1. What is the projected Compound Annual Growth Rate (CAGR) of the By-product Hydrochloric Acid?

The projected CAGR is approximately 10.82%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

By-product Hydrochloric Acid

By-product Hydrochloric AcidBy-product Hydrochloric Acid by Type (Below 20%, 20-30%, Above 30%, World By-product Hydrochloric Acid Production ), by Application (Organic Chemical Raw Materials, Metal Cleaning and Treatment, Food and Dairy Industry, Water Treatment, Others, World By-product Hydrochloric Acid Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

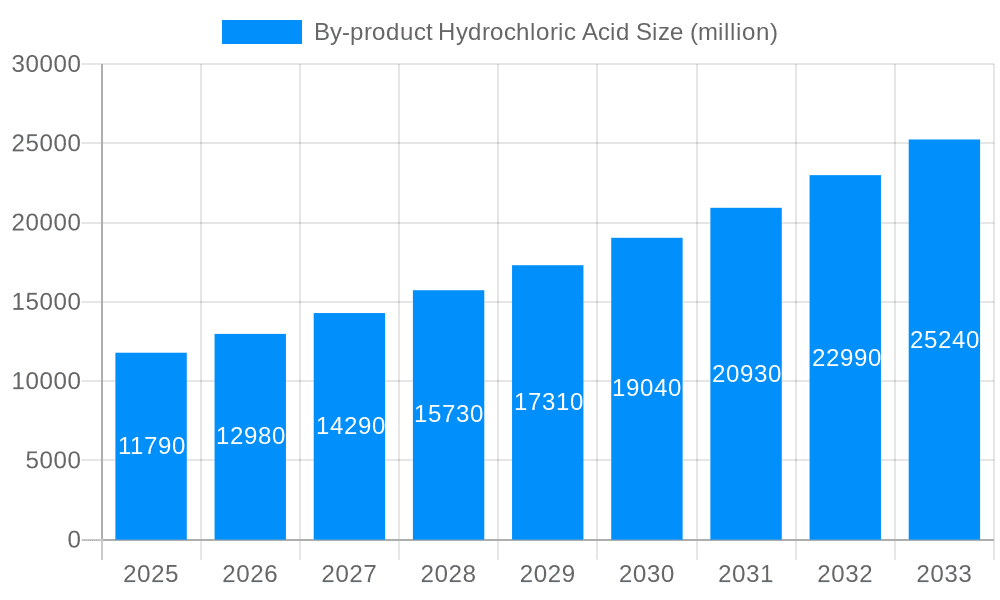

The global By-product Hydrochloric Acid market is projected to witness robust expansion, reaching an estimated market size of $11.79 billion in the base year of 2025. This growth is underpinned by a significant Compound Annual Growth Rate (CAGR) of 10.82%, indicating a dynamic and expanding market landscape. The increasing demand for hydrochloric acid across various industrial applications, such as organic chemical synthesis, metal processing, and water treatment, serves as a primary driver. As a by-product of numerous chemical manufacturing processes, its cost-effectiveness compared to primary production methods further fuels its adoption. Emerging economies, particularly in the Asia Pacific region, are anticipated to be key contributors to this growth, driven by rapid industrialization and expanding manufacturing capabilities. The market is characterized by a diverse range of applications, with organic chemical raw materials and metal cleaning and treatment segments holding substantial shares.

The forecast period, from 2025 to 2033, is expected to witness sustained growth, with the market size expanding significantly as industrial activities continue to rise globally. Key trends shaping the market include advancements in production technologies that enhance purity and reduce environmental impact, alongside a growing emphasis on circular economy principles, where by-products are valorized. However, the market also faces certain restraints, including stringent environmental regulations concerning the handling and disposal of hydrochloric acid, and potential fluctuations in the supply chain of its parent industrial processes. Nevertheless, the inherent advantages of by-product hydrochloric acid, coupled with ongoing innovation and expanding industrial sectors, position it for continued strong performance in the foreseeable future. The market is segmented by type, including concentrations below 20%, 20-30%, and above 30%, catering to a wide array of specific industrial needs.

