1. What is the projected Compound Annual Growth Rate (CAGR) of the Baby & Toddler Toys?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Baby & Toddler Toys

Baby & Toddler ToysBaby & Toddler Toys by Type (Activity Toys, Games and Puzzles, Construction Toys, Dolls and Accessories, Outdoor and Sports Toys, Other Type), by Application (Baby Toys, Toddler Toys), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

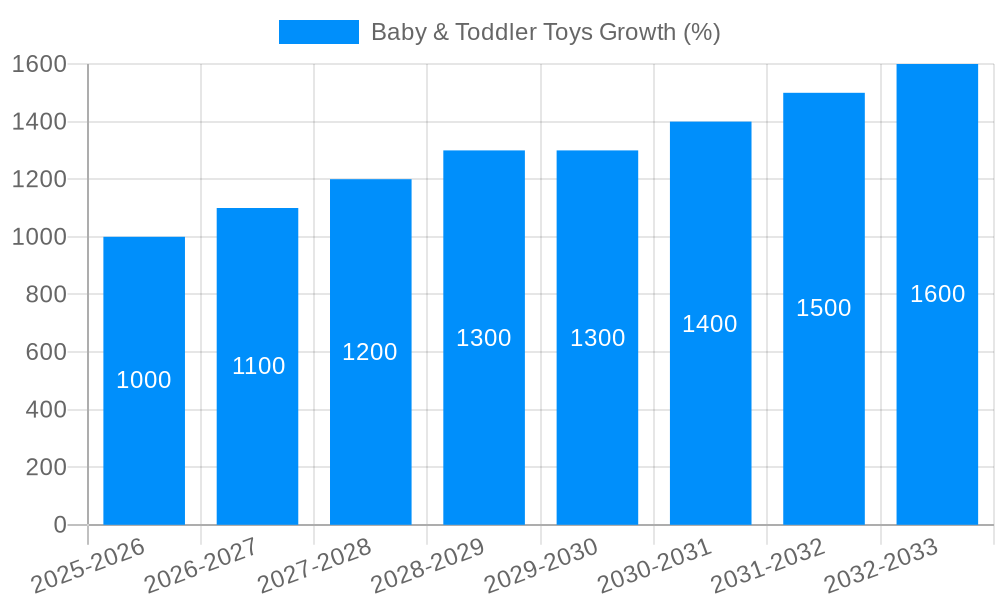

The global baby and toddler toys market is experiencing robust expansion, projected to reach a significant valuation by 2025, driven by an increasing birth rate and heightened parental spending on developmental products. The market is expected to grow at a Compound Annual Growth Rate (CAGR) of approximately 5.5% from 2025 to 2033, reflecting sustained consumer demand. Key growth drivers include a growing awareness among parents about the importance of early childhood education and cognitive development, leading to a preference for interactive and stimulating toys. This trend is further amplified by advancements in toy technology, with manufacturers increasingly incorporating educational elements, safety features, and eco-friendly materials into their product lines. The rise of online retail channels has also significantly broadened market accessibility, allowing for wider distribution and increased consumer reach.

