1. What is the projected Compound Annual Growth Rate (CAGR) of the Automotive Multi Domain Controller?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Automotive Multi Domain Controller

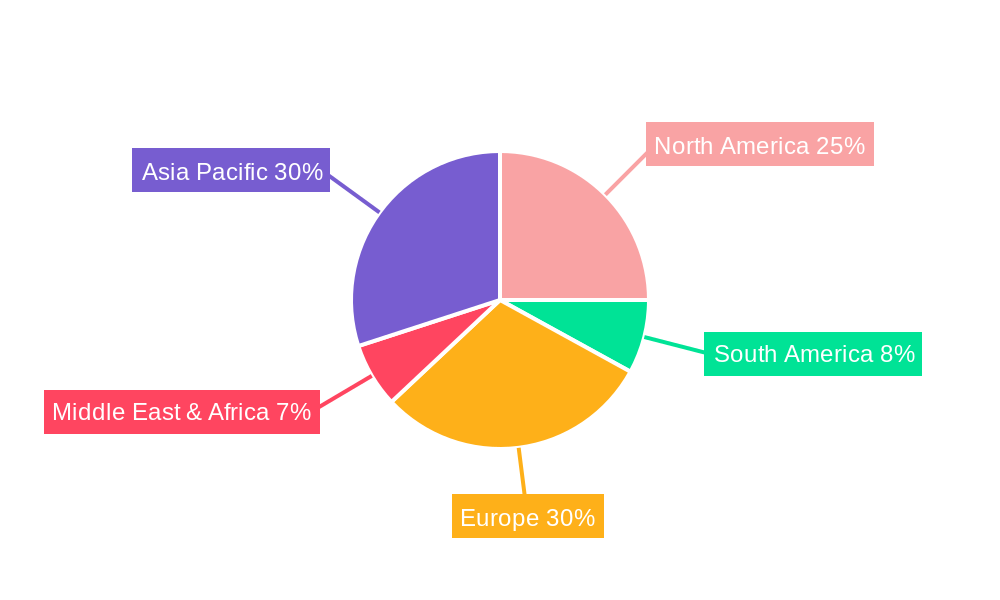

Automotive Multi Domain ControllerAutomotive Multi Domain Controller by Type (/> 32-Bit, 64-Bit, 128-Bit), by Application (/> Passenger Cars, Light Commercial Vehicles, Heavy Commercial Vehicles), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

