1. What is the projected Compound Annual Growth Rate (CAGR) of the Baby Toys?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Baby Toys

Baby ToysBaby Toys by Type (Electronic, Soft, Educational, Others, World Baby Toys Production ), by Application (0-6 Months, 6 Month-1 years old, Above 1 years old, World Baby Toys Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

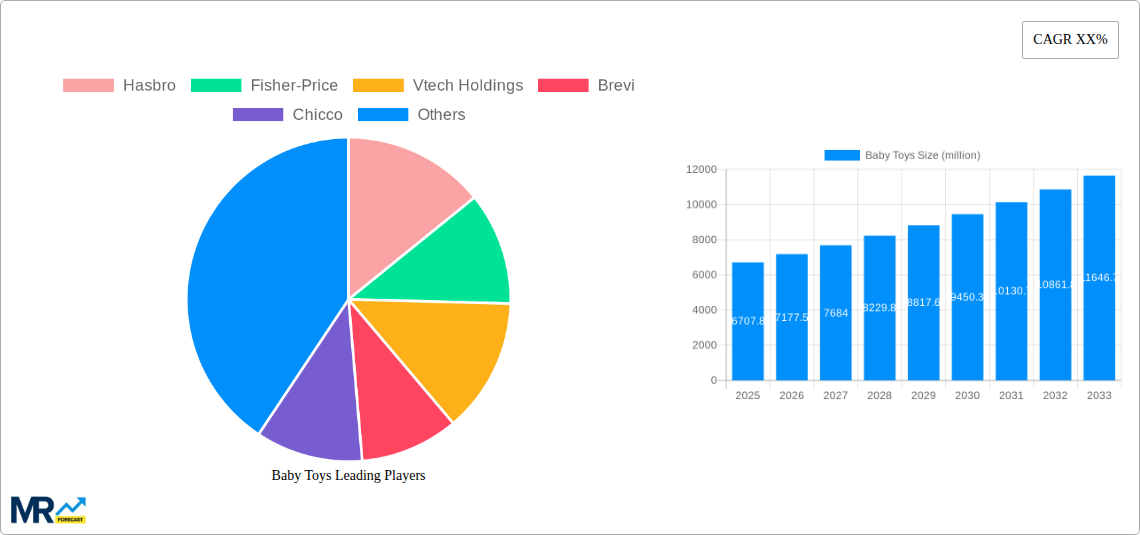

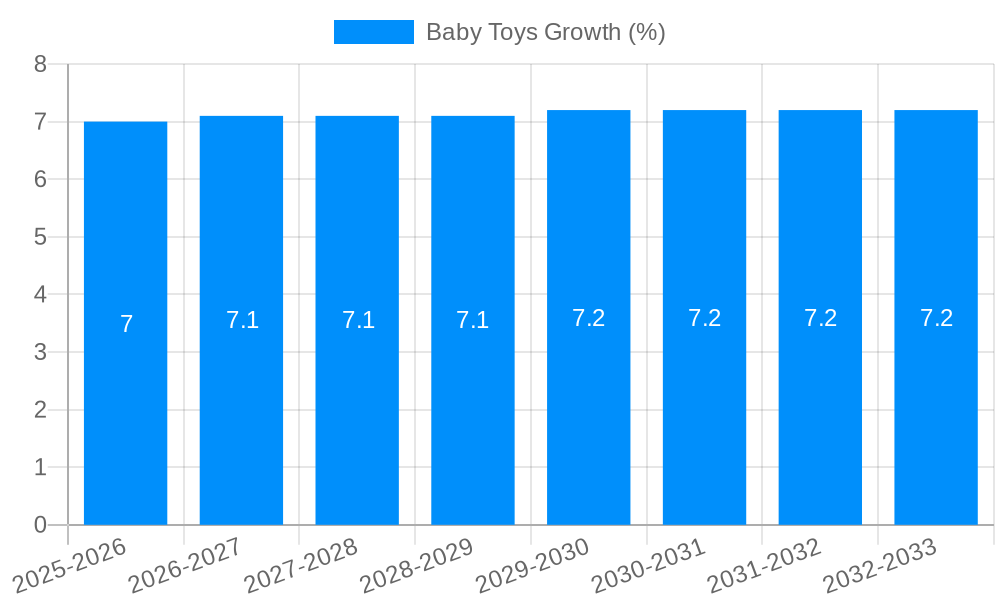

The global baby toys market is poised for significant growth, currently valued at an estimated $6707.8 million. Driven by increasing disposable incomes, a growing awareness of early childhood development, and a constant influx of innovative products, the market is expected to expand at a Compound Annual Growth Rate (CAGR) of approximately 7-9% through 2033. Parents worldwide are prioritizing educational and interactive toys that foster cognitive, motor, and sensory skills in infants and toddlers. This trend is particularly pronounced in developed regions, but emerging economies are also showing robust growth as access to quality baby products increases. Key drivers include product diversification, with a rise in sustainable and tech-integrated toys, alongside an expanding distribution network that makes these products more accessible. The market is also benefiting from a consistent birth rate in many key regions, ensuring a sustained demand for baby essentials, including toys.

