1. What is the projected Compound Annual Growth Rate (CAGR) of the Biodegradable Plastics for Packaging?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Biodegradable Plastics for Packaging

Biodegradable Plastics for PackagingBiodegradable Plastics for Packaging by Application (Daily Consumer Goods, Industrial Packaging, Others, World Biodegradable Plastics for Packaging Production ), by Type (PBS, PBAT, PHA, World Biodegradable Plastics for Packaging Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

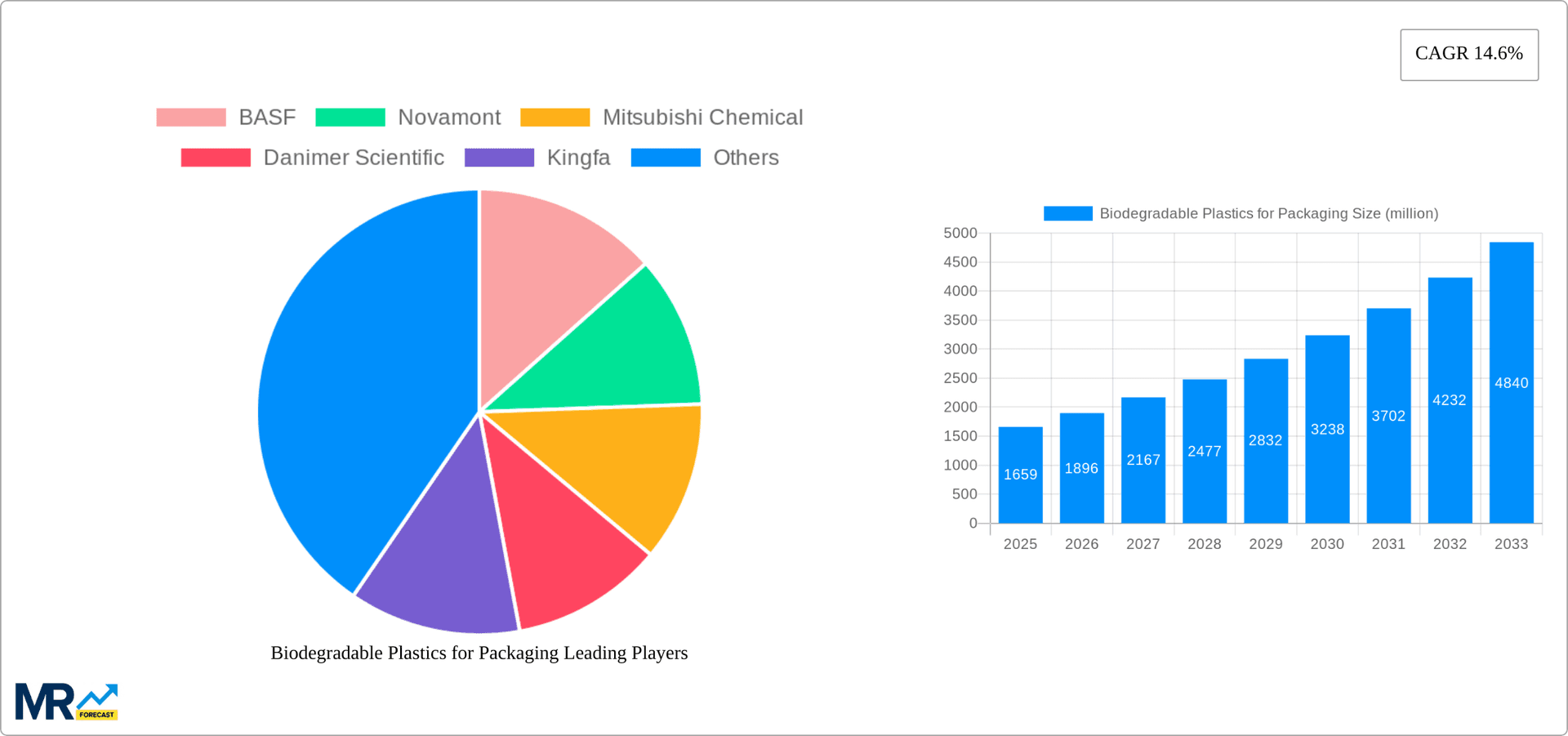

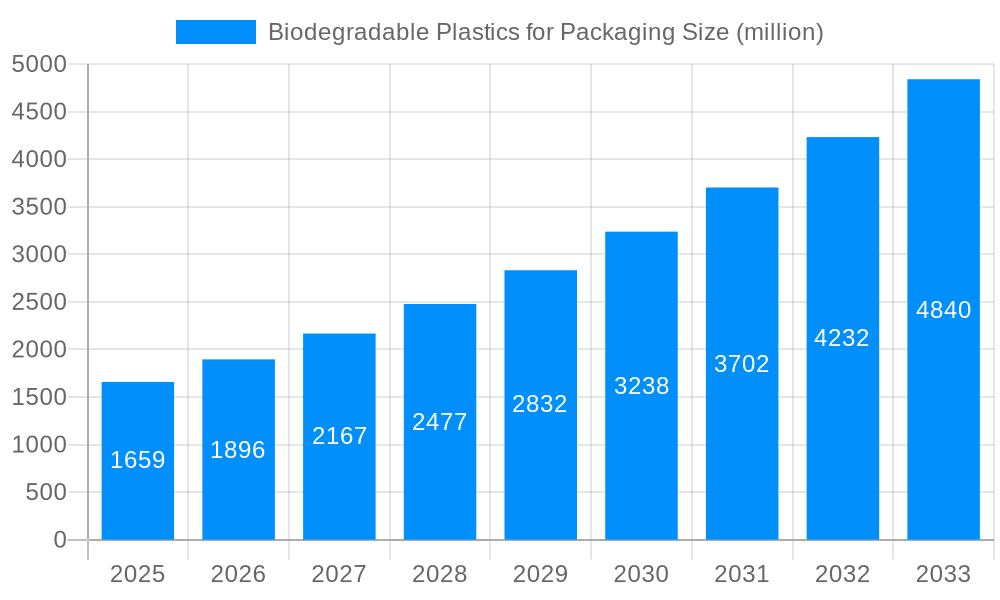

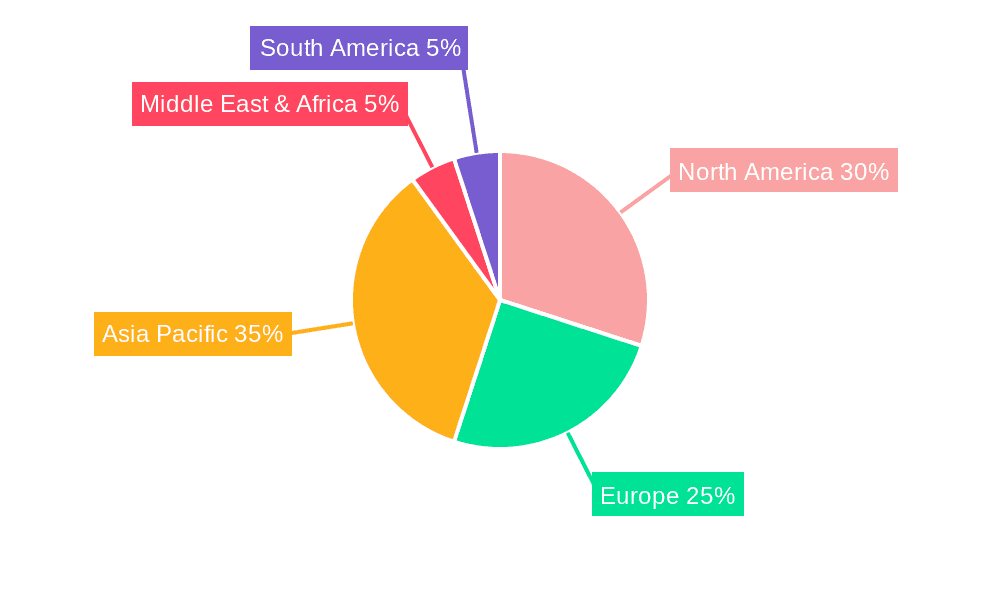

The global biodegradable plastics for packaging market is experiencing robust growth, driven by increasing environmental concerns and stringent regulations regarding plastic waste. The market, valued at approximately $1.66 billion in 2025, is projected to exhibit significant expansion over the forecast period (2025-2033). This growth is fueled by a rising consumer preference for eco-friendly packaging solutions, coupled with proactive government policies promoting sustainable alternatives to traditional plastics. Key application segments include daily consumer goods and industrial packaging, with the former experiencing higher growth due to the increasing demand for sustainable packaging in food and beverage, cosmetics, and other consumer product sectors. PBS and PBAT currently dominate the type segment, although PHA is witnessing considerable growth due to its superior biodegradability and compostability properties. Leading players like BASF, Novamont, and Mitsubishi Chemical are driving innovation in material science, developing new biodegradable polymers with enhanced performance characteristics. Geographical expansion is also a key factor, with regions like Asia Pacific and North America leading the market due to robust economic growth and increasing environmental awareness. However, challenges remain, including the higher cost of biodegradable plastics compared to conventional alternatives and inconsistencies in biodegradation rates depending on the composting infrastructure. Future growth will likely hinge on overcoming these cost barriers through technological advancements and the establishment of robust waste management systems to ensure effective biodegradation.

