1. What is the projected Compound Annual Growth Rate (CAGR) of the Battery Self-Adhesive Label?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Battery Self-Adhesive Label

Battery Self-Adhesive LabelBattery Self-Adhesive Label by Type (PET, PVC, Polyimide, Aluminized, World Battery Self-Adhesive Label Production ), by Application (Carbon Zinc Battery, Alkaline Battery, Rechargeable Battery, Mobile Phone Battery, Dry Battery, Fuel Cell, Others, World Battery Self-Adhesive Label Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

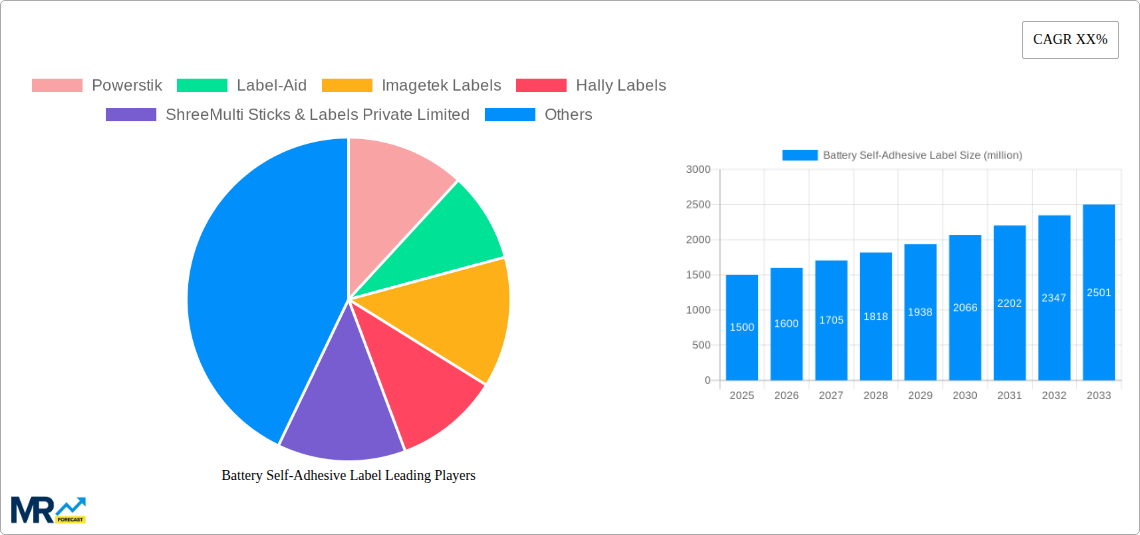

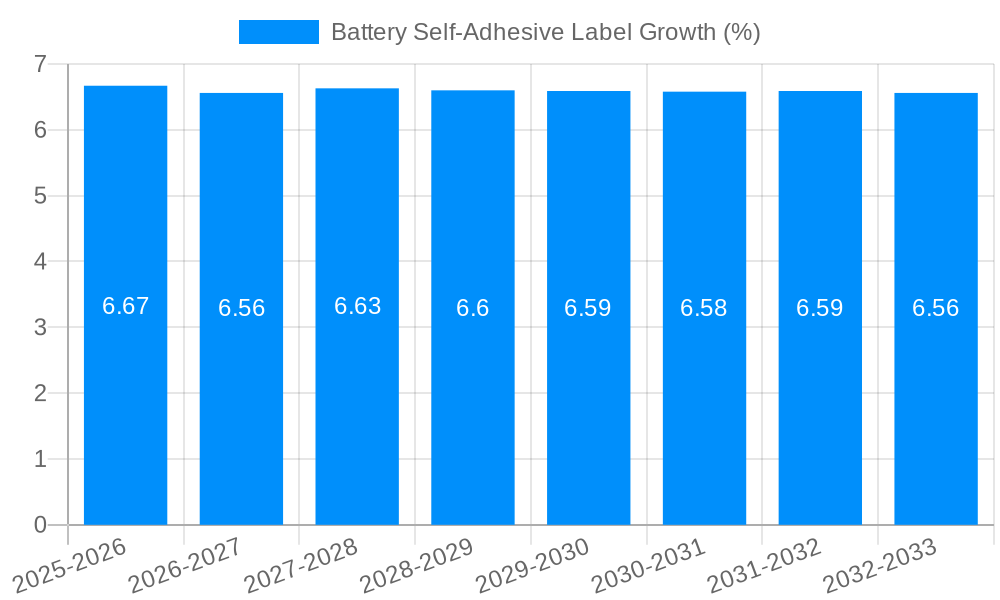

The global Battery Self-Adhesive Label market is poised for significant expansion, projected to reach approximately \$1,500 million by 2025. This robust growth trajectory is underpinned by a compelling Compound Annual Growth Rate (CAGR) of around 6.5%, indicating a healthy and sustained demand for these critical components across various battery types. The market's vitality is primarily driven by the escalating demand for portable electronic devices, including smartphones and laptops, which rely heavily on advanced battery technologies. Furthermore, the burgeoning electric vehicle (EV) sector is a substantial growth catalyst, as each EV requires multiple batteries, each necessitating reliable and durable self-adhesive labels for identification, safety, and regulatory compliance. The increasing adoption of renewable energy storage solutions, such as those used in solar power systems and grid-scale storage, also contributes significantly to this market's expansion.

