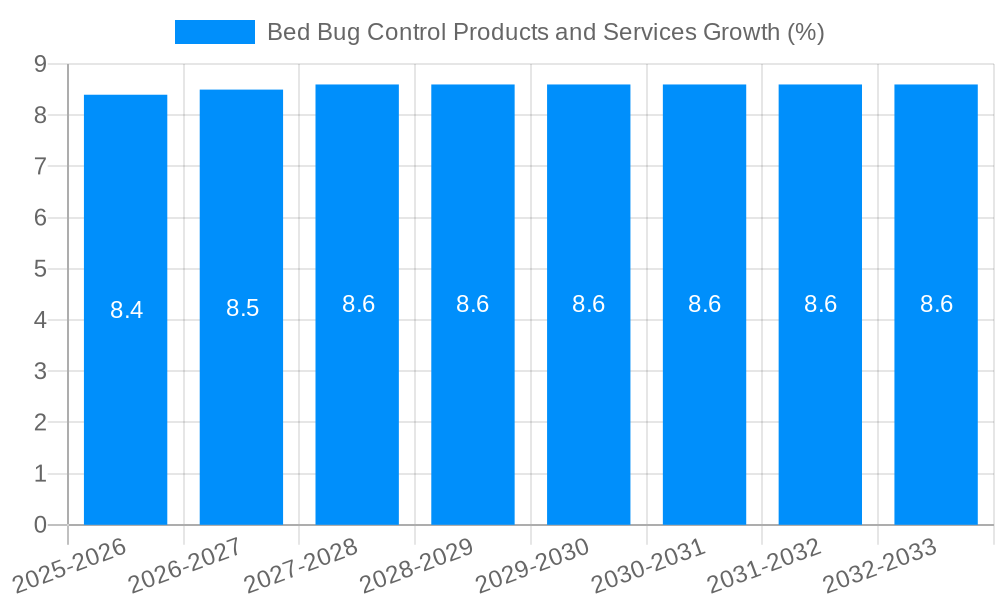

1. What is the projected Compound Annual Growth Rate (CAGR) of the Bed Bug Control Products and Services?

The projected CAGR is approximately 8.4%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Bed Bug Control Products and Services

Bed Bug Control Products and ServicesBed Bug Control Products and Services by Type (Bed Bug Control Products, Bed Bug Control Services), by Application (Residential, Commercial), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

