1. What is the projected Compound Annual Growth Rate (CAGR) of the Backingless Tape?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Backingless Tape

Backingless TapeBackingless Tape by Type (Acrylic Backing Tape, Silicone Backingless Tape, Hot Melt Linerless Tape, Rubber Backing Tape), by Application (Electronic Industry, Automobile Industry, Medical Industry, Achitechive, Printing Industry, Packaging Industry, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

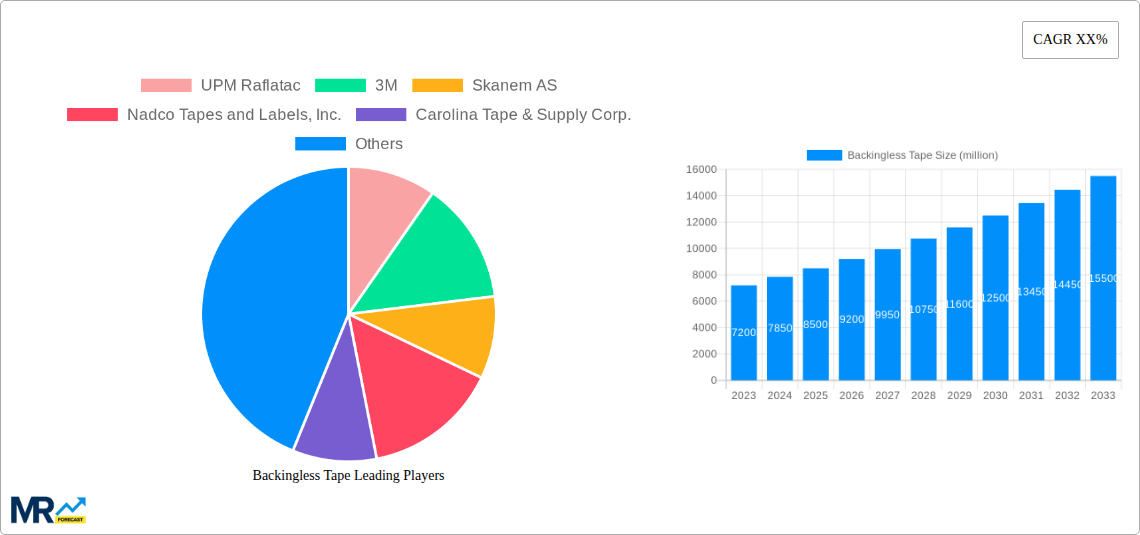

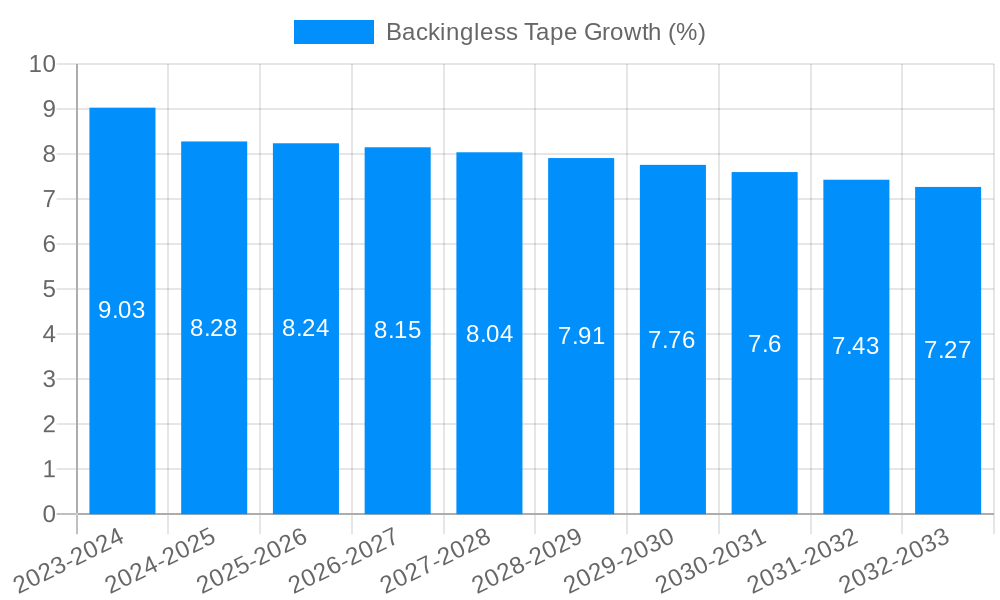

The global backingless tape market is poised for significant expansion, projected to reach approximately USD 8,500 million by 2025, with an estimated Compound Annual Growth Rate (CAGR) of around 7.5% through 2033. This robust growth is primarily fueled by the increasing demand across diverse industrial sectors, notably the electronics, automotive, and medical industries, where precision, reduced waste, and enhanced efficiency are paramount. The inherent advantages of backingless tapes, such as their reduced material usage, lower shipping weight, and minimized environmental footprint compared to traditional tapes, are major drivers. Furthermore, ongoing technological advancements in adhesive formulations