1. What is the projected Compound Annual Growth Rate (CAGR) of the Bromine Market?

The projected CAGR is approximately XXX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Bromine Market

Bromine MarketBromine Market by Derivative (Organobromine, Clear Brine Fluids, Hydrogen Bromide), by Application (Flame Retardants, Oil & Gas Drilling, PTA Synthesis, Water Treatment, Pesticides, Others), by End-Use (Oil & Gas, Automotive, Electrical & Electronics, Agriculture, Pharmaceutical, Textile, Others), by North America (U.S., Canada, Mexico), by Europe (UK, Germany, France, Italy, Spain, Russia, Netherlands, Switzerland, Poland, Sweden, Belgium), by Asia Pacific (China, India, Japan, South Korea, Australia, Singapore, Malaysia, Indonesia, Thailand, Philippines, New Zealand), by Latin America (Brazil, Mexico, Argentina, Chile, Colombia, Peru), by MEA (UAE, Saudi Arabia, South Africa, Egypt, Turkey, Israel, Nigeria, Kenya) Forecast 2026-2034

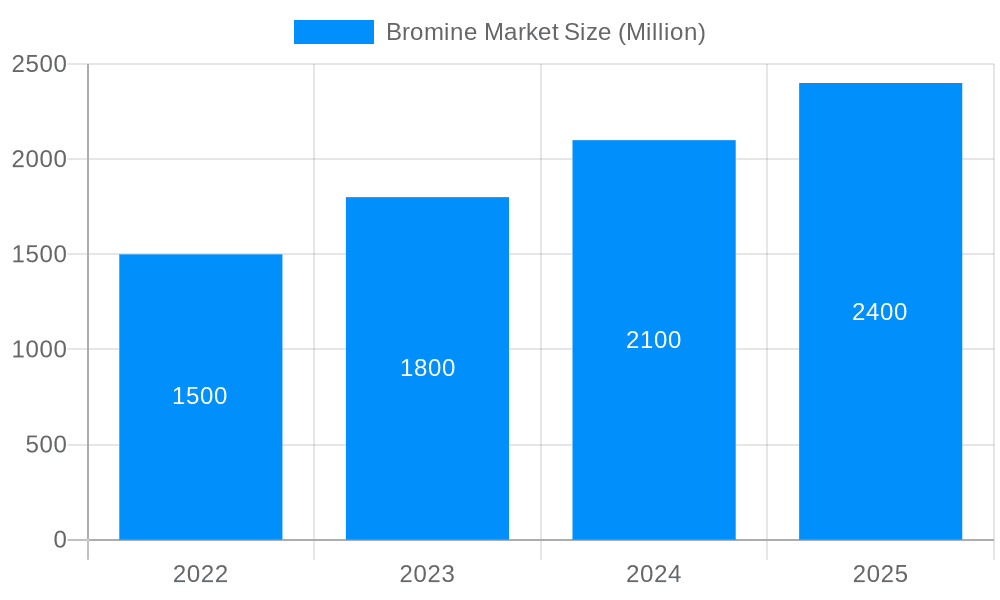

The size of the Bromine Market was valued at USD XX Million in 2023 and is projected to reach USD XXX Million by 2032, with an expected CAGR of XXX% during the forecast period. Bromine (Br) is a chemical element that belongs to the halogen group of the periodic table, with an atomic number of 35. It is a highly reactive and volatile element, primarily found in nature in the form of bromide salts, such as in seawater and salt lakes. Bromine is used in various industrial applications, including flame retardants, water purification, pharmaceuticals, and the production of bromine-based chemicals like hydrobromic acid and brominated compounds. Due to its corrosive nature, bromine is handled with care, often stored in specialized containers to prevent exposure. It is a reddish-brown liquid at room temperature and has a strong, pungent odor, which makes it distinct from other halogens. The market's growth can be attributed to the rising demand for bromine in various industries, including oil and gas, automotive, and electrical and electronics.

Bromine is a versatile element used in a wide range of applications. The growing demand for bromine in the oil and gas industry is a major driver of the market. Bromine-based clear brine fluids (CBFs) are widely used in oil and gas well drilling and completion operations. Additionally, bromine derivatives such as organobromine are extensively utilized as flame retardants in various industries, contributing to the market growth.