The market is characterized by a diverse range of applications, from traditional carbon zinc and alkaline batteries to high-performance rechargeable batteries found in modern electronics and EVs. The segmentation by material, including PET, PVC, Polyimide, and Aluminized labels, reflects the industry's need for specialized solutions that can withstand varying temperature ranges, chemical exposures, and physical stresses inherent in battery manufacturing and operation. Innovations in label technology, such as enhanced adhesion, tamper-evident features, and eco-friendly materials, are emerging trends that cater to evolving industry standards and consumer preferences. However, the market also faces certain restraints, including fluctuating raw material costs and the stringent regulatory landscape governing battery production and labeling. Companies like Powerstik, Label-Aid, and Imagetek Labels are at the forefront, driving innovation and addressing the dynamic needs of this essential market segment.

Here's a unique report description on Battery Self-Adhesive Labels, incorporating your specified values, companies, segments, and structure:

The global Battery Self-Adhesive Label market is poised for significant expansion, driven by the ever-increasing demand for portable power solutions across a multitude of industries. Our comprehensive report, covering the Study Period: 2019-2033, with a Base Year: 2025 and an Estimated Year: 2025, details a market that has witnessed robust growth during the Historical Period: 2019-2024, and is projected to continue its upward trajectory through the Forecast Period: 2025-2033. Key market insights reveal a burgeoning need for labels that not only provide crucial product information and branding but also offer enhanced functionality such as safety warnings, authentication features, and environmental compliance data. The proliferation of consumer electronics, electric vehicles, and the burgeoning renewable energy sector, all heavily reliant on battery technology, forms the bedrock of this market's expansion. Specifically, the World Battery Self-Adhesive Label Production is expected to reach an impressive valuation, indicating a substantial increase in the volume of labels manufactured and deployed. The shift towards more sophisticated battery chemistries, such as those used in mobile devices and electric vehicles, necessitates labels with superior durability, heat resistance, and chemical inertness, driving innovation in material science and manufacturing processes. Furthermore, regulatory mandates concerning battery disposal and recycling are placing greater emphasis on traceable and informative labeling, adding another layer of complexity and opportunity for label manufacturers. The market is also witnessing a trend towards miniaturization and customized labeling solutions to cater to the diverse form factors and specific requirements of various battery types, from small coin cells to large industrial power packs. This dynamic landscape presents a compelling investment and strategic planning opportunity for stakeholders involved in the battery ecosystem.

The burgeoning demand for portable power solutions across diverse sectors is the primary engine propelling the Battery Self-Adhesive Label market forward. The exponential growth of consumer electronics, from smartphones and laptops to wearable devices, directly translates into a higher volume of battery production and, consequently, a greater need for associated labeling. Furthermore, the electrifying automotive industry, with its massive expansion in electric vehicles (EVs), represents a significant and rapidly growing application for battery self-adhesive labels. These labels are critical for providing essential information such as battery capacity, voltage, safety warnings, and charging instructions, ensuring proper and safe usage. The increasing adoption of battery storage solutions for renewable energy systems, such as solar and wind power, also contributes to this market's growth. As governments and industries globally push for sustainable energy, the demand for efficient and reliable battery storage, and thus their labeling, escalates. Beyond these macro trends, advancements in battery technology itself, leading to higher energy densities and more complex designs, necessitate labels with enhanced durability, thermal resistance, and specialized functionalities to withstand harsher operating conditions and provide critical safety information.

Despite the robust growth trajectory, the Battery Self-Adhesive Label market faces several critical challenges and restraints that could impede its full potential. One significant hurdle is the increasing pressure on manufacturing costs. As the battery industry scales up, there is a constant demand for more cost-effective labeling solutions without compromising on quality or functionality. This necessitates continuous innovation in material science and production processes to achieve economies of scale. Another challenge lies in the stringent and evolving regulatory landscape surrounding battery safety and environmental compliance. Manufacturers must ensure their labels meet a complex web of international standards, which can be time-consuming and expensive to navigate. The rapid pace of technological advancements in battery design also presents a challenge; labels need to be adaptable to new chemistries, form factors, and operating conditions, requiring ongoing research and development investments. Furthermore, global supply chain disruptions, influenced by geopolitical events, raw material availability, and logistical complexities, can impact the timely and cost-effective production and delivery of battery self-adhesive labels. Finally, the threat of counterfeit products and the need for robust anti-counterfeiting features on labels add another layer of complexity and cost for manufacturers.