This report offers an in-depth analysis of the global By-product Hydrochloric Acid (HCl) market, meticulously tracing its trajectory from the historical period of 2019-2024 through the base and estimated year of 2025, and projecting its future through the forecast period of 2025-2033. We leverage comprehensive market intelligence, including data points valued in the billions, to illuminate the intricate dynamics shaping this vital industrial chemical's landscape. The study meticulously examines production volumes, segment-specific growth, and application-driven demand, providing stakeholders with actionable insights for strategic decision-making. Our detailed segmentation covers production by type (Below 20%, 20-30%, Above 30%), by application (Organic Chemical Raw Materials, Metal Cleaning and Treatment, Food and Dairy Industry, Water Treatment, Others), and crucially, the overarching World By-product Hydrochloric Acid Production. Furthermore, the report delves into critical industry developments, market trends, driving forces, challenges, and key regional dominance to provide a holistic understanding of the market's present and future.

The global By-product Hydrochloric Acid (HCl) market is poised for significant evolution over the study period (2019-2033), with the base and estimated year of 2025 acting as a crucial benchmark. During the historical period (2019-2024), the market witnessed a steady increase in production, driven largely by its co-generation in various chemical manufacturing processes, particularly chlor-alkali production and organic synthesis. The estimated global production for 2025 is projected to reach $12.5 billion, a testament to the chemical's ubiquitous role. Looking ahead into the forecast period (2025-2033), a compound annual growth rate (CAGR) of approximately 4.2% is anticipated, pushing market value to exceed $18 billion by 2033. Key market insights reveal a growing emphasis on efficient utilization and monetization of this byproduct. Producers are increasingly investing in purification technologies to enhance HCl quality for higher-value applications, moving beyond its traditional commodity status. The segmentation by type provides further clarity: the "Above 30%" concentration segment, often the most readily available, is expected to remain dominant in volume, contributing significantly to the overall production. However, the "Below 20%" and "20-30%" segments are showing robust growth potential as purification technologies become more accessible and demand for specific grades rises. Application-wise, "Organic Chemical Raw Materials" is projected to continue its reign as the largest consumer, accounting for an estimated 35% of the total market demand in 2025, valued at approximately $4.38 billion. This is followed by "Metal Cleaning and Treatment," which is expected to see a steady growth of 3.8% CAGR due to increasing industrial activity and stricter environmental regulations mandating efficient metal processing. The "Food and Dairy Industry" and "Water Treatment" segments, while smaller in absolute terms, are exhibiting higher percentage growth rates, indicating emerging opportunities driven by evolving consumer preferences and stringent environmental standards. The overall trend is one of increased sophistication in managing, processing, and applying by-product HCl, transforming it from a simple waste stream into a valuable industrial commodity with diverse and expanding applications. The estimated production for 2025 is projected to reach approximately 38 billion metric tons, with a significant portion, around 28 billion metric tons, being utilized in various industrial processes, highlighting the scale of this byproduct's contribution to the chemical industry.

The global By-product Hydrochloric Acid (HCl) market is experiencing a robust upward momentum, propelled by a confluence of powerful driving forces. Primarily, the sheer volume of its generation as a co-product in large-scale industrial processes acts as a foundational driver. The chlor-alkali industry, a cornerstone of chemical manufacturing, inherently produces substantial quantities of HCl. As global demand for caustic soda and chlorine continues to rise, so too does the availability of byproduct HCl. This inherent supply means that for many industries, byproduct HCl represents a cost-effective and readily available source of hydrochloric acid, thereby reducing their reliance on direct synthesis. Furthermore, the increasing global emphasis on circular economy principles and waste valorization is significantly boosting the demand for byproduct HCl. Companies are actively seeking ways to extract maximum value from their waste streams, and by-product HCl fits perfectly into this paradigm. This focus on sustainability and resource efficiency encourages greater investment in purification and handling technologies, making byproduct HCl a more attractive and viable option across a wider range of applications. The growing industrialization and manufacturing activities across developing economies are also contributing significantly. As these regions expand their chemical, metal processing, and agricultural sectors, the demand for hydrochloric acid as a key input escalates, naturally increasing the pull for byproduct HCl. The estimated production for 2025 is projected to reach around 38 billion metric tons, a substantial portion of which is by-product derived. This abundance, coupled with increasingly efficient recovery methods, ensures a steady supply that can meet the burgeoning global demand, estimated to reach $12.5 billion in the same year.