The competitive landscape is characterized by a mix of large multinational corporations and smaller specialized players. Strategic collaborations and mergers and acquisitions are anticipated as companies seek to enhance their product portfolios and expand their market reach. Significant investment in research and development is further expected to fuel the development of innovative biodegradable packaging materials with superior properties, addressing existing limitations such as barrier performance and durability. The market is poised for substantial growth, driven by the convergence of technological advancements, supportive regulatory frameworks, and growing consumer demand for environmentally responsible packaging solutions. The focus will be on developing materials suitable for various applications while also addressing challenges related to cost-effectiveness and efficient biodegradation.

The global biodegradable plastics for packaging market is experiencing robust growth, driven by escalating environmental concerns and stringent regulations targeting plastic pollution. The market, valued at XXX million units in 2025, is projected to reach XXX million units by 2033, exhibiting a remarkable CAGR (Compound Annual Growth Rate) during the forecast period (2025-2033). This surge is fueled by a growing consumer preference for eco-friendly alternatives and increasing corporate sustainability initiatives. Analysis of the historical period (2019-2024) reveals a consistent upward trend, indicating a sustained commitment to sustainable packaging solutions. Key market insights reveal a shift towards biodegradable polymers like PBAT and PHA, driven by their superior performance characteristics and broader applications compared to traditional plastics. The daily consumer goods sector currently dominates the application landscape, reflecting the high volume of packaging used in this segment. However, the industrial packaging sector is poised for significant growth, driven by increasing demand for environmentally friendly solutions in various industries. Furthermore, technological advancements are continually enhancing the biodegradability and performance of these materials, expanding their applicability across diverse sectors. The market is characterized by a diverse range of players, including both established chemical giants and specialized biodegradable plastic