1. What is the projected Compound Annual Growth Rate (CAGR) of the Ballistic and Tactical Eyewear?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Ballistic and Tactical Eyewear

Ballistic and Tactical EyewearBallistic and Tactical Eyewear by Application (Military, Government, Law Enforcement, World Ballistic and Tactical Eyewear Production ), by Type (Ballistic & Tactical Glasses, Ballistic & Goggles, World Ballistic and Tactical Eyewear Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

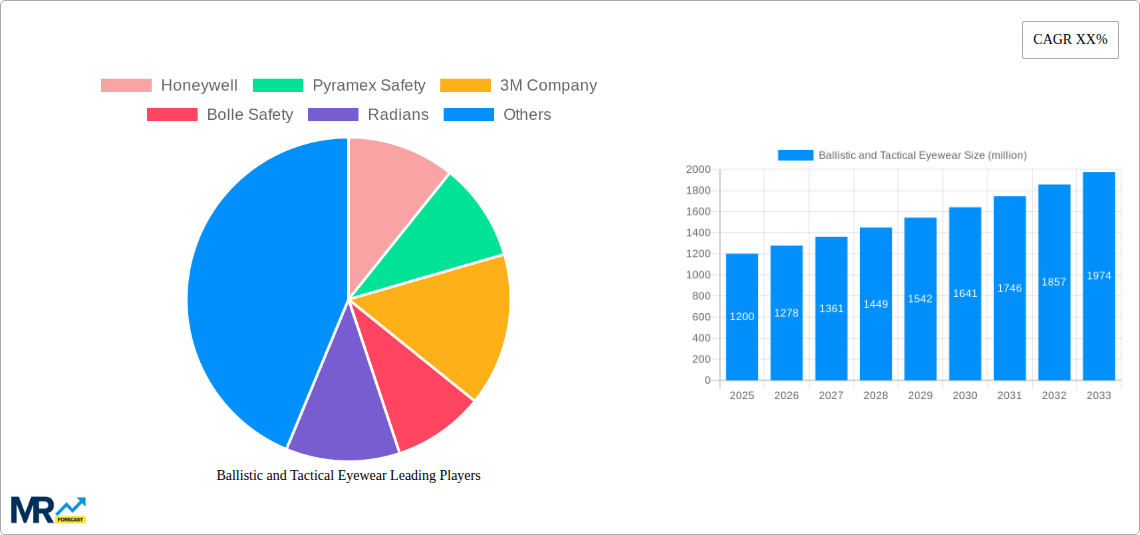

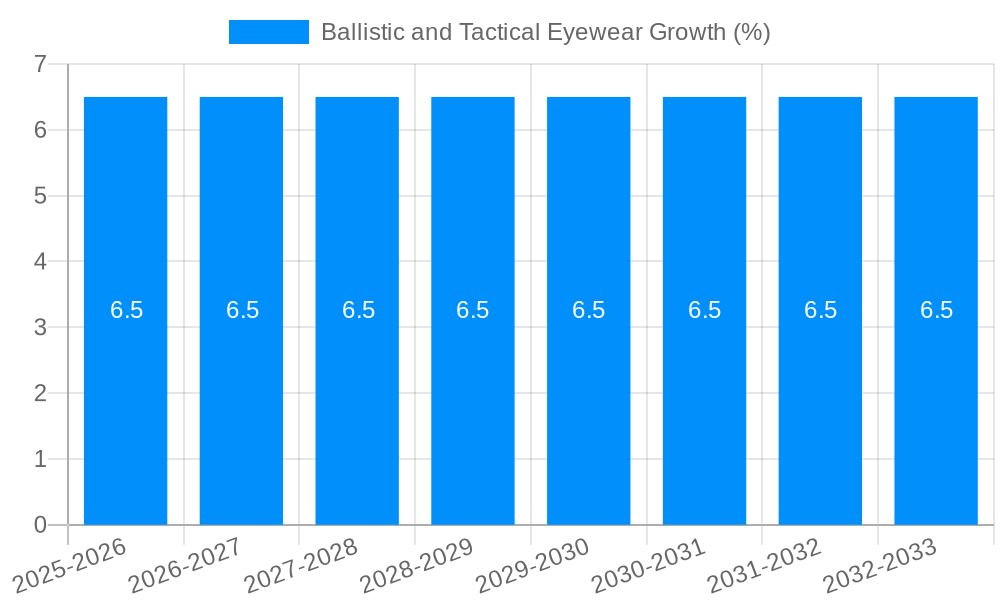

The global ballistic and tactical eyewear market is poised for robust expansion, projected to reach approximately USD 1,200 million in 2025, and is expected to grow at a significant Compound Annual Growth Rate (CAGR) of around 6.5% during the forecast period of 2025-2033. This impressive growth is primarily fueled by increasing demand from military and law enforcement agencies worldwide, driven by a continuous need for enhanced soldier and officer protection in diverse operational environments. The rising awareness among tactical professionals regarding the critical importance of high-impact, shatter-resistant eyewear in preventing serious eye injuries further propels market adoption. Furthermore, advancements in materials science and manufacturing technologies are leading to the development of lighter, more durable, and optically superior eyewear solutions, catering to the evolving requirements of these demanding sectors.