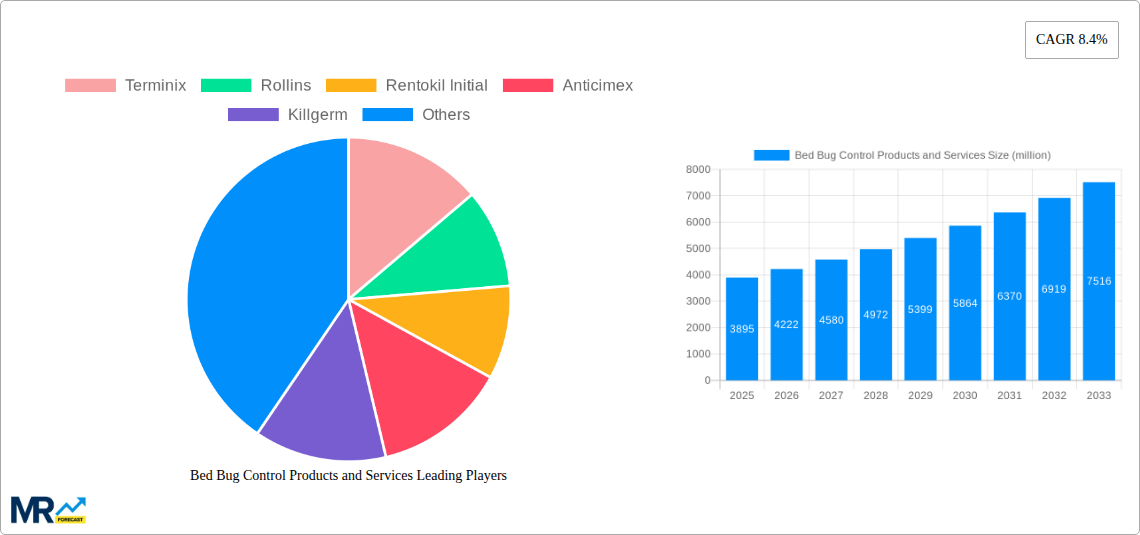

The global Bed Bug Control Products and Services market is projected for robust expansion, currently valued at approximately USD 3,895 million. With a Compound Annual Growth Rate (CAGR) of 8.4%, this dynamic sector is expected to witness significant momentum through the forecast period ending in 2033. The primary drivers fueling this growth are the increasing urbanization and population density in major cities worldwide, which unfortunately create more hospitable environments for bed bug infestations. Furthermore, heightened consumer awareness regarding the health and hygiene implications of bed bug presence, coupled with a greater willingness to invest in professional pest control solutions, are critical growth catalysts. The persistent nature of bed bug infestations and the need for effective, long-term eradication strategies also contribute to sustained market demand for both advanced control products and specialized services.

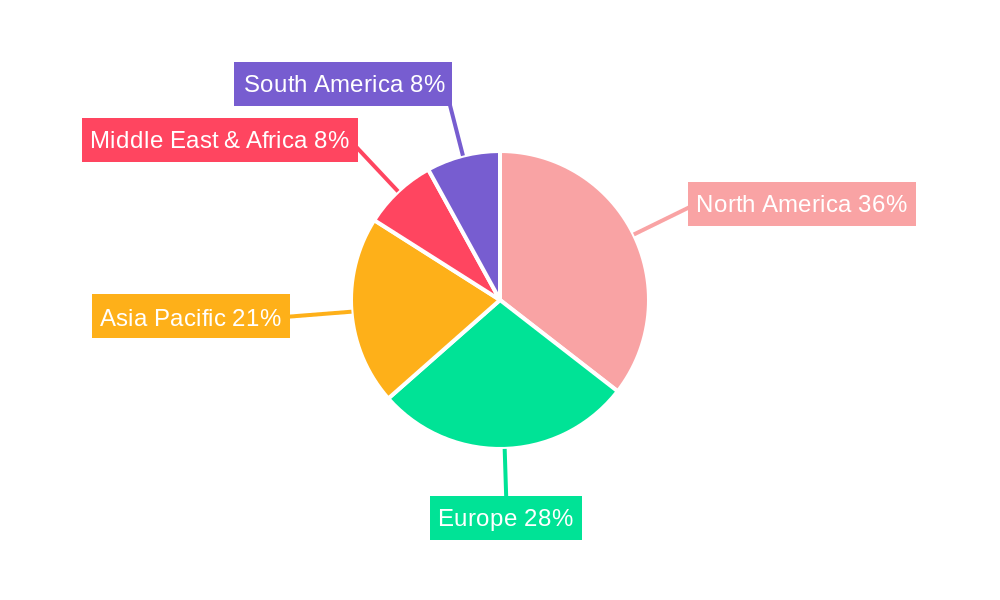

The market is segmented into distinct categories, including Bed Bug Control Products and Bed Bug Control Services, catering to both Residential and Commercial applications. Within products, innovative chemical treatments, advanced traps, and integrated pest management solutions are gaining traction. Simultaneously, the demand for professional bed bug extermination services is escalating, driven by the complexity of eradication and the desire for guaranteed results. Geographically, North America and Europe currently represent significant market shares due to well-established pest control infrastructure and high consumer spending. However, the Asia Pacific region is anticipated to emerge as a rapidly growing market, spurred by increasing disposable incomes, expanding urban landscapes, and a growing awareness of pest-related issues. Key industry players are actively engaged in research and development to introduce more eco-friendly and effective solutions, anticipating stricter environmental regulations and consumer preferences for sustainable pest management.

The global market for bed bug control products and services is a dynamic and essential sector, projected to witness substantial growth throughout the study period of 2019-2033. Driven by an increasing awareness of the health and economic implications of bed bug infestations, this market is expanding as both individuals and businesses seek effective solutions. The base year of 2025 serves as a crucial benchmark, with estimations for the year also set at 2025, and the forecast period from 2025-2033 indicating a sustained upward trajectory. This report delves into the intricate landscape of bed bug control, encompassing both the tangible products and the professional services designed to combat these persistent pests.

