1. What is the projected Compound Annual Growth Rate (CAGR) of the Bitcoin and Cryptocurrency ATMs?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Bitcoin and Cryptocurrency ATMs

Bitcoin and Cryptocurrency ATMsBitcoin and Cryptocurrency ATMs by Type (1-way Model, 2-way Model, World Bitcoin and Cryptocurrency ATMs Production ), by Application (Shopping Mall, Gas Station, Others, World Bitcoin and Cryptocurrency ATMs Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

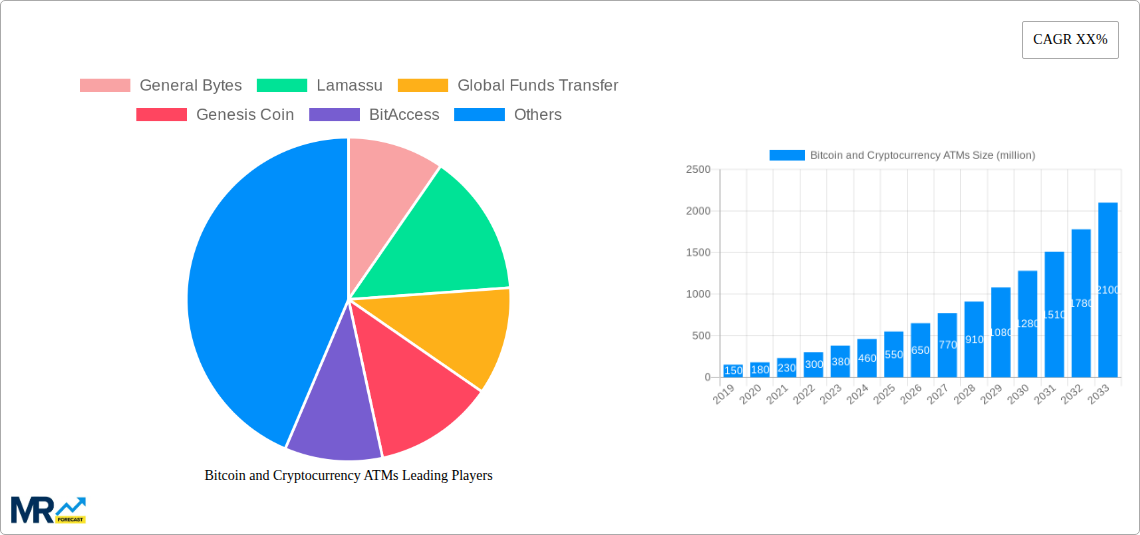

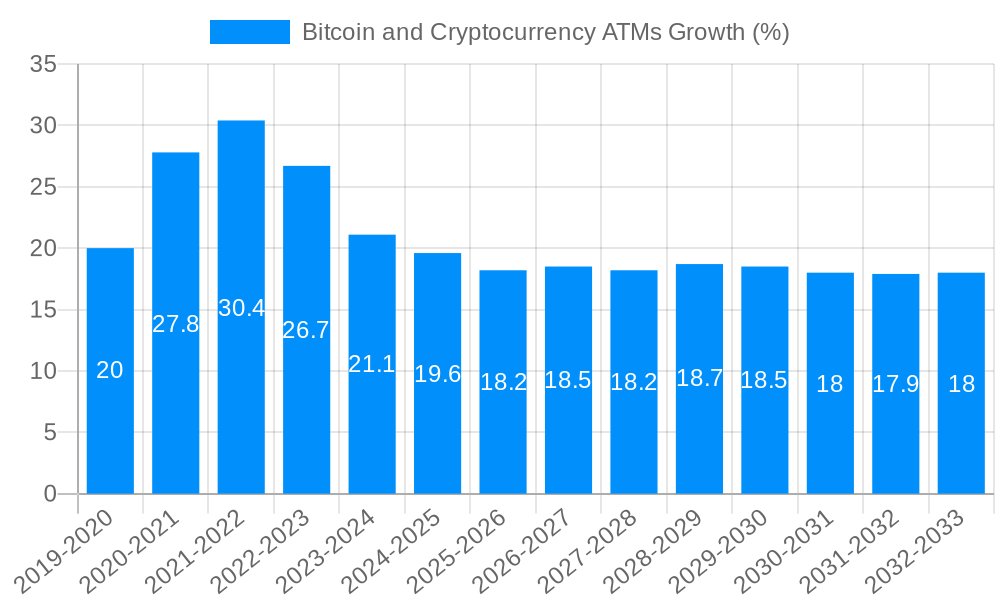

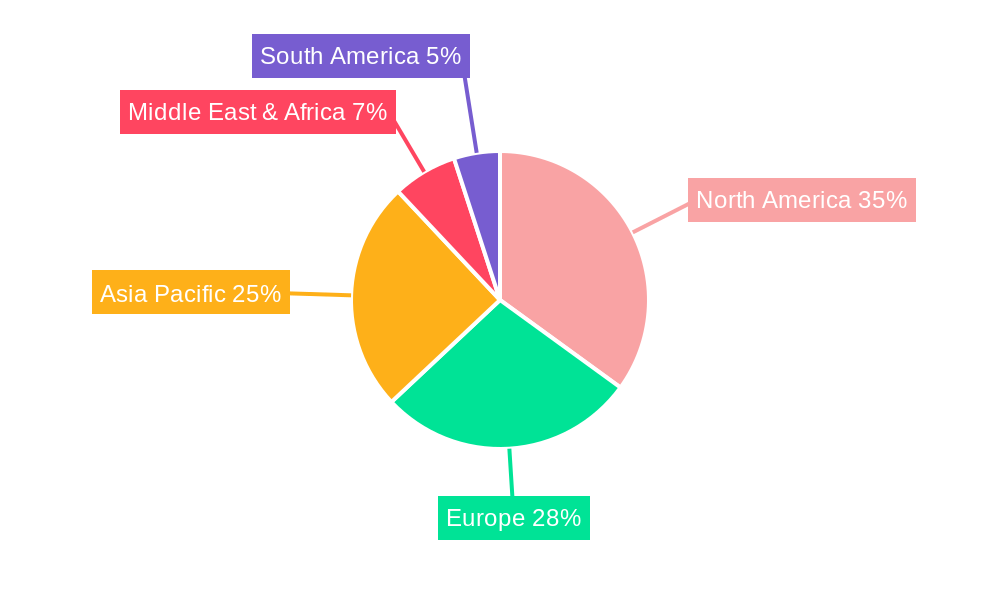

The global Bitcoin and Cryptocurrency ATM (BTM) market is experiencing robust growth, driven by increasing cryptocurrency adoption, the need for convenient fiat-to-cryptocurrency exchange, and the expansion of BTM networks into diverse geographical locations. While precise market size figures for past years are unavailable, analyzing current trends and considering a plausible CAGR (let's assume a conservative 25% based on industry reports showing high growth rates for this sector) applied to an estimated 2025 market value of $500 million, we can project substantial expansion. This projected growth is fueled by several key factors: the growing popularity of cryptocurrencies among retail investors, the increasing number of merchants accepting crypto payments (requiring convenient access points for transactions), and the continuous technological advancements making BTMs more user-friendly and secure. The market is segmented by type (one-way and two-way models), application (shopping malls, gas stations, etc.), and geographical regions, with North America and Europe currently holding the largest market share. However, regions like Asia-Pacific are demonstrating significant potential for future growth, driven by rapid technological adoption and expanding crypto ecosystems.

Challenges for the market include regulatory hurdles in various jurisdictions, security concerns surrounding BTMs, and the inherent volatility of cryptocurrency prices, which may impact both customer demand and investment in BTM infrastructure. However, these challenges are counterbalanced by innovation in BTM technology, including improved security features and user interfaces. The growing number of BTM manufacturers and operators also