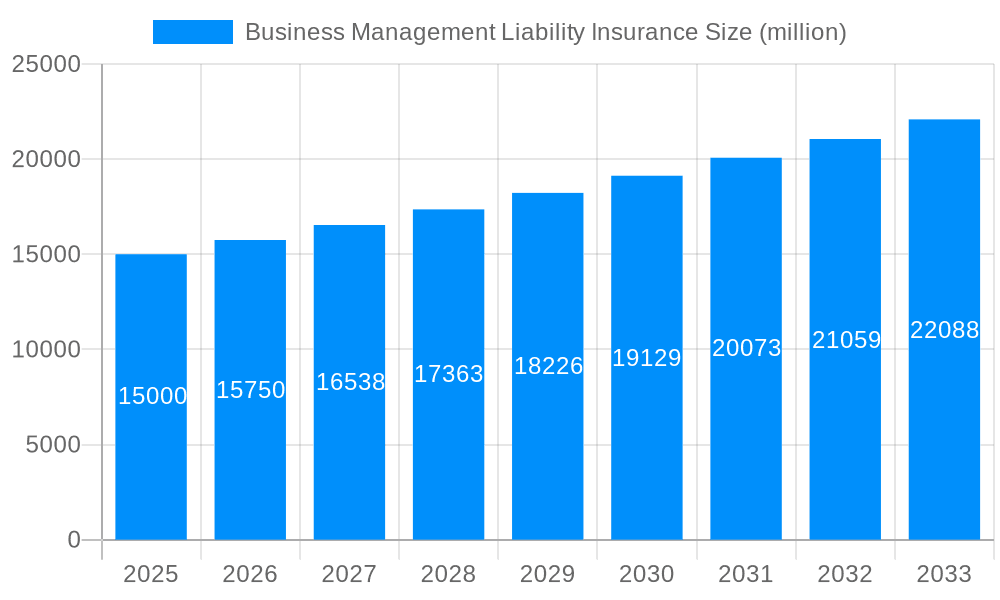

1. What is the projected Compound Annual Growth Rate (CAGR) of the Business Management Liability Insurance?

The projected CAGR is approximately 2.9%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Business Management Liability Insurance

Business Management Liability InsuranceBusiness Management Liability Insurance by Type (Kidnap and Ransom Insurance, Directors and Officers (D&O) Liability Insurance, Employment Practices Liability Insurance, Fiduciary Liability, Other), by Application (Agency, Digital & Direct Channels, Brokers, Bancassurance), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

