1. What is the projected Compound Annual Growth Rate (CAGR) of the Biocompatibility Testing Services?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Biocompatibility Testing Services

Biocompatibility Testing ServicesBiocompatibility Testing Services by Type (In Vitro, In Vivo), by Application (Medical, Cosmetics), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

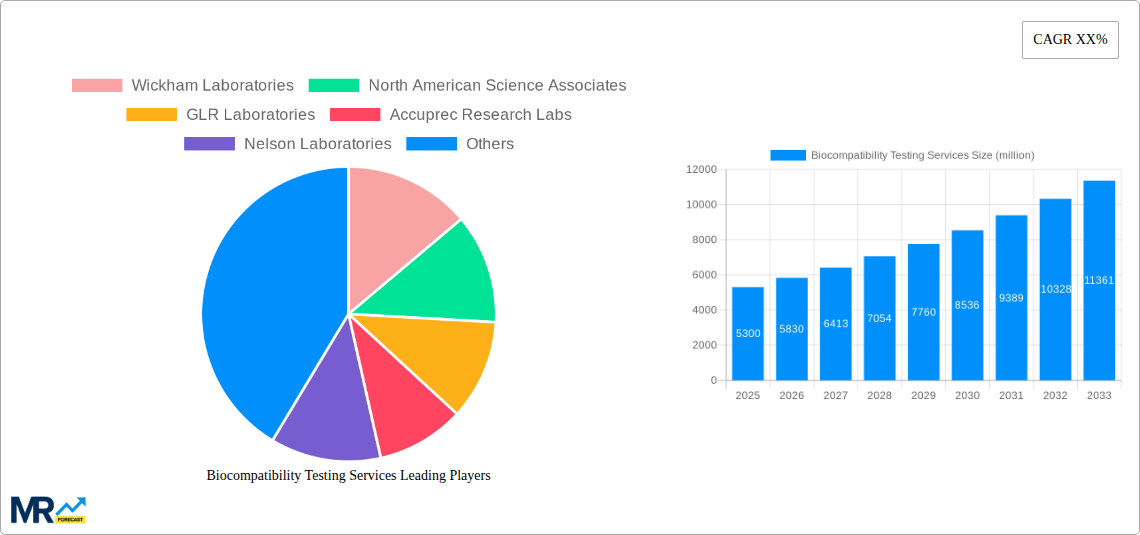

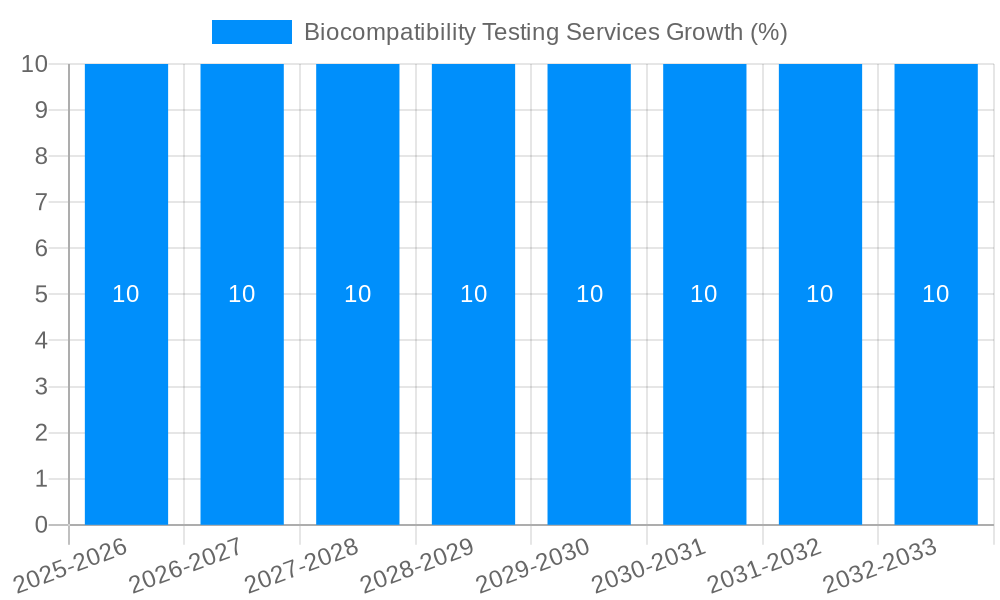

The global Biocompatibility Testing Services market is poised for significant expansion, projected to reach an estimated \$5,300 million by 2025. This robust growth is driven by a compound annual growth rate (CAGR) of approximately 10% over the forecast period. This upward trajectory is fueled by increasingly stringent regulatory requirements for medical devices and pharmaceuticals, demanding rigorous safety and efficacy evaluations. The escalating investment in healthcare infrastructure, coupled with the rising prevalence of chronic diseases, further amplifies the need for comprehensive biocompatibility assessments to ensure patient safety and product reliability. The growing demand for advanced medical technologies and personalized medicine also contributes to market expansion, as these innovations necessitate thorough validation of their interaction with biological systems.