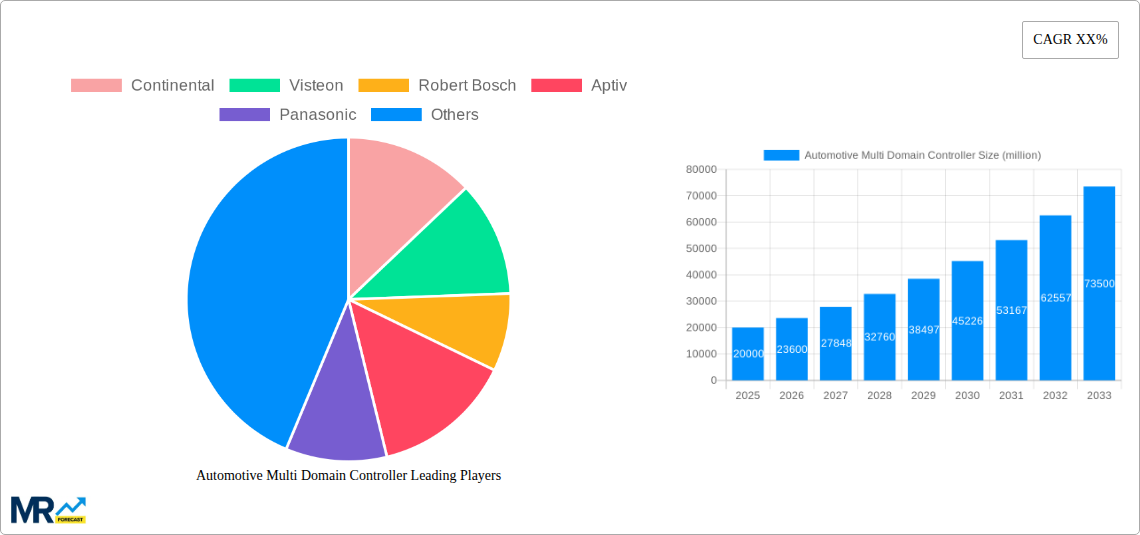

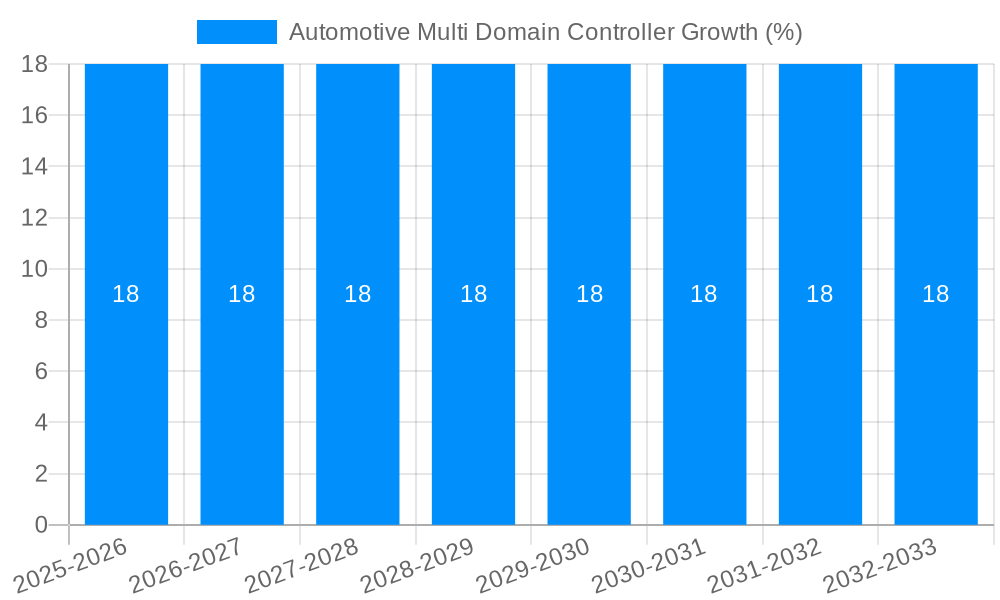

The Automotive Multi Domain Controller (MDC) market is experiencing robust expansion, projected to reach a significant market size of [Estimate based on XXX and CAGR XX, e.g., $20,000 million] by 2025, with a compound annual growth rate (CAGR) of [XX, e.g., 18%] through 2033. This surge is primarily fueled by the escalating demand for advanced driver-assistance systems (ADAS), autonomous driving capabilities, and sophisticated in-car infotainment experiences. Modern vehicles are transforming into mobile computing platforms, requiring centralized, high-performance processing units like MDCs to manage diverse functionalities ranging from powertrain control and chassis management to safety systems and user interfaces. The increasing complexity of vehicle electronics and the drive towards software-defined vehicles are critical growth drivers, pushing automakers to adopt MDCs for improved efficiency, reduced complexity, and enhanced scalability of vehicle architectures.

Key trends shaping the Automotive MDC market include the shift towards centralized computing architectures, the integration of AI and machine learning for enhanced functionality, and the growing importance of cybersecurity in protecting complex vehicle systems. The market is segmented by type, with 64-bit and 128-bit processors emerging as dominant forces due to their superior processing power essential for handling data-intensive automotive applications. Applications span across passenger cars, light commercial vehicles, and heavy commercial vehicles, with passenger cars currently holding the largest share due to their rapid adoption of advanced technologies. Geographically, Asia Pacific, led by China and Japan, is expected to witness the fastest growth, driven by a strong automotive manufacturing base and rapid technological adoption. North America and Europe remain significant markets, characterized by early adoption of advanced automotive technologies and stringent safety regulations. However, the market faces certain restraints, including the high cost of development and integration, the need for robust cybersecurity measures, and the complexity of ensuring functional safety standards.