and manufacturing processes are leading to the development of specialized backingless tapes with improved performance characteristics, including enhanced tack, shear strength, and temperature resistance, further broadening their application scope and market appeal.

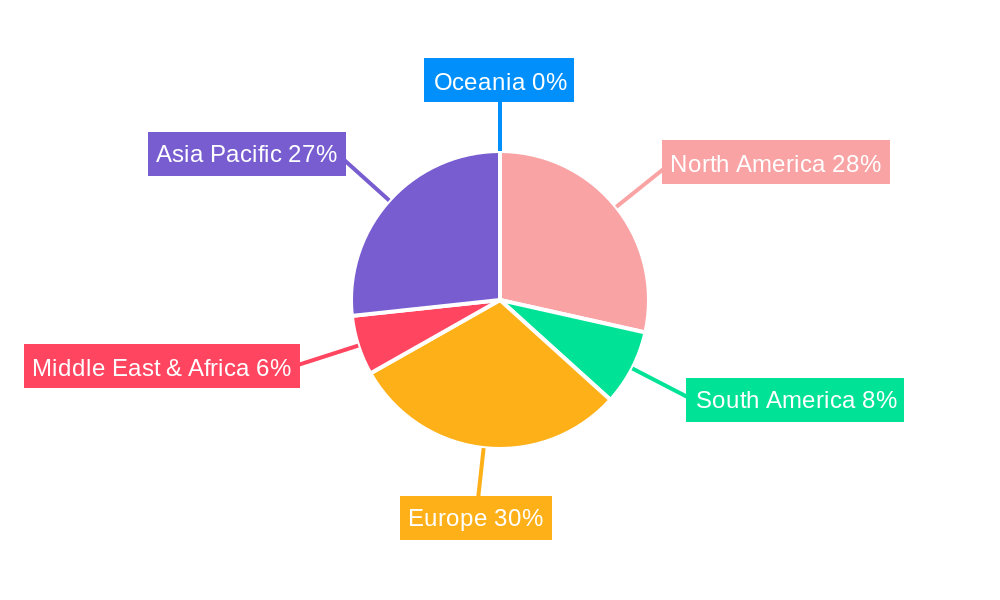

The market segmentation reveals a dynamic landscape, with Acrylic Backing Tape and Silicone Backingless Tape currently dominating due to their established versatility and performance. However, the emergence and increasing adoption of Hot Melt Linerless Tape are set to disrupt this, offering a compelling combination of cost-effectiveness and environmental benefits. Restraints such as the initial higher cost of some advanced backingless tape formulations and the need for specialized application equipment in certain scenarios are being addressed through innovation and economies of scale. Geographically, Asia Pacific, led by China and India, is expected to be the fastest-growing region, driven by its burgeoning manufacturing sector and increasing adoption of advanced materials. North America and Europe remain significant markets, benefiting from established industrial bases and a strong emphasis on sustainable packaging and manufacturing solutions.