The global bromine market is experiencing robust growth, propelled by several key factors. A significant driver is the unwavering demand from the oil and gas drilling sector. Bromine-based clear brine fluids (CBFs) are indispensable for optimizing drilling operations by enhancing wellbore stability, mitigating corrosion, and maximizing fluid recovery. The inherent properties of bromine compounds make them crucial for maintaining operational efficiency and safety in challenging exploration environments.

Furthermore, a heightened global awareness regarding fire safety is significantly boosting the demand for bromine-based flame retardants. These advanced materials play a critical role in preventing fire accidents across a wide spectrum of industries, including electronics, construction, and textiles, by inhibiting the spread of flames and reducing smoke production. This growing emphasis on safety is a potent catalyst for market expansion.

Despite its promising growth trajectory, the bromine market is not without its hurdles. A primary constraint is the limited availability of high-quality bromine resources. Bromine is predominantly extracted from subterranean brines and seawater, and the discovery and accessibility of economically viable and rich brine sources are finite. This scarcity can influence supply chain stability and pricing.

Moreover, environmental considerations surrounding bromine production and disposal present ongoing challenges. The industry is under increasing scrutiny to adopt more sustainable and eco-friendly extraction and processing methods. Managing the environmental footprint of bromine operations, from extraction to the end-of-life management of bromine-containing products, requires continuous innovation and adherence to stringent regulations.

The bromine market exhibits a strong regional presence, with North America, Europe, and Asia-Pacific emerging as the leading continents. North America's dominance is largely attributed to its expansive oil and gas industry, a voracious consumer of bromine for drilling applications. In Europe and Asia-Pacific, the automotive and electrical & electronics sectors are substantial contributors to bromine demand, driven by their use in flame retardants and other specialized chemicals.

Looking ahead, the oil and gas drilling segment is projected to retain its position as the largest market share holder throughout the forecast period. This sustained leadership is a direct consequence of the ongoing need for high-performance CBFs in exploration and production activities, coupled with advancements in drilling technologies that further underscore the utility of bromine compounds.

Growth Catalysts in Bromine IndustrySeveral factors are poised to accelerate the growth of the bromine industry. Technological advancements in bromine extraction and purification techniques are continuously improving efficiency and reducing costs, making bromine more accessible and competitive. Innovations are also focused on developing novel applications for bromine and its derivatives.

Concurrently, a growing emphasis on sustainability and environmental stewardship is spurring government initiatives and industry-led efforts to develop and implement eco-friendly bromine production processes. This includes exploring alternative extraction methods and improving waste management practices, which will foster long-term market viability and social acceptance.

