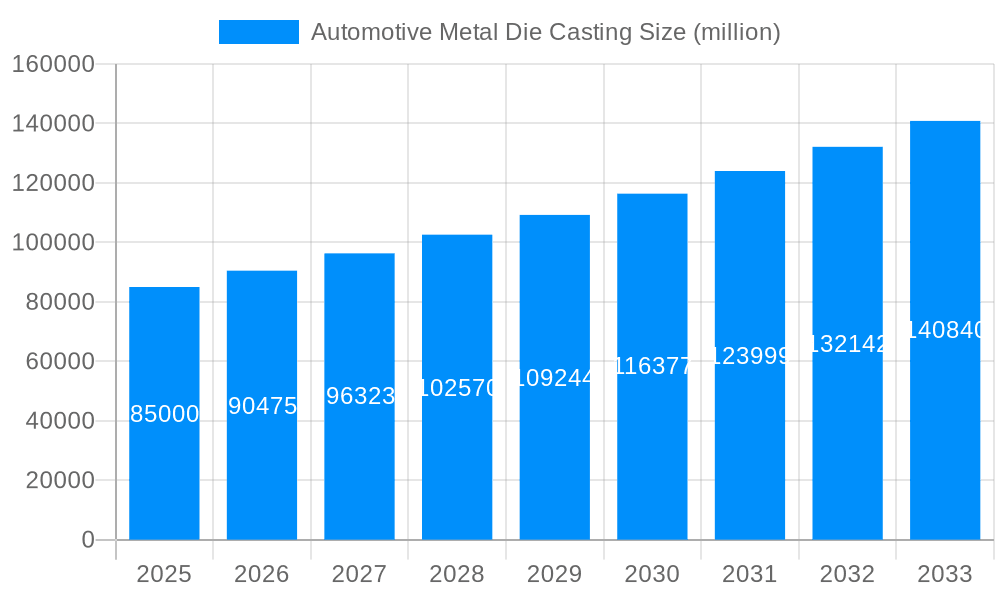

1. What is the projected Compound Annual Growth Rate (CAGR) of the Automotive Metal Die Casting?

The projected CAGR is approximately 4.91%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Automotive Metal Die Casting

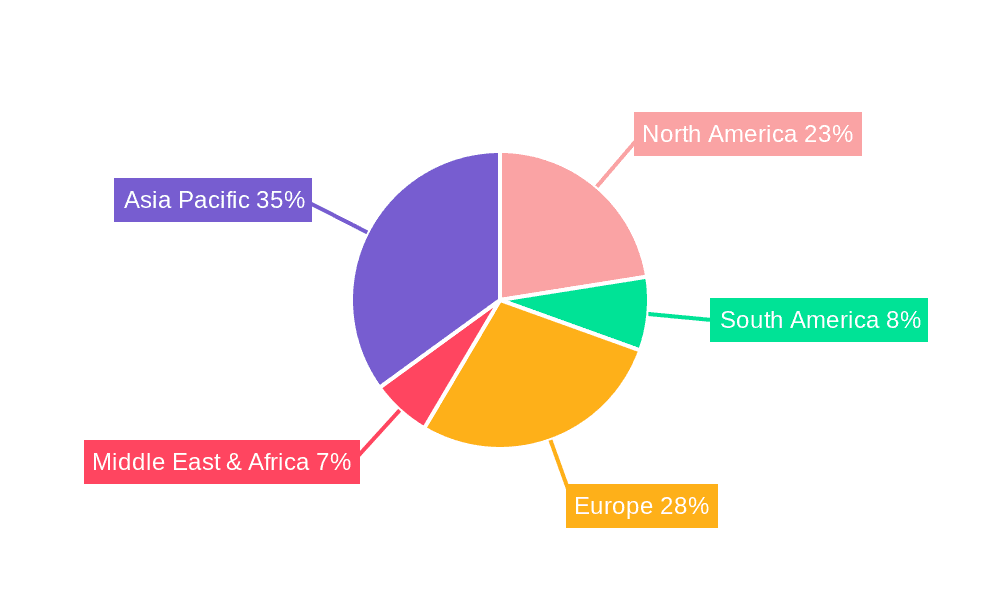

Automotive Metal Die CastingAutomotive Metal Die Casting by Type (Steel Casting, Magnesium Castings, Aluminium Casting, Zinc Casting, Others), by Application (Body Structure and Interior System, Chassis System, Powertrain System, Other), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