This report offers an in-depth analysis of the global Backingless Tape market, meticulously examining market dynamics, growth drivers, challenges, and future projections. The study covers the historical period from 2019 to 2024, with a base year of 2025 and extends through a comprehensive forecast period from 2025 to 2033. The report leverages extensive primary and secondary research, including expert interviews and market intelligence, to provide actionable insights for stakeholders. The global Backingless Tape market is projected to witness a significant upward trajectory, driven by the increasing demand for sustainable and efficient labeling and bonding solutions across various industries. With an estimated market size of over 500 million USD in the base year of 2025, the market is poised for substantial growth, potentially reaching over 950 million USD by 2033, exhibiting a compound annual growth rate (CAGR) of approximately 8.5%. This growth is fueled by the inherent advantages of backingless tapes, such as reduced material usage, lower shipping costs, and enhanced environmental profiles compared to traditional tapes. The report delves into the nuanced performance of different backingless tape types, including Acrylic Backing Tape, Silicone Backingless Tape, Hot Melt Linerless Tape, and Rubber Backing Tape, analyzing their specific market penetration and growth potential. Furthermore, it provides a detailed segmental analysis across key application industries, including the Electronic Industry, Automobile Industry, Medical Industry, Architecture, Printing Industry, Packaging Industry, and 'Others'. The impact of evolving industry regulations, technological advancements in adhesive formulations, and the growing consumer preference for eco-friendly products are thoroughly explored as key influencers shaping the market landscape. The report also identifies emerging trends and opportunities, such as the development of specialized backingless tapes for niche applications and the increasing adoption of these solutions in high-growth emerging economies.

The global Backingless Tape market is experiencing a transformative period, marked by a growing shift towards sustainable and efficient adhesive solutions. This trend is primarily driven by an increasing awareness of environmental concerns and the regulatory push for reduced waste. Traditional tapes, with their inherent backing material, contribute significantly to landfill waste and increased shipping volumes due to added weight and bulk. Backingless tapes, by eliminating the liner, offer a compelling alternative. Over the study period of 2019-2033, with a base year of 2025, the market has observed a discernible increase in demand for these linerless solutions. The estimated market size, currently over 500 million USD in 2025, is projected to exceed 950 million USD by 2033, underscoring a robust growth trajectory. Key insights reveal a strong preference for Acrylic Backing Tape due to its versatility and good performance across a wide range of temperatures and surfaces. Silicone Backingless Tape is gaining traction in applications requiring high-temperature resistance and clean removability, particularly in the automotive and electronics sectors. Hot Melt Linerless Tape is witnessing adoption in high-speed packaging operations where fast tack and strong adhesion are paramount. Rubber Backing Tape, while historically significant, is seeing its market share evolve as newer technologies emerge. The printing industry, a substantial consumer of labeling solutions, is actively exploring backingless options to streamline their production processes and reduce operational costs. Similarly, the packaging industry is leveraging the benefits of reduced material consumption and improved efficiency. The medical industry is also showing growing interest, particularly for applications requiring precise and secure labeling without adhesive residue. The overarching trend indicates a market moving towards innovation in adhesive formulations, enabling backingless tapes to meet increasingly stringent performance requirements while adhering to sustainability mandates.

The expansion of the Backingless Tape market is fueled by a confluence of powerful driving forces that highlight their inherent advantages and growing industry acceptance. A primary catalyst is the escalating emphasis on sustainability and environmental responsibility. Industries worldwide are actively seeking ways to minimize their ecological footprint, and the elimination of backing material in these tapes directly contributes to waste reduction and a decrease in carbon emissions associated with manufacturing and transportation. This resonates strongly with corporate social responsibility initiatives and evolving consumer preferences for eco-friendly products. Furthermore, economic benefits play a crucial role. By removing the backing, manufacturers achieve significant cost savings related to raw material procurement, production processes, and logistics. The reduced weight and volume of backingless tapes translate into lower shipping expenses, a critical factor in today's globalized marketplace. For instance, companies can transport a larger volume of product in the same shipping container, leading to substantial operational efficiencies. Technological advancements in adhesive science are also instrumental in this growth. Innovations in formulating pressure-sensitive adhesives have led to backingless tapes that offer superior adhesion, durability, and specialized properties, such as resistance to extreme temperatures, chemicals, and UV radiation. This allows for their application in increasingly demanding environments and industries, broadening their market reach. The inherent simplicity and operational efficiency offered by backingless tapes are also appealing. In applications like label printing and application, the absence of a liner simplifies the process, reduces potential for errors, and can increase throughput. This efficiency gain is particularly attractive to high-volume industries.