The market is segmented into In Vitro and In Vivo testing methodologies, with a strong emphasis on their application in both the medical and cosmetic industries. The medical application segment, in particular, is expected to witness substantial growth due to the continuous innovation in implantable devices, drug delivery systems, and diagnostic tools, all of which require extensive biocompatibility validation. The cosmetic sector also presents a growing opportunity as consumer awareness regarding product safety and ingredient interactions with the skin increases. Emerging trends such as the development of novel biomaterials and the integration of AI and machine learning in testing protocols are expected to shape the market landscape. However, challenges such as high operational costs and the need for specialized expertise may present some restraints, albeit offset by the critical importance of these services in safeguarding public health and driving product innovation.

Here's a unique report description for Biocompatibility Testing Services, incorporating your specified elements:

This comprehensive report delves into the dynamic landscape of Biocompatibility Testing Services, a critical sector underpinning the safety and efficacy of a vast array of medical devices, pharmaceuticals, cosmetics, and industrial products. Between 2019 and 2033, the market is poised for substantial expansion, driven by increasing regulatory stringency, a surge in advanced material adoption, and a growing global demand for safer consumer and healthcare products. Our analysis projects the global Biocompatibility Testing Services market to reach an estimated $5.2 billion by the Base Year of 2025, with a robust compound annual growth rate (CAGR) anticipated during the Forecast Period of 2025-2033. The Historical Period of 2019-2024 has laid the groundwork for this growth, showcasing a consistent upward trajectory fueled by evolving scientific understanding and a proactive approach to risk mitigation. This report provides an in-depth examination of market trends, driving forces, challenges, regional dynamics, key players, and significant developments, offering invaluable insights for stakeholders seeking to capitalize on this burgeoning market.

XXX: The global Biocompatibility Testing Services market is exhibiting a significant and multi-faceted evolution, characterized by an increasing reliance on advanced methodologies and a broadening scope of applications. A pivotal trend is the accelerated adoption of in vitro testing methods. These methods, including cell-based assays and cytotoxicity tests, are gaining prominence due to their cost-effectiveness, reduced ethical concerns associated with animal testing, and their ability to deliver rapid results. This shift is directly influenced by evolving regulatory landscapes that increasingly favor non-animal alternatives where scientifically validated. Furthermore, the growing complexity of medical devices and implantable technologies necessitates more sophisticated biocompatibility assessments. As novel materials like advanced polymers, ceramics, and nanomaterials become integral to product design, the demand for specialized testing protocols capable of evaluating their long-term interactions with biological systems is soaring. The cosmetics industry's commitment to "clean beauty" and ethical sourcing is also a significant driver, pushing for rigorous biocompatibility assessments to ensure product safety and consumer trust, thereby expanding the market beyond traditional medical applications. The convergence of digital technologies with testing services, such as advanced data analytics and AI-driven predictive modeling, is emerging as a transformative trend, promising to enhance efficiency, accuracy, and accelerate the entire testing lifecycle. Moreover, the increasing focus on personalized medicine is indirectly fueling demand for biocompatibility testing, as novel drug delivery systems and patient-specific implants require tailored safety evaluations. Regulatory bodies worldwide are continuously updating and harmonizing their guidelines, fostering a more standardized yet demanding environment for biocompatibility testing, which, in turn, encourages investment in cutting-edge testing capabilities and services.

The expansion of the Biocompatibility Testing Services market is intrinsically linked to a confluence of powerful driving forces. Foremost among these is the ever-tightening regulatory framework surrounding medical devices and pharmaceuticals. Agencies like the FDA, EMA, and their global counterparts are progressively enforcing stricter biocompatibility requirements to ensure patient safety, leading to increased mandatory testing. The unprecedented innovation in the medical device sector, particularly in areas like cardiovascular implants, orthopedics, and drug-eluting technologies, necessitates comprehensive biocompatibility assessments for novel materials and designs. Similarly, the booming biotechnology and pharmaceutical industries, with their continuous development of new drugs and biologics, rely heavily on robust biocompatibility data to secure regulatory approvals and mitigate potential adverse reactions. Growing consumer awareness regarding product safety, especially in the cosmetics and personal care segments, is also a significant propellant, compelling manufacturers to invest in rigorous testing to build brand trust and avoid recalls. Furthermore, the increasing prevalence of chronic diseases globally translates into a higher demand for implantable medical devices and advanced therapeutic solutions, each requiring thorough biocompatibility evaluations. The growing emphasis on ethical considerations and the drive to reduce animal testing further bolster the demand for sophisticated in vitro and alternative testing methods.