producers. Competition is fierce, with companies focusing on product innovation, cost optimization, and strategic partnerships to gain a competitive edge. The market is also witnessing increased investments in research and development to further improve the properties and reduce the cost of biodegradable plastics, making them a more viable alternative to conventional plastics. This trend is further boosted by government incentives and subsidies aimed at promoting the adoption of sustainable packaging solutions. Overall, the market demonstrates strong potential for continued expansion, driven by a confluence of environmental concerns, technological advancements, and favorable regulatory frameworks.

Several factors are propelling the remarkable growth of the biodegradable plastics for packaging market. Firstly, the escalating global concern over plastic pollution and its devastating impact on the environment is a primary driver. Consumers are increasingly demanding eco-friendly alternatives, prompting brands to adopt sustainable packaging options to meet this demand. Secondly, stringent government regulations and policies aimed at reducing plastic waste are accelerating the adoption of biodegradable plastics. Many countries are implementing bans or restrictions on single-use plastics, creating a strong impetus for businesses to seek sustainable substitutes. Thirdly, advancements in biopolymer technology are continuously improving the performance and cost-effectiveness of biodegradable plastics. These improvements are making them a more viable and competitive alternative to traditional plastics in terms of strength, durability, and barrier properties. Furthermore, rising awareness among consumers about the environmental impact of their purchasing decisions is fueling the demand for sustainable and ethically sourced products packaged in eco-friendly materials. Finally, the growing corporate social responsibility initiatives are pushing companies to embrace sustainable practices, including the adoption of biodegradable packaging solutions to enhance their brand image and attract environmentally conscious consumers. This convergence of environmental concerns, regulatory pressure, technological advancements, and consumer preferences is creating a powerful impetus for the growth of the biodegradable plastics for packaging market.

