1. What is the projected Compound Annual Growth Rate (CAGR) of the Automotive Parts Vision Inspection System?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Automotive Parts Vision Inspection System

Automotive Parts Vision Inspection SystemAutomotive Parts Vision Inspection System by Type (2D Inspection System, 3D Inspection System, World Automotive Parts Vision Inspection System Production ), by Application (Automotive Manufacturing, Automotive Maintenance & Repair, New Products Development, Others, World Automotive Parts Vision Inspection System Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

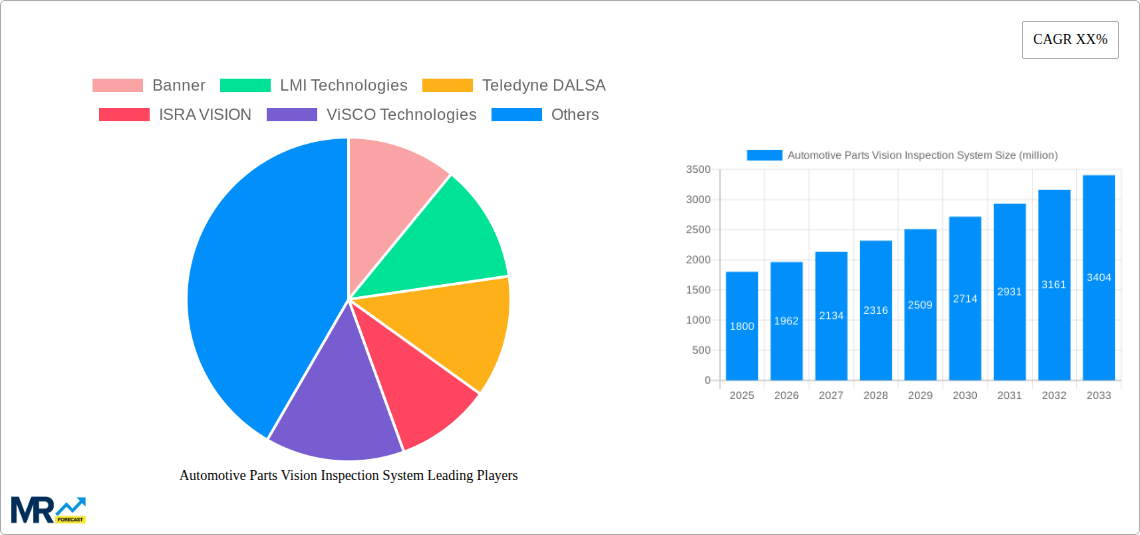

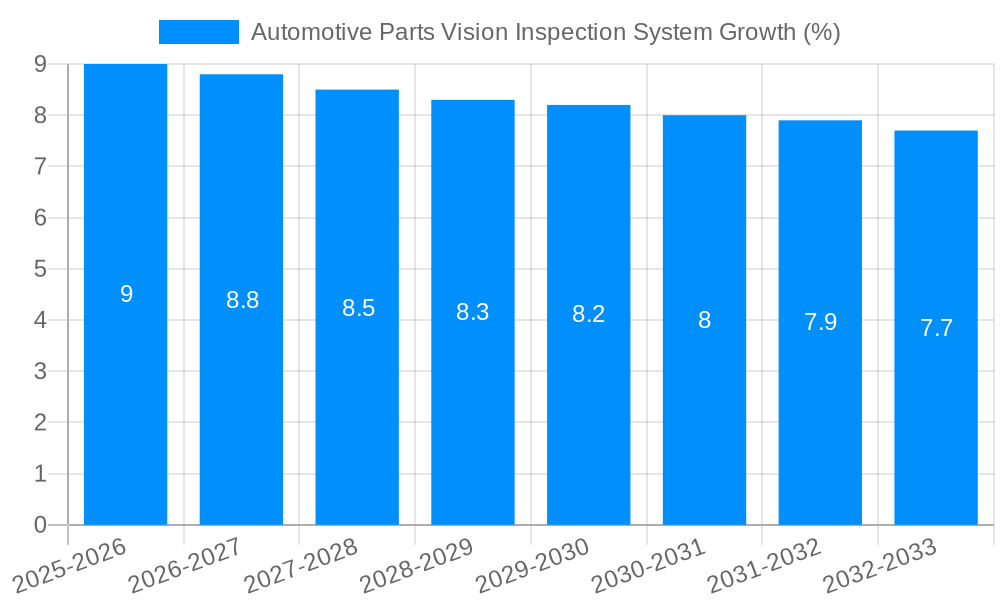

The global Automotive Parts Vision Inspection System market is projected to reach approximately USD 1,800 million by 2025, exhibiting a robust Compound Annual Growth Rate (CAGR) of around 9-10% during the forecast period of 2025-2033. This significant growth is primarily fueled by the increasing demand for enhanced quality control and defect detection in automotive manufacturing. The stringent regulatory landscape demanding flawless automotive components, coupled with the rising adoption of advanced manufacturing technologies like Industry 4.0 and AI-powered solutions, are key drivers. Furthermore, the continuous innovation in vision inspection systems, offering higher