1. What is the projected Compound Annual Growth Rate (CAGR) of the Baby Pajamas and Sleepwears?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Baby Pajamas and Sleepwears

Baby Pajamas and SleepwearsBaby Pajamas and Sleepwears by Type (Cotton, Linen, Silk, Others, World Baby Pajamas and Sleepwears Production ), by Application (0-12 months, 12-24 months, 2-3 years, World Baby Pajamas and Sleepwears Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

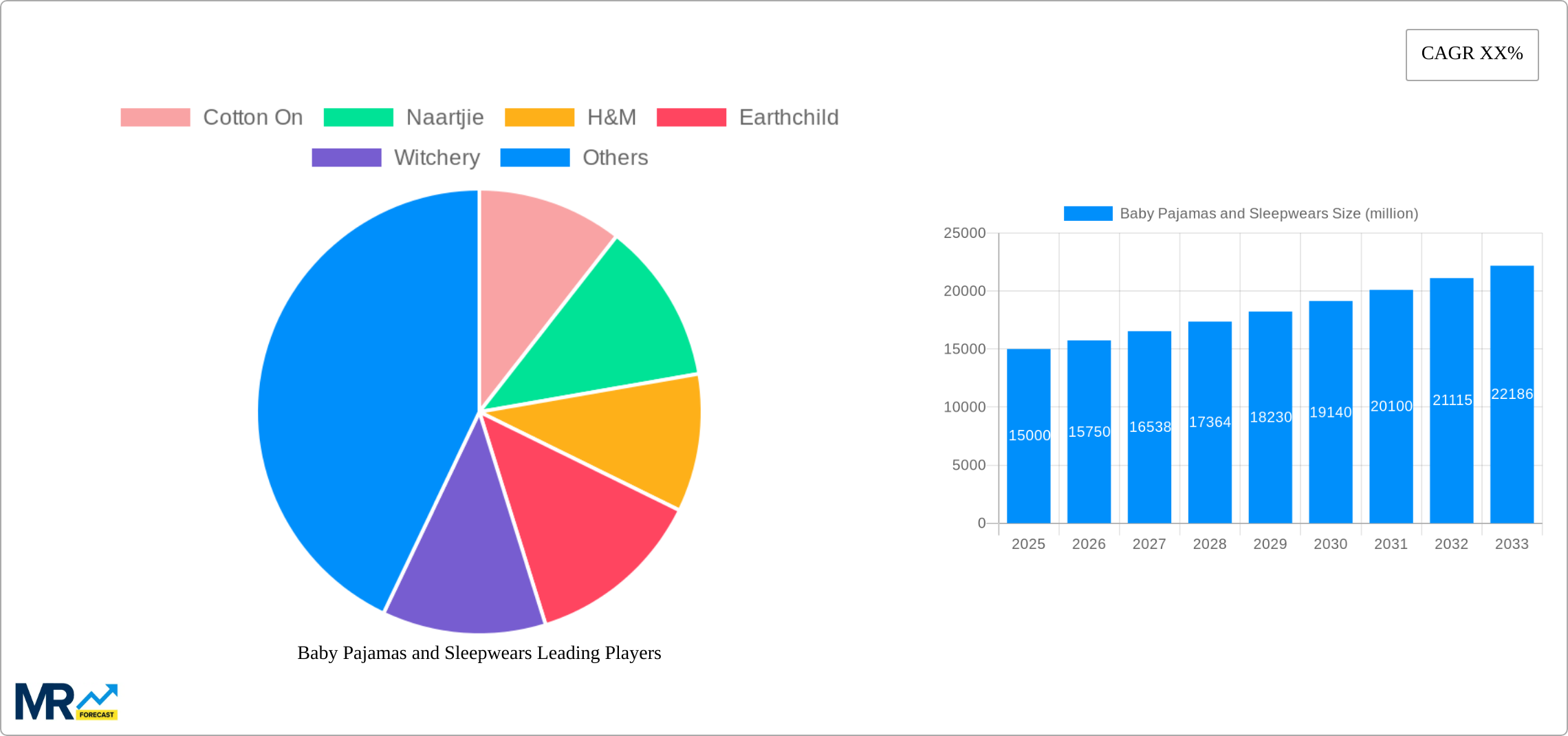

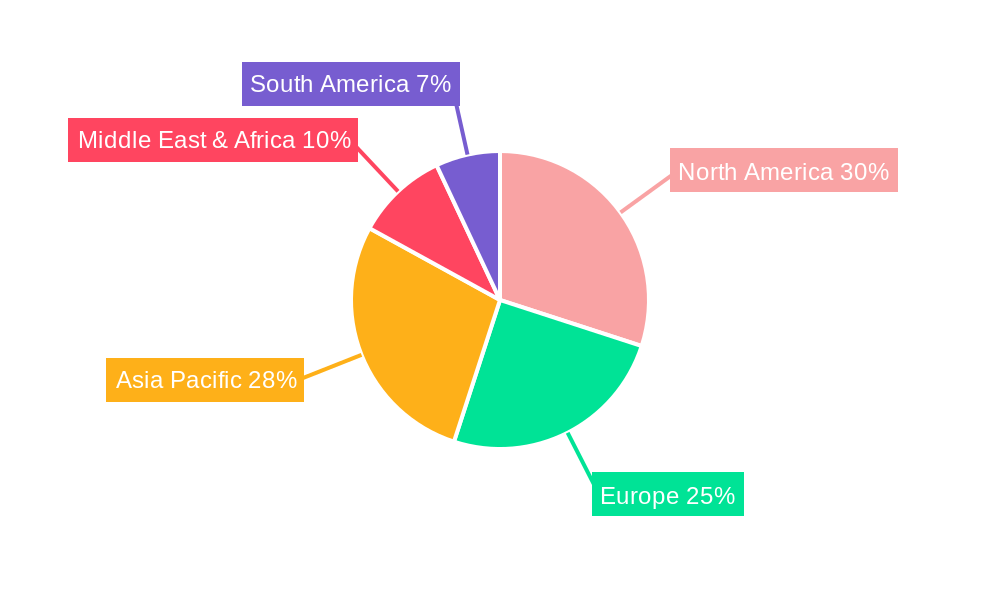

The global baby pajamas and sleepwear market is a dynamic sector experiencing significant growth, driven by rising birth rates, increasing disposable incomes in developing economies, and a growing preference for comfortable and safe sleepwear for infants and toddlers. The market is segmented by fabric type (cotton, linen, silk, and others), showcasing cotton's dominance due to its breathability, affordability, and softness. Further segmentation by age group (0-12 months, 12-24 months, 2-3 years) highlights the highest demand within the 0-12 months category, reflecting the immediate need for sleepwear upon a child's arrival. Key players like Carter's, GAP, H&M, and Zara dominate the market, leveraging their established brand recognition and extensive distribution networks. However, smaller, specialized brands focusing on organic and sustainable materials are gaining traction, driven by increasing consumer awareness of environmental and health concerns. Regional analysis reveals strong market presence in North America and Europe, though Asia-Pacific is expected to witness the fastest growth in the coming years, fueled by its burgeoning middle class and expanding e-commerce infrastructure. The market faces certain restraints including fluctuating raw material prices and increasing competition. However, continuous innovation in materials, designs, and functionalities, along with the rising adoption of online retail channels, will likely mitigate these challenges and further propel market expansion.

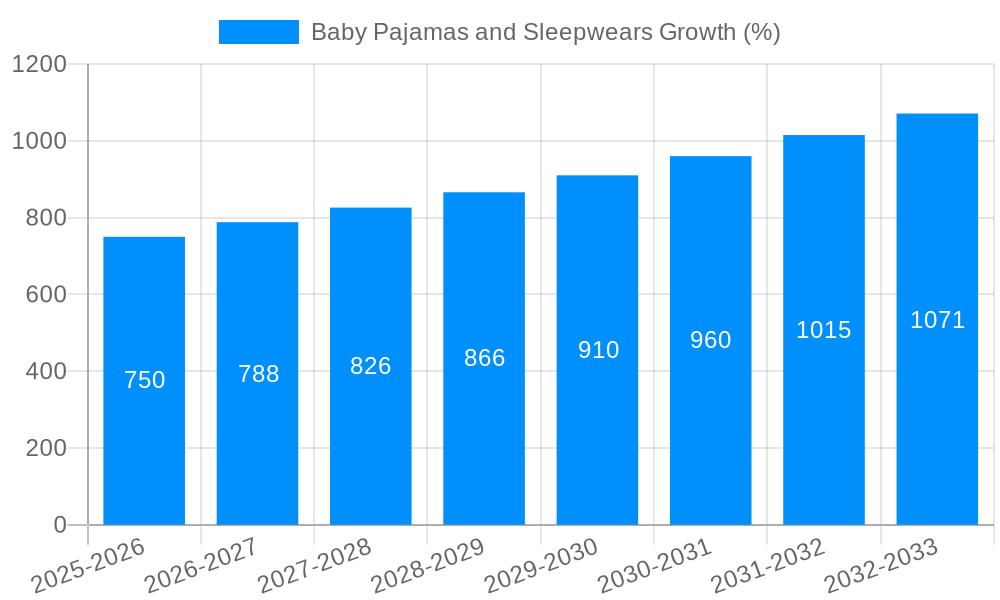

The forecast period of 2025-2033 anticipates consistent growth, with a projected Compound Annual Growth Rate (CAGR) of approximately 5%. This growth is attributable to several factors including the aforementioned market drivers, and new product launches featuring smart technologies and enhanced safety features. While established brands maintain a strong foothold, the rise of niche players with a focus on eco-friendly and specialized products indicates a shift toward more discerning consumer preferences. The market’s regional diversity presents both opportunities and challenges; established markets like North America and Europe will maintain steady growth, while emerging markets in Asia-Pacific will offer significant expansion potential. Successful navigation of this market necessitates a keen understanding of consumer preferences, adaptable supply chain strategies, and a commitment to sustainability and innovation.

The global baby pajamas and sleepwear market, valued at approximately 150 million units in 2025, is experiencing a dynamic shift driven by evolving parental preferences and technological advancements. Over the historical period (2019-2024), we witnessed a steady growth trajectory, primarily fueled by rising birth rates in certain regions and increasing disposable incomes in developing economies. The forecast period (2025-2033) projects continued expansion, with an estimated 250 million units by 2033. Key trends shaping this growth include a rising demand for organic and sustainable materials like cotton and linen, reflecting a growing awareness of environmental and health concerns. Parents are increasingly seeking pajamas made from breathable, hypoallergenic fabrics, prioritizing comfort and safety for their infants. The market is also witnessing a surge in demand for innovative designs incorporating smart features, such as sleep trackers embedded in sleepwear or pajamas with built-in temperature regulation. This reflects a broader trend of leveraging technology to improve childcare and parental convenience. Moreover, the rise of e-commerce and online retail channels has significantly broadened market access, offering consumers greater choice and convenience. This accessibility has allowed smaller, niche brands to gain traction, increasing competition and driving innovation in design and material selection. Furthermore, the influence of social media and celebrity endorsements in shaping consumer preferences is undeniable, contributing to the dynamism of the market. Brand loyalty also plays a considerable role, especially among parents who have had positive experiences with particular brands in the past. Finally, there is a growing focus on personalization, with an increasing number of brands offering customized sleepwear options, further catering to the specific needs and preferences of parents and their babies. This multifaceted landscape underscores a market ripe for continued growth and expansion in the years to come.

Several factors contribute to the robust growth of the baby pajamas and sleepwear market. The most significant is the consistently high birth rate in many parts of the world, creating a continuously replenished consumer base. This is especially true in developing nations experiencing population booms. Coupled with this is the rising disposable income in numerous countries, enabling parents to spend more on high-quality, comfortable, and aesthetically pleasing sleepwear for their children. The increasing awareness of the importance of safe and healthy sleep for infants is another key driver. Parents are actively seeking out sleepwear made from materials that are hypoallergenic, breathable, and free from harmful chemicals. This trend fuels demand for organic cotton and other natural materials. The proliferation of online retail channels has also made it significantly easier for parents to access a wide variety of baby sleepwear options from various brands across the globe, fostering increased market penetration. Furthermore, innovative product features, such as sleep-tracking capabilities or temperature-regulating fabrics, are attracting discerning parents who are willing to pay a premium for advanced functionalities that enhance their baby's sleep quality and overall well-being. Marketing and advertising, particularly targeted towards expectant parents and new mothers, significantly influence purchasing decisions and drive sales. Finally, the growing trend of gift-giving for newborns further contributes to the overall market size.

Despite the positive growth trajectory, the baby pajamas and sleepwear market faces several challenges. Fluctuations in raw material prices, particularly for cotton and other natural fibers, can impact production costs and profitability. Competition from low-cost manufacturers, especially from countries with lower labor costs, puts pressure on pricing strategies for established brands. Stringent safety regulations and quality standards, while essential for consumer safety, add to the operational complexities and compliance costs for businesses. Maintaining consistent product quality and managing supply chains to meet fluctuating demands remain crucial operational challenges. Economic downturns and recessions can significantly affect consumer spending habits, potentially reducing demand for non-essential items like premium baby sleepwear. Moreover, evolving consumer preferences and changing fashion trends require brands to constantly adapt their product offerings and designs to stay competitive. Finally, the increasing prevalence of counterfeit products undermines the market share of legitimate brands and necessitates effective anti-counterfeiting measures.

The 0-12 months age segment is projected to dominate the market due to the higher frequency of sleep and clothing changes required within this age group. Parents are also more likely to prioritize comfort and safety features in sleepwear during this crucial developmental stage. This segment's projected value is approximately 75 million units by 2025, representing over 50% of the total market. Geographically, North America and Europe are expected to remain dominant markets due to higher per capita incomes and a strong emphasis on product safety and quality. These regions show a high consumer preference for premium materials and innovative designs. The cotton segment is anticipated to maintain a significant market share (approximately 60 million units by 2025) owing to its breathability, affordability, and widespread acceptance as a safe and comfortable material for baby sleepwear.

While Asia-Pacific is experiencing robust growth due to rising birth rates and increasing disposable incomes, the market penetration of premium brands and the emphasis on quality is still developing compared to North America and Europe.

The baby pajamas and sleepwear market is experiencing robust growth driven by several key catalysts. Increased awareness of infant sleep safety and health is prompting parents to prioritize comfort and breathability in sleepwear, leading to increased demand for organic and natural materials. The burgeoning e-commerce sector has expanded market access, allowing parents to explore a wider range of products from diverse brands. Additionally, innovative designs incorporating smart features and advanced materials continue to create excitement and drive higher price points. Finally, rising disposable incomes globally enable parents to invest more in quality sleepwear for their children.

The baby pajamas and sleepwear market offers substantial opportunities for growth and innovation, driven by strong consumer demand, expanding retail channels, and the ongoing development of new, technologically advanced products. The consistent rise in birth rates worldwide, coupled with increased disposable incomes, further enhances the market's potential. This is expected to result in significant growth over the forecast period, creating a profitable landscape for established brands and new entrants alike.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Cotton On, Naartjie, H&M, Earthchild, Witchery, Exact Kids, NIKE, Mr Price, Zara, Carters, GAP, JACADI.

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Baby Pajamas and Sleepwears," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Baby Pajamas and Sleepwears, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.