The market landscape for baby toys is characterized by a dynamic segmentation, with electronic and educational toys showing particularly strong uptake due to their perceived developmental benefits. The "Soft" toy segment, encompassing plush toys and comfort items, continues to hold a significant share due to their timeless appeal. In terms of application, the 0-6 months and 6 months to 1-year-old segments represent crucial early developmental stages, driving demand for sensory and teething toys. As children approach and surpass the one-year mark, the demand shifts towards toys that encourage exploration, problem-solving, and imaginative play. Major industry players like Hasbro, Fisher-Price, and LEGO are continuously investing in research and development to launch new product lines that cater to these evolving consumer preferences, further solidifying the market's upward trajectory. While the market is largely driven by positive factors, potential restraints such as increasing raw material costs and stringent safety regulations for toys could pose challenges, though these are generally navigated by established manufacturers through robust supply chain management and quality control.

This comprehensive report delves into the dynamic global Baby Toys market, providing an in-depth analysis and robust forecast from 2019 to 2033. With 2025 designated as the base and estimated year, and the forecast period spanning 2025-2033, this study offers critical insights into market trends, driving forces, challenges, and growth opportunities. The historical period of 2019-2024 provides context for understanding the market's evolution. The report quantifies market size in millions of units, offering a clear perspective on scale and growth.

The global baby toys market is currently undergoing a significant transformation, driven by a confluence of evolving parental preferences, technological advancements, and a growing emphasis on early childhood development. One of the most prominent trends is the increasing demand for educational toys that foster cognitive, motor, and social-emotional skills. Parents are actively seeking out toys that offer more than just entertainment, prioritizing those that can contribute to their child's learning journey. This has led to a surge in the popularity of STEM-focused toys, puzzle-based games, and interactive learning devices. The Electronic segment is experiencing substantial growth, with a move towards smart toys that incorporate app connectivity, augmented reality features, and personalized learning experiences. These toys often offer features like language learning, basic coding concepts, and problem-solving challenges, catering to the digital native generation of both parents and children. Furthermore, there is a discernible shift towards sustainable and eco-friendly toys. Concerns about environmental impact and child safety are prompting parents to opt for products made from organic materials, recycled plastics, and natural wood. Brands are increasingly adopting sustainable manufacturing practices and transparent sourcing, resonating with a conscious consumer base. The Soft Toys segment, while a traditional staple, is also evolving with an emphasis on sensory development, incorporating different textures, sounds, and interactive elements designed to stimulate infants. Moreover, the 0-6 Months application segment is witnessing innovation in the form of sensory play mats, high-contrast visual toys, and safe, chewable teething aids designed for early development. The 6 Month-1 years old segment is focusing on developing fine motor skills through stacking toys, shape sorters, and simple musical instruments, while the Above 1 years old segment is characterized by a demand for more complex building blocks, imaginative play sets, and early role-playing toys. The World Baby Toys Production is seeing a geographical shift, with emerging economies playing an increasingly vital role in both production and consumption, diversifying the global supply chain. The overarching trend is towards smarter, safer, and more developmentally enriching play experiences for babies and toddlers, reflecting a maturing understanding of the crucial role of early play in lifelong learning and well-being. The market is no longer just about simple playthings; it's about curated experiences that support holistic child development.

