1. What is the projected Compound Annual Growth Rate (CAGR) of the Battery Grade Lithium Sulfide?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Battery Grade Lithium Sulfide

Battery Grade Lithium SulfideBattery Grade Lithium Sulfide by Type (99.9%, 99.99%), by Application (Sulfide Solid Electrolytes, Lithium-sulfur Batteries Electrodes), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

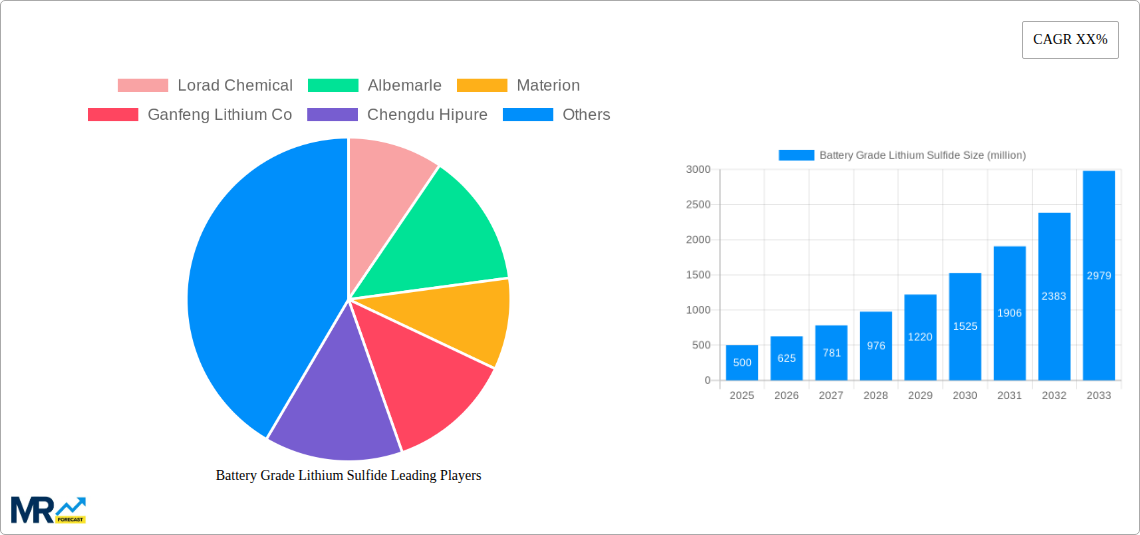

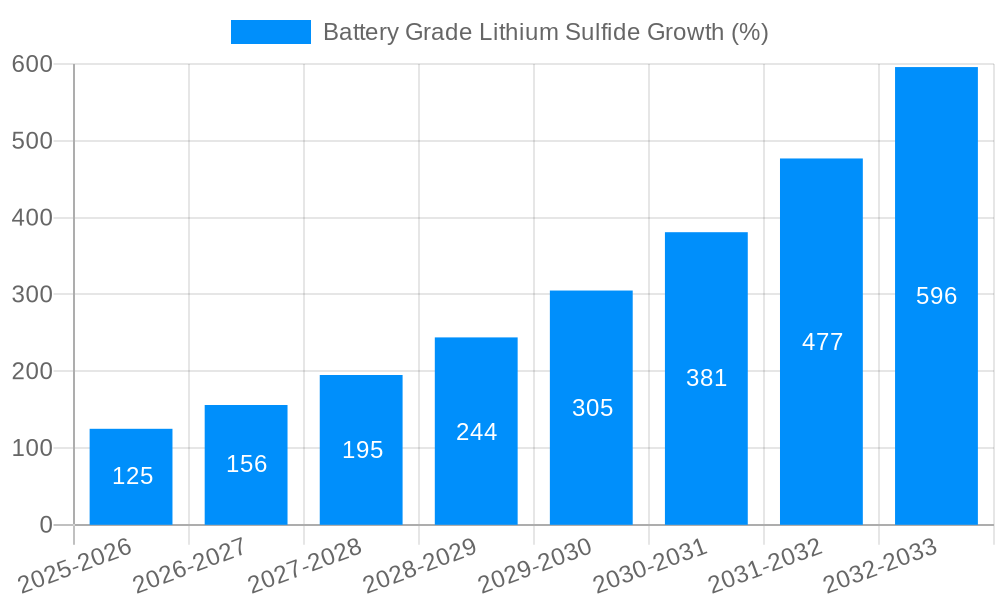

The global Battery Grade Lithium Sulfide market is poised for significant expansion, estimated to reach approximately USD 700 million in 2025 and projected to grow at a robust Compound Annual Growth Rate (CAGR) of 18% through 2033. This dynamic growth is fueled by the escalating demand for advanced battery technologies, particularly lithium-sulfur (Li-S) batteries, which offer superior energy density and lower cost potential compared to conventional lithium-ion batteries. The primary drivers for this market surge include the burgeoning electric vehicle (EV) sector, the increasing adoption of renewable energy storage solutions, and the continuous innovation in battery materials science. As governments worldwide champion decarbonization efforts and incentivize the transition to cleaner energy, the need for high-performance, cost-effective battery components like battery-grade lithium sulfide intensifies. The market's structure is largely dominated by high-purity grades, with 99.99% purity accounting for a substantial portion of demand, reflecting the stringent requirements for optimal battery performance and longevity.

Emerging trends within the Battery Grade Lithium Sulfide market revolve around advancements in synthesis techniques to improve purity and reduce production costs, alongside the development of novel electrolyte formulations that enhance the stability and cycle life of Li-S batteries. The application segment of sulfide solid electrolytes and lithium-sulfur battery electrodes are the key growth areas, signifying a direct correlation between the advancement of Li-S battery technology and the demand for its core components. While the market presents immense opportunities, certain restraints, such as the technical challenges associated with polysulfide shuttling in Li-S batteries and the initial high cost of production for ultra-high purity grades, need to be addressed. Key players like Lorad Chemical, Albemarle, and Ganfeng Lithium Co. are actively investing in research and development to overcome these challenges and capture a larger market share, particularly within the rapidly growing Asia Pacific region, which is anticipated to lead in terms of both production and consumption due to its strong manufacturing base and burgeoning EV market.