Despite its promising growth trajectory, the By-product Hydrochloric Acid (HCl) market is not without its inherent challenges and restraints that could temper its expansion. A primary concern revolves around the variability in quality and concentration of by-product HCl. Depending on the specific industrial process and the raw materials used, the purity and concentration of the byproduct can fluctuate significantly. This inconsistency can make it unsuitable for high-purity applications without extensive and often costly purification steps, limiting its market penetration in certain sensitive sectors like pharmaceuticals and electronics. Furthermore, logistics and transportation costs present a considerable hurdle. Hydrochloric acid, particularly in higher concentrations, is a corrosive substance requiring specialized handling, storage, and transportation equipment. The geographical dispersion of byproduct generation sites relative to demand centers can lead to substantial logistical expenses, making it less competitive compared to locally produced or direct-synthesized HCl in certain regions. The regulatory landscape surrounding the handling, disposal, and transportation of hazardous chemicals like HCl can also be a restraint. Stringent environmental regulations, while driving sustainability, can also impose significant compliance costs on producers and users of byproduct HCl, potentially impacting profitability and market accessibility. Moreover, the market price volatility of primary chemicals that generate HCl as a byproduct can indirectly influence the availability and cost of byproduct HCl itself. Fluctuations in the prices of feedstocks for chlor-alkali or other chemical processes can lead to unpredictable supply and cost dynamics for the byproduct. The estimated production for 2025 is projected to be around 38 billion metric tons, but the actual market-ready supply can be hampered by these challenges, affecting the overall market value estimated at $12.5 billion.

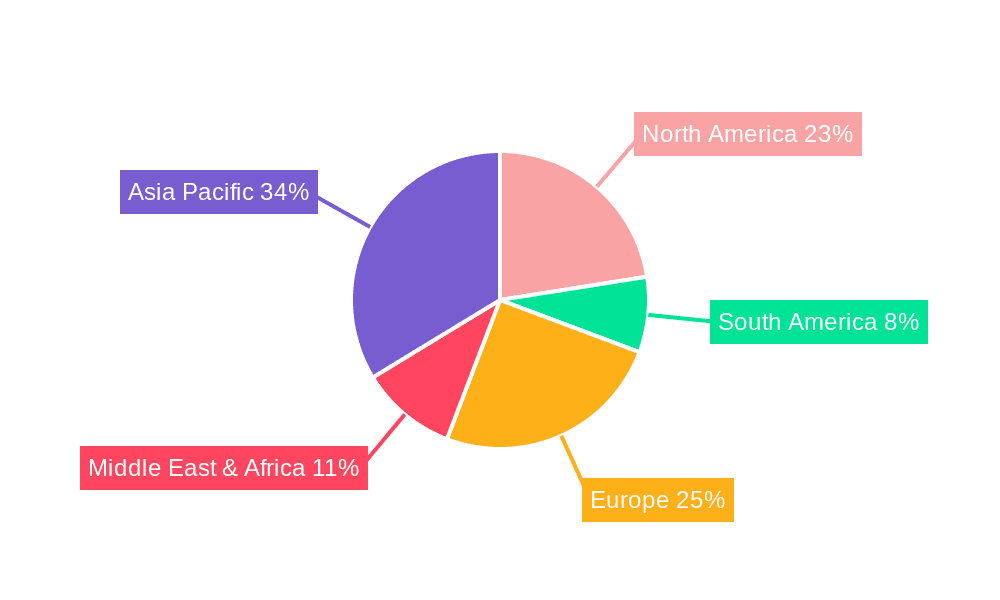

The global By-product Hydrochloric Acid (HCl) market is characterized by the dominance of specific regions and segments, each contributing to the overall market dynamics.

