1. What is the projected Compound Annual Growth Rate (CAGR) of the Brand Apparel and Accessories Retail?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Brand Apparel and Accessories Retail

Brand Apparel and Accessories RetailBrand Apparel and Accessories Retail by Type (Men, Women, World Brand Apparel and Accessories Retail Production ), by Application (Children, Adults, World Brand Apparel and Accessories Retail Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

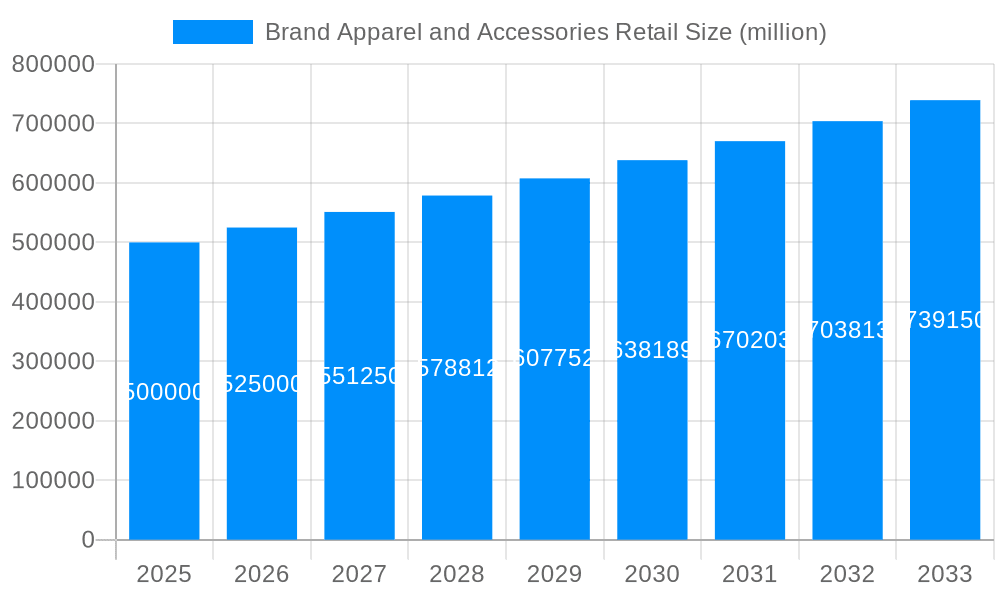

The global brand apparel and accessories retail market is a dynamic and competitive landscape, exhibiting significant growth potential. While precise market size figures for 2025 are unavailable, extrapolating from general industry trends and considering a hypothetical CAGR of 5% (a conservative estimate given the fluctuations in the apparel industry) and a 2019 market size of $500 billion (a reasonable assumption for the global market), we can project a 2025 market size of approximately $670 billion. This growth is driven primarily by rising disposable incomes in emerging economies, increasing consumer spending on fashion and accessories, and the expanding influence of social media and e-commerce on purchasing behaviors. The market is segmented by gender (men's, women's) and age group (children's, adult's) with noticeable variations in spending habits and preferences across these segments. Furthermore, the industry is witnessing a surge in sustainable and ethical fashion trends, forcing brands to adapt their production processes and supply chains.