The global baby toys market is experiencing robust growth, propelled by a multifaceted set of drivers. A primary impetus is the increasing global birth rate, particularly in emerging economies, which directly expands the target consumer base. As more babies are born, the demand for essential infant and toddler products, including toys, naturally escalates. Coupled with this is the rising disposable income in many regions, enabling parents to invest more in their children's upbringing and well-being, including purchasing higher-quality and developmentally appropriate toys. The growing awareness among parents regarding the importance of early childhood development is a significant catalyst. Parents are increasingly educated about how play contributes to cognitive, physical, social, and emotional growth, leading them to prioritize educational and skill-building toys. This awareness is further amplified by digital media and parenting influencers who advocate for specific types of play and toys. Technological advancements are also a major driving force, particularly in the Electronic segment. Innovations such as smart toys, interactive learning apps, and augmented reality (AR) experiences are creating novel and engaging play opportunities, appealing to both children and tech-savvy parents. The increasing focus on STEM education from an early age is fueling the demand for toys that introduce basic scientific, technological, engineering, and mathematical concepts in an accessible and fun manner. Furthermore, the premiumization trend within the consumer goods sector is extending to baby products. Parents are willing to spend more on well-designed, safe, and durable toys from reputable brands, perceiving them as an investment in their child's development and future. The globalization of e-commerce has also played a crucial role, providing consumers with wider access to a diverse range of baby toys from international brands and facilitating direct-to-consumer sales, thus expanding market reach and accessibility.

Despite the promising growth trajectory, the global baby toys market is not without its challenges and restraints. A significant concern is the increasing scrutiny and stringent regulations surrounding toy safety. Manufacturers must adhere to evolving safety standards and testing protocols across different regions, which can be costly and time-consuming. Any product recall due to safety issues can severely damage brand reputation and incur substantial financial losses. The economic slowdowns and inflationary pressures in certain regions can impact consumer spending power, leading parents to postpone or reduce discretionary purchases, including premium baby toys. This makes the market susceptible to economic downturns. The intense competition within the market is another significant challenge. With numerous established players and new entrants constantly vying for market share, companies face pressure on pricing and margins. Differentiating products and building strong brand loyalty in a crowded marketplace requires substantial marketing and product innovation investment. The rapid pace of technological change can also be a double-edged sword. While driving innovation, it also necessitates continuous investment in research and development to stay competitive. Outdated electronic toys can quickly lose their appeal, requiring manufacturers to constantly update their offerings. Furthermore, environmental concerns and the push for sustainability, while a growth driver, also present challenges. Sourcing sustainable materials and implementing eco-friendly manufacturing processes can increase production costs, which may be difficult to pass on to price-sensitive consumers. The counterfeit market poses a persistent threat, with cheaper, often unsafe, imitation products undermining legitimate brands and consumer trust. Finally, changing parental preferences and trends, while creating opportunities, can also be a restraint if manufacturers fail to adapt quickly enough, leading to a decline in demand for their existing product lines.

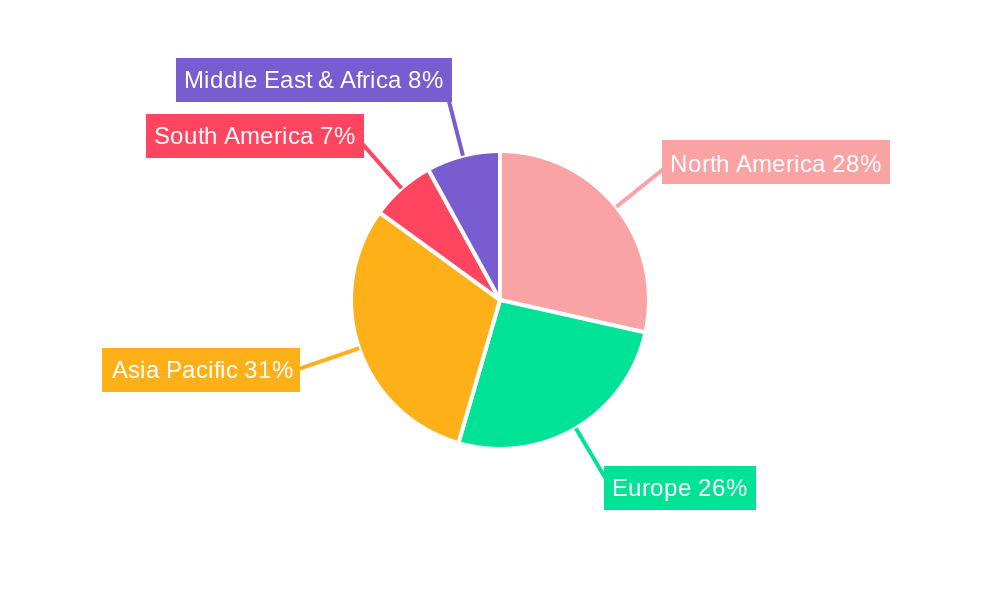

The global baby toys market is characterized by significant regional variations and a clear dominance within specific segments.

