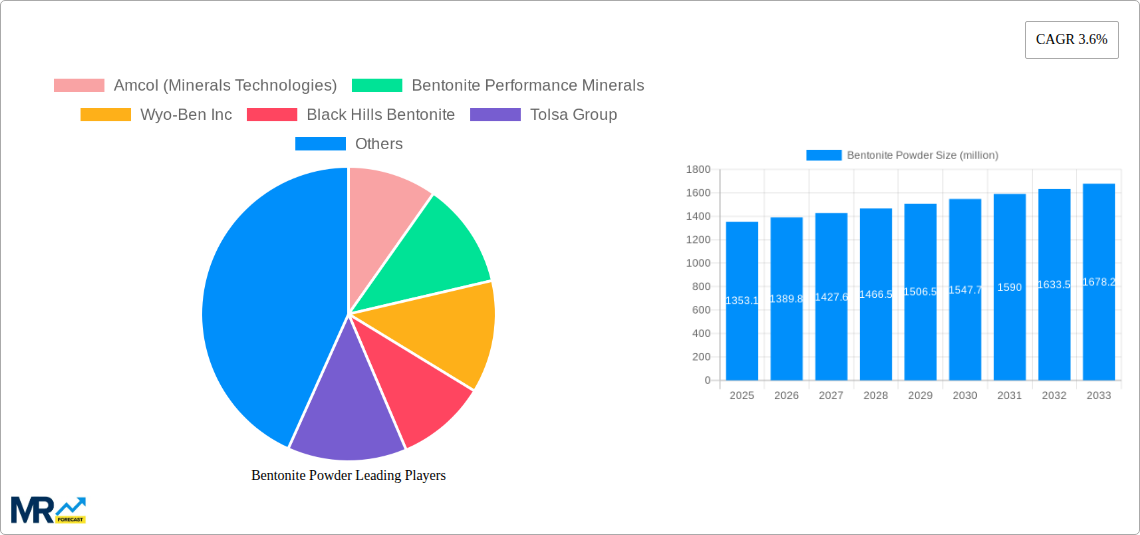

1. What is the projected Compound Annual Growth Rate (CAGR) of the Bentonite Powder?

The projected CAGR is approximately 3.6%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Bentonite Powder

Bentonite PowderBentonite Powder by Type (Sodium Bentonite, Calcium Bentonite), by Application (Molding Sands, Iron Ore Pelletizing, Pet Litter, Drilling Mud, Civil Engineering, Agriculture, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

The global bentonite powder market is projected to reach a substantial valuation, driven by its diverse and essential applications across multiple industries. With a projected market size of USD 1353.1 million in 2025 and a Compound Annual Growth Rate (CAGR) of 3.6% from 2019 to 2033, the market demonstrates steady and sustainable expansion. Key growth drivers include the increasing demand from the foundry sector for molding sands, the crucial role of bentonite in iron ore pelletizing for the steel industry, and its continued prominence in drilling fluids for oil and gas exploration. Furthermore, the growing adoption of bentonite in agriculture for soil amendment and its widespread use in pet litter products are significant contributors to market buoyancy. The market is segmented by type, with Sodium Bentonite and Calcium Bentonite dominating, and by application, highlighting the broad utility of this versatile mineral.

