1. What is the projected Compound Annual Growth Rate (CAGR) of the Business Finance Services?

The projected CAGR is approximately 26.33%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Business Finance Services

Business Finance ServicesBusiness Finance Services by Type (Onsite, Offsite), by Application (Accounting Services, Bookkeeping Services, Tax Services, Financial Consulting), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

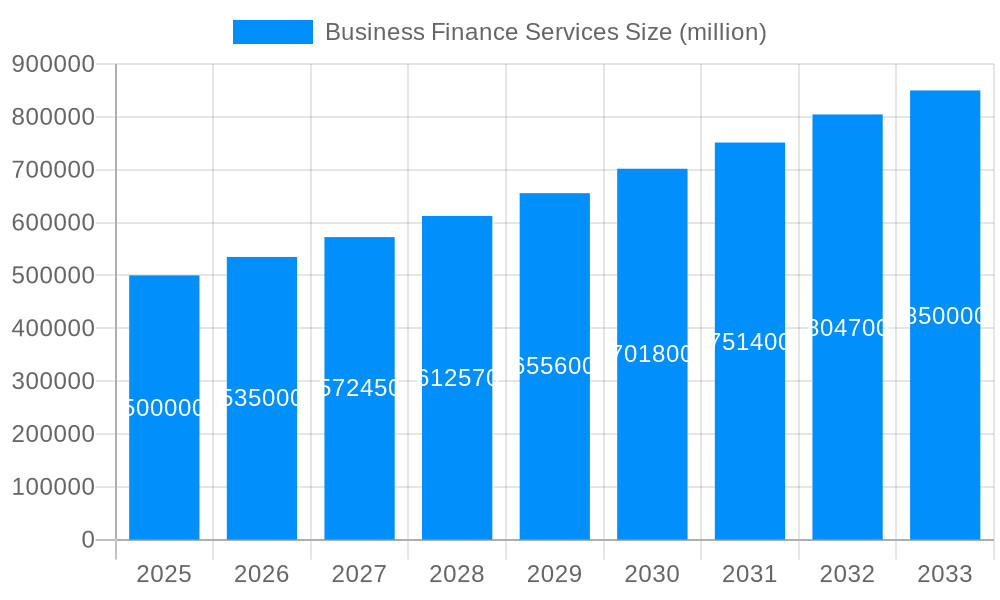

The global business finance services market is experiencing robust growth, driven by the increasing complexity of financial operations for businesses of all sizes and the rising adoption of digital solutions. The market, estimated at $500 billion in 2025, is projected to achieve a compound annual growth rate (CAGR) of 7% from 2025 to 2033, reaching an estimated $850 billion by 2033. Key drivers include the expanding need for efficient accounting and bookkeeping services, the growing demand for specialized tax and financial consulting, and the increasing adoption of cloud-based financial management software. The shift towards digitalization is transforming the industry, with businesses increasingly relying on automated solutions for tasks like invoicing, payment processing, and financial reporting. This trend is further propelled by the need for enhanced data security and improved operational efficiency. Market segmentation reveals strong growth across all service types (onsite, offsite), with accounting and tax services consistently holding significant market share. Major players like PwC, KPMG, and Ernst & Young dominate the market, leveraging their extensive expertise and global reach. Regional analysis indicates North America and Europe as the largest contributors to market revenue, but significant growth potential exists in rapidly developing economies in Asia-Pacific and the Middle East & Africa.

The competitive landscape is characterized by a mix of large multinational firms offering comprehensive financial services and smaller, specialized firms focusing on niche market segments. Competition is intensifying as technology continues to disrupt the industry, leading to innovations such as AI-powered financial analytics and blockchain-based accounting solutions. Despite this growth, challenges remain, including regulatory compliance complexities, cybersecurity risks, and the need to adapt to evolving business needs. The market’s ongoing evolution necessitates strategic investments in technology, talent acquisition, and the development of new service offerings to maintain a competitive edge and cater to the diversifying needs of the business community. The forecast period promises continued expansion, offering significant opportunities for businesses operating within this dynamic sector.

The global business finance services market is experiencing robust growth, projected to reach USD X billion by 2033, expanding at a CAGR of X% during the forecast period (2025-2033). This expansion is fueled by several converging factors, including the increasing complexity of financial regulations, the accelerating adoption of cloud-based accounting software, and the rising demand for outsourced financial expertise, particularly among small and medium-sized enterprises (SMEs). The historical period (2019-2024) witnessed significant market evolution, with a notable shift towards digitalization and automation. This trend is expected to continue and intensify, leading to the emergence of innovative service offerings such as AI-powered financial planning tools and robotic process automation (RPA) for tasks like bookkeeping and tax preparation. The market is also seeing a rising demand for specialized financial consulting services, particularly in areas like mergers and acquisitions (M&A) advisory, risk management, and cybersecurity. The base year 2025 marks a crucial point in the market’s trajectory, with established players consolidating their market share while new entrants challenge the status quo with disruptive technologies and service models. The increasing adoption of subscription-based services, particularly in accounting and bookkeeping, is another key trend influencing market dynamics. This subscription model offers businesses predictable costs and scalable access to essential financial services, leading to higher client retention and overall market expansion. The growth is also significantly affected by the global economic climate; periods of robust economic growth generally see increased demand for these services, whereas recessions can lead to a temporary downturn. Furthermore, the increasing adoption of cloud computing and the prevalence of remote work are driving significant changes within the Business Finance Services sector. The shift from onsite to offsite services is becoming increasingly prevalent, with many companies opting for the flexibility and cost-effectiveness of remote teams and cloud-based platforms. The estimated year 2025 provides a benchmark for understanding the current state of the market and projecting future growth trajectories. Detailed analysis of historical data allows for more accurate forecasting, enabling businesses to strategize for success in this dynamic and evolving market.