Dominant Regions/Countries:

North America (United States and Canada): This region consistently holds a leading position due to a combination of high disposable incomes, a strong emphasis on early childhood education, and a technologically savvy consumer base. Parents in North America are early adopters of innovative and educational toys, readily investing in products that promise developmental benefits. The well-established retail infrastructure, including both brick-and-mortar and online channels, further facilitates market penetration. The presence of major global toy manufacturers with a strong foothold in this region also contributes significantly to its dominance.

Europe (Germany, United Kingdom, France): Europe represents another substantial market, driven by a well-developed economy and a cultural appreciation for quality and safety in children's products. Stringent safety regulations in European countries ensure a high standard for baby toys, encouraging investment in superior manufacturing processes and materials. The increasing focus on eco-friendly and sustainable products in Europe aligns well with growing consumer demand for such options, creating a niche for environmentally conscious brands. The high birth rates in certain European countries, coupled with active government initiatives supporting early childhood development, further bolster the market.

Asia-Pacific (China, India, Japan, South Korea): While historically a manufacturing hub, the Asia-Pacific region is rapidly emerging as a significant consumption market for baby toys. The burgeoning middle class, increasing urbanization, and a strong desire among parents to provide the best for their children are fueling demand. China, in particular, with its vast population and growing affluence, is becoming a powerhouse in both production and consumption. India, with its substantial young population, presents immense untapped potential. Japan and South Korea are characterized by a high adoption rate of technologically advanced and innovative toys, mirroring the trends seen in North America and Europe.

Dominant Segments:

Type: Educational Toys: The Educational segment is poised for sustained dominance. Parents are increasingly recognizing the critical role of play in cognitive development, problem-solving abilities, and the acquisition of essential life skills. This translates into a strong demand for toys that offer structured learning experiences, such as alphabet blocks, number puzzles, shape sorters, and early coding toys. The integration of technology into educational toys, such as interactive learning apps and smart toys that provide personalized feedback, further solidifies the dominance of this segment. Brands are investing heavily in developing toys that align with early learning curricula and cater to the growing emphasis on STEM education from a very young age. The perceived value proposition of educational toys, promising long-term benefits for a child's future, makes them a priority purchase for many parents, thus driving their market share.

Application: 6 Month - 1 Years Old: The 6 Month - 1 years old application segment is a key driver of market growth and dominance. This phase of development is characterized by rapid physical and cognitive milestones, including crawling, walking, and the burgeoning understanding of cause and effect. Toys designed for this age group are crucial for supporting these developmental leaps. This includes a high demand for:

The sheer volume of products designed for this age group, combined with parents' keen attention to developmental milestones during this period, ensures this segment's significant market share. Manufacturers are focused on creating safe, durable, and engaging toys that cater to the specific needs and emerging abilities of infants and young toddlers. The transition from passive exploration to active engagement makes this age group a prime target for a wide array of developmental toys, contributing to its leading position in the market.

The baby toys industry is experiencing significant growth catalysts that are shaping its future. A primary catalyst is the increasing global awareness and focus on early childhood development. Parents worldwide are more educated than ever about the critical role of play in cognitive, physical, and emotional growth. This drives demand for toys that are not just entertaining but also educational and skill-building. The rise of the digital economy and e-commerce platforms has made a vast array of baby toys accessible to consumers globally, breaking down geographical barriers and enabling smaller brands to reach a wider audience. Furthermore, technological innovations, particularly in the electronic and smart toy segments, are creating novel and engaging play experiences, attracting tech-savvy parents and their children.

This report provides an exhaustive analysis of the global baby toys market, offering a 360-degree view of its current landscape and future prospects. It meticulously examines market dynamics, including trends, drivers, and challenges, with a keen eye on World Baby Toys Production and its evolving global footprint. The study dissects the market by key product types such as Electronic, Soft, and Educational toys, alongside a detailed breakdown by application segments including 0-6 Months, 6 Month-1 years old, and Above 1 years old. Furthermore, it delves into significant industry developments and the strategic initiatives of leading players like Hasbro, Fisher-Price, and Vtech Holdings. The forecast period of 2025-2033, with 2025 as the base year, provides actionable insights for stakeholders seeking to capitalize on emerging opportunities and navigate market complexities. The report is an indispensable tool for understanding market size in millions of units, identifying growth catalysts, and making informed strategic decisions within this vital sector.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Hasbro, Fisher-Price, Vtech Holdings, Brevi, Chicco, Kids II, Mothercare, Newell Rubbermaid, LEGO.

The market segments include Type, Application.

The market size is estimated to be USD 6707.8 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Baby Toys," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Baby Toys, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.