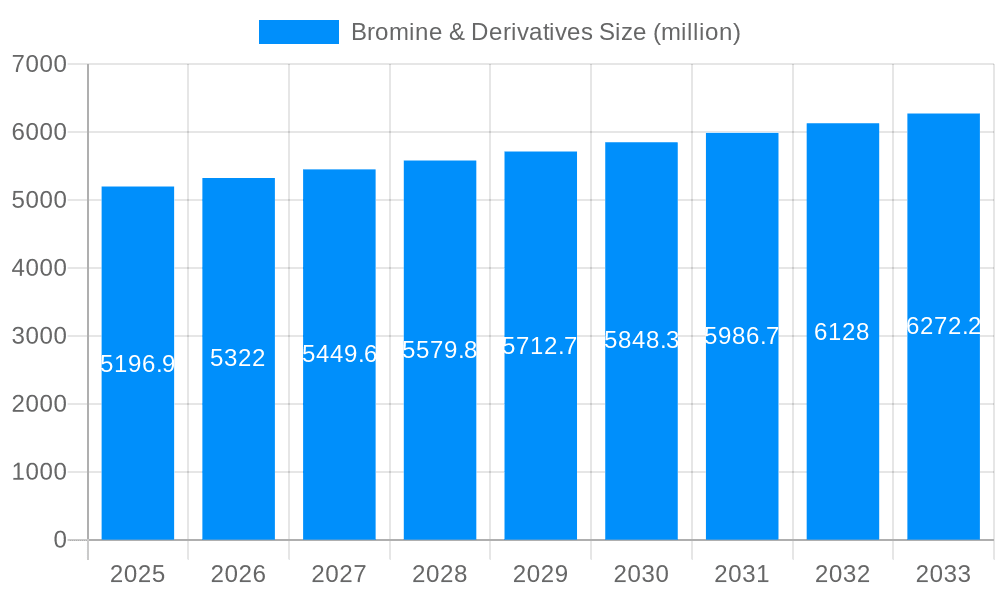

1. What is the projected Compound Annual Growth Rate (CAGR) of the Bromine & Derivatives?

The projected CAGR is approximately 2.4%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Bromine & Derivatives

Bromine & DerivativesBromine & Derivatives by Type (Bromide, Bromine Derivatives), by Application (Flame Retardants, Biocides, Drilling Fluids, Chemical Intermediate, Water Treatment, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

The global Bromine & Derivatives market is poised for steady growth, projected to reach a substantial USD 5196.9 million by the estimated year of 2025. This expansion is fueled by the intrinsic properties of bromine compounds, particularly their efficacy as flame retardants in a wide array of materials, including plastics, textiles, and electronics, addressing increasing safety regulations worldwide. The demand for biocides in water treatment and industrial processes, crucial for preventing microbial contamination and enhancing operational efficiency, further underpins market growth. Additionally, bromine derivatives play a vital role as chemical intermediates in the synthesis of pharmaceuticals, agrochemicals, and specialty chemicals, contributing to their sustained relevance. The drilling fluids segment also presents a consistent demand, especially in the oil and gas industry, where bromine compounds are utilized to control formation pressures and enhance well productivity.