precision, speed, and automation capabilities, is pivotal in meeting the evolving needs of the automotive sector. The market is witnessing a strong preference for 3D inspection systems due to their ability to capture complex geometries and surface defects with unparalleled accuracy, thereby reducing rework and scrap rates.

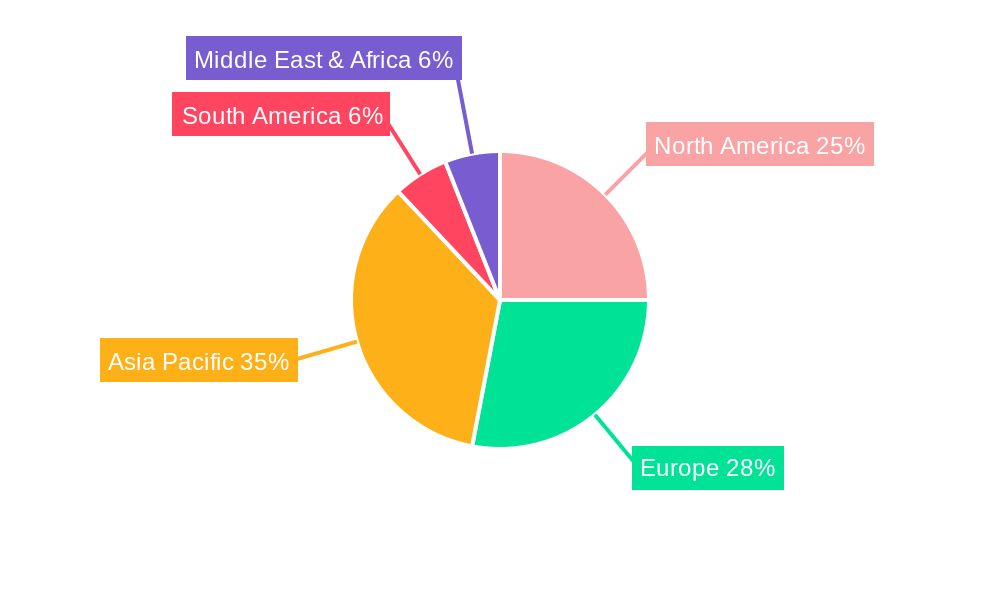

The Asia Pacific region, led by China and Japan, is expected to dominate the market owing to its position as a global automotive manufacturing hub, substantial investments in technological advancements, and a growing domestic demand for vehicles. North America and Europe also represent significant markets, driven by the presence of major automotive manufacturers and a strong emphasis on quality and safety standards. Key players are actively involved in research and development to introduce more sophisticated and cost-effective inspection solutions, including AI-driven anomaly detection and deep learning algorithms. However, the high initial investment cost for advanced vision inspection systems and the availability of skilled labor to operate and maintain these complex technologies could pose some challenges to market expansion. Despite these restraints, the undeniable benefits of improved product quality, reduced production costs, and enhanced operational efficiency are expected to propel the market forward.