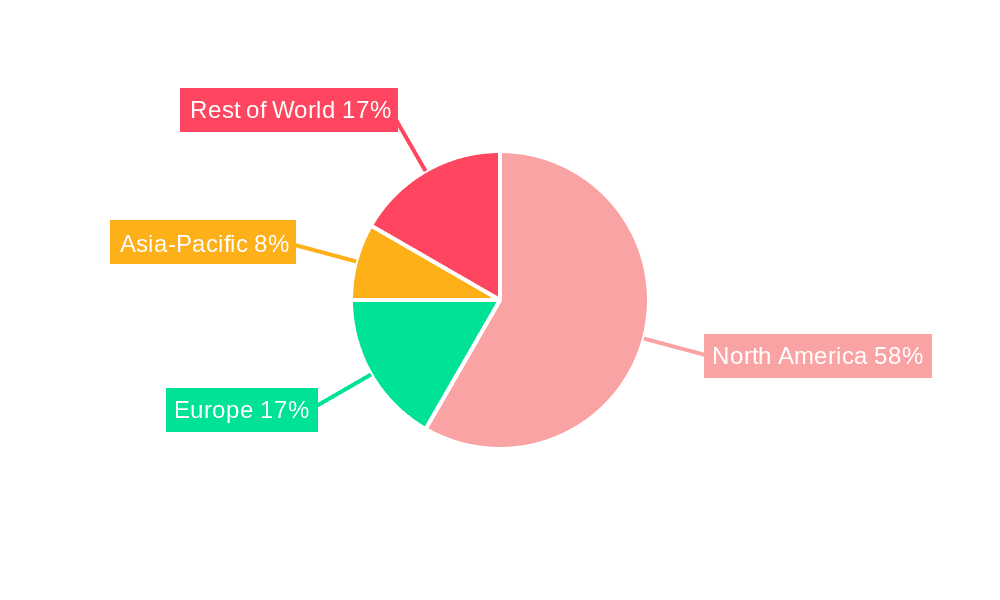

However, the market also faces several challenges. Fluctuations in raw material prices, intense competition among established and emerging brands, and the increasing pressure for greater transparency and ethical sourcing in production represent significant restraints. Regional variations in market growth are expected, with North America and Europe maintaining strong positions, while the Asia-Pacific region demonstrates significant potential for future growth, driven by the expanding middle class in countries like China and India. The success of individual brands within this market hinges on their ability to adapt to evolving consumer preferences, leverage digital marketing strategies effectively, and maintain a sustainable and ethical supply chain. The presence of major players like LVMH, Adidas, and Lululemon illustrates the consolidation and competitive nature of the market, highlighting the importance of brand building, innovation, and effective distribution channels for achieving sustainable growth.

The brand apparel and accessories retail market experienced significant shifts during the historical period (2019-2024), influenced by evolving consumer preferences, technological advancements, and global economic conditions. The market witnessed a surge in e-commerce adoption, driven by the convenience and accessibility it offers. This led to a restructuring of the retail landscape, with many traditional brick-and-mortar stores facing challenges adapting to the online shift. Simultaneously, the rise of fast fashion and conscious consumerism created a dynamic market characterized by both price sensitivity and an increasing demand for sustainable and ethically produced apparel. Luxury brands, while maintaining their high-end positioning, have also adapted to the changing market by expanding their online presence and offering personalized experiences. The impact of the COVID-19 pandemic further accelerated these trends, with many consumers shifting their shopping habits completely to online channels. Post-pandemic, while some return to in-person shopping has been observed, the growth in omnichannel strategies (integrating online and offline experiences) has firmly established itself as the new normal for successful retail brands. The market is expected to maintain its growth trajectory throughout the forecast period (2025-2033), driven by factors such as increasing disposable incomes in developing economies and a continued focus on personalized and experiential retail. However, the market faces the ongoing challenges of managing supply chain disruptions, maintaining competitive pricing, and addressing evolving consumer expectations regarding sustainability and ethical sourcing. The estimated market value in 2025 is projected to reach $XXX million, with a significant growth potential by 2033. The market shows consistent demand across various segments, though specific growth rates vary depending on factors such as economic conditions and fashion trends.

Several key factors are propelling the growth of the brand apparel and accessories retail market. Firstly, the increasing disposable incomes globally, particularly in emerging economies, are driving higher consumer spending on apparel and accessories. Secondly, the rapid expansion of e-commerce provides unprecedented access to a wider range of brands and products, fueling market growth. Thirdly, the increasing influence of social media and influencers is shaping consumer preferences and driving demand for specific brands and styles. This is particularly impactful on younger demographics, creating a fast-paced fashion cycle. Furthermore, innovative marketing strategies, such as personalized recommendations and loyalty programs, are enhancing the customer experience and boosting sales. The rising popularity of athleisure wear and comfortable clothing has also significantly impacted the market, creating a strong demand for comfortable and versatile apparel. The growing awareness of sustainability and ethical sourcing is also creating new opportunities for brands that prioritize these values, while simultaneously putting pressure on companies to improve their supply chains and production methods. Finally, the continuous innovation in apparel technology, such as smart fabrics and personalized fitting systems, further enhances the appeal and value proposition for consumers.