Several key factors are propelling the growth of the business finance services market. The increasing complexity of financial regulations, particularly for international businesses and larger corporations, necessitates the engagement of specialized professionals to ensure compliance and avoid costly penalties. This demand fuels the growth of accounting, tax, and financial consulting services. Furthermore, the ongoing digital transformation across industries is forcing businesses to adopt advanced technologies to manage their financial operations efficiently. This trend drives the demand for cloud-based accounting software, data analytics tools, and other technological solutions offered by business finance service providers. The rise of SMEs and the increasing adoption of outsourcing strategies are also significant drivers. Many SMEs lack the internal resources or expertise to manage their finances effectively, leading them to outsource these functions to specialized firms. This trend is further reinforced by the cost-effectiveness and scalability offered by outsourcing. Finally, the growing need for proactive financial planning and risk management is driving demand for sophisticated financial consulting services. Businesses are increasingly recognizing the importance of proactive financial planning to navigate economic uncertainties, mitigate risks, and achieve sustainable growth. This has fostered a demand for expert financial advice, market analysis, and risk mitigation strategies from seasoned financial professionals.

Despite the positive growth outlook, the business finance services market faces several challenges. Cybersecurity threats are a significant concern, with the increasing reliance on digital platforms and data storage creating vulnerabilities for data breaches and financial fraud. Protecting sensitive client data and maintaining robust cybersecurity measures are critical for service providers to ensure client trust and prevent reputational damage. Competition, particularly from smaller, specialized firms that offer niche services, is intense. Established players must constantly innovate and adapt to remain competitive, offering cutting-edge technologies and specialized expertise. Maintaining high levels of expertise and staying current with evolving regulations and industry best practices presents ongoing challenges. The need for continuous professional development and investment in training to ensure employees have the skills required for the latest technologies and regulatory compliance is paramount for success. Finally, attracting and retaining skilled professionals is a challenge across the sector, given the high demand for qualified accountants, tax advisors, and financial consultants. Competition for talent is fierce, leading to pressure on salaries and benefits packages. Furthermore, economic downturns can significantly impact demand for non-essential financial services, leading to temporary revenue drops and increased pressure on profitability.

The North American market is projected to dominate the business finance services market during the forecast period (2025-2033), driven by the high concentration of large corporations, a robust SME sector, and a well-developed financial infrastructure. The region’s mature economy, strong regulatory framework, and high levels of technology adoption provide a fertile ground for the expansion of business finance services.

Within the application segments, Financial Consulting is expected to witness the fastest growth. The increasing complexity of financial markets, the need for strategic decision-making, and the rising importance of risk management are driving demand for specialized financial consulting services. This segment benefits from higher profit margins and a growing need for expertise in areas such as mergers and acquisitions (M&A) advisory, restructuring, and valuation services.

The convergence of technological advancements, increased regulatory compliance requirements, and the growing need for efficient financial management are key catalysts for the growth of the business finance services industry. The increasing adoption of cloud-based solutions, AI-powered tools, and data analytics is streamlining financial processes, boosting efficiency, and unlocking new opportunities for value creation. Stringent regulatory requirements, while posing challenges, simultaneously create opportunities for specialized service providers to assist businesses in navigating complex compliance landscapes. Finally, the desire for businesses to gain a competitive edge through strategic financial planning and effective resource allocation further fuels demand for comprehensive business finance services.

This report provides a comprehensive overview of the business finance services market, offering detailed insights into market trends, driving forces, challenges, key players, and future growth prospects. The study covers a broad range of services, including accounting, bookkeeping, tax services, and financial consulting, and analyzes the market across various geographic regions and segments. The report uses a robust methodology, combining primary and secondary research to develop accurate market projections and forecasts. This detailed analysis provides valuable insights for businesses operating in, or considering entering, the dynamic and evolving business finance services market.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 26.33% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 26.33%.

Key companies in the market include AlixPartners, Bench, Fiserv, KPMG, Right Networks, PwC, Wolters Kluwer, Acuity, Ernst & Young, CARTA, Deluxe Corporation, FundThrough, Healy Consultants, McKinsey, .

The market segments include Type, Application.

The market size is estimated to be USD XXX N/A as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in N/A.

Yes, the market keyword associated with the report is "Business Finance Services," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Business Finance Services, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.