Despite its robust growth trajectory, the Biocompatibility Testing Services market encounters several significant challenges and restraints. One of the primary hurdles is the increasing complexity and cost of advanced biocompatibility testing. As materials and devices become more intricate, the specialized equipment, highly trained personnel, and sophisticated protocols required can elevate testing expenses, potentially impacting smaller companies or nascent markets. The lack of globally harmonized regulatory standards for certain niche applications can create complexities for companies operating across different regions, requiring them to conduct varied testing regimes and increasing compliance costs. Another restraint is the long lead times associated with in vivo testing, which, despite being essential for certain assessments, can significantly delay product development and market entry. The shortage of skilled professionals in specialized areas of toxicology and biocompatibility testing can also pose a challenge, limiting the capacity of testing service providers and potentially impacting turnaround times. Moreover, the evolving scientific understanding of biological interactions means that test methodologies themselves are subject to change, requiring continuous investment in research and development by testing laboratories to remain at the forefront of the field. The potential for unexpected adverse events or unforeseen interactions even after rigorous testing can lead to product recalls and damage consumer confidence, highlighting the inherent risks that testing aims to mitigate but cannot entirely eliminate.

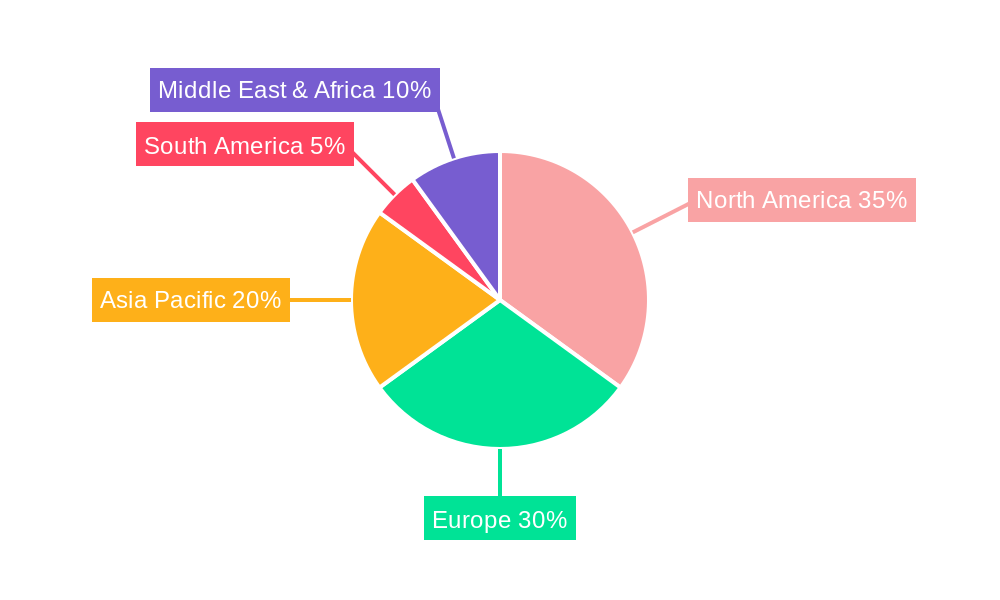

The Biocompatibility Testing Services market exhibits a clear dominance in specific regions and segments, driven by a combination of regulatory maturity, industrial innovation, and healthcare infrastructure.

North America (USA and Canada): This region stands as a leading force in the Biocompatibility Testing Services market.

Europe: Closely following North America, Europe represents another dominant market.

Asia Pacific: This region is witnessing the fastest growth and is poised to become a significant player.

Dominant Segment: Medical Application

Within the Biocompatibility Testing Services market, the Medical Application segment unequivocally dominates and is expected to maintain its lead throughout the forecast period. This dominance is attributed to several critical factors:

While the Cosmetics segment is experiencing significant growth due to consumer demand for safe products, and the Industrial segment has niche applications, the sheer volume, regulatory necessity, and critical patient safety considerations firmly place the Medical application segment at the forefront of the Biocompatibility Testing Services market.

Several key growth catalysts are propelling the Biocompatibility Testing Services industry forward. The escalating adoption of advanced biomaterials in medical devices and the continuous development of novel drug delivery systems necessitate rigorous biocompatibility assessments. Furthermore, tightening global regulatory requirements for product safety and efficacy are compelling manufacturers to invest more in comprehensive testing. The growing consumer demand for safer cosmetics and personal care products also contributes significantly. Finally, the increasing prevalence of chronic diseases globally drives the demand for medical devices and therapeutic solutions, all requiring thorough biocompatibility evaluation.

This report offers a holistic and granular analysis of the Biocompatibility Testing Services market. It meticulously covers market sizing, segmentation by type (in vitro, in vivo), application (medical, cosmetics), and geography, providing a clear understanding of current market dynamics. The report delves into historical trends from 2019-2024 and projects future growth from 2025-2033, with a specific focus on the Base Year of 2025. It identifies key growth drivers, restraints, opportunities, and challenges, alongside a detailed competitive landscape featuring leading companies like Nelson Laboratories and Toxikon. Furthermore, it highlights significant technological advancements and regulatory shifts impacting the industry, ensuring stakeholders have the most comprehensive and actionable intelligence to navigate this vital sector.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Wickham Laboratories, North American Science Associates, GLR Laboratories, Accuprec Research Labs, Nelson Laboratories, Toxikon, Pacific BioLabs, BioComp Laboratories, Morulaa HealthTech, Geneva Laboratories, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Biocompatibility Testing Services," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Biocompatibility Testing Services, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.