively innovating and expanding their product portfolios to meet evolving industry requirements. While the market is poised for substantial growth, certain restraints exist. The high initial cost of sophisticated testing equipment and the need for specialized technical expertise for operation and maintenance can pose barriers to entry for smaller enterprises. However, the long-term benefits of ensuring product reliability, preventing costly failures, and maintaining brand reputation are compelling reasons for significant investment in cable retention testing. The market is segmented into Pointer Type and Digital Display Type, catering to diverse testing needs, and primarily serves the electronics industry and wire harness cable applications. Emerging economies, particularly in the Asia Pacific region, present significant untapped potential due to rapid industrialization and increasing adoption of advanced manufacturing practices.

This comprehensive report delves into the dynamic landscape of the cable retention testing market, providing an in-depth analysis from the historical period of 2019-2024 through to the projected forecast period of 2025-2033, with a base year set for 2025. The study encompasses market trends, driving forces, challenges, regional dominance, growth catalysts, leading players, and significant developments within the sector. The estimated market size is projected to reach several million dollars, with a substantial compound annual growth rate anticipated over the forecast period.

XXX reports a robust and evolving market for cable retention testing, a critical component in ensuring the reliability and safety of electrical and electronic systems. The study period, spanning from 2019 to 2033, reveals a significant upward trajectory, fueled by increasing demands for product longevity and compliance with stringent industry standards. Historically, the market has witnessed steady growth, driven by the foundational need for secure cable connections across various applications. However, the advent of more sophisticated electronic devices, the proliferation of complex wire harnesses in automotive and aerospace, and the burgeoning Internet of Things (IoT) ecosystem have accelerated this trend. The estimated market valuation for the base year of 2025 is in the millions of dollars, underscoring the substantial economic significance of this testing segment. Looking ahead into the forecast period of 2025-2033, projections indicate a continued expansion, likely driven by advancements in testing methodologies and the integration of digital technologies.

The market is bifurcating, with a growing demand for both high-precision digital display types and the more traditional, cost-effective pointer types, catering to diverse application needs and budget constraints. The electronics industry, a cornerstone of modern technology, represents a primary application segment, demanding rigorous testing to prevent failures in consumer electronics, industrial automation, and telecommunications equipment. Simultaneously, the specialized needs of wire harness cable manufacturers, ensuring the integrity of intricate wiring systems for vehicles, aircraft, and heavy machinery, are contributing significantly to market growth. Emerging trends point towards increased automation in testing processes, enhanced data analytics for performance insights, and the development of portable and in-line testing solutions to improve efficiency and reduce downtime. The industry is also seeing a greater emphasis on environmental testing, simulating extreme conditions to ensure cable retention under duress, a crucial factor for mission-critical applications. Furthermore, the continuous innovation in cable and connector technology necessitates corresponding advancements in retention testing, creating a feedback loop of development and application. The sheer volume of electrical connections in modern infrastructure, from smart cities to advanced manufacturing, ensures a sustained and growing need for reliable cable retention solutions.

The cable retention testing market is experiencing a significant surge driven by a confluence of compelling factors that underscore the critical importance of secure and reliable electrical connections. Foremost among these is the escalating demand for enhanced product reliability and longevity across all sectors. Consumers and industries alike are no longer content with components that fail prematurely; they expect durable products that can withstand prolonged use and challenging environmental conditions. This expectation directly translates into a heightened need for rigorous cable retention testing, as loose or compromised connections are a primary cause of product failure. Furthermore, the increasing complexity of modern electronic devices and systems, from advanced automotive electronics and intricate aerospace wiring to the expanding realm of smart home devices and industrial IoT, introduces a greater number of potential failure points. Each cable and connector represents a critical junction, and ensuring their robust connection is paramount to the overall functionality and safety of the entire system.

The relentless pursuit of safety standards and regulatory compliance further fuels the market. Industries such as aerospace, automotive, medical devices, and industrial manufacturing are governed by stringent regulations that mandate thorough testing to prevent accidents and ensure public safety. Cable retention testing is a non-negotiable aspect of this compliance framework, directly impacting the certification and market access of countless products. The rapid pace of technological innovation also plays a crucial role. As new materials, designs, and functionalities are introduced into cables and connectors, the methods and standards for testing their retention must evolve accordingly. This continuous innovation cycle necessitates ongoing investment in advanced testing equipment and methodologies. Finally, the economic implications of product failures, including costly recalls, warranty claims, and reputational damage, incentivize companies to proactively invest in robust cable retention testing to mitigate these risks, thereby driving consistent demand for testing solutions and services.