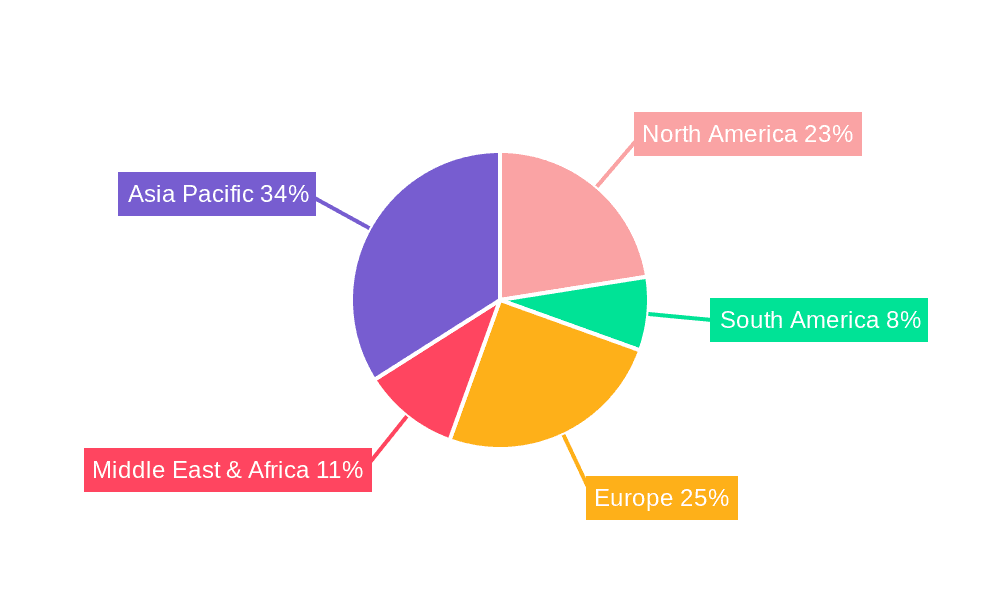

The market's trajectory, with a Compound Annual Growth Rate (CAGR) of 2.4% anticipated from 2025 to 2033, reflects a mature yet evolving industry. Key trends shaping this landscape include the growing emphasis on sustainable flame retardant solutions, prompting innovation in bromine-based chemistries with improved environmental profiles. Advancements in water treatment technologies are also driving demand for more efficient and targeted biocidal applications. Geographically, the Asia Pacific region, particularly China and India, is expected to be a significant growth engine due to rapid industrialization and burgeoning manufacturing sectors. However, the market is not without its challenges. Stringent environmental regulations and concerns regarding the persistence of certain brominated compounds in the environment necessitate continuous research and development for greener alternatives. Fluctuations in raw material prices and geopolitical factors impacting supply chains also present potential restraints to consistent growth, demanding strategic foresight and resilience from market players.

The global Bromine & Derivatives market is projected to witness significant expansion over the study period of 2019-2033, with a robust forecast from 2025-2033 building upon the base year estimations of 2025. The market, valued in the millions, is characterized by a dynamic interplay of established demand drivers and emerging opportunities. During the historical period (2019-2024), the market has demonstrated consistent growth, fueled by the indispensable applications of bromine and its compounds across diverse industries. The estimated market size in 2025, a pivotal point for future projections, is anticipated to reflect this sustained upward trajectory.

Key market insights reveal a growing emphasis on specialty bromine derivatives, driven by their enhanced performance characteristics in high-growth application areas. For instance, the demand for advanced flame retardants, crucial for enhancing fire safety in electronics, construction, and textiles, is on a steady rise. Similarly, the increasing adoption of biocides in water treatment and industrial processes to combat microbial contamination is a significant contributor to market growth. The Chemical Intermediate segment, serving as a fundamental building block for a multitude of downstream products, is expected to maintain its strong market presence. Furthermore, the vital role of bromine compounds in Drilling Fluids, particularly in the oil and gas sector, continues to be a cornerstone of market demand, albeit subject to the cyclical nature of this industry. The Bromide and Bromine Derivatives types are expected to exhibit differentiated growth patterns, with derivatives poised for higher growth due to their specialized functionalities. The "Others" application segment is also likely to witness expansion as novel uses for bromine compounds emerge. The industry is also navigating evolving regulatory landscapes, particularly concerning environmental impact and health safety, which influences product development and market penetration strategies. Innovation in production processes, aiming for increased efficiency and reduced environmental footprint, is another critical trend shaping the future of the Bromine & Derivatives market. The competitive landscape remains concentrated with a few key global players holding significant market share, but emerging regional manufacturers are also carving out niches, particularly in Asia-Pacific. The overall outlook suggests a healthy and evolving market, driven by both essential applications and ongoing technological advancements.

The global Bromine & Derivatives market is being propelled by a confluence of powerful driving forces, primarily stemming from the inherent functionalities and expanding applications of these compounds. A significant contributor is the escalating demand for enhanced safety standards across various industries. The Flame Retardants segment, in particular, is experiencing robust growth, driven by stringent fire safety regulations in electronics, automotive, construction, and textile sectors. As global populations grow and urbanization intensifies, the need for fire-safe materials becomes paramount, directly translating into increased consumption of brominated flame retardants. Furthermore, the ever-increasing global demand for clean water and efficient industrial processes is fueling the adoption of Biocides and other bromine-based compounds for Water Treatment. These chemicals are vital for controlling microbial growth in industrial cooling towers, municipal water systems, and swimming pools, preventing biofouling and ensuring public health. The oil and gas industry's continuous need for efficient extraction operations also underpins the demand for bromine compounds in Drilling Fluids. Their high density and effectiveness in controlling formation pressures are indispensable for deep-sea and unconventional drilling activities. Beyond these primary applications, the fundamental role of bromine as a Chemical Intermediate in the synthesis of pharmaceuticals, agrochemicals, and a wide array of specialty chemicals ensures a consistent baseline demand. The ongoing research and development efforts exploring novel applications and enhancing the performance of existing bromine derivatives are also acting as significant growth catalysts.

Despite the promising growth trajectory, the Bromine & Derivatives market faces several challenges and restraints that could impede its expansion. Foremost among these are environmental and health concerns associated with certain brominated compounds, particularly some legacy flame retardants. Regulatory bodies worldwide are increasingly scrutinizing and, in some cases, restricting the use of specific brominated chemicals due to potential persistence in the environment and bioaccumulation. This has led to a push for the development and adoption of "greener" alternatives, posing a significant challenge for manufacturers of traditional brominated products. The volatility of raw material prices, especially for elemental bromine which is primarily extracted from brines, can also impact profit margins and market stability. Fluctuations in extraction costs, geopolitical factors affecting supply chains, and the availability of suitable brine sources can lead to price instability for downstream derivatives. Furthermore, the Drilling Fluids segment, while significant, is highly dependent on the cyclical nature of the oil and gas industry. Downturns in oil prices and exploration activities can lead to a sharp decline in demand for bromine-based drilling fluids. The high capital investment required for bromine extraction and processing facilities can also act as a barrier to entry for new players, consolidating the market among established entities. Moreover, the complex and often lengthy regulatory approval processes for new bromine-based products in various applications, particularly in pharmaceuticals and agrochemicals, can slow down market penetration and innovation. The increasing emphasis on recycling and the circular economy also presents a challenge, as the market may need to adapt to alternative sourcing or end-of-life management strategies for bromine-containing products.