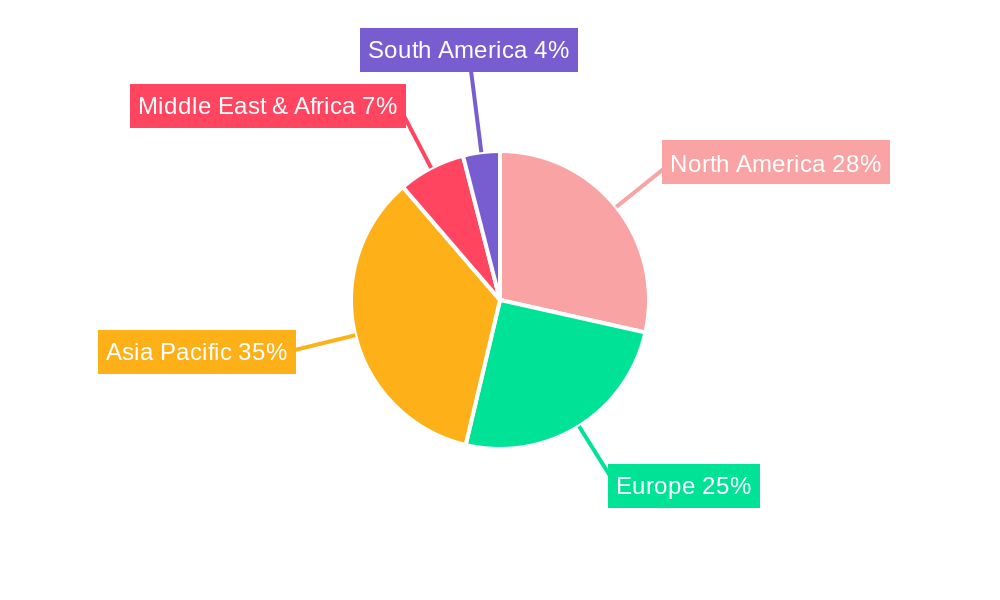

The forecast period, from 2025 to 2033, is expected to witness sustained growth, influenced by evolving industrial demands and technological advancements in bentonite processing and application. While the market enjoys robust demand, certain restraints may emerge, such as fluctuating raw material prices and environmental regulations associated with mining and processing. However, the inherent properties of bentonite, including its high absorbency, swelling capacity, and binding capabilities, ensure its continued relevance. Leading players like Amcol (Minerals Technologies), Bentonite Performance Minerals, and Imerys are actively engaged in market expansion and product innovation, further shaping the competitive landscape. Regional analysis indicates strong market presence in North America and Asia Pacific, with emerging opportunities in other developing regions.

Here is a unique report description on Bentonite Powder, incorporating your specified values and structure:

The global Bentonite Powder market is poised for robust growth and significant evolution throughout the study period of 2019-2033, with a keen focus on the base year of 2025 and a comprehensive forecast from 2025-2033. Historical data from 2019-2024 provides the foundation for understanding past market dynamics. In 2025, the market is projected to reach a valuation of USD 3,500 million, a testament to its indispensable role across a multitude of industrial applications. A key trend observed is the increasing demand for high-purity sodium bentonite, particularly driven by its superior swelling and binding properties, essential for applications like drilling muds in the oil and gas sector, and high-performance pet litters. The estimated market size for 2025, USD 3,500 million, is anticipated to witness a Compound Annual Growth Rate (CAGR) of approximately 6.2% during the forecast period, pushing the market value beyond USD 6,000 million by 2033. This growth trajectory is further bolstered by advancements in processing technologies that enhance bentonite's functional characteristics, allowing for tailored solutions in specialized applications. The report will delve into the intricate interplay of supply chain efficiencies, raw material availability, and technological innovations that are shaping the market landscape. Furthermore, the burgeoning construction industry's demand for bentonite in civil engineering applications, such as waterproofing and slurry walls, is a significant contributor to market expansion. The circular economy and sustainability initiatives are also gaining traction, with a growing emphasis on recycled bentonite products and eco-friendly sourcing, presenting both opportunities and challenges for market players. The competitive landscape is characterized by a mix of large, established global players and smaller, regional specialists, all vying for market share through product differentiation and strategic partnerships. The report will meticulously analyze these trends, providing invaluable insights for stakeholders navigating this dynamic market.

The sustained and accelerated growth of the Bentonite Powder market is primarily propelled by a confluence of robust industrial demand and inherent material properties. The oil and gas industry continues to be a dominant consumer, with drilling muds accounting for a substantial portion of bentonite consumption. As exploration and production activities intensify globally, especially in challenging offshore and unconventional reservoirs, the need for high-quality bentonite for viscosity control, fluid loss prevention, and wellbore stability remains paramount. Furthermore, the agricultural sector is increasingly recognizing the benefits of bentonite in soil conditioning and as a carrier for pesticides and fertilizers, contributing to improved crop yields and reduced environmental impact. The pet care industry, particularly the market for clumping cat litter, represents another significant growth engine. The superior absorbency and odor-control capabilities of sodium bentonite make it the preferred choice for pet owners seeking effective and hygienic solutions. Civil engineering projects, ranging from infrastructure development to environmental remediation, are also a major driver. Bentonite's exceptional impermeability and sealing properties are critical for applications like landfill liners, diaphragm walls, and foundation stabilization, especially as urbanization and infrastructure upgrades continue worldwide. The expansion of the foundry industry, utilizing bentonite as a binder in molding sands for metal casting, also contributes to this upward trend, ensuring the production of intricate and high-quality metal components.

Despite the strong growth trajectory, the Bentonite Powder market is not without its challenges and restraints, which could temper its full potential. One of the primary concerns is the fluctuation in raw material prices and availability. While bentonite deposits are relatively widespread, high-quality, economically viable deposits can be scarce, leading to price volatility and potential supply chain disruptions. Geopolitical factors and mining regulations in key producing regions can also impact supply. Another significant restraint is the increasing environmental scrutiny and regulatory compliance. Mining operations, by their nature, can have environmental impacts, and companies face stringent regulations regarding land reclamation, water usage, and waste disposal. Non-compliance can lead to hefty fines and operational shutdowns. The development of alternative materials also poses a competitive threat. While bentonite offers unique properties, ongoing research and development in other absorbent and binding materials could potentially displace bentonite in certain niche applications, particularly if those alternatives offer cost advantages or enhanced environmental profiles. Furthermore, logistics and transportation costs can be substantial, especially for bulk quantities of bentonite, impacting profitability and market accessibility, particularly for remote or developing regions. Finally, quality control and consistency across different mining sources can be a challenge, requiring rigorous processing and testing to meet the specific demands of various industrial applications.