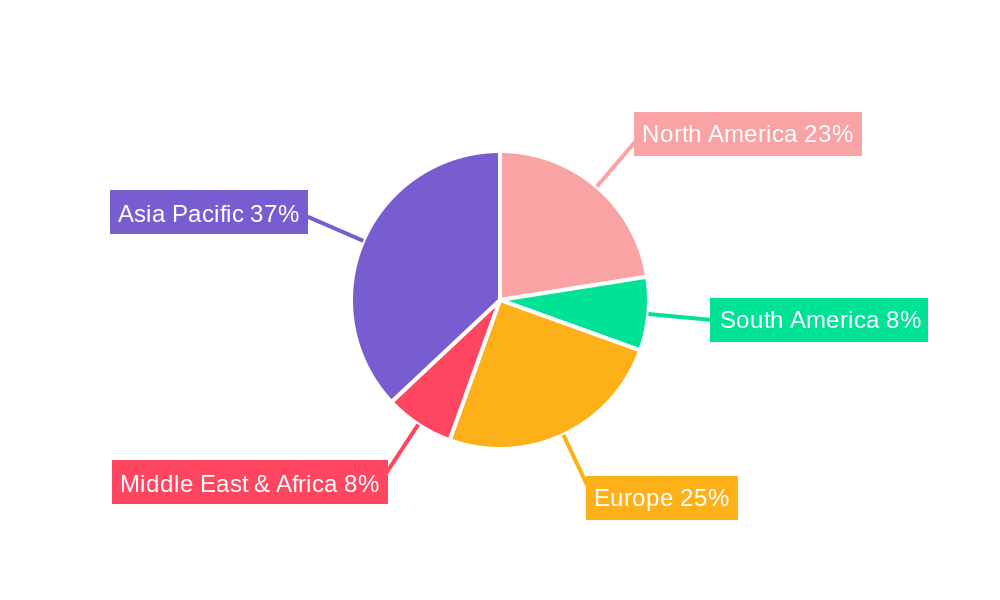

The World Battery Self-Adhesive Label Production market is a complex ecosystem influenced by regional manufacturing capabilities, regulatory frameworks, and the concentration of battery production and consumption. In terms of regions, Asia-Pacific is anticipated to be the dominant force, driven by its status as a global manufacturing hub for consumer electronics and, increasingly, for electric vehicles and battery components. Countries like China, South Korea, and Japan are at the forefront of battery innovation and production, creating a substantial and sustained demand for high-quality battery self-adhesive labels. North America and Europe also represent significant markets, propelled by the strong growth in EV adoption, renewable energy storage solutions, and stringent safety regulations that mandate comprehensive labeling.

Within the segments, the Rechargeable Battery application is expected to exhibit the most significant dominance. This is directly correlated with the widespread use of rechargeable batteries in virtually all portable electronic devices, from smartphones and laptops to power tools and medical equipment. The continuous upgrade cycles for these devices, coupled with the increasing global penetration of smartphones and other battery-dependent gadgets, ensure a consistent and growing demand for their labels.

Furthermore, within the Type segmentation, PET (Polyethylene Terephthalate) labels are projected to hold a commanding share of the market. PET offers an excellent balance of durability, chemical resistance, temperature tolerance, and printability, making it an ideal material for the harsh environments and demanding conditions often associated with battery manufacturing and usage. Its versatility allows for various finishes and functionalities, including tamper-evident features and high-resolution graphics for branding and critical information display.

The battery self-adhesive label industry is experiencing significant growth fueled by several key catalysts. The relentless expansion of the electric vehicle (EV) market is a paramount driver, demanding robust and informative labeling for high-capacity battery packs. Concurrently, the proliferation of smart devices and the Internet of Things (IoT) ecosystem necessitates labels for a vast array of smaller, specialized batteries. Furthermore, government initiatives promoting renewable energy and energy storage solutions are indirectly boosting the demand for labels used in these applications. Innovations in label materials, offering enhanced durability, temperature resistance, and tamper-evident features, are also acting as growth catalysts by enabling their use in more demanding environments and for security purposes.

This report offers an exhaustive examination of the Battery Self-Adhesive Label market, providing deep insights into its current state and future prospects. It meticulously analyzes market dynamics, including growth drivers such as the burgeoning electric vehicle sector and the increasing demand for consumer electronics. The report delves into the challenges, such as fluctuating raw material costs and evolving regulatory landscapes, offering strategic perspectives on how to navigate them. Furthermore, it provides a detailed segmentation analysis, highlighting the dominant trends in label types like PET and PVC, and key application areas such as rechargeable and mobile phone batteries. The comprehensive coverage ensures that stakeholders, from manufacturers to end-users and investors, gain a holistic understanding of this vital and rapidly evolving market.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Powerstik, Label-Aid, Imagetek Labels, Hally Labels, ShreeMulti Sticks & Labels Private Limited, Monarch graphics, S.Anand Packaging, Durga Holographics Private Limited, Anandha Print Solutions, Holosafe Security Labels, Concept Labels & Packaging Company, Papa Mango, Weifang New Star Label Products, Jiangsu Jinghong New Mstar Technology, Suzhou Guanwei Thermal Paper, Dongguan Huayi Packaging, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Battery Self-Adhesive Label," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Battery Self-Adhesive Label, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.