indicates healthy competition and continued market penetration. The forecast period (2025-2033) suggests a continuing upward trajectory for the BTM market, with new features like lightning network integration and broader cryptocurrency support expected to further boost adoption and drive future growth. The diverse range of companies involved, including General Bytes, Lamassu, and others, contributes to market dynamism and innovation, contributing to sustained market expansion.

The global Bitcoin and cryptocurrency ATM (BTM) market experienced significant growth throughout the historical period (2019-2024), driven by increasing cryptocurrency adoption and the desire for convenient access to digital assets. The estimated number of BTMs in 2025 surpasses millions, reflecting the industry's considerable expansion. This growth is projected to continue throughout the forecast period (2025-2033), although at a potentially moderating pace compared to the earlier, more explosive growth years. Key market insights indicate a shift towards two-way models, offering users both buying and selling capabilities, as opposed to the earlier predominance of one-way models. Geographical distribution is also evolving, with initially concentrated deployments in North America and Europe gradually diversifying into emerging markets in Asia, Africa, and South America. The average transaction value has shown modest growth, suggesting increased adoption by users making larger investments or trades. The market is also witnessing innovation in BTM design and functionality, including enhanced security features, improved user interfaces, and integration with mobile applications for streamlined transactions. This increasing sophistication aims to address earlier concerns around user experience and security, ultimately fostering broader mainstream adoption. The competition among BTM manufacturers is intensifying, leading to price reductions and the emergence of new models catering to specific market niches. This competitive landscape is beneficial to consumers, driving innovation and pushing down the cost of access to cryptocurrency. The overall trajectory points towards a continued, albeit perhaps less rapidly expanding, BTM market characterized by increased sophistication, geographic diversification, and stronger user adoption.

