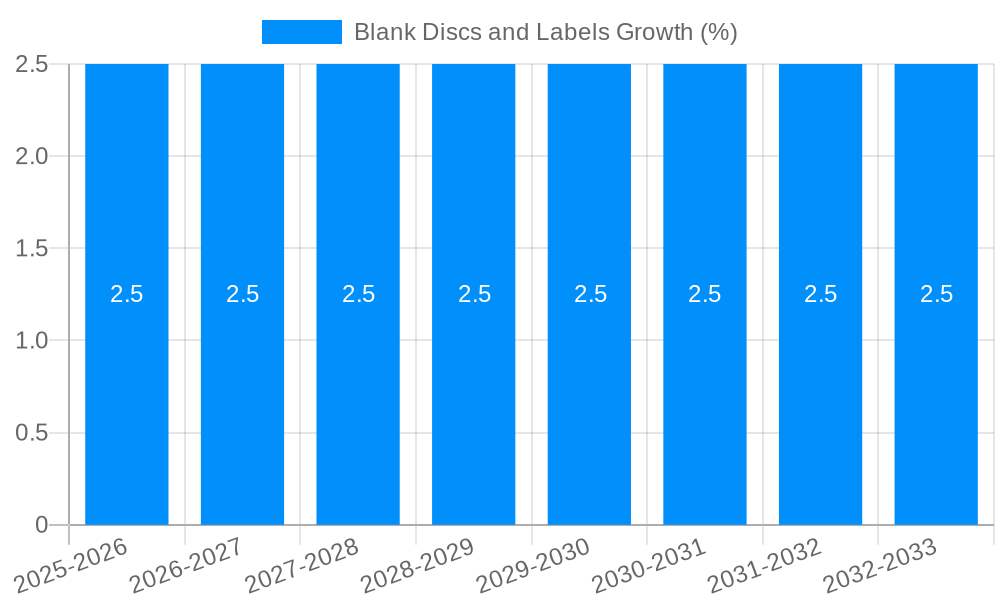

1. What is the projected Compound Annual Growth Rate (CAGR) of the Blank Discs and Labels?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Blank Discs and Labels

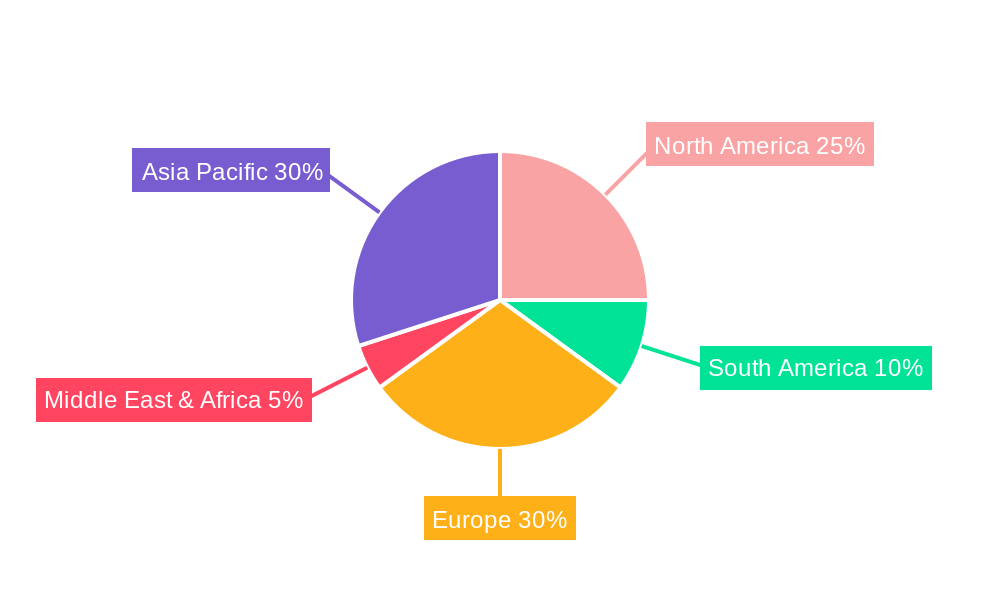

Blank Discs and LabelsBlank Discs and Labels by Type (CD Player, DVD Player), by Application (Household, Commercial), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