The global Bentonite Powder market demonstrates a clear dominance of certain regions and application segments, driven by specific industrial strengths and resource availability.

Dominant Regions/Countries:

Asia Pacific: This region is a powerhouse in bentonite consumption and production, driven by its rapid industrialization and massive infrastructure development projects.

North America: This region remains a critical player due to its established industries and significant natural resources.

Dominant Segments:

Application: Drilling Mud: This segment consistently represents the largest share of the bentonite powder market. The oil and gas industry's relentless pursuit of new energy sources necessitates extensive drilling operations, where bentonite's rheological properties are indispensable for lubricating drill bits, suspending rock cuttings, and preventing fluid loss. The projected market size for drilling muds in 2025 is estimated to be in the range of USD 1,200 million to USD 1,500 million.

Type: Sodium Bentonite: This type of bentonite is highly sought after due to its superior swelling and thixotropic properties, making it the preferred choice for drilling muds and pet litter. The estimated market share for sodium bentonite in 2025 is anticipated to be around 60% to 65% of the total market value.

Application: Pet Litter: The booming pet care industry, particularly the demand for effective and eco-friendly cat litter, has propelled this segment into a significant growth area. The convenience and high absorbency offered by sodium bentonite-based litters drive consistent consumer demand. The pet litter segment alone is estimated to contribute USD 800 million to USD 1,000 million to the market in 2025.

Application: Iron Ore Pelletizing: This segment is crucial for the steel industry, where bentonite acts as a binder to form iron ore into pellets, facilitating efficient smelting. The growth of the steel industry, especially in emerging economies, directly influences the demand for bentonite in this application.

The report will offer a granular analysis of how these regions and segments interact, identifying growth hotspots and potential shifts in market dynamics throughout the forecast period.

Several factors are acting as potent catalysts for the expansion of the Bentonite Powder industry. The escalating global demand for energy, particularly from unconventional sources, fuels the need for efficient drilling operations, where bentonite is a critical component of drilling fluids. Furthermore, increased urbanization and infrastructure development worldwide necessitate the use of bentonite in civil engineering applications for ground stabilization, waterproofing, and waste containment. The booming pet care market, driven by increasing pet ownership and a preference for premium products, continues to propel the demand for bentonite in absorbent pet litter. Moreover, advancements in processing technologies are enabling the development of higher-value, specialized bentonite products catering to niche applications, thereby broadening the market's scope.

This report offers a comprehensive and in-depth analysis of the global Bentonite Powder market, covering the period from 2019 to 2033, with a detailed examination of the base year 2025 and the forecast period 2025-2033. It provides a granular breakdown of market dynamics, including historical trends, current market size estimated at USD 3,500 million in 2025, and future growth projections. The report meticulously dissects the market by type (Sodium Bentonite, Calcium Bentonite) and application (Molding Sands, Iron Ore Pelletizing, Pet Litter, Drilling Mud, Civil Engineering, Agriculture, Others), offering insights into the demand drivers and competitive landscape within each segment. Key regional analyses highlight dominant markets such as Asia Pacific and North America, with a focus on their specific consumption patterns and production capabilities. Furthermore, the report identifies and elaborates on the primary growth catalysts and significant challenges impacting the market. An exhaustive list of leading players, alongside significant recent developments, provides a holistic view of the competitive environment. This report is designed to equip stakeholders with the strategic intelligence necessary to navigate the evolving Bentonite Powder industry.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.6% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 3.6%.

Key companies in the market include Amcol (Minerals Technologies), Bentonite Performance Minerals, Wyo-Ben Inc, Black Hills Bentonite, Tolsa Group, Imerys (S&B), Clariant, Bentonite Company LLC, Laviosa Minerals SpA, LKAB Minerals, Ashapura, Star Bentonite Group, Kunimine Industries, Huawei Bentonite, Fenghong New Material, Chang'an Renheng, Liufangzi Bentonite, Bentonit União, Castiglioni Pes y Cia, Canbensan, Aydın Bentonit, KarBen, G & W Mineral Resources, Ningcheng Tianyu, Elementis.

The market segments include Type, Application.

The market size is estimated to be USD 1353.1 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Bentonite Powder," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Bentonite Powder, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.