Despite the robust growth prospects, the cable retention testing market is not without its significant hurdles and restraints that can impede its full potential. A primary challenge lies in the ever-increasing complexity and miniaturization of electronic components and connectors. As devices become smaller and more integrated, the physical space available for testing becomes constrained, requiring highly specialized and often more expensive testing equipment capable of accurately assessing retention forces on delicate connections. This miniaturization also raises concerns about potential damage to the cables or connectors during the testing process itself, necessitating the development of non-destructive testing methods or extremely precise control over testing parameters. Another considerable challenge is the high cost of advanced testing equipment and sophisticated software, which can be a significant barrier to entry for smaller manufacturers or those operating in cost-sensitive market segments. The initial investment in state-of-the-art testing machines, calibration services, and data management systems can run into hundreds of thousands, if not millions, of dollars, impacting the overall adoption rate.

Furthermore, the lack of standardized testing protocols across all industries and regions can create confusion and inconsistencies. While certain sectors have well-defined standards, others are still developing them, leading to variations in testing methodologies and making it difficult to compare results across different applications or geographical locations. This also poses a challenge for global manufacturers who need to comply with diverse regional requirements. The shortage of skilled personnel capable of operating and interpreting the results from advanced cable retention testing equipment is another significant restraint. Operating complex testing machinery and analyzing the data effectively requires specialized training and expertise, and a lack of qualified professionals can lead to bottlenecks in testing processes. Finally, the rapid evolution of cable and connector technologies means that testing equipment can quickly become outdated, requiring continuous investment in upgrades and new solutions, thus presenting an ongoing financial and technical challenge for market players.

The cable retention testing market exhibits a dynamic dominance across both geographical regions and specific application segments, driven by technological adoption, industrial output, and regulatory frameworks.

Key Regions/Countries:

Key Segment to Dominate the Market:

Several key factors are acting as powerful catalysts for growth within the cable retention testing industry. The escalating demand for enhanced product reliability and durability across all manufacturing sectors is paramount, as companies strive to reduce warranty claims and build stronger brand reputations. Furthermore, the rapid proliferation of the Internet of Things (IoT) and the increasing complexity of smart devices necessitate more secure and dependable electrical connections, driving innovation in testing methodologies. Stringent safety regulations and compliance requirements in critical industries like aerospace, automotive, and medical devices are also compelling significant investments in rigorous testing. Finally, the ongoing advancements in miniaturization and the development of new connector technologies require complementary progress in testing techniques, fostering a continuous cycle of research and development.

This report offers a holistic examination of the cable retention testing market, providing unparalleled depth and breadth of analysis. It meticulously covers market dynamics, including historical trends from 2019-2024 and future projections up to 2033, with a key focus on the base year of 2025. The report delves into the pivotal driving forces propelling market growth, such as the increasing demand for product reliability, the complexities of modern electronics, and stringent safety regulations. It also critically assesses the challenges and restraints that could impede market expansion, including the high cost of advanced equipment and the need for skilled personnel. Furthermore, the report highlights dominant regions and key application segments, such as the vital Electronics Industry and Wire Harness Cable sectors, projecting their significant market contributions. The report is enriched with insights into growth catalysts and provides a detailed listing of leading industry players. Its comprehensive coverage ensures stakeholders have the necessary intelligence to navigate and capitalize on opportunities within this crucial testing domain.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include OCETA, DMC Tools, Roxtec International AB, Russtech Engineering Co., Inc., Heamar Company Limited, AEP Tools, Cirris, Inc., CRiMP-TECH Australia, Daniels Manufacturing Corporation (DMC), Kingsing, Hgdibang, Wenzhou Yiding Instrument Manufacturing Co., Ltd., Kaiqiangli, Zhbaozhuangji, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Cable Retention Testing," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Cable Retention Testing, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.