Despite the significant growth potential, the biodegradable plastics for packaging market faces several challenges and restraints. One major hurdle is the higher cost of biodegradable plastics compared to conventional petroleum-based plastics. This price differential can hinder widespread adoption, particularly in price-sensitive markets. Another challenge is the inconsistent biodegradability of these materials. Biodegradation relies heavily on specific environmental conditions (e.g., composting facilities), and inconsistent infrastructure globally limits the effective decomposition of these plastics in many regions. Furthermore, concerns about the performance of biodegradable plastics in comparison to traditional plastics remain. While advancements are being made, some biodegradable plastics may not match the durability and barrier properties required for certain applications, particularly in the food and beverage industry. The lack of standardized testing methods for biodegradability further complicates the situation, making it challenging to compare and evaluate different products objectively. Finally, the limited availability of suitable composting infrastructure in many regions hampers the complete lifecycle benefits of biodegradable plastics. Addressing these challenges requires collaborative efforts from industry stakeholders, governments, and research institutions to improve the cost-effectiveness, consistency of biodegradability, and performance of biodegradable plastics.

The daily consumer goods segment is currently the dominant application area for biodegradable plastics packaging. This is due to the high volume of packaging needed for products like food, beverages, and personal care items. The increasing consumer awareness of environmental issues and the demand for eco-friendly alternatives further fuel this segment's growth. The European Union is expected to be a leading region due to its stringent regulations on plastic waste and strong consumer preference for sustainable products. The EU's commitment to the circular economy, along with supportive policies and incentives for biodegradable plastics, is driving significant market growth within the region. Specifically, countries like Germany and France, with established recycling infrastructure and environmentally conscious populations, are at the forefront of this adoption.

Furthermore, the PBAT (polybutylene adipate terephthalate) type of biodegradable plastic holds a significant market share due to its good balance of properties, including strength, flexibility, and biodegradability under industrial composting conditions. PHA (polyhydroxyalkanoates), a class of biodegradable polymers produced from renewable resources, is also experiencing rapid growth, driven by its superior biodegradability and potential for diverse applications. These segments are expected to continue their strong performance throughout the forecast period. However, other segments such as industrial packaging are showing significant potential for future growth as businesses adopt sustainable practices and regulations become more stringent. The adoption rate across different regions also varies. While developed economies lead in adoption rates due to regulatory pressure and consumer awareness, developing economies are also exhibiting a growing interest in sustainable packaging solutions, promising a broadened market reach in the future.

The biodegradable plastics for packaging industry is experiencing rapid growth, primarily driven by the increasing global awareness of plastic pollution and its environmental consequences. Government regulations aimed at reducing plastic waste are creating significant opportunities for biodegradable alternatives. The continuous improvement in the properties and cost-effectiveness of biodegradable plastics makes them a more attractive option for various industries. Growing consumer preference for sustainable products and corporate social responsibility initiatives further fuel this growth. These factors collectively contribute to a strong and sustained expansion of this market.

This report offers a comprehensive overview of the biodegradable plastics for packaging market, encompassing its current trends, driving forces, challenges, and future growth prospects. The detailed analysis includes market segmentation, regional insights, competitive landscape, and key industry developments. It provides valuable information for industry stakeholders, investors, and researchers seeking a deep understanding of this rapidly evolving market. The data-driven approach provides actionable insights to support strategic decision-making in the sustainable packaging sector.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of XX% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include BASF, Novamont, Mitsubishi Chemical, Danimer Scientific, Kingfa, Yifan Xinfu Pharmaceutical, Anqing Hexing, SJBRT Chemical, Hengli, Jinhuizhaolong, Sinopec.

The market segments include Application, Type.

The market size is estimated to be USD 1659 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Biodegradable Plastics for Packaging," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Biodegradable Plastics for Packaging, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.