Despite the robust growth potential, the Backingless Tape market is not without its challenges and restraints that could impede its widespread adoption. A significant hurdle is the initial cost of specialized printing and application equipment. While the long-term savings are evident, the upfront investment required to transition from traditional liner-based systems to linerless solutions can be a deterrent for some businesses, particularly smaller enterprises with limited capital. The learning curve associated with new application techniques and potential issues with adhesive management in linerless formats can also pose a challenge. Ensuring consistent adhesive application and preventing premature curing or contamination requires careful process control and trained personnel. Another restraint stems from the perception of performance limitations in certain niche applications. While backingless tapes have made significant advancements, some highly specialized requirements, such as extreme tensile strength or the need for intricate die-cutting on delicate substrates, may still favor traditional tapes with a stable backing. Furthermore, the availability and complexity of specialized backingless tape formulations can be limited compared to the vast array of traditional tape options. Developing custom solutions for unique industrial needs can be time-consuming and costly. Supply chain disruptions and the availability of raw materials for advanced adhesive formulations can also present occasional challenges, potentially impacting production schedules and pricing. The inherent stickiness of linerless tapes, while an advantage in application, can also lead to challenges in handling and storage, requiring careful management to prevent accidental adhesion and contamination.

The Backingless Tape market is poised for dominance by specific regions and application segments due to a combination of technological adoption, industrial demand, and favorable regulatory environments.

Dominant Regions:

Dominant Segments:

Several key growth catalysts are propelling the Backingless Tape industry forward. Foremost among these is the escalating global commitment to sustainability and waste reduction. Industries are actively seeking eco-friendly alternatives to minimize their environmental impact, and backingless tapes, by eliminating the need for backing material, directly address this imperative. This aligns with increasing regulatory pressures and consumer demand for greener products and processes. Technological advancements in adhesive formulations are also playing a crucial role. Innovations are leading to backingless tapes with enhanced performance characteristics, such as superior adhesion, temperature resistance, and chemical inertness, enabling their use in more demanding applications. The pursuit of operational efficiency and cost optimization across various sectors, including packaging and electronics, is another significant catalyst. Backingless tapes offer reduced material usage, lighter shipping weights, and streamlined application processes, translating into tangible cost savings for businesses. The growing adoption in emerging economies, driven by industrialization and increasing environmental awareness, further fuels market expansion.

This report provides a comprehensive overview of the Backingless Tape market, offering detailed insights into trends, drivers, challenges, and future projections. It meticulously analyzes the market from 2019 to 2033, with a base year of 2025, encompassing a thorough examination of key segments such as Acrylic Backing Tape, Silicone Backingless Tape, Hot Melt Linerless Tape, and Rubber Backing Tape. Furthermore, it delves into the market's penetration and growth across critical application industries including the Electronic Industry, Automobile Industry, Medical Industry, Architecture, Printing Industry, and Packaging Industry. The report identifies and elaborates on the key growth catalysts, such as the increasing demand for sustainable solutions, technological advancements in adhesive formulations, and the pursuit of operational efficiency. It also highlights the leading players in the market and their significant contributions through recent developments. This report serves as an invaluable resource for manufacturers, suppliers, investors, and other stakeholders seeking a deep understanding of the Backingless Tape market landscape.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include UPM Raflatac, 3M, Skanem AS, Nadco Tapes and Labels, Inc., Carolina Tape & Supply Corp., MBK Tape Solutions, Can-Do National Tape, Inc., Multi-Action, Sure-Foot Industries Corp., Fabri-Tech Components, Inc., Lanmar Inc., Associated Bag, Champion Tape, Neway Packaging Corporation, RRD, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Backingless Tape," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Backingless Tape, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.