The global Bromine & Derivatives market is poised for significant dominance by specific regions and segments, driven by a combination of established industrial infrastructure, burgeoning demand, and strategic resource availability.

Dominant Segments:

Dominant Regions/Countries:

The interplay between these dominant segments and regions creates a dynamic market landscape. The increasing focus on sustainability and stricter regulations in developed regions like North America is likely to drive innovation towards more environmentally friendly bromine derivatives. Meanwhile, the sheer scale of manufacturing and industrial growth in Asia-Pacific will continue to be the primary engine of overall market expansion, particularly for flame retardants and chemical intermediates. The Middle East will remain a critical hub for drilling fluid applications, closely mirroring the fortunes of the global oil and gas market.

Several factors are acting as growth catalysts for the Bromine & Derivatives industry. The unwavering global demand for enhanced fire safety is a primary driver, fueling the market for flame retardants. Growing environmental consciousness and the need for cleaner water are propelling the adoption of biocides for water treatment applications. The ongoing exploration and production activities in the oil and gas sector continue to necessitate the use of bromine compounds in drilling fluids. Furthermore, continuous research and development efforts are uncovering novel applications for bromine derivatives, opening up new market avenues.

This comprehensive report delves into the intricate workings of the Bromine & Derivatives market, providing an in-depth analysis of its multifaceted landscape. It meticulously examines the market dynamics, encompassing historical trends, current estimations, and future projections for the period of 2019-2033. The report offers a granular breakdown of the market by type (Bromide, Bromine Derivatives) and application (Flame Retardants, Biocides, Drilling Fluids, Chemical Intermediate, Water Treatment, Others), providing crucial insights into segment-specific growth drivers and challenges. It also identifies the key regions and countries poised to dominate the market, analyzing the underlying factors contributing to their leadership. Furthermore, the report profiles the leading companies in the sector, highlighting their strategic initiatives and contributions. Through this extensive coverage, the report aims to equip stakeholders with the necessary intelligence to navigate the evolving Bromine & Derivatives industry and capitalize on emerging opportunities.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.4% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 2.4%.

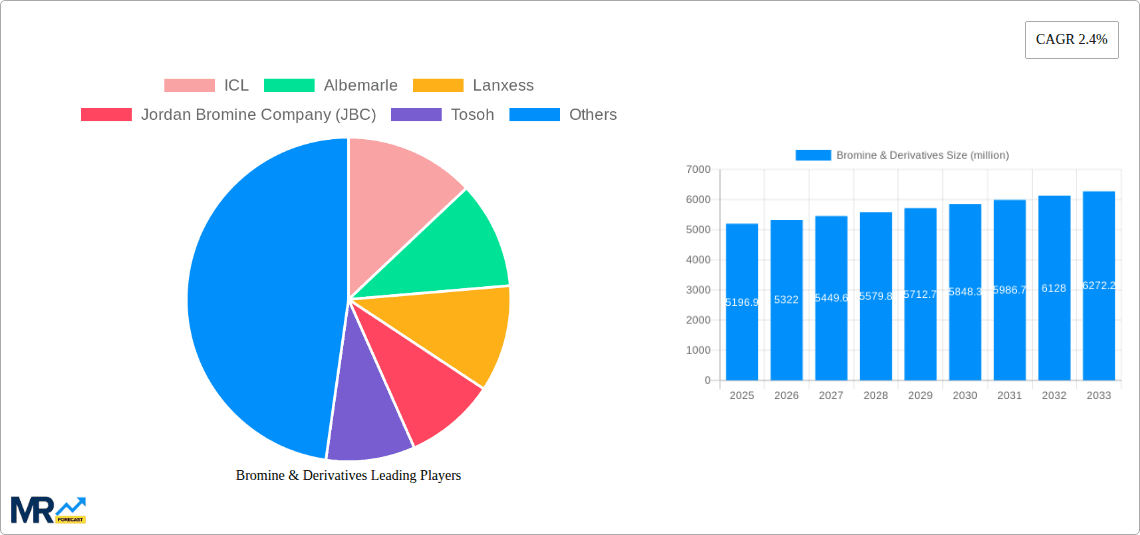

Key companies in the market include ICL, Albemarle, Lanxess, Jordan Bromine Company (JBC), Tosoh, Solaris Chemtech (SCIL), Perekop Bromine, Yuyuan Group, Haiwang Chemical, Dadi Salt Chemical Group, Chengyuan Salt Chemical, Lubei Chemical, Runke Chemical, Haihua Group, Tata Chemicals, Gulf Resources, Tetra Technologies, .

The market segments include Type, Application.

The market size is estimated to be USD 5196.9 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Bromine & Derivatives," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Bromine & Derivatives, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.