1. What is the projected Compound Annual Growth Rate (CAGR) of the Blood Group Typing?

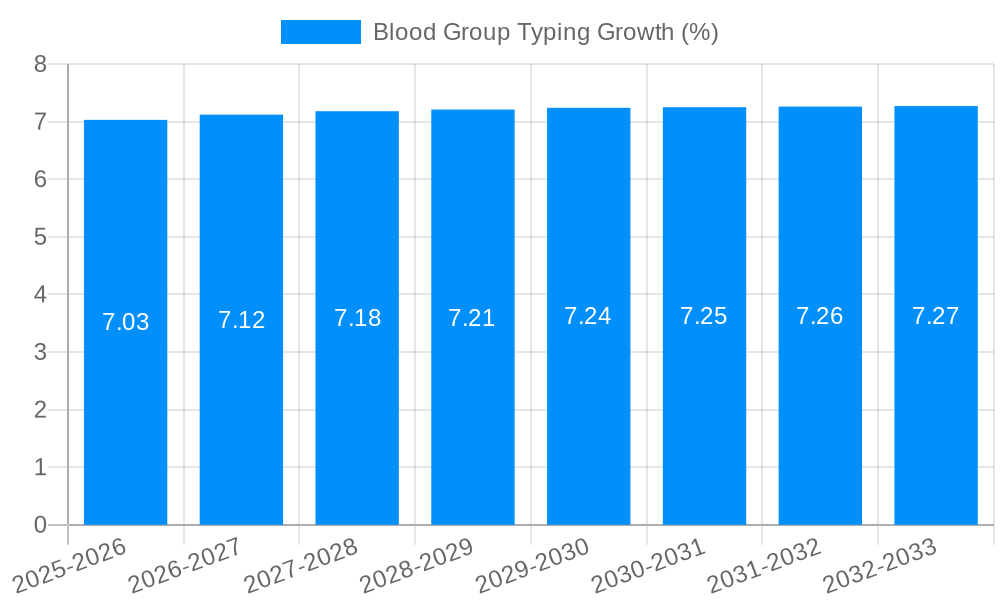

The projected CAGR is approximately 7.6%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Blood Group Typing

Blood Group TypingBlood Group Typing by Type (PCR-Based and Microarray Techniques, Massively Parallel Sequencing Techniques, Assay-Based Techniques, Others), by Application (Hospitals, Blood Banks, Clinical Laboratories, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