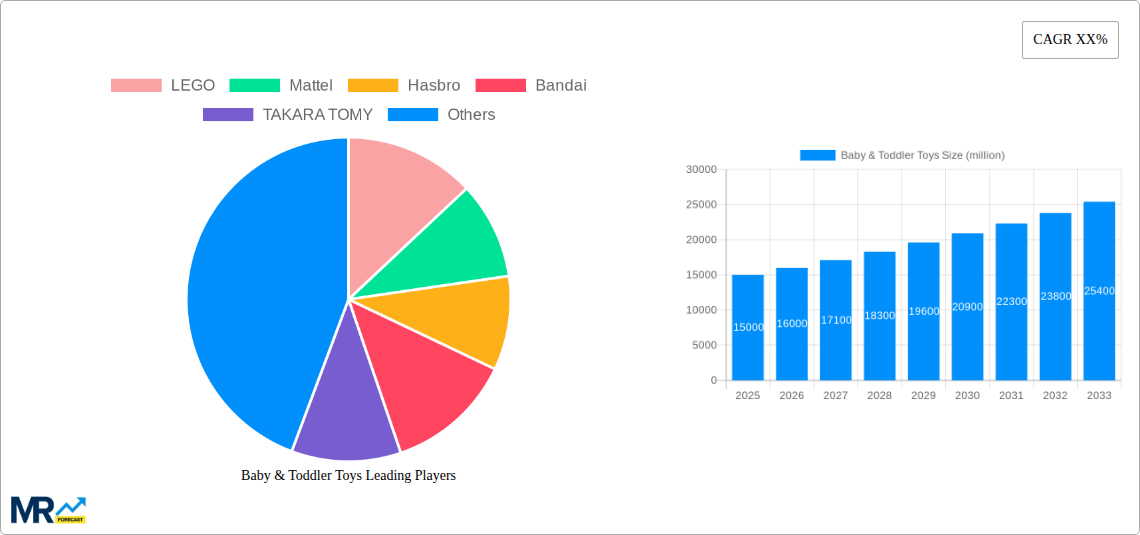

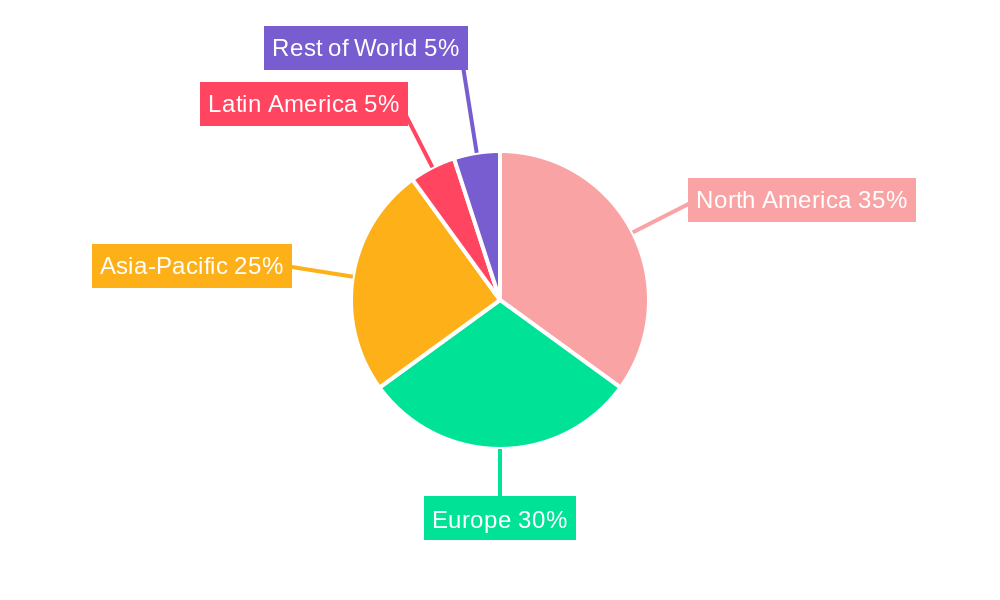

The market is segmented into various toy types, with Activity Toys, Games and Puzzles, and Construction Toys anticipated to dominate due to their educational benefits and engagement potential. The application segment is primarily focused on Baby Toys and Toddler Toys, catering to the critical developmental stages of early childhood. Leading companies such as LEGO, Mattel, and Hasbro are heavily investing in research and development to introduce innovative products that align with evolving consumer preferences for STEM-focused and sustainable toys. Regional analysis indicates strong market penetration in Asia Pacific, driven by a large young population and rising disposable incomes. North America and Europe also represent substantial markets, characterized by a strong emphasis on premium and educational toys. Restraints such as stringent toy safety regulations and the potential impact of economic downturns on discretionary spending are present but are being effectively managed through product innovation and market diversification by major players.