This report offers a comprehensive analysis of the global Battery Grade Lithium Sulfide market, focusing on its evolution, drivers, challenges, and future trajectory. The study encompasses a detailed examination of trends, key players, and technological advancements from the historical period of 2019-2024, with the base year set at 2025 and an extensive forecast period extending to 2033. We delve into the intricate dynamics shaping this crucial component for next-generation battery technologies.

The Battery Grade Lithium Sulfide market is experiencing an unprecedented surge in interest and investment, driven by the relentless pursuit of superior energy storage solutions. Throughout the historical period (2019-2024), the market witnessed steady growth, primarily fueled by early-stage research and development in advanced battery chemistries. However, the base year (2025) marks a significant inflection point, with burgeoning demand from niche applications and increasing commercialization efforts. The forecast period (2025-2033) is poised for exponential expansion, as lithium-sulfur (Li-S) batteries transition from laboratory curiosities to viable commercial alternatives. This growth is intrinsically linked to the intrinsic advantages of Li-S batteries, including their exceptionally high theoretical energy density, which promises lighter and more powerful energy storage systems for electric vehicles, portable electronics, and grid-scale storage. The market is witnessing a pronounced shift towards higher purity grades, with 99.99% purity becoming increasingly sought after for demanding applications where even trace impurities can significantly impact battery performance and lifespan. Furthermore, the development of novel synthesis methods and purification techniques is crucial to meeting this demand and ensuring cost-effectiveness. The increasing investment in research and development by both established chemical manufacturers and emerging battery technology companies underscores the transformative potential of lithium sulfide. Industry experts anticipate that by 2025, the market will be characterized by a growing number of strategic partnerships and collaborations aimed at scaling up production and optimizing battery performance. The focus is also shifting towards sustainable sourcing and manufacturing practices, reflecting the broader industry trend towards environmental responsibility. The inherent challenges in handling and processing lithium sulfide, such as its reactivity and hygroscopic nature, are being actively addressed through innovative encapsulation and manufacturing processes. This evolving landscape highlights a dynamic market, ripe with opportunity and innovation. The projected market size, estimated to reach several million units by the end of the forecast period, underscores the significant economic potential and strategic importance of battery grade lithium sulfide in the global energy transition. The increasing penetration of electric vehicles and the growing need for efficient grid storage solutions are expected to be the primary volume drivers.