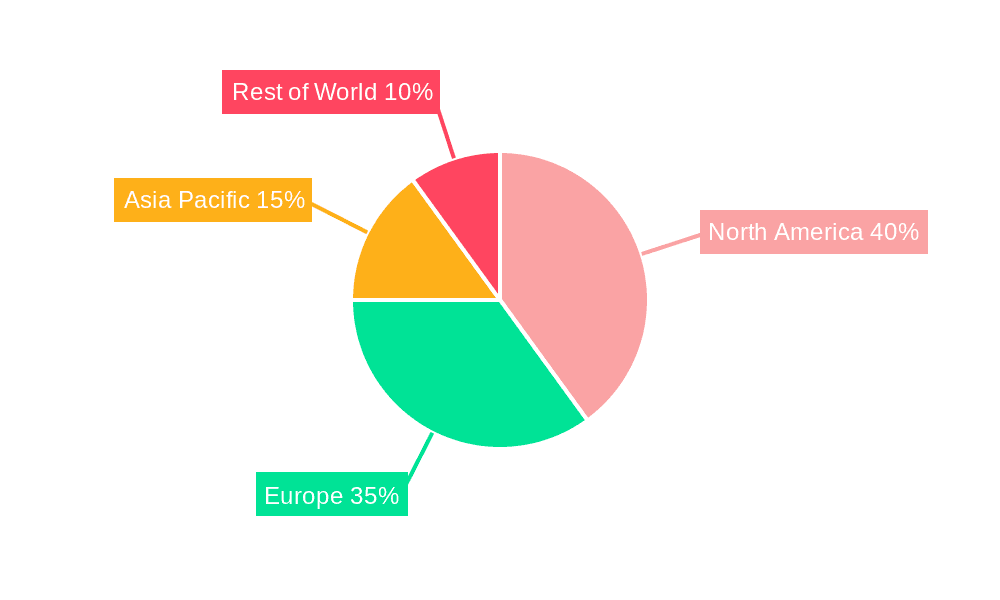

The Business Management Liability Insurance (BMLI) market is experiencing robust growth, driven by increasing regulatory scrutiny, heightened litigation risks, and a growing awareness of potential liabilities among businesses of all sizes. The market, encompassing Kidnap and Ransom Insurance, Directors and Officers (D&O) Liability Insurance, Employment Practices Liability Insurance, and Fiduciary Liability, among others, is projected to expand significantly over the forecast period (2025-2033). The CAGR, while not explicitly provided, is likely to be in the range of 5-7% based on comparable insurance market growth rates and the increasing complexity of business operations. Growth is fueled by the rising prevalence of cyberattacks and data breaches, necessitating robust cyber liability coverage within BMLI policies. Furthermore, the expansion of businesses into new markets and the increasing interconnectedness of global supply chains contribute to the demand for comprehensive liability protection. Digital distribution channels, like online platforms and direct-to-consumer sales, are also boosting market penetration and accessibility. However, restraints include economic downturns that may impact insurance purchasing decisions and the complexity of policy structures, potentially hindering broader market adoption. Regional variations exist, with North America and Europe currently holding the largest market shares, but Asia Pacific is projected to demonstrate significant growth potential driven by economic expansion and rising business activity.

The diverse range of BMLI products caters to various business needs and risk profiles. The segments, including Kidnap and Ransom Insurance, D&O Liability Insurance, and Employment Practices Liability Insurance, each contribute significantly to the overall market size, with D&O Liability and Employment Practices Liability experiencing particularly strong growth due to the increasing complexity of corporate governance and employment laws. The distribution channels, including agency, digital & direct channels, brokers, and bancassurance, each offer unique advantages in terms of market reach and customer service. Leading players like Chubb, AIG, Hiscox, and Allianz are heavily invested in BMLI, constantly innovating their products and services to meet the evolving needs of businesses and stay ahead of competition. Future market expansion will likely be driven by further technological advancements, a rise in sophisticated risk management practices, and continued regulatory changes.

The global business management liability insurance market is experiencing robust growth, projected to reach multi-million dollar valuations by 2033. The period between 2019 and 2024 (historical period) witnessed a steady expansion, driven by increasing regulatory scrutiny, heightened litigation risks, and a growing awareness of potential liabilities among businesses of all sizes. The estimated market value in 2025 signifies a significant milestone, representing a culmination of past growth and a launchpad for future expansion. The forecast period (2025-2033) anticipates continued market expansion, fueled by factors such as the increasing complexity of business operations, globalization, and the evolving digital landscape. Cybersecurity threats and data breaches pose significant risks for businesses, leading to a surge in demand for comprehensive coverage. The base year (2025) provides a crucial benchmark against which to measure future performance, offering valuable insights into market dynamics and growth trajectories. Moreover, the diversification of insurance products and the expansion of distribution channels are contributing to the market's overall growth. This includes specialized coverages addressing emerging risks like reputational damage and environmental liabilities, further catering to the evolving needs of businesses operating in a complex and dynamic global environment. The study period of 2019-2033 encompasses this pivotal era of market transformation, allowing for a comprehensive understanding of the industry’s evolution and future prospects.

Several key factors are driving the expansion of the business management liability insurance market. Firstly, the increasing complexity of business operations, especially in the face of globalization and technological advancements, has elevated the risk of legal disputes and financial losses. Businesses are facing more intricate regulatory landscapes and heightened competition, increasing the likelihood of errors and omissions that can lead to substantial liability claims. Secondly, the growing frequency and severity of cyberattacks and data breaches are significantly impacting businesses, making cyber liability insurance a crucial component of comprehensive risk management strategies. The rising costs associated with legal proceedings, settlements, and reputational damage further necessitate robust insurance coverage. Thirdly, the evolving employment landscape, with stricter labor laws and regulations, has led to a greater need for employment practices liability insurance (EPLI) to protect businesses against potential lawsuits related to discrimination, harassment, and wrongful termination. Finally, a growing awareness among businesses of the potential financial consequences of unforeseen events and the importance of proactive risk management is fueling the demand for comprehensive business management liability insurance policies.