Here's a unique report description for an Automotive Parts Vision Inspection System, incorporating your specified elements:

The global automotive parts vision inspection system market is poised for substantial growth, driven by an escalating demand for enhanced quality control and defect detection within the automotive manufacturing ecosystem. Throughout the historical period of 2019-2024, the industry has witnessed a steady adoption of advanced machine vision solutions, moving beyond basic checks to sophisticated, AI-powered inspection. The base year, 2025, marks a pivotal point where the market is expected to consolidate its gains and embark on a robust expansion trajectory. The forecast period, 2025-2033, is anticipated to see the market value surge, potentially reaching several hundred million units in terms of deployed systems and the value of inspected parts. Key trends shaping this evolution include the increasing integration of deep learning algorithms for more accurate defect identification, the growing preference for 3D inspection systems to capture intricate surface imperfections and dimensional inaccuracies, and the rising adoption of these systems for end-of-line inspection, sub-assembly verification, and even in the critical stages of new product development. Furthermore, the push towards Industry 4.0 and smart factories is accelerating the deployment of automated vision inspection solutions, enabling real-time data analysis and predictive maintenance for production lines. The sheer volume of automotive production, which runs into hundreds of millions of units annually worldwide, directly translates into a continuous need for reliable and efficient quality assurance processes, making vision inspection systems indispensable. The shift towards electric vehicles (EVs) and autonomous driving technologies also introduces new and complex component requirements, necessitating even more stringent inspection protocols, further fueling market demand. The market's trajectory is not just about counting defects; it’s about enabling higher production yields, reducing costly recalls, and ultimately ensuring the safety and reliability of millions of vehicles on the road. The estimated market value for 2025, projected to be in the hundreds of million dollars, is expected to more than double by the end of the forecast period, underscoring the significant investment and innovation within this sector. The proliferation of smart manufacturing initiatives and the ongoing digital transformation within the automotive sector will continue to be the bedrock of this market's expansion for the foreseeable future, impacting the quality of every single automotive part produced, which numbers in the billions annually.

The burgeoning automotive industry, characterized by its relentless pursuit of Zero Defect production and a significant global output in the hundreds of millions of units annually, stands as the primary propellant for the automotive parts vision inspection system market. The increasing complexity of automotive components, driven by advancements in electrification and autonomous driving, demands inspection systems capable of identifying minute flaws that could compromise performance and safety. This inherent need for precision and reliability, coupled with the escalating cost of recalls and warranty claims, compels manufacturers to invest heavily in automated quality control. The global push towards Industry 4.0 and smart manufacturing further amplifies this demand, as vision inspection systems are integral to achieving real-time data acquisition, process optimization, and enhanced traceability across production lines. The drive for increased production efficiency and reduced scrap rates directly translates into a higher return on investment for vision inspection solutions, making them an attractive proposition for automotive OEMs and Tier-1 suppliers alike. Moreover, evolving regulatory landscapes and stringent safety standards globally necessitate robust inspection methodologies, further solidifying the role of vision inspection systems in ensuring compliance. The market's growth is also fueled by the continuous innovation in machine vision hardware and software, leading to more affordable, powerful, and easier-to-integrate solutions.