Dominant Regions/Countries:

Dominant Segments:

The synergy between these dominant regions and segments creates a powerful market dynamic. The high production volumes in North America and Asia-Pacific, coupled with the unwavering demand from the "Organic Chemical Raw Materials" application and the accessibility of "Above 30%" concentration HCl, are the primary pillars supporting the growth and future trajectory of the global By-product Hydrochloric Acid market.

The By-product Hydrochloric Acid industry is propelled by several key growth catalysts that are shaping its future. The relentless pursuit of circular economy principles and waste valorization is a primary driver, encouraging industries to extract maximum value from their co-products. Furthermore, the increasing global demand for key end-use products, such as plastics (PVC), pharmaceuticals, and processed foods, directly translates to a higher consumption of HCl, thereby boosting the demand for its by-product form. Advancements in purification technologies are also crucial, enabling byproduct HCl to meet the stringent quality requirements of a wider array of applications, thus expanding its market reach.

This comprehensive report provides an unparalleled deep dive into the global By-product Hydrochloric Acid (HCl) market. Spanning the historical period of 2019-2024 and projecting through 2033, it offers meticulous analysis of production volumes, market segmentation by type and application, and an exhaustive overview of industry developments. Leveraging data valued in the billions and projecting future scenarios with expert estimations for 2025, the report details key market trends, driving forces, and the critical challenges faced by the industry. Furthermore, it identifies dominant regions and segments, alongside emerging growth catalysts and the leading players shaping the market landscape. This detailed examination equips stakeholders with the essential intelligence to navigate the complexities and capitalize on the opportunities within the dynamic By-product Hydrochloric Acid sector.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.82% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 10.82%.

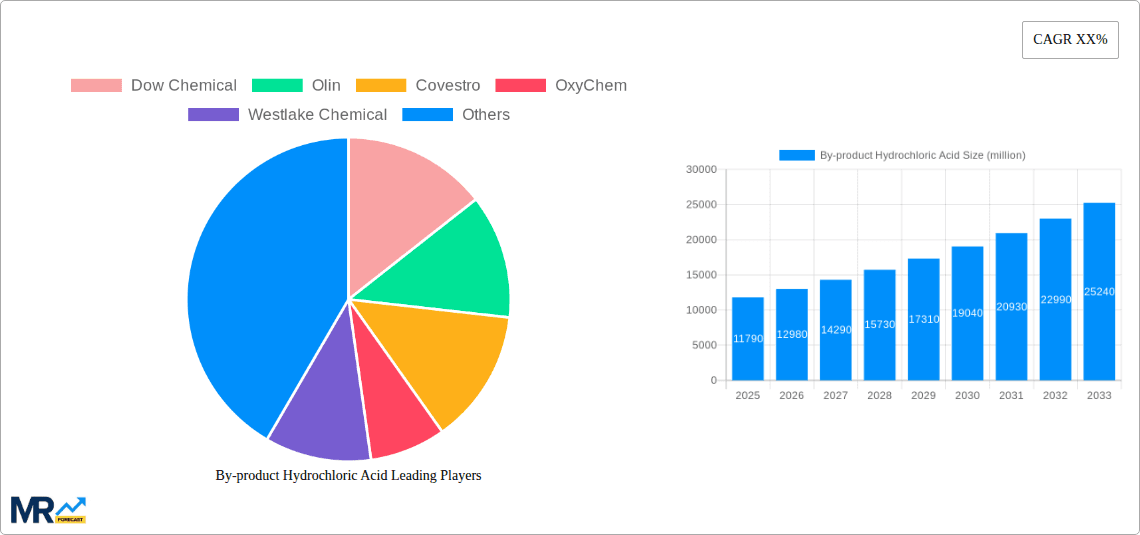

Key companies in the market include Dow Chemical, Olin, Covestro, OxyChem, Westlake Chemical, Inovyn, Westlake Chemical, BASF, Shin-Etsu Chemical, UNID, .

The market segments include Type, Application.

The market size is estimated to be USD XXX N/A as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in N/A and volume, measured in K.

Yes, the market keyword associated with the report is "By-product Hydrochloric Acid," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the By-product Hydrochloric Acid, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.