Despite the robust growth prospects, the business management liability insurance market faces several challenges. The increasing frequency and severity of catastrophic events, such as natural disasters and pandemics, can strain insurers' capacity and lead to higher premiums. Moreover, the fluctuating economic conditions, especially during periods of recession, can impact the profitability of insurers and limit their willingness to provide extensive coverage at competitive rates. The difficulty in accurately assessing and pricing certain types of risks, particularly emerging risks associated with rapidly evolving technologies and business models, poses significant challenges for underwriters. Furthermore, regulatory changes and evolving legal interpretations can impact the scope and terms of insurance policies, creating uncertainty for both insurers and businesses. Competition among insurers, including both traditional and new entrants, can also put downward pressure on premiums, potentially affecting the profitability of the market. Finally, the ever-increasing sophistication of fraudulent claims poses a challenge to insurers, requiring robust risk assessment and fraud detection mechanisms.

The North American market is expected to dominate the business management liability insurance sector throughout the forecast period due to a combination of factors: a highly developed insurance market, robust regulatory frameworks, a high concentration of multinational corporations, and a greater awareness of risk management practices. Within this region, the United States holds a significant market share.

Directors and Officers (D&O) Liability Insurance: This segment is projected to experience significant growth due to the increased scrutiny of corporate governance practices, heightened regulatory oversight, and the rising incidence of shareholder lawsuits. The complexity of corporate decision-making and the potential for legal challenges related to mergers and acquisitions, financial reporting, and environmental issues fuel the demand for comprehensive D&O coverage. The higher potential payouts associated with D&O claims makes it a substantial segment within the overall business management liability insurance landscape.

Employment Practices Liability Insurance (EPLI): The increasing awareness of workplace discrimination and harassment issues, along with more stringent employment regulations, is driving growth in the EPLI segment. Businesses are seeking insurance protection against lawsuits alleging wrongful termination, discrimination, harassment, and other employment-related issues. The cost of defending EPLI lawsuits and the potential for substantial settlements make this type of insurance essential for businesses.

Brokers: The application segment dominated by brokers is vital for distribution, providing expertise and facilitating the selection of appropriate policies, often acting as a conduit between insurers and businesses. Their comprehensive understanding of market dynamics, policy nuances, and risk assessment enable effective risk management for their clients.

In Europe, the UK and Germany are key markets, demonstrating robust growth driven by evolving regulatory environments, a considerable pool of businesses facing increased legal and financial pressures, and growing awareness of the significance of risk mitigation. Asia-Pacific regions like Japan, China, and India are anticipated to witness substantial growth, driven by increasing economic activity, industrial expansion, and a growing understanding of the importance of risk management strategies within business operations. However, challenges remain including limited insurance penetration in certain developing economies and variability in regulatory frameworks, which can influence market dynamics across regions.

The increasing adoption of advanced technologies, such as artificial intelligence and machine learning, is driving innovation within the business management liability insurance sector. These technologies enable better risk assessment, faster claim processing, and more efficient fraud detection, significantly improving the operational efficiency and cost-effectiveness of insurers. Furthermore, the evolving regulatory environment, with new laws and regulations mandating greater transparency and accountability, is driving growth by increasing the demand for comprehensive insurance coverage. The trend of globalization and cross-border business operations is increasing exposure to risks across geographical boundaries, leading businesses to seek global insurance solutions to protect their operations.

This report provides a comprehensive overview of the business management liability insurance market, analyzing key trends, driving forces, challenges, and growth opportunities. It offers detailed insights into various market segments, including D&O liability insurance, EPLI, and Kidnap and Ransom insurance. Leading players and their strategies are profiled, highlighting competitive dynamics and innovation within the sector. This report is an essential resource for insurers, businesses, investors, and industry stakeholders seeking to understand and capitalize on the growth potential within this dynamic market.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.9% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 2.9%.

Key companies in the market include Chubb (ACE), AIG, Hiscox, Allianz, Tokio Marine Holdings, XL Group, AXA, Travelers, Assicurazioni Generali, .

The market segments include Type, Application.

The market size is estimated to be USD XXX N/A as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in N/A.

Yes, the market keyword associated with the report is "Business Management Liability Insurance," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Business Management Liability Insurance, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.