Several factors contribute to the expanding Bitcoin and cryptocurrency ATM market. Firstly, the rising popularity and acceptance of cryptocurrencies globally fuel demand for convenient access points. Users seeking to buy or sell cryptocurrencies often prefer the anonymity and immediate nature of BTM transactions compared to online exchanges, which require KYC (Know Your Customer) procedures and may involve delays. The increasing ease of use of BTMs, driven by advancements in user interface design and functionality, has significantly lowered the barrier to entry for novice users. Simultaneously, the growing number of cryptocurrency options beyond Bitcoin increases the versatility and potential applications of BTMs, accommodating a wider user base. Furthermore, strategic partnerships between BTM manufacturers and businesses (such as shopping malls, gas stations, and convenience stores) are extending the reach and accessibility of these machines to a more widespread audience. Finally, regulatory clarity (or at least a lack of outright prohibition) in certain jurisdictions contributes to a more conducive environment for BTM deployment and operation. The convergence of these factors underscores the powerful driving forces behind the burgeoning BTM sector.

Despite the rapid growth, the Bitcoin and cryptocurrency ATM market faces several challenges. Regulatory uncertainty remains a significant obstacle, with varying levels of legal acceptance and regulation across different jurisdictions. This inconsistency hinders widespread deployment and can increase operational costs for BTM operators. Security concerns, including the risk of theft, hacking, and fraud, remain a major concern and require robust security measures to mitigate. The volatility of cryptocurrency prices can impact both the profitability of BTM operations and the willingness of users to engage in transactions. High initial investment costs associated with purchasing and installing BTMs, coupled with ongoing maintenance and transaction fees, can act as a barrier to entry for smaller operators. Furthermore, the lack of widespread public understanding and awareness of cryptocurrencies can hinder adoption, although educational initiatives are gradually addressing this limitation. Addressing these challenges through improved security, regulatory clarity, and public education will be crucial for sustained growth in the BTM market.

The North American market, particularly the United States, currently holds a dominant position in terms of BTM deployment, driven by high cryptocurrency adoption rates and a relatively favorable regulatory environment. However, significant growth is anticipated in regions like Europe and Asia, reflecting the increasing global acceptance of cryptocurrencies.

Dominant Segment: Two-way models are gaining traction and are expected to dominate the market in the coming years. This reflects users' increasing interest in both purchasing and selling cryptocurrencies through a single, convenient interface.

Geographic Distribution: While North America remains a key market, the fastest growth is projected to occur in emerging markets in Asia and parts of Europe as cryptocurrency adoption gains momentum and regulatory environments become more receptive.

Paragraph Elaboration: The North American market's dominance stems from early adoption of cryptocurrencies and robust financial infrastructure. The prevalence of Bitcoin ATMs in locations like shopping malls, gas stations, and other public places illustrates this early adoption. However, the burgeoning markets in Europe and Asia offer massive untapped potential. Growing middle classes in these regions, combined with increasing smartphone penetration and financial inclusion, are paving the way for cryptocurrency adoption. While regulatory hurdles may exist in some parts of these regions, the overall trend indicates significant expansion of Bitcoin ATMs in the coming years. The transition towards two-way models is driven by user demand for a more comprehensive service offering. A two-way BTM provides greater flexibility and eliminates the need to utilize separate platforms for buying and selling, increasing user convenience and potentially enhancing transaction volume. This segment’s dominance is further fueled by manufacturers adapting their offerings to meet the evolving needs of the marketplace.

Several factors are poised to propel the Bitcoin and cryptocurrency ATM industry's growth. Increased regulatory clarity in key markets will reduce uncertainties and encourage wider deployment. Technological advancements, including improved security measures and user-friendly interfaces, will enhance accessibility and attract a larger user base. Expanding partnerships with businesses to place ATMs in high-traffic locations will broaden reach. Finally, ongoing education and increased public awareness surrounding cryptocurrencies will further drive adoption and market expansion.

This report provides a comprehensive analysis of the Bitcoin and cryptocurrency ATM market, covering historical trends, current market dynamics, and future projections. It offers deep insights into market segmentation, key players, growth drivers, and challenges. This detailed analysis will help businesses, investors, and policymakers understand the evolving landscape and make informed decisions about this rapidly expanding sector. The report further highlights the significant impact of technological advancements, regulatory changes, and public perception on market growth.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include General Bytes, Lamassu, Global Funds Transfer, Genesis Coin, BitAccess, Coinsource, DBA COAVULT, Orderbob, Coinme, LightningXchange, ByteFederal, BTC facil.

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Bitcoin and Cryptocurrency ATMs," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Bitcoin and Cryptocurrency ATMs, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.