This report provides a comprehensive analysis of the global Automotive Multi Domain Controller (MDC) market, encompassing market trends, driving forces, challenges, regional dynamics, key players, and significant developments. The study period spans from 2019 to 2033, with a base year of 2025 and a forecast period from 2025 to 2033, building upon historical data from 2019-2024. The market is segmented by controller bit type (32-bit, 64-bit, 128-bit) and vehicle application (Passenger Cars, Light Commercial Vehicles, Heavy Commercial Vehicles).

The automotive industry is undergoing a profound transformation, driven by the relentless pursuit of enhanced safety, increased automation, and superior in-car experience. At the heart of this revolution lies the Automotive Multi Domain Controller (MDC), a sophisticated computing platform that consolidates the functions of numerous ECUs into a single, powerful unit. This consolidation is not merely an organizational shift; it represents a fundamental evolution in vehicle architecture, moving away from decentralized, single-function ECUs towards a centralized, software-defined approach. The market for MDCs is experiencing robust growth, projected to reach over 15 million units by the end of the forecast period. This surge is propelled by the escalating demand for advanced driver-assistance systems (ADAS), autonomous driving (AD) capabilities, and sophisticated infotainment and connectivity features. As vehicles become increasingly intelligent and interconnected, the MDC acts as the central nervous system, processing vast amounts of data from sensors, cameras, and other inputs to enable complex functionalities such as advanced parking assist, adaptive cruise control, and predictive safety systems. Furthermore, the integration of over-the-air (OTA) updates and the growing adoption of electric vehicles (EVs) further amplify the need for powerful, centralized computing power offered by MDCs. The trend towards software-defined vehicles (SDVs) is a significant tailwind, as manufacturers increasingly rely on software to differentiate their offerings and deliver new features throughout the vehicle's lifecycle. MDCs are instrumental in enabling this software-centric paradigm, providing the necessary computational horsepower and flexibility to manage complex software stacks. The increasing complexity of automotive systems, coupled with stringent safety regulations and consumer expectations for seamless digital integration, are all pointing towards a future where MDCs will be an indispensable component of every modern vehicle. The market is also witnessing a gradual shift towards higher bit types, with 64-bit and 128-bit controllers gaining traction due to their superior processing capabilities required for advanced AI and machine learning applications crucial for autonomous driving. The convergence of these trends signifies a paradigm shift in vehicle electronics, moving towards smarter, more integrated, and highly capable automobiles.

The exponential growth of the Automotive Multi Domain Controller (MDC) market is fueled by several powerful driving forces that are reshaping the automotive landscape. The primary catalyst is the burgeoning demand for advanced driver-assistance systems (ADAS) and the escalating development of autonomous driving (AD) technologies. As vehicles become more sophisticated in their ability to perceive, decide, and act, the computational demands placed upon them skyrocket. MDCs, with their consolidated processing power and ability to handle complex algorithms, are essential for enabling features like adaptive cruise control, lane keeping assist, automatic emergency braking, and eventually, fully autonomous navigation. Beyond safety and autonomy, the in-car digital experience is a significant driver. Consumers increasingly expect seamless integration of their digital lives into the vehicle, demanding advanced infotainment systems, robust connectivity solutions, and personalized user interfaces. MDCs provide the central computing hub necessary to power these sophisticated systems, managing everything from high-resolution displays and advanced navigation to in-car streaming services and advanced voice command functionalities. Furthermore, the electrification of vehicles is another crucial factor. Electric vehicles often incorporate complex battery management systems, power electronics, and charging management systems that benefit from centralized control and optimized processing capabilities offered by MDCs. The increasing adoption of Over-the-Air (OTA) updates, which allow manufacturers to remotely update vehicle software, also necessitates a powerful and centralized computing architecture that MDCs provide, enabling continuous improvement and feature deployment throughout the vehicle's lifespan. The industry’s shift towards a software-defined vehicle (SDV) architecture is a fundamental underlying trend, positioning the MDC as the core enabler for flexible, scalable, and upgradable vehicle functionalities.