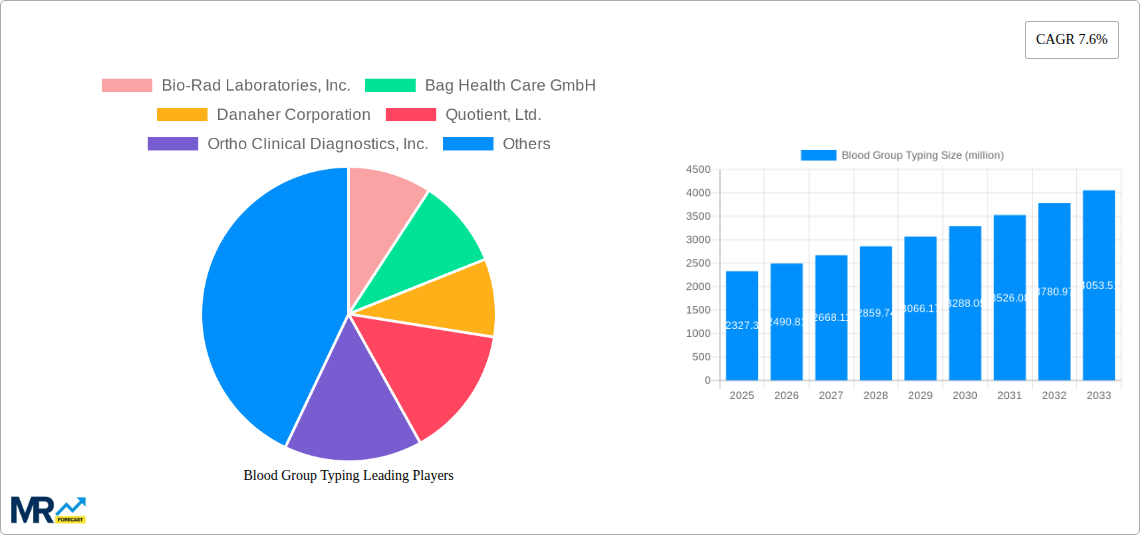

The global Blood Group Typing market is experiencing robust growth, projected to reach $2327.3 million by 2025 with a compound annual growth rate (CAGR) of 7.6% through 2033. This expansion is primarily driven by the increasing demand for accurate and efficient blood compatibility testing, crucial for safe blood transfusions, organ transplantation, and prenatal testing. The rising incidence of chronic diseases, blood disorders, and the growing emphasis on personalized medicine are further fueling market expansion. Technological advancements, particularly in PCR-based and massively parallel sequencing techniques, are enabling more precise and rapid blood group determination, thereby enhancing diagnostic capabilities. The market is also benefiting from increased awareness about the importance of blood group typing in various medical procedures and its role in reducing transfusion-related complications. Furthermore, the expanding healthcare infrastructure and increased government initiatives promoting blood donation and testing in emerging economies are contributing to market buoyancy.

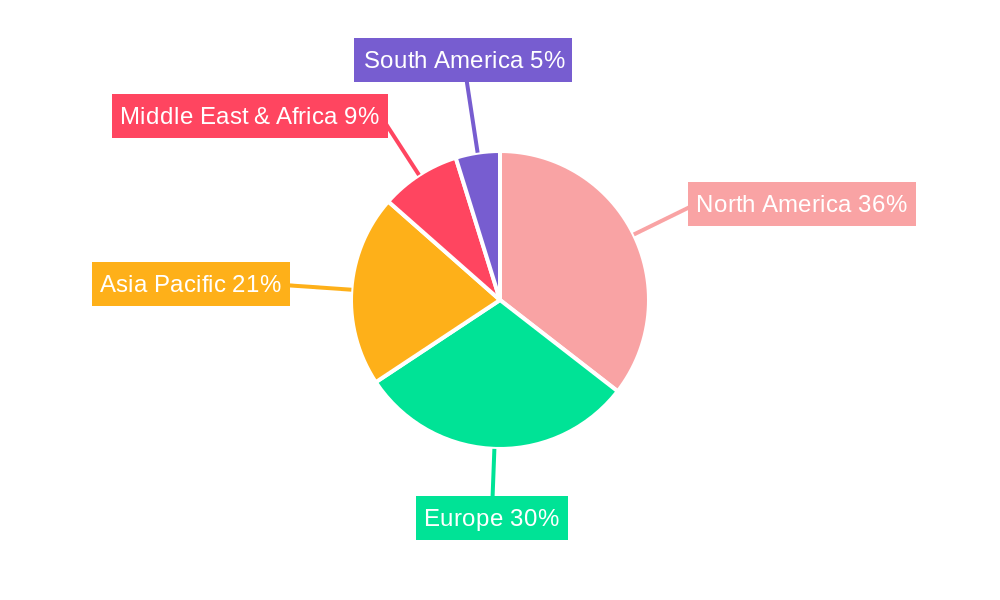

The market segmentation reveals a diverse landscape with PCR-Based and Microarray Techniques, along with Massively Parallel Sequencing Techniques, expected to lead in adoption due to their superior accuracy and throughput. Assay-Based Techniques also hold significant importance, catering to routine testing needs. The application segment is dominated by hospitals and clinical laboratories, where the majority of blood group typing procedures are performed. Blood banks also represent a substantial segment, emphasizing the critical role of accurate typing in ensuring the safety of the blood supply. Geographically, North America and Europe are leading markets, owing to well-established healthcare systems, high adoption rates of advanced technologies, and significant investment in R&D. However, the Asia Pacific region is anticipated to witness the fastest growth, driven by a large patient pool, expanding healthcare expenditure, and increasing investments in diagnostic infrastructure. Key market players are actively engaged in strategic collaborations, product innovations, and geographical expansions to capitalize on these burgeoning opportunities.