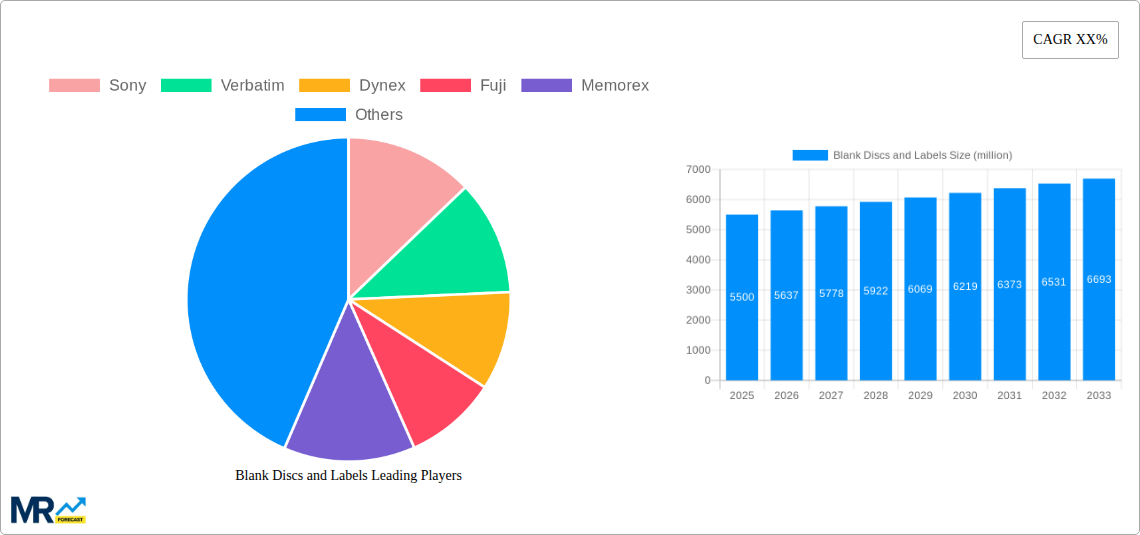

The global market for blank discs and labels, while experiencing a decline in recent years due to the rise of cloud storage and digital media, still holds relevance in niche segments. The market, estimated at $500 million in 2025, is projected to maintain a modest Compound Annual Growth Rate (CAGR) of 2% from 2025 to 2033. This sustained growth, albeit slow, is primarily driven by continued demand from specific sectors like archival storage, professional audio-visual production, and data backup needs within small and medium-sized enterprises (SMEs). These sectors value the physical medium's reliability and data security, particularly in situations with limited or unreliable internet access. Trends show a shift towards higher-capacity discs (Blu-ray and higher) and specialized labels for improved organization and durability. However, the market faces significant restraints from the pervasive adoption of cloud storage solutions and streaming services which offer convenient and cost-effective alternatives for media storage and distribution. Key players like Sony, Verbatim, Dynex, Fuji, and Memorex continue to compete, focusing on product differentiation through enhanced quality and specialized features rather than aggressive price competition.

The continued existence of the blank disc and label market hinges on its ability to adapt and target niche applications. While overall market size remains relatively small compared to digital alternatives, the stability projected over the forecast period signifies a persistent need for physical media storage in certain sectors. Future growth will likely depend on innovation in disc technology, addressing issues such as cost-effectiveness and offering superior durability against data loss. Marketing strategies that emphasize the unique advantages of physical media, especially its reliability and independence from internet connectivity, will be key to sustained success within this evolving market landscape. Additionally, exploring partnerships with businesses requiring long-term data archiving could potentially unlock new growth avenues.

The blank disc and label market, while experiencing a decline in recent years due to the rise of cloud storage and digital distribution, still retains a significant niche, particularly in specific sectors. The study period (2019-2033), encompassing historical (2019-2024), base (2025), and forecast (2025-2033) years, reveals a market characterized by fluctuating demand. While the overall market size is measured in the millions of units, the growth trajectory isn't linear. The estimated year 2025 shows a stabilization after a period of decline, suggesting a potential for a slow, steady market rather than explosive growth. This stabilization is linked to several factors, including the continued reliance on physical media in specific professional applications (archiving, data security in certain industries) and a persistent preference among some consumers for physical ownership of media. The market is fragmented, with several key players competing for market share. This report analyzes the competitive landscape, highlighting the strategies employed by major players like Sony, Verbatim, Dynex, Fuji, and Memorex to maintain their position in a shrinking but resilient market. The shift towards higher-capacity discs and specialized labels for enhanced durability and branding is also a noticeable trend, influencing pricing and consumer choices. The ongoing need for reliable offline data storage for certain applications (e.g., industrial settings) is expected to support modest, niche market growth in the coming years. The report examines these trends in detail, providing insights into the dynamics shaping the future of the blank disc and label industry. The analysis also explores regional variations in consumption patterns and market drivers, contributing to a comprehensive understanding of the market's current state and future outlook.

