1. What is the projected Compound Annual Growth Rate (CAGR) of the Biometrics Banking?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Biometrics Banking

Biometrics BankingBiometrics Banking by Type (Hardware, Software), by Application (Finger print, Facial recognition, Hand geometry, Iris recognition, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

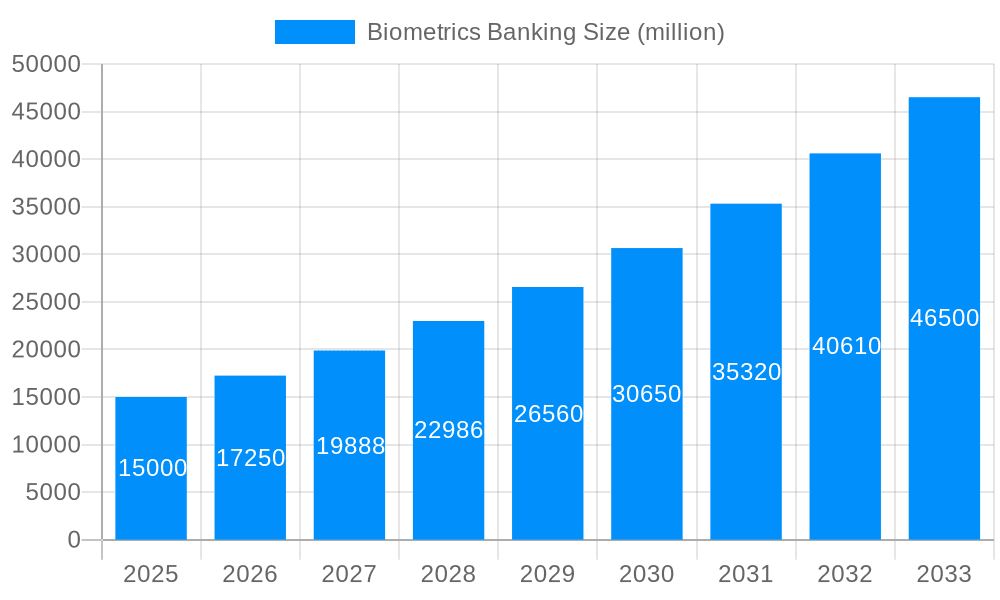

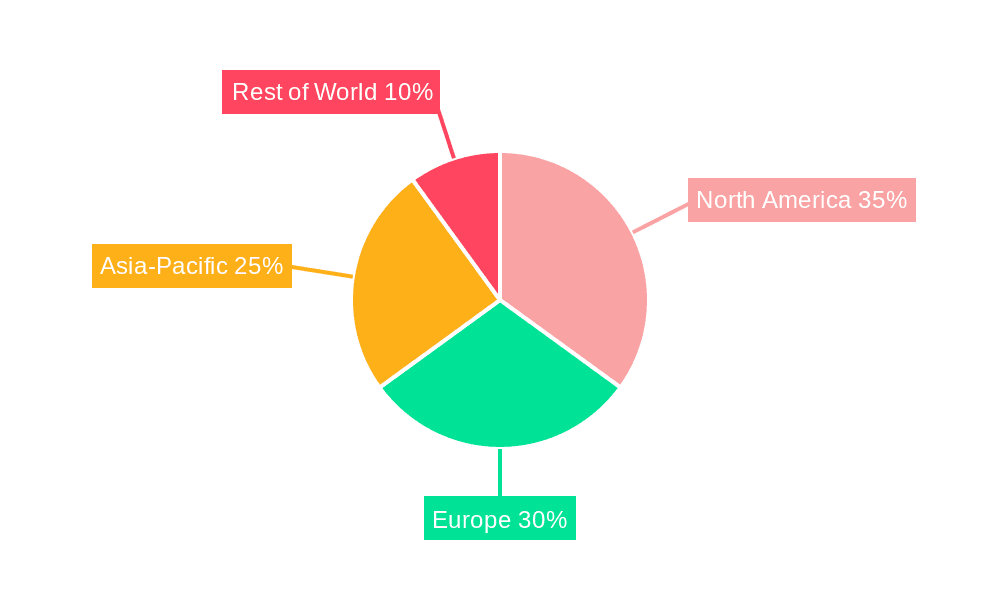

The global biometrics banking market is experiencing robust growth, driven by increasing concerns over security breaches and the rising adoption of digital banking channels. The market's expansion is fueled by the need for enhanced authentication and fraud prevention measures within the financial sector. Several biometric technologies, including fingerprint, facial recognition, and iris scanning, are gaining traction, offering convenient and secure user experiences. The increasing sophistication of these technologies, coupled with declining costs, is further accelerating market penetration. While regulatory hurdles and privacy concerns present challenges, the overall market outlook remains positive, with a projected Compound Annual Growth Rate (CAGR) exceeding 15% (a reasonable estimate based on industry trends in similar tech sectors) over the next decade. This robust growth is expected across various geographical regions, with North America and Europe maintaining leading positions due to advanced technological infrastructure and stringent security regulations. However, the Asia-Pacific region is anticipated to exhibit significant growth potential, driven by rapid digitalization and expanding internet penetration, particularly in countries like India and China. The market segmentation by hardware, software, and application type reflects the diverse technological landscape, with the software segment potentially experiencing higher growth due to the increasing need for advanced biometric authentication platforms and analytical tools. Key players in this market include established technology companies, financial institutions, and specialized biometric solution providers, all competing to offer innovative and secure solutions to the banking industry.