The bed bug control products and services market is currently experiencing a multifaceted evolution, driven by a confluence of factors that are reshaping consumer behavior and industry practices. One prominent trend is the increasing demand for integrated pest management (IPM) solutions, which combine a variety of methods – chemical, physical, and biological – for a more sustainable and effective approach. This shift away from solely relying on chemical treatments reflects growing concerns about environmental impact and the development of pesticide resistance in bed bug populations. Consumers are actively seeking products that are perceived as safer for homes with children and pets, leading to a surge in demand for eco-friendly and natural insecticides, such as diatomaceous earth and essential oil-based repellents. The estimated market value in this segment is expected to reach into the hundreds of millions of dollars annually within the forecast period.

Simultaneously, the professional bed bug control services sector is witnessing a significant increase in adoption, particularly within commercial applications. Hotels, multi-unit residential buildings, healthcare facilities, and educational institutions are all recognizing the critical need for proactive and reactive bed bug management to protect their reputation, guest satisfaction, and operational continuity. The cost of a significant bed bug infestation can be astronomically high in terms of lost revenue, property damage, and legal liabilities, making professional intervention a financially prudent choice. The residential segment, while often more price-sensitive, is also experiencing robust growth as awareness campaigns highlight the pervasive nature of bed bugs and the limitations of DIY solutions. The increasing urbanization and global travel further exacerbate the problem, creating a continuous cycle of infestation and control. The market value for bed bug control services is anticipated to surpass the billions of dollars annually by the end of the study period. Furthermore, the development of advanced application technologies, such as precision spraying equipment and heat treatment systems, is enhancing the efficacy and efficiency of professional services, further driving market expansion.

Several powerful forces are propelling the growth of the bed bug control products and services market. Foremost among these is the increasing global mobility and urbanization. As more people travel internationally and live in densely populated urban environments, the opportunities for bed bugs to spread from one location to another are amplified. This constant movement, facilitated by luggage, clothing, and public transportation, ensures a perpetual cycle of potential infestations, thus sustaining the demand for effective control measures. The growing awareness and understanding of bed bug infestations among the general public and in commercial sectors also plays a pivotal role. Historically, bed bugs were often met with stigma and misunderstanding, leading to delayed action. However, extensive public awareness campaigns by health organizations, pest control companies, and media outlets have educated individuals and businesses about the health risks, economic impact, and effective solutions available, prompting more proactive and timely interventions. The escalating incidence of pesticide resistance among bed bug populations is another significant driver. Traditional chemical treatments are becoming less effective over time, forcing consumers and professionals to seek out newer, more innovative, and often more potent or diversified control methods. This necessitates continuous research and development in the field, fostering the demand for advanced products and integrated service offerings. The increasing focus on public health and hygiene, particularly in hospitality and residential settings, further bolsters the market. Maintaining a pest-free environment is now a critical component of ensuring occupant well-being and satisfaction, making robust bed bug control a non-negotiable aspect of property management and individual home care.

Despite the promising growth trajectory, the bed bug control products and services market faces several significant challenges and restraints that can temper its expansion. A primary concern is the inherent difficulty in completely eradicating bed bugs. Their elusive nature, ability to hide in minute cracks and crevices, and rapid reproductive cycle make them notoriously challenging to eliminate. This often necessitates repeated treatments, increasing the overall cost and effort for both consumers and service providers, and can lead to frustration and a perception of ineffectiveness. Another major hurdle is the rising cost of effective treatments. Advanced products and professional services, while more efficacious, can be financially burdensome for many individuals and small businesses. This price sensitivity can lead consumers to opt for less effective, cheaper DIY solutions, which may not resolve the infestation and could even exacerbate the problem by spreading the bed bugs further. The development of pesticide resistance poses a continuous and evolving challenge. As bed bugs adapt and become resistant to commonly used insecticides, manufacturers and service providers are compelled to constantly innovate and develop new formulations, which can be costly and time-consuming. This arms race between pest and control measure can lead to a market where older, less effective products remain in circulation due to affordability, hindering the adoption of more advanced solutions. Furthermore, the stigma and emotional distress associated with bed bug infestations can sometimes lead to delays in seeking professional help or admitting to an infestation, as individuals fear judgment or negative repercussions. This psychological barrier can hinder timely intervention and the proper application of control measures. Finally, regulatory hurdles and evolving environmental concerns can impact the availability and use of certain chemical control agents, requiring manufacturers and service providers to adapt their product lines and methodologies to comply with increasingly stringent environmental and health regulations.