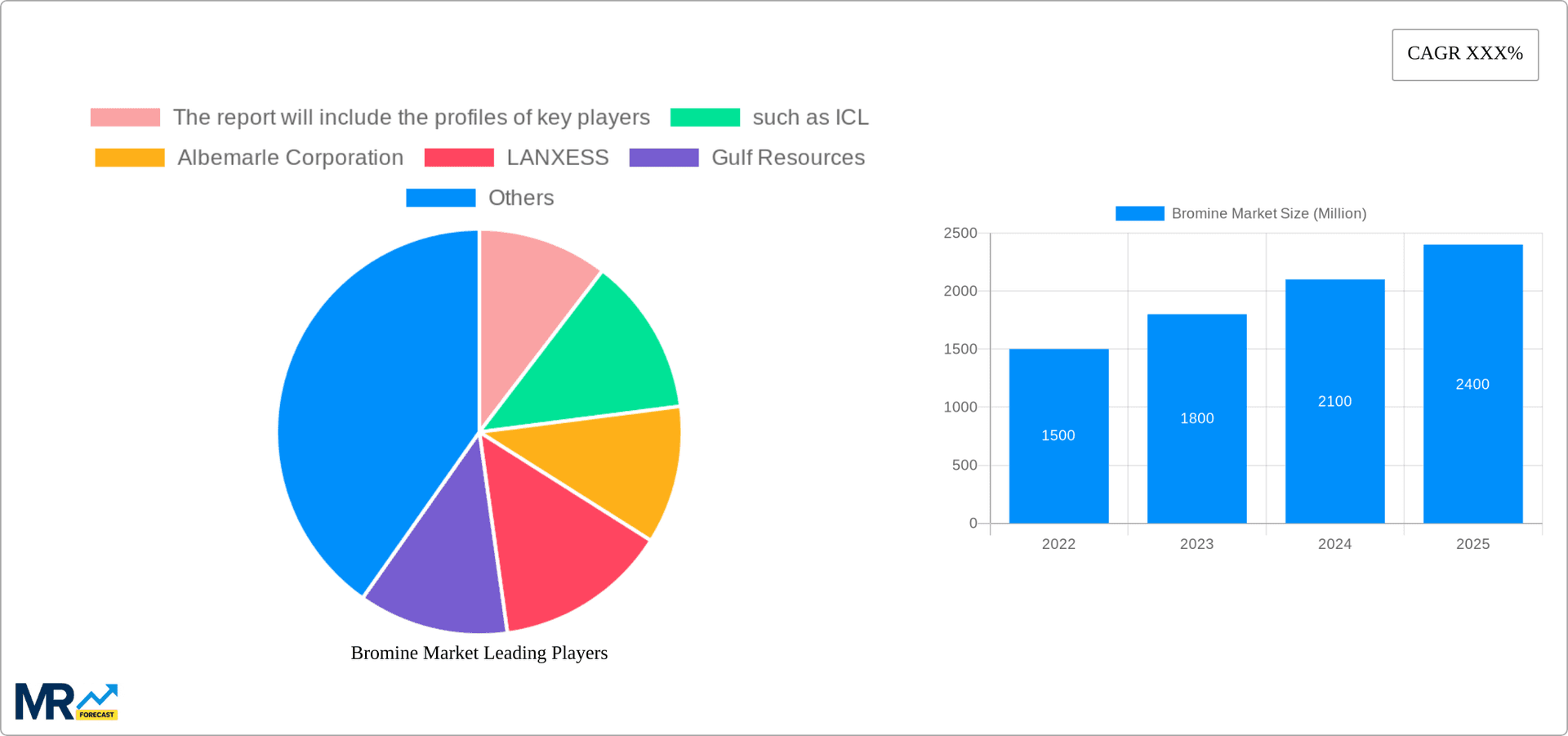

Some of the key players in the bromine market include:

The bromine sector has witnessed strategic moves aimed at enhancing market competitiveness and addressing customer needs. In August 2022, Albemarle Corporation took a significant step by restructuring its bromine and lithium global business units (GBUs) into a new corporate framework. This organizational shift was strategically designed to bolster their capacity to meet escalating customer demand within a dynamic and competitive global marketplace.

Further demonstrating innovation in product development, ICL launched BromoQuel in January 2022. This novel product is engineered to offer rapid response times, crucial for emergency situations, and is specifically designed to prevent bromine vapor and liquid spills, thereby enhancing safety and environmental protection within handling and usage scenarios.

This report provides a comprehensive overview of the global bromine market, including market analysis, industry developments, key players, and demand-supply dynamics. The report also includes detailed segment analysis, growth catalysts, and challenges faced by the industry.

The report analyzes consumer behavior, preferences, and purchasing patterns related to bromine and its derivatives. It provides insights into end-user industries and their consumption trends.

The report assesses the demand for bromine from various industries, including oil and gas, automotive, and electrical and electronics. It also analyzes the factors influencing demand growth and identifies potential growth opportunities.

The report provides an analysis of bromine import and export trends, including major trading countries and the dynamics of the global bromine trade.

The report examines the pricing strategies adopted by key players in the bromine market. It analyzes pricing trends, discounts, and other commercial strategies used by industry participants.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of XXX% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XXX%.

Key companies in the market include The report will include the profiles of key players, such as ICL, Albemarle Corporation, LANXESS, Gulf Resources, Inc., Jordan Bromine Company, Tosoh Corporation, TETRA Technologies, TATA Chemicals Ltd., Hindustan Salts Ltd., Honeywell International Inc., and Satyesh Brinechem Pvt. Ltd..

The market segments include Derivative, Application, End-Use.

The market size is estimated to be USD XX Million as of 2022.

N/A

N/A

N/A

In August 2022, Albemarle Corporation announced reconstructing its bromine and lithium global business units (GBU) into a new corporate structure. The reconstruction aims to meet growing customer demand in a competitive global environment.

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4850, USD 5850, and USD 6850 respectively.

The market size is provided in terms of value, measured in Million.

Yes, the market keyword associated with the report is "Bromine Market," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Bromine Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.