The competitive landscape is dynamic, with established players focusing on expanding their product portfolios and geographical reach, while emerging companies are innovating with new technologies and cost-effective solutions. Strategic partnerships and mergers & acquisitions are expected to shape the market dynamics. Future growth will be driven by advancements in artificial intelligence (AI) and machine learning (ML), enabling more accurate and reliable biometric authentication systems. Furthermore, the increasing adoption of mobile banking and contactless payments will fuel the demand for seamless and secure biometric authentication solutions. Addressing consumer privacy concerns through robust data protection measures and transparent data handling practices will be crucial for sustained market expansion and building consumer trust. The long-term outlook for the biometrics banking market is exceptionally promising, presenting significant opportunities for businesses capable of providing innovative, secure, and user-friendly biometric solutions.

The global biometrics banking market is experiencing explosive growth, projected to reach \$XXX million by 2033, up from \$XXX million in 2025. This surge is driven by a confluence of factors, including the increasing need for enhanced security, the rising adoption of digital banking channels, and the growing consumer preference for convenient and frictionless authentication methods. The historical period (2019-2024) witnessed significant adoption of biometric authentication in various banking applications, laying a strong foundation for the forecast period (2025-2033). Key market insights reveal a strong preference for fingerprint and facial recognition technologies, particularly in developed economies. However, the market is rapidly diversifying, with hand geometry, iris recognition, and other emerging biometrics gaining traction, especially in developing nations where infrastructure limitations may affect other methods. The base year (2025) serves as a crucial point of analysis, highlighting the current market maturity and indicating the trajectory of future growth. The shift towards mobile and online banking is further accelerating the demand for secure and user-friendly biometric solutions. Moreover, regulatory pressure to improve fraud prevention and customer data protection is bolstering the adoption of biometric technologies within the banking sector. Competition is fierce, with established players and innovative startups vying for market share, leading to continuous product innovation and service enhancements. This dynamic environment ensures the biometrics banking market remains vibrant and poised for significant expansion throughout the forecast period. The study period (2019-2033) provides a comprehensive view of this evolution, from the initial stages of adoption to the widespread integration expected in the coming years.

Several key factors are propelling the growth of the biometrics banking market. The foremost is the increasing prevalence of cybercrime and fraud targeting financial institutions. Biometric authentication, offering a highly secure and unique identifier, provides a robust defense against unauthorized access and fraudulent transactions, reducing losses for banks and safeguarding customer assets. Simultaneously, consumers are increasingly demanding more convenient and seamless banking experiences. Biometric authentication eliminates the need for passwords and PINs, providing a faster and more user-friendly login process for online and mobile banking. This enhances customer satisfaction and promotes wider adoption of digital banking platforms. Government regulations and initiatives worldwide are also actively encouraging the adoption of strong authentication methods, including biometrics. These regulatory frameworks aim to enhance security standards and protect consumers from financial risks. Furthermore, the decreasing cost of biometric technologies, particularly fingerprint and facial recognition sensors, is making these solutions more accessible to financial institutions of all sizes. The continuous improvement in accuracy and reliability of biometric systems further boosts their appeal, solidifying their position as a key security and usability feature for modern banking.

Despite the significant growth potential, the biometrics banking market faces several challenges and restraints. One major concern is data privacy and security. The collection and storage of sensitive biometric data raise significant concerns about potential misuse, breaches, and identity theft. Regulations regarding data protection and privacy vary across different jurisdictions, adding complexity to the deployment of biometric systems. Another challenge lies in the integration of biometric technologies into existing banking infrastructure. This can be a complex and costly process, requiring substantial investment in new hardware, software, and training for staff. Interoperability between different biometric systems and platforms also poses a significant hurdle, limiting the scalability and flexibility of solutions. Furthermore, concerns regarding accuracy and reliability, particularly in challenging environments with varying lighting conditions or poor fingerprint quality, can deter adoption. Finally, the need for robust cybersecurity measures to prevent spoofing attacks, where malicious actors attempt to mimic biometric traits, adds an extra layer of complexity and cost. Addressing these challenges requires careful planning, significant investment in secure infrastructure, and strict adherence to data privacy regulations.

The fingerprint recognition segment is poised to dominate the biometrics banking market throughout the forecast period. This is largely due to its relatively low cost, widespread availability, and established maturity compared to other biometric modalities.