The bed bug control products and services market is characterized by regional variations and segment dominance, with North America, particularly the United States, emerging as a dominant force. This leadership is underpinned by a combination of factors, including high levels of urbanization, extensive international travel, a strong awareness of pest control issues, and a robust economy that supports investment in both products and professional services. The residential segment in North America is a significant contributor to the market value, driven by a large homeowner base and a persistent concern for health and hygiene within households. Consumers are increasingly willing to invest in preventative measures and immediate solutions when infestations are detected. Simultaneously, the commercial segment in the United States, encompassing hotels, apartment complexes, hospitals, and educational institutions, represents a substantial revenue stream. The high density of these facilities, coupled with the severe reputational and financial repercussions of bed bug outbreaks, necessitates continuous and professional pest management strategies. The market value for both products and services within the North American residential and commercial segments is projected to reach into the billions of dollars annually during the study period.

Within this dominant region, the Bed Bug Control Services segment is anticipated to exhibit particularly strong growth. This is attributable to the inherent complexity of bed bug eradication and the increasing preference for professional expertise. Companies like Rollins (through Orkin), Terminix, and Massey Services have established extensive networks and sophisticated treatment methodologies, making professional services the go-to solution for many challenging infestations. The estimated market value for services within North America alone is expected to contribute a significant portion to the global market's total, potentially reaching the high hundreds of millions to over a billion dollars annually. The Bed Bug Control Products segment, while also substantial, is characterized by a wider array of players and a more diverse product offering, ranging from DIY kits to professional-grade chemicals and equipment. However, the recurring nature of infestations and the demand for comprehensive solutions often steer consumers towards professional services, thus reinforcing the segment dominance of services in terms of overall market value and impact within North America.

Beyond North America, Europe and Asia-Pacific are also showing significant market potential. European countries, with their dense urban populations and significant tourism industries, are experiencing a steady rise in bed bug incidents, driving demand for both products and services. Countries like the United Kingdom, Germany, and France are key markets within this region. The Asia-Pacific region, driven by rapid urbanization, increasing disposable incomes, and growing awareness of hygiene standards, presents a long-term growth opportunity. Countries like China, India, and Southeast Asian nations are expected to witness a substantial increase in bed bug control market penetration in the coming years, with the commercial segment, particularly in hospitality and multi-family housing, taking the lead.

The bed bug control products and services industry is propelled by several key growth catalysts. The persistent nature of bed bug infestations, often requiring recurring treatments, ensures a sustained demand for both products and services. Furthermore, increasing global travel and urbanization continually introduce new opportunities for bed bug spread, creating an ongoing need for preventative and reactive measures. The growing awareness among consumers and businesses about the detrimental health and economic impacts of bed bugs is also a significant driver, leading to a greater willingness to invest in effective control solutions. The development of more advanced and eco-friendly pest control technologies, alongside the increasing demand for integrated pest management strategies, further fuels innovation and market expansion.

This comprehensive report offers an in-depth analysis of the global bed bug control products and services market, spanning the historical period from 2019-2024 and projecting forward to 2033. Utilizing 2025 as the base and estimated year, the report provides critical market insights, including market size in millions of units, segmentation by product type and application (residential, commercial), and a detailed examination of key industry drivers, challenges, and growth catalysts. Leading players are identified, and significant developments are highlighted to offer a holistic understanding of market dynamics and future trends. The report aims to equip stakeholders with the necessary information to make informed strategic decisions in this ever-evolving sector.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.4% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 8.4%.

Key companies in the market include Terminix, Rollins, Rentokil Initial, Anticimex, Killgerm, Ecolab, Massey Services, BioAdvanced, BASF, Harris, Spectrum Brands, SC Johnson, Ortho, Willert Home Products, Bonide Products, MGK.

The market segments include Type, Application.

The market size is estimated to be USD 3895 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Bed Bug Control Products and Services," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Bed Bug Control Products and Services, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.