This comprehensive report delves into the dynamic landscape of the Blood Group Typing market, meticulously analyzing trends, drivers, challenges, and opportunities from 2019 to 2033. With a robust base year of 2025, the report provides granular insights into the market's trajectory, offering a detailed forecast for the period 2025-2033 based on historical performance between 2019 and 2024. The global Blood Group Typing market, estimated to be worth USD 2,100 million in the base year of 2025, is projected to witness substantial growth, driven by advancements in diagnostic technologies and an increasing demand for accurate blood compatibility testing. The report will also explore various segments including Type, covering PCR-Based and Microarray Techniques, Massively Parallel Sequencing Techniques, Assay-Based Techniques, and Others; Application, encompassing Hospitals, Blood Banks, Clinical Laboratories, and Others; and significant Industry Developments.

XXX The global Blood Group Typing market is experiencing a significant paradigm shift, moving beyond traditional serological methods towards more advanced and accurate molecular techniques. This evolution is fueled by a growing understanding of the complexities of blood group antigens, including the discovery of numerous minor blood group systems crucial for patient safety in transfusions and organ transplantation. The market is projected to reach an impressive USD 3,500 million by 2033, demonstrating a Compound Annual Growth Rate (CAGR) of approximately 4.5% during the forecast period. A key trend is the increasing adoption of high-throughput molecular methods such as Massively Parallel Sequencing (MPS) and PCR-based techniques. These technologies offer unparalleled precision, enabling the identification of a wider spectrum of blood group alleles and genotypes, thereby minimizing the risk of transfusion reactions and alloimmunization. The enhanced sensitivity of these methods is particularly critical in managing patients with complex transfusion histories or those requiring specialized blood products. Furthermore, the integration of artificial intelligence (AI) and machine learning (ML) in interpreting complex genetic data is emerging as a transformative trend, promising to further streamline and enhance the accuracy of blood group typing. The report will highlight how these technological advancements are reshaping diagnostic workflows and improving patient outcomes globally. The shift towards personalized medicine and the growing emphasis on genetic screening for inherited blood disorders are also contributing to the sustained growth trajectory observed in the Blood Group Typing market. The expanding awareness regarding the implications of blood group disparities in various medical procedures, including obstetric care and transplantation, is further solidifying the market's upward momentum. The increasing prevalence of autoimmune diseases and the need for accurate blood matching in these cases also play a crucial role in driving market demand.

The Blood Group Typing market is experiencing robust growth, propelled by a confluence of critical factors. Foremost among these is the escalating global demand for safe blood transfusions and organ transplants. Accurate blood group typing is paramount to preventing transfusion-related acute lung injury (TRALI) and hemolytic disease of the newborn (HDN), thereby directly contributing to enhanced patient safety and reducing healthcare costs associated with adverse reactions. The increasing incidence of chronic diseases like sickle cell anemia and thalassemia, which necessitate frequent blood transfusions, further amplifies the need for precise and comprehensive blood group profiling. Moreover, significant advancements in molecular diagnostic technologies are a major catalyst. Techniques such as PCR-based methods and Massively Parallel Sequencing (MPS) offer superior sensitivity, specificity, and throughput compared to conventional serological methods. These technologies can identify a broader range of blood group antigens and antibodies, including those from minor blood group systems, which are often missed by older techniques. The growing recognition of the importance of these minor blood groups in specific patient populations, such as those with rare blood types or those who have developed antibodies, is driving the adoption of these sophisticated methodologies. This technological evolution allows for more personalized and effective transfusion strategies, ultimately improving patient outcomes and reducing the incidence of alloimmunization.