The market's trajectory is also influenced by several emerging trends. A notable trend is the increasing integration of advanced features such as prescription lens compatibility, anti-fog coatings, and enhanced UV protection into ballistic and tactical eyewear. The growing emphasis on customized eyewear solutions for specific operational needs and individual user preferences is another key factor driving innovation and market penetration. However, the market faces certain restraints, including the high cost associated with premium ballistic eyewear and the prevalence of counterfeit products that may compromise safety standards. Despite these challenges, the continuous technological evolution, coupled with the unwavering commitment to soldier and officer safety, ensures a dynamic and promising outlook for the ballistic and tactical eyewear market. The market is segmented into Ballistic & Tactical Glasses and Ballistic & Goggles, with applications spanning military, government, and law enforcement sectors, all contributing to the overall market's value and volume.

This report provides an in-depth analysis of the global Ballistic and Tactical Eyewear market, encompassing production, segmentation, and future projections. Covering the historical period from 2019-2024 and extending to a forecast period of 2025-2033, with a base year of 2025, this study offers critical insights for industry stakeholders.

The global ballistic and tactical eyewear market is undergoing a significant transformation, driven by increasing awareness of ocular protection in high-risk environments and the relentless pursuit of enhanced performance and comfort. XXX, the market is projected to witness a robust expansion, with production expected to reach approximately 15 million units by 2025, and further growth anticipated to exceed 25 million units by 2033. This upward trajectory is fueled by a confluence of factors, including the escalating demand from military and law enforcement agencies worldwide, coupled with a growing adoption in civilian sectors such as construction, manufacturing, and extreme sports. The evolution of materials science has been pivotal, leading to the development of lightweight yet exceptionally durable polycarbonate lenses that offer superior impact resistance, meeting stringent ballistic standards like ANSI Z87.1+ and MIL-PRF-32432A. Innovations in lens coatings are also a key trend, with anti-fog, anti-scratch, and UV-protective technologies becoming standard features, significantly enhancing user experience and extending product lifespan. Furthermore, the market is observing a shift towards customizable and modular eyewear solutions. This includes interchangeable lenses for varying light conditions, adjustable temple arms for a secure and personalized fit, and integration with other tactical gear like helmets and communication systems. The aesthetic appeal is also gaining importance, with manufacturers offering sleeker, more ergonomic designs that do not compromise on protection, making these products more appealing for extended wear. The rise of e-commerce platforms has also democratized access to these specialized products, allowing a broader customer base to procure high-performance eyewear, thereby contributing to the overall market volume. The increasing investment in research and development by key players is continuously pushing the boundaries of what is possible, leading to the introduction of advanced features such as photochromic lenses that adapt to changing light, and integrated electronic components for enhanced situational awareness. This dynamic market landscape is characterized by continuous innovation and a strong focus on meeting the evolving needs of its diverse user base.

The robust growth of the ballistic and tactical eyewear market is primarily propelled by an unwavering commitment to soldier and officer safety. Escalating global security concerns and the increasing prevalence of asymmetric warfare tactics necessitate advanced protection for personnel operating in hazardous environments. Consequently, governments and defense organizations worldwide are prioritizing the procurement of high-performance eyewear that can withstand ballistic impacts and provide comprehensive ocular protection. This demand is further amplified by stringent regulatory frameworks and performance standards that mandate the use of certified protective eyewear in military and law enforcement operations. Beyond these critical sectors, the market is also experiencing significant traction from the industrial and construction sectors. Workers in these fields face daily risks of debris, chemical splashes, and impact hazards, leading to a heightened demand for reliable ballistic and tactical eyewear. Furthermore, the expanding popularity of outdoor recreational activities such as shooting sports, hunting, and tactical training has broadened the consumer base for this specialized gear. Manufacturers are responding to this demand by developing more comfortable, lightweight, and visually clear eyewear, incorporating advanced technologies like anti-fog and anti-scratch coatings. The continuous innovation in material science, leading to stronger and lighter protective materials, also plays a crucial role in driving market expansion.

Despite the promising growth trajectory, the ballistic and tactical eyewear market faces several significant challenges and restraints that could temper its expansion. One of the primary hurdles is the high cost of production and the premium pricing associated with advanced ballistic and tactical eyewear. The specialized materials, rigorous testing, and intricate manufacturing processes required to meet stringent safety standards contribute to a higher retail price, which can be a deterrent for some segments of the market, particularly for civilian applications or budget-constrained agencies. Furthermore, the proliferation of counterfeit and substandard products poses a significant threat. The demand for protective eyewear can attract unscrupulous manufacturers who produce low-quality imitations that do not meet safety certifications, potentially leading to serious injuries and eroding consumer trust in genuine products. The complexity of procurement processes for government and military contracts can also act as a restraint. Navigating lengthy bidding procedures, intricate specifications, and bureaucratic approvals can be time-consuming and challenging for manufacturers, potentially delaying market penetration. Lack of widespread awareness regarding the necessity and benefits of high-performance tactical eyewear in certain civilian sectors also limits market penetration. While industrial safety regulations are in place, the understanding and adoption of ballistic-grade protection may not be uniform, especially in smaller enterprises or less hazardous environments. Finally, rapid technological obsolescence can be a challenge. As new materials and technologies emerge, older models can quickly become outdated, requiring continuous investment in research and development to remain competitive, which can strain the resources of smaller companies.