Despite the impressive growth trajectory, the Automotive Multi Domain Controller (MDC) market faces several significant challenges and restraints that could temper its expansion. One of the foremost hurdles is the immense complexity involved in developing and integrating these sophisticated systems. Designing an MDC that can reliably manage diverse domains, including powertrain, chassis, ADAS, infotainment, and body control, requires a deep understanding of interdependencies and robust software development practices. Ensuring seamless communication and data flow between different domains while maintaining functional safety and cybersecurity is a monumental task. The high cost of development and the significant investment in research and development (R&D) for these advanced controllers can also be a restraint, particularly for smaller automotive manufacturers or suppliers. Furthermore, the rigorous safety and regulatory standards in the automotive industry, especially for ADAS and autonomous driving functions, place immense pressure on MDC developers to achieve extremely high levels of reliability and fault tolerance. Cybersecurity is another critical concern; as vehicles become more connected and software-dependent, they become more vulnerable to cyber threats. Robust security measures must be integrated into the MDC architecture to protect against hacking and data breaches. The long development cycles inherent in the automotive industry, coupled with the rapid pace of technological advancement, can lead to a mismatch between the time it takes to develop and validate an MDC and the pace at which new technologies emerge. This can result in potential obsolescence issues if not managed carefully. Finally, the fragmentation of the automotive supply chain and the need for close collaboration between OEMs, Tier-1 suppliers, and semiconductor manufacturers add another layer of complexity to the successful deployment of MDCs.

The Passenger Cars segment is poised to dominate the Automotive Multi Domain Controller (MDC) market throughout the forecast period. This dominance is directly attributable to the sheer volume of passenger vehicles produced globally and the increasing sophistication of features being integrated into these vehicles.

Passenger Cars:

Geographical Dominance – Asia Pacific:

The 64-Bit controller type is also expected to witness significant growth and play a crucial role in this dominant segment. While 32-bit controllers will continue to cater to entry-level vehicles, the increasing complexity of ADAS algorithms, AI-driven features, and high-performance infotainment systems in passenger cars will necessitate the superior processing power and memory management capabilities offered by 64-bit architectures. As the market matures and autonomous driving capabilities become more widespread, the adoption of even higher bit types like 128-bit will become more pronounced, but 64-bit is expected to represent the sweet spot for a majority of passenger car applications in the mid-term forecast period.

The Automotive Multi Domain Controller (MDC) industry is experiencing significant growth catalysts that are propelling its expansion. The relentless innovation in Advanced Driver-Assistance Systems (ADAS) and the ongoing development of autonomous driving (AD) technologies are paramount, demanding increased computational power and sophisticated data processing capabilities that MDCs inherently provide. The growing consumer expectation for seamless in-car digital experiences, including advanced infotainment, connectivity, and personalized services, further fuels the need for centralized computing power. Additionally, the accelerating shift towards electric vehicles (EVs) introduces new complexities in vehicle management that MDCs are well-equipped to handle. The ongoing trend towards software-defined vehicles (SDVs), enabling Over-the-Air (OTA) updates and feature enhancements, relies heavily on the flexible and upgradeable architecture offered by MDCs.

This report offers an in-depth and holistic analysis of the Automotive Multi Domain Controller (MDC) market, providing a 360-degree view of its dynamics. It meticulously examines market size and growth projections, driven by a detailed understanding of current trends and future opportunities. The report dissects the technological landscape, including the evolution of controller architectures (32-bit, 64-bit, 128-bit) and their implications for various applications. It deeply investigates the driving forces, such as ADAS, autonomous driving, and the evolving digital cockpit, as well as the challenges and restraints like complexity, cost, and cybersecurity. Furthermore, it highlights key regional market insights, identifying dominant geographies and growth hotspots. The report also provides a comprehensive overview of the competitive landscape, profiling leading players and their strategic initiatives. Through a robust study period (2019-2033) with a focus on the base year (2025) and forecast period (2025-2033), this analysis equips stakeholders with actionable intelligence for strategic decision-making, investment planning, and market penetration strategies in this rapidly evolving sector.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Continental, Visteon, Robert Bosch, Aptiv, Panasonic, ZF Friedrichshafen, Faurecia, Magna, Lear, Autoliv, Magneti Marelli, Harman, Mitsubishi Electric, Hitachi, NXP, Infineon, Nvidia, Denso, Intel, Valeo.

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Automotive Multi Domain Controller," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Automotive Multi Domain Controller, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.