Despite the promising growth trajectory, the Blood Group Typing market encounters several significant challenges and restraints that warrant careful consideration. A primary hurdle is the high cost associated with advanced molecular diagnostic technologies. While techniques like Massively Parallel Sequencing (MPS) offer unparalleled precision, their initial investment and ongoing operational expenses can be prohibitive, especially for smaller laboratories or healthcare facilities in resource-limited settings. This cost factor can hinder widespread adoption and create a disparity in access to advanced blood typing services. Furthermore, the lack of skilled personnel and specialized training required to operate and interpret the results from complex molecular assays poses another significant challenge. Proficiency in molecular biology techniques and bioinformatics is essential for accurate diagnosis, and a global shortage of adequately trained professionals can impede market expansion. Regulatory hurdles and the need for stringent validation of new technologies also contribute to market restraints. The introduction of novel blood typing platforms requires rigorous testing and approval processes to ensure their safety, efficacy, and reliability, which can be time-consuming and resource-intensive for manufacturers. Moreover, reimbursement policies for advanced blood typing procedures can be complex and vary significantly across different regions, impacting the economic viability of these tests for healthcare providers. Lastly, resistance to change and the inertia of established practices within some healthcare institutions, which are accustomed to traditional serological methods, can slow down the adoption of newer, more advanced techniques.

The Blood Group Typing market is characterized by a dynamic interplay of regional strengths and segment dominance, with several key players and areas poised to lead in the coming years.

Dominant Regions & Countries:

North America (particularly the United States): This region is expected to maintain its leading position, driven by several factors:

Europe: Another significant market, Europe's dominance is attributed to:

Dominant Segments:

Type: Massively Parallel Sequencing Techniques: This segment is anticipated to witness the most substantial growth and dominance in the long term.

Application: Hospitals: Hospitals represent the largest end-user segment and are expected to continue their dominance.

The Blood Group Typing industry is experiencing remarkable growth fueled by several key catalysts. The increasing global demand for safer blood transfusions and organ transplants is paramount, as accurate typing significantly reduces the risk of adverse reactions. Advancements in molecular diagnostic technologies, such as PCR-based methods and Massively Parallel Sequencing (MPS), offer enhanced accuracy and the ability to detect a wider array of blood group antigens, driving their adoption. Furthermore, the growing prevalence of chronic diseases requiring regular transfusions and the expanding awareness of the importance of minor blood group compatibility are significant drivers. The rise of personalized medicine initiatives and the focus on genetic screening for inherited blood disorders also contribute to market expansion, pushing the estimated market value to USD 2,800 million by 2030.

This report provides an exhaustive analysis of the Blood Group Typing market, offering critical insights for stakeholders. It meticulously examines market trends, from the shift towards molecular diagnostics to the increasing recognition of minor blood group systems. The report details the driving forces, including the growing demand for transfusion safety and technological advancements, and addresses the challenges such as high costs and regulatory hurdles. Key regions and dominant segments, like North America and Massively Parallel Sequencing techniques, are thoroughly explored, along with their projected market share, estimated to be over 30% for Massively Parallel Sequencing by 2033. Growth catalysts, leading players, and significant industry developments from 2019 to the projected advancements in 2026 are also comprehensively covered, providing a 360-degree view of this evolving market, projected to exceed USD 3,200 million by the end of the forecast period.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.6% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 7.6%.

Key companies in the market include Bio-Rad Laboratories, Inc., Bag Health Care GmbH, Danaher Corporation, Quotient, Ltd., Ortho Clinical Diagnostics, Inc., Grifols, S.A., Immucor, Inc., Agena Bioscience, Inc., Merck Millipore, .

The market segments include Type, Application.

The market size is estimated to be USD 2327.3 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Blood Group Typing," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Blood Group Typing, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.