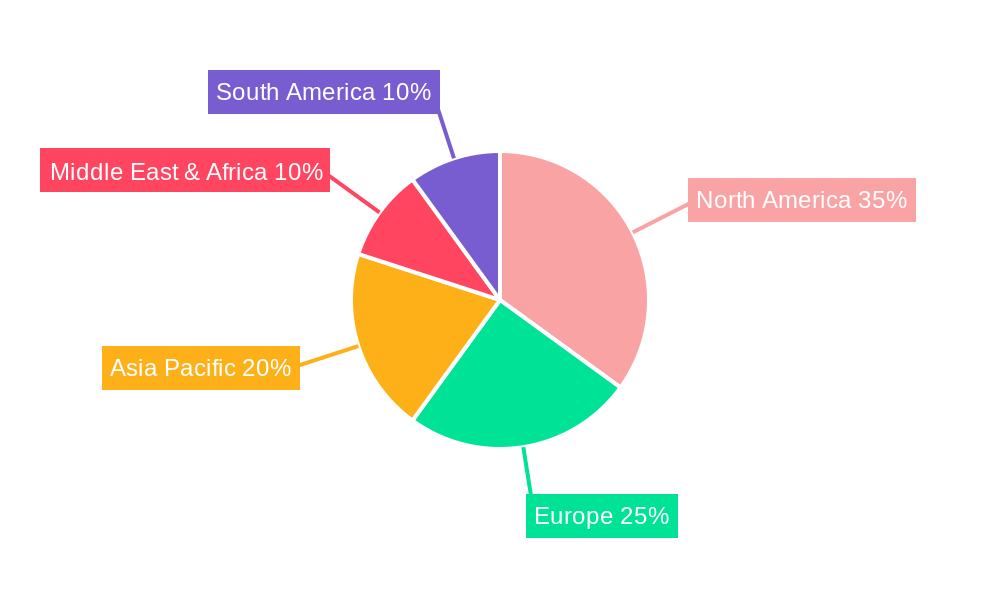

The global ballistic and tactical eyewear market is characterized by the dominance of specific regions and segments, each contributing significantly to the overall market volume and value.

Key Dominating Regions:

Key Dominating Segment: Application - Military

Within the various application segments, the Military application stands out as the primary revenue generator and volume driver for the ballistic and tactical eyewear market.

While law enforcement and government applications are also significant contributors, the scale of military procurement and the unwavering demand for the highest level of protection position the Military segment as the undisputed leader in the global ballistic and tactical eyewear market. The production volume for military-grade eyewear alone is estimated to be in the tens of millions of units annually, a figure expected to grow steadily through the forecast period.

The ballistic and tactical eyewear industry is poised for sustained growth, fueled by several key catalysts. The primary growth catalyst remains the increasing global emphasis on soldier and officer safety, driven by geopolitical instability and the evolving nature of conflict. Governments worldwide are prioritizing the modernization of their armed forces and law enforcement agencies, leading to substantial investments in advanced protective equipment, including high-performance eyewear. Furthermore, the expanding adoption of ballistic and tactical eyewear in the civilian industrial and recreational sectors is a significant growth driver. As awareness of potential eye hazards in construction, manufacturing, and shooting sports increases, so does the demand for reliable protective eyewear. Innovations in material science and optical technology are also acting as catalysts, enabling the development of lighter, more durable, and more comfortable eyewear with enhanced features like improved clarity and impact resistance.

This comprehensive report delves into the multifaceted global ballistic and tactical eyewear market, providing an exhaustive analysis from 2019 to 2033. It meticulously examines production volumes, projected to reach millions of units, and forecasts future market trends with a base year of 2025 and a forecast period extending to 2033. The report meticulously dissects the market into key segments, including applications such as Military, Government, and Law Enforcement, as well as product types like Ballistic & Tactical Glasses and Ballistic & Goggles. It further explores significant industry developments and the impact of technological advancements on the market's trajectory. By identifying the driving forces and challenges, along with key regional and segment dominance, this report offers invaluable insights for stakeholders aiming to navigate and capitalize on the evolving landscape of ballistic and tactical eyewear. The leading players have been identified, and their contributions to market innovation highlighted, ensuring a complete overview of this critical safety and performance-enhancing sector.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Honeywell, Pyramex Safety, 3M Company, Bolle Safety, Radians, Gatorz, Oakley, SPY OPTIC, Wiley X, Blueye Tactical Eyewear, .

The market segments include Application, Type.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Ballistic and Tactical Eyewear," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Ballistic and Tactical Eyewear, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.