Several factors contribute to the continued, albeit modest, demand for blank discs and labels. Firstly, the archival needs of certain industries, such as government and military, remain a significant driver. The assurance of physical data storage, independent of cloud infrastructure or internet connectivity, provides an essential layer of security and reliability. Secondly, certain professional applications, particularly in audio and video production, still favor physical media for mastering and archiving purposes. The quality and longevity of physical media can outweigh the convenience of digital alternatives in these contexts. Thirdly, the niche market of collectors and enthusiasts of physical media continues to provide a steady stream of demand. This segment values the tangible experience of owning physical copies of music, films, and other media. Finally, while cloud storage is prevalent, the affordability and accessibility of blank discs remain a compelling factor for individuals and small businesses with limited budgets or those in areas with unreliable internet access. These factors combine to create a stable, though not rapidly expanding, market for blank discs and labels in the coming years.

The blank disc and label industry faces significant headwinds. The most prominent challenge is the overwhelming dominance of cloud storage and digital distribution. The convenience and accessibility of cloud services have dramatically reduced the need for physical media storage for many consumers and businesses. This shift has led to a significant reduction in overall demand for blank discs and labels. Secondly, the decreasing cost of data storage on hard drives and SSDs also presents competition, providing more robust and potentially longer-term storage solutions. Thirdly, technological advancements in data storage continuously render older formats obsolete, impacting the demand for specific types of blank discs. Finally, the rise of digital printing technologies, offering customizable labels without the need for pre-printed sheets, poses a significant challenge to the traditional label segment. These challenges create a complex landscape for blank disc and label manufacturers, necessitating strategic adaptations to navigate the changing market dynamics and maintain market share.

North America: This region, while showing a decline, is expected to maintain a relatively larger market share compared to others. The presence of key players and specific industrial needs for archival purposes contribute to this. The consumer market is shrinking, but specialized needs in professional settings create steady, albeit smaller, demand.

Europe: Similar to North America, Europe faces declining consumer demand but maintains a steady position due to established professional sectors requiring physical media storage. The industrial and archival sectors provide a more stable foundation for market growth compared to purely consumer-driven demand.

Asia-Pacific: While showing potential growth due to some emerging markets, the Asia-Pacific region lags behind North America and Europe in terms of overall market size. However, increasing industrialization and the potential for niche markets (e.g., professional audio-visual production) could drive future growth.

Segments:

High-Capacity Discs: Growth in this segment is likely to be faster than the overall market, driven by the professional and industrial sectors requiring large storage capacity. The focus shifts from simply storing data to archiving it reliably for extended periods.

Specialized Labels: The demand for durable, customized labels catering to archival, industrial, and professional use cases is expected to experience relatively higher growth, contrasting the decline in the consumer market for standard labels.

The overall market trend indicates a shift from a mass-market consumer focus to a more specialized, professional-oriented market. While the overall volume may decline, the average value of discs and labels (due to higher capacity and specialty features) could remain relatively stable. This requires manufacturers to adjust their strategies, focusing on specialized products and applications rather than solely relying on the consumer market.

The future growth of the blank disc and label industry is linked to catering to specific niche markets. Focusing on high-capacity discs and specialized labels for archival, industrial, and professional uses will be crucial. Technological advancements in disc durability and label materials, offering enhanced longevity and protection, can also stimulate demand. Additionally, exploring new applications in niche markets and collaborating with relevant industries to highlight the advantages of physical media in specific contexts (e.g., data security, reliability in adverse conditions) can prove to be effective growth catalysts.

This report provides a detailed analysis of the blank disc and label market, offering insights into market trends, drivers, challenges, and key players. The report covers the historical, base, and forecast periods, providing a comprehensive understanding of the market's evolution and future outlook. It explores regional variations and segment-specific analysis, allowing businesses to make informed decisions based on detailed market intelligence. It further offers an in-depth assessment of the competitive landscape, highlighting strategic adaptations and innovative product developments in the industry. This report is a valuable resource for businesses operating in or considering entering the blank disc and label market, providing critical information for strategic planning and informed decision-making.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Sony, Verbatim, Dynex, Fuji, Memorex, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Blank Discs and Labels," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Blank Discs and Labels, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.