This report offers an in-depth analysis of the global baby and toddler toys market, providing critical insights into market dynamics, growth drivers, challenges, and future trajectories. Spanning a study period from 2019 to 2033, with a base year of 2025, this comprehensive report leverages historical data from 2019-2024 and presents robust estimations for the forecast period of 2025-2033. The market is analyzed across various segments including Type (Activity Toys, Games and Puzzles, Construction Toys, Dolls and Accessories, Outdoor and Sports Toys, Other Type) and Application (Baby Toys, Toddler Toys), with a focus on key industry developments and leading players. We project significant market expansion, potentially reaching figures in the tens of millions of units annually.

The baby and toddler toy market is undergoing a significant transformation, driven by evolving parenting philosophies, technological integration, and a growing emphasis on early childhood development. XXX A key trend observed is the ascendancy of educational and STEM-focused toys, designed to foster cognitive skills, problem-solving abilities, and creativity from an early age. This shift reflects a conscious effort by parents to provide stimulating and enriching experiences for their little ones, moving beyond purely entertainment-based products. The demand for sustainable and eco-friendly toys is also rapidly escalating. With increasing environmental awareness, parents are actively seeking out toys made from natural, recycled, or biodegradable materials, reducing their ecological footprint. This trend is pushing manufacturers to adopt greener production processes and explore innovative material sourcing. Furthermore, the market is witnessing a surge in interactive and smart toys. These toys often incorporate digital elements, augmented reality (AR), and artificial intelligence (AI) to offer personalized learning experiences and engage children in more dynamic ways. While concerns about screen time persist, the focus is on smart toys that promote active play and educational engagement, rather than passive consumption of digital content. The "open-ended" play concept continues to gain traction, with toys that encourage imagination and allow for multiple modes of play, such as building blocks and art supplies, remaining highly popular. This contrasts with single-function toys and aligns with the belief that unstructured play is crucial for developing creativity and independent thinking. The collectible toy market, particularly within dolls and action figures, continues to show robust performance, fueled by popular media franchises and the desire for imaginative role-playing. Finally, sensory and tactile toys designed for infants, focusing on developing motor skills and sensory exploration through textures, sounds, and shapes, are consistently strong performers. The market is dynamic, with these trends influencing product innovation and marketing strategies across the board, creating both opportunities and the need for adaptability among manufacturers.

Several powerful forces are collectively propelling the growth of the baby and toddler toys market. A primary driver is the increasing disposable income in emerging economies, which is enabling a larger segment of the population to invest in quality toys that support their children's development. As global economic conditions improve and middle-class households expand, the demand for a wider range of educational and engaging toys for young children is naturally on the rise. Furthermore, a growing awareness among parents about the critical importance of early childhood development is a significant catalyst. Educated parents actively seek toys that stimulate cognitive, social, emotional, and physical growth during the formative years. This awareness is translating into a higher demand for toys that offer developmental benefits beyond mere entertainment, pushing the market towards educational and STEM-oriented products. The rise of influencer marketing and social media platforms is also playing a crucial role. Parenting bloggers, vloggers, and social media influencers often showcase and recommend specific toys, creating trends and influencing purchasing decisions among parents looking for trusted advice and inspiration. This digital word-of-mouth is a powerful tool in reaching target demographics and highlighting product benefits. The continuous innovation in product design and technology by manufacturers is another key driver. Companies are investing heavily in research and development to create safer, more engaging, and technologically advanced toys, including those incorporating augmented reality, artificial intelligence, and interactive features, catering to evolving consumer preferences and offering novel play experiences. The trend towards smaller family sizes in many developed nations, coupled with a heightened focus on individual child development, means parents are often willing to spend more on fewer children, prioritizing high-quality, developmental toys.

Despite the promising growth trajectory, the baby and toddler toys market is not without its challenges and restraints. A significant hurdle is the increasingly stringent safety regulations and product testing requirements across different regions. Manufacturers must adhere to evolving standards for materials, design, and manufacturing processes to ensure child safety, which can lead to higher production costs and longer product development cycles. The intense competition within the market is another considerable restraint. With numerous established players and new entrants, companies face pressure to innovate constantly and differentiate their products, often leading to price wars and squeezed profit margins. The ever-changing nature of children's preferences and fads poses a challenge for manufacturers. Toys that are popular one season might quickly fall out of favor the next, requiring companies to be agile and responsive to market shifts, which can lead to inventory management complexities and the risk of obsolescence. Economic downturns and inflation can also impact consumer spending on non-essential items like toys. During periods of economic uncertainty, parents might reduce their discretionary spending, leading to a slowdown in market growth. The growing popularity of digital entertainment and electronic devices among young children presents a competition for traditional toy sales. While some smart toys bridge this gap, the allure of screens can divert attention away from physical toys. Furthermore, supply chain disruptions and rising raw material costs, exacerbated by global events, can impact production capacity, lead times, and the overall cost of goods, creating operational challenges for manufacturers. The ethical considerations and consumer concerns regarding data privacy and AI usage in smart toys also require careful navigation and transparency from manufacturers.

Segment Dominance: Dolls and Accessories

The Dolls and Accessories segment is poised to be a significant market dominator within the baby and toddler toys sector. This enduring category has consistently demonstrated strong sales and consumer engagement across the study period, from 2019 to the projected 2033. The intrinsic appeal of dolls lies in their ability to foster imaginative play, role-playing, and the development of social-emotional skills in young children. Parents often associate dolls with nurturing behaviors and the early exploration of interpersonal relationships, making them a staple in a child's toy collection.

Regional Dominance: North America and Asia Pacific

North America is expected to continue its reign as a dominant region in the baby and toddler toys market. This dominance is fueled by several factors:

The Asia Pacific region is projected to experience the most rapid growth and emerge as another pivotal market in the coming years.

While North America will maintain its strong market share, the rapid expansion and demographic advantages of the Asia Pacific region position it as the key growth engine for the global baby and toddler toys market.

The baby and toddler toys industry is experiencing a robust growth phase, propelled by several key catalysts. The increasing global awareness and parental prioritization of early childhood development are paramount, driving demand for educational and STEM-focused toys. Simultaneously, technological advancements are paving the way for innovative interactive and smart toys that offer engaging learning experiences. The expansion of e-commerce channels has significantly improved accessibility to a wider range of products for consumers worldwide, while rising disposable incomes in emerging economies are fueling increased spending on quality children's products. Furthermore, the sustained popularity of licensed characters and franchises continues to drive consumer interest and sales within specific toy categories.

This comprehensive report delves into the intricacies of the global baby and toddler toys market, offering a holistic view of its landscape. We provide in-depth analyses of market trends, including the growing demand for educational, sustainable, and interactive toys. The report identifies key driving forces, such as rising disposable incomes, increased parental awareness of early childhood development, and the influence of digital marketing. Furthermore, it meticulously examines the challenges and restraints faced by the industry, from stringent safety regulations to intense market competition. The report highlights dominant regions and segments, with a detailed focus on the significant contributions of North America and the rapid growth of the Asia Pacific market, as well as the enduring appeal of the Dolls and Accessories segment. We also outline crucial growth catalysts and present a comprehensive list of leading players. This report is an invaluable resource for stakeholders seeking to understand market dynamics and capitalize on future opportunities within the baby and toddler toys sector.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include LEGO, Mattel, Hasbro, Bandai, TAKARA TOMY, Gigotoys, MGA Entertainment, Melissa & Doug, Simba-Dickie Group, Giochi Preziosi, PLAYMOBIL, Ravensburger, Vtech, Leapfrog, Spin Master, MindWare, Safari, BanBao, Qunxing, Goldlok Toys, Star-Moon, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Baby & Toddler Toys," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Baby & Toddler Toys, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.