North America and Europe: These regions are expected to lead the market initially, driven by strong regulatory support, high technological adoption rates, and significant investments in security infrastructure. However, rapid growth is also anticipated in Asia-Pacific, particularly in countries like China and India, fueled by increasing smartphone penetration and digital banking adoption.

Software segment: While the hardware segment (fingerprint scanners, facial recognition cameras, etc.) is crucial, the software segment (authentication algorithms, data management systems, etc.) is equally vital. The software's capabilities determine accuracy, speed, and security. Sophisticated algorithms capable of handling noise and spoofing attempts are paramount.

Fingerprint Recognition Dominance: The widespread availability of affordable and reliable fingerprint sensors, coupled with their proven track record in security applications, makes fingerprint recognition the dominant modality. The ongoing advancements in fingerprint technology, improving accuracy and speed, will reinforce this trend. The ability to easily integrate fingerprint sensors into various devices, from ATMs to smartphones, adds to its appeal. However, the market is diversifying, with increasing use of facial recognition systems in areas where fingerprint acquisition might be challenging.

Regional Variations: While fingerprint recognition is dominant globally, regional variations exist. In areas with concerns about fingerprint spoofing or where hygiene standards are lower, alternative biometrics like facial recognition or iris scanning may be preferred.

The convergence of several factors is catalyzing the growth of the biometrics banking industry. Firstly, the increasing adoption of digital banking channels, coupled with the growing demand for convenient and seamless user experiences, significantly drives the demand for biometric authentication. Secondly, the rising incidence of cybercrime and fraud necessitates stronger security measures, pushing financial institutions towards biometric solutions as a robust defense mechanism. Finally, government regulations promoting strong authentication methods, along with technological advancements reducing the cost and improving the accuracy of biometric systems, further fuel market growth.

This report provides a comprehensive overview of the biometrics banking market, analyzing trends, drivers, challenges, and key players. It offers valuable insights into the market segmentation by technology type (hardware and software), application (fingerprint, facial recognition, etc.), and geographic region. The detailed forecast for the 2025-2033 period provides a strategic roadmap for industry stakeholders, enabling informed decision-making and investment strategies. The report also examines emerging technologies, competitive landscapes, and regulatory developments shaping the future of biometrics in the banking sector.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of XX% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

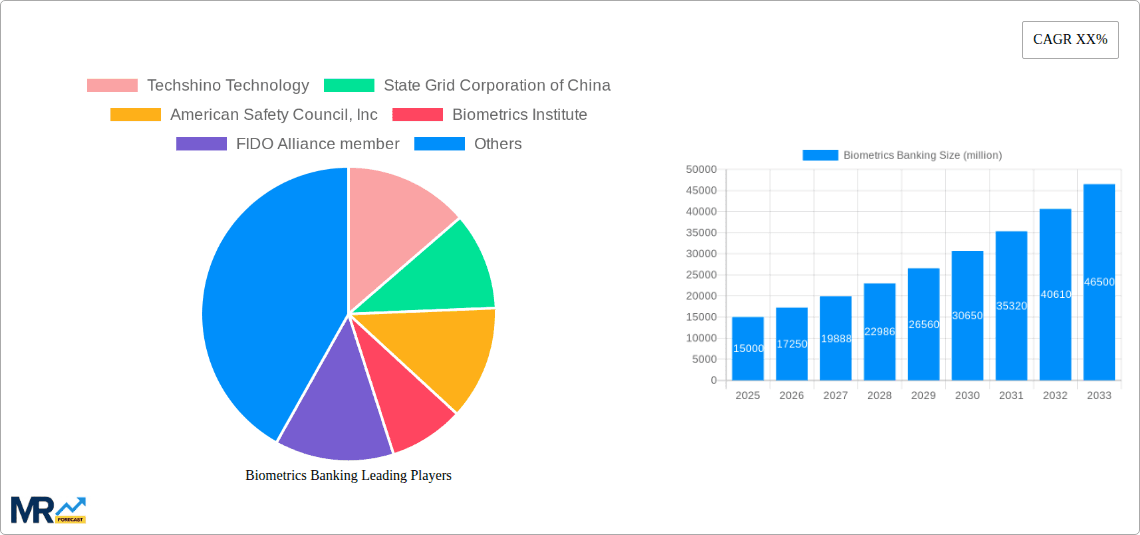

Key companies in the market include Techshino Technology, State Grid Corporation of China, American Safety Council, Inc, Biometrics Institute, FIDO Alliance member, Digital Persona, BPI Connected Identification, Ample trails, Inc, Diebold & Co, Aulich & Co, Authentik Solutions, Auraya Systems Pty Ltd, Charles Schwab And Co, Innoventry Corporation, Omaha Based First Data Co, Biolink Solutions, Axon Wireless International, Chase & Co, Baztech Inc, Visa Co, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Biometrics Banking," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Biometrics Banking, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.