Despite the positive growth prospects, the brand apparel and accessories retail market faces significant challenges. Supply chain disruptions, particularly those related to raw materials sourcing, manufacturing, and logistics, remain a major concern, impacting production costs and delivery timelines. Fluctuations in raw material prices, like cotton and synthetic fibers, can significantly impact profitability. Increasing competition, both from established brands and emerging players, puts pressure on pricing and requires continuous innovation and marketing efforts to maintain market share. The ever-changing consumer preferences require brands to adapt swiftly to evolving fashion trends and styles, often demanding quicker product cycles and increased investment in design and development. Furthermore, the pressure to adopt sustainable and ethical practices increases production costs and requires significant investment in sustainable materials and technologies. Counterfeit products pose a significant threat, eroding brand value and impacting sales. Economic downturns can significantly impact consumer spending, leading to reduced demand for non-essential goods like apparel and accessories. Finally, managing the complexities of the omnichannel experience, integrating online and offline retail strategies seamlessly, requires significant investment in technology and infrastructure.

The global brand apparel and accessories retail market exhibits diverse growth patterns across different regions and segments. However, several key areas stand out as dominant:

North America: This region continues to be a major market driver due to high consumer spending power and established retail infrastructure. The presence of major brands and a strong online retail sector contribute to its dominance.

Europe: Europe boasts a mature market with sophisticated consumers and a strong emphasis on luxury and designer brands. Key markets within Europe include the UK, France, Germany, and Italy.

Asia-Pacific: This region is experiencing rapid growth, fueled by rising disposable incomes, a burgeoning middle class, and increasing online penetration. China and India are major growth drivers within this region.

Dominant Segment: The Women's apparel segment consistently represents a larger market share compared to men's apparel. This is due to a higher frequency of purchases and a greater variety of styles and trends within the women's fashion market.

Women's Fashion: The women's segment encompasses a broad range of apparel categories, including dresses, tops, bottoms, outerwear, and accessories. This diversity contributes to higher sales volumes.

Higher Spending: Women tend to spend a larger portion of their disposable income on apparel and accessories compared to men, further contributing to the segment's dominance.

Trend Sensitivity: Women's fashion is typically characterized by faster-changing trends, leading to more frequent purchases and higher market turnover.

While the children's and adult's application segments are substantial, the sheer volume and purchasing patterns in the women's apparel segment positions it as a key driver of overall market growth.

The brand apparel and accessories retail industry is poised for continued growth, propelled by several key catalysts. These include the rising disposable incomes in emerging markets, increasing adoption of e-commerce and omnichannel strategies, and the ever-growing influence of social media on consumer behavior. Furthermore, the rising popularity of athleisure, sustainable and ethically sourced apparel, and the ongoing innovation in apparel technology all contribute to the market's dynamic growth trajectory. The focus on personalized customer experiences and loyalty programs further enhances brand engagement and drives sales.

This report provides a comprehensive analysis of the brand apparel and accessories retail market, offering valuable insights into market trends, drivers, challenges, and key players. It covers historical data, current market estimates, and future forecasts, enabling informed decision-making for businesses operating within this dynamic sector. The report delves into regional and segmental performance, offering a granular understanding of market dynamics. The inclusion of key player profiles and significant market developments provides a holistic perspective on the industry's evolution and future trajectory.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of XX% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Caleres Inc, Canali SpA, Carolina Mills Inc, Bill Blass Group LLC, Blair Corporation, Danier Leather Inc, Deb Shops Inc, Deckers Outdoor Corpora, ECCO Sko A/S, Eddie Bauer LLC, Elder-Beerman Stores Corp (Th, K-Swiss Inc, Kuraray Co Ltd, L Brands Inc, Lululemon Athletica Inc, LVMH Moet Hennessy Louis Vuitton SE, Macy’S Inc, Nitto Boseki Co Ltd, Nordstrom Inc, Columbia, OMNOVA Solutions Inc, 3M Company, Abercrombie & Fitch Co, Academy Sports & Outdoors Ltd, Adidas AG, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Brand Apparel and Accessories Retail," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Brand Apparel and Accessories Retail, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.