The rapid ascent of the Battery Grade Lithium Sulfide market is propelled by a confluence of powerful drivers, chief among them being the global imperative for enhanced energy density in battery technologies. The theoretical energy density of lithium-sulfur batteries far surpasses that of current lithium-ion counterparts, making them an attractive proposition for applications demanding extended operational lifespans and reduced weight. This is particularly relevant for the electric vehicle (EV) sector, where range anxiety and vehicle weight are critical considerations. As governments worldwide implement stringent emissions regulations and incentivize EV adoption, the demand for advanced battery chemistries like Li-S is set to skyrocket. Furthermore, the decreasing cost of lithium and sulfur, coupled with advancements in material processing, is making Li-S batteries more economically viable. The increasing sophistication of research and development efforts, supported by substantial funding from both public and private sectors, is continuously unlocking new possibilities for improving Li-S battery performance, addressing current limitations, and accelerating their commercialization timeline. The growing consumer appetite for lighter, more powerful portable electronic devices also contributes to this demand, pushing the boundaries of current battery capabilities. The strategic importance of secure and sustainable energy storage solutions in an era of geopolitical instability and climate change further bolsters the market's growth trajectory.

Despite its immense promise, the Battery Grade Lithium Sulfide market faces several significant challenges and restraints that temper its immediate growth. A primary hurdle lies in the inherent instability and reactivity of lithium sulfide, particularly its tendency to form polysulfides during the charge-discharge cycles. This phenomenon, known as the "polysulfide shuttle," leads to capacity fading and a reduced lifespan for Li-S batteries, necessitating sophisticated electrolyte formulations and electrode designs to mitigate these issues. The complex and often multi-step synthesis and purification processes required to achieve high-purity battery grade lithium sulfide contribute to higher production costs compared to more established battery materials. This cost factor remains a significant barrier to widespread commercial adoption, especially in cost-sensitive markets. Furthermore, the handling and processing of lithium sulfide require specialized infrastructure and stringent safety protocols due to its sensitivity to moisture and air, adding to operational complexities and expenses. The lack of standardized manufacturing processes and quality control measures across different producers can also lead to inconsistencies in product quality, impacting the reliability of Li-S battery performance. Consumer and industry perception, still largely dominated by the proven reliability of lithium-ion batteries, represents another restraint, requiring significant education and demonstration of Li-S battery advantages to gain widespread acceptance. The scaling up of production from laboratory to industrial levels presents engineering and logistical challenges, further impacting cost-effectiveness and market penetration.

The Battery Grade Lithium Sulfide market is poised for significant growth, with specific regions and segments set to spearhead this expansion.

Dominant Segments:

Application: Sulfide Solid Electrolytes: This segment is expected to be a primary growth engine. The development of sulfide-based solid-state electrolytes offers a compelling pathway to overcome the safety concerns associated with liquid electrolytes in conventional batteries. Lithium sulfide is a crucial precursor for many of these advanced solid electrolytes, which promise enhanced ionic conductivity, improved thermal stability, and the potential for higher energy densities. The ongoing research and development efforts focused on optimizing the composition and structure of sulfide solid electrolytes, such as Li$2$S-P$2$S$_5$ based systems, are directly fueling the demand for high-purity battery grade lithium sulfide. As these solid-state batteries move closer to commercialization, particularly for applications demanding superior safety and performance, this segment will witness substantial growth. Companies are investing heavily in understanding and controlling the interfacial resistance between solid electrolytes and electrodes, a critical factor for achieving practical battery performance. The potential to eliminate flammable liquid electrolytes makes sulfide solid electrolytes particularly attractive for next-generation electric vehicles and consumer electronics.

Type: 99.99% Purity: The demand for ultra-high purity lithium sulfide (99.99%) is projected to outpace that of lower purity grades. This is driven by the stringent requirements of advanced battery chemistries where even trace impurities can significantly degrade electrochemical performance, cycle life, and overall battery safety. For applications like sulfide solid electrolytes and high-performance lithium-sulfur battery electrodes, the presence of contaminants such as sodium, potassium, calcium, or iron can lead to increased internal resistance, accelerated side reactions, and premature battery failure. Manufacturers are therefore prioritizing the development and implementation of advanced purification techniques to meet the exacting standards of these cutting-edge battery technologies. The investment in state-of-the-art manufacturing facilities capable of producing and verifying 99.99% purity lithium sulfide is a testament to its critical role in future battery innovations.

Key Regions/Countries Poised for Dominance:

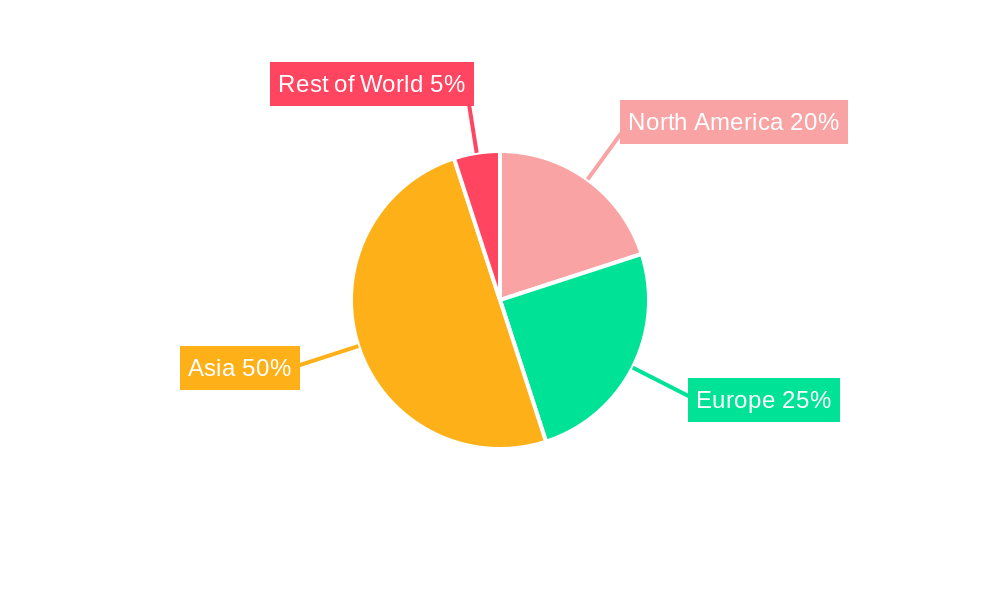

Asia-Pacific: This region, particularly China, is expected to be a dominant force in the Battery Grade Lithium Sulfide market. China's established leadership in battery manufacturing, encompassing both lithium-ion and emerging battery technologies, provides a strong foundation for growth. The country's extensive supply chain for battery raw materials, coupled with substantial government support for electric vehicles and renewable energy storage, creates a highly favorable ecosystem. Major lithium producers and battery material suppliers are based in this region, driving innovation and production capacity for lithium sulfide. The rapid adoption of electric vehicles in China, coupled with its ambitious targets for renewable energy integration, will further accelerate demand.

North America: The United States is emerging as a significant player, driven by substantial investments in advanced battery research and development, particularly in solid-state battery technologies. Government initiatives, such as the Bipartisan Infrastructure Law, are channeling significant funding into domestic battery manufacturing and supply chains. The presence of leading research institutions and technology companies focusing on next-generation energy storage solutions positions North America for substantial growth in the higher purity segments of the lithium sulfide market. The increasing focus on securing critical mineral supply chains also contributes to domestic production efforts.

Europe: Europe is demonstrating a strong commitment to transitioning to sustainable energy and electric mobility, leading to increased demand for advanced battery materials. Countries like Germany, France, and Sweden are investing heavily in battery gigafactories and research consortia aimed at developing and commercializing next-generation battery technologies, including those utilizing lithium sulfide. The emphasis on circular economy principles and sustainable manufacturing practices within Europe will also influence the production and sourcing of battery grade lithium sulfide.

The interplay between these dominant segments and regions will define the market landscape in the coming years, with innovation and strategic partnerships playing a crucial role in shaping the trajectory of Battery Grade Lithium Sulfide.

The Battery Grade Lithium Sulfide industry is propelled by several key growth catalysts. The relentless demand for higher energy density batteries in electric vehicles and portable electronics, driven by consumer expectations and regulatory pressures, is a primary driver. Significant advancements in materials science and engineering, leading to improved performance and reduced costs of lithium-sulfur batteries, are unlocking new market opportunities. Government incentives and policies promoting renewable energy storage and electric mobility further accelerate adoption. Furthermore, the growing focus on developing safer and more sustainable battery technologies, where solid-state electrolytes derived from lithium sulfide show immense potential, acts as a significant catalyst for market expansion.

This report provides an exhaustive overview of the Battery Grade Lithium Sulfide market, meticulously analyzing its growth trajectory from 2019 to 2033. It delves into the intricate interplay of market drivers, challenges, and opportunities, offering insights into regional dynamics and segment-specific trends. The report examines the competitive landscape, highlighting key players and their strategic initiatives. Furthermore, it explores the technological advancements and industry developments shaping the future of lithium sulfide in next-generation battery applications, including the promising arena of solid-state electrolytes and enhanced lithium-sulfur battery electrodes. The comprehensive coverage ensures a deep understanding of this pivotal market.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Lorad Chemical, Albemarle, Materion, Ganfeng Lithium Co, Chengdu Hipure, Hangzhou Kaiyada, Hubei Xinrunde, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Battery Grade Lithium Sulfide," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Battery Grade Lithium Sulfide, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.