Despite the robust growth prospects, the automotive parts vision inspection system market faces several significant challenges and restraints that can temper its expansion. The substantial upfront investment required for advanced 2D and 3D inspection systems, particularly for smaller manufacturers or those in emerging economies, can be a deterrent. Integrating these sophisticated systems into existing legacy production lines can also prove complex and costly, requiring significant engineering expertise and downtime. The rapid evolution of technology means that systems can become obsolete relatively quickly, necessitating continuous upgrades and reinvestment, which can strain budgets. Furthermore, the need for highly skilled personnel to operate, maintain, and calibrate these systems can be a bottleneck, especially in regions with a shortage of trained technicians. The development and ongoing training of AI models for specific defect types can also be time-consuming and resource-intensive. Finally, the global economic uncertainties and fluctuations in automotive production volumes can directly impact the demand for new inspection equipment, acting as a cyclical restraint on market growth. The sheer volume of automotive parts produced, estimated in the hundreds of millions annually, means any disruption in production can have a magnified effect on the demand for inspection systems.

The Automotive Manufacturing segment, specifically within the Asia Pacific region, is poised to dominate the global automotive parts vision inspection system market. This dominance is underpinned by a confluence of factors that make it a powerhouse for both production and technological adoption.

Dominating Segments and Regions:

Segment: Automotive Manufacturing:

Region: Asia Pacific:

The interplay between the critical need for quality in Automotive Manufacturing and the sheer scale of production and technological adoption in the Asia Pacific region positions these as the clear leaders in driving the global automotive parts vision inspection system market forward. The projected growth in this segment and region is expected to significantly outweigh others throughout the study period of 2019-2033.

The automotive parts vision inspection system industry is propelled by several key growth catalysts. The relentless pursuit of impeccable quality and defect reduction, driven by safety regulations and consumer expectations, is paramount. The increasing complexity of modern automotive components, especially for EVs and autonomous vehicles, necessitates more advanced inspection capabilities. The global shift towards smart manufacturing and Industry 4.0 principles makes automated vision inspection an integral part of efficient production lines. Furthermore, continuous technological advancements in AI, deep learning, and high-resolution imaging are creating more sophisticated and cost-effective solutions, making them accessible to a wider range of manufacturers.

This comprehensive report delves deep into the global automotive parts vision inspection system market, providing a granular analysis from 2019 to 2033. It offers an in-depth understanding of market dynamics, segmentation, and regional landscapes, crucial for strategic decision-making. The report examines the impact of emerging trends such as the increasing adoption of AI and deep learning for advanced defect detection, alongside the growing preference for 3D inspection systems to capture intricate geometries and surface imperfections. It highlights the critical role of vision inspection in the burgeoning electric vehicle (EV) sector and the ongoing evolution of autonomous driving technologies, both of which present unique quality assurance challenges. The report further analyzes the market's key growth catalysts, including stringent quality standards, the drive for Industry 4.0 adoption, and continuous technological advancements, while also addressing significant challenges like high upfront costs and the need for skilled personnel. With projected market values in the hundreds of millions of dollars and production volumes of automotive parts reaching hundreds of millions of units annually, the strategic importance of robust vision inspection systems cannot be overstated. The report provides detailed insights into the competitive landscape, profiling leading players and their contributions, alongside significant industry developments. This comprehensive coverage ensures stakeholders are equipped with the knowledge to navigate and capitalize on the evolving opportunities within this vital sector, impacting the quality of billions of automotive parts produced globally.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Banner, LMI Technologies, Teledyne DALSA, ISRA VISION, ViSCO Technologies, craftworks, Basler AG, VISION Embesoft Solution, Industrial Vision Systems Ltd, Frinks AI, Kitov Systems, Baker Hughes Waygate Technologies, Kar Ming Industries, Guangdong Sygole Intelligent Technology Co.,Ltd, INTSOFT, HANSWELL, Comos Vision, Irayple, DAHENG IMAGING, Dongguan Wepro Automation Technology Co.,Ltd, ALFA Intellect, Zhiqi Tech, Keyence, Bellybovision, Ruizhi Optoelectronics, HIKROBOT, Hongke, Cognex, Omron Corporation, Syntegon, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Automotive Parts Vision Inspection System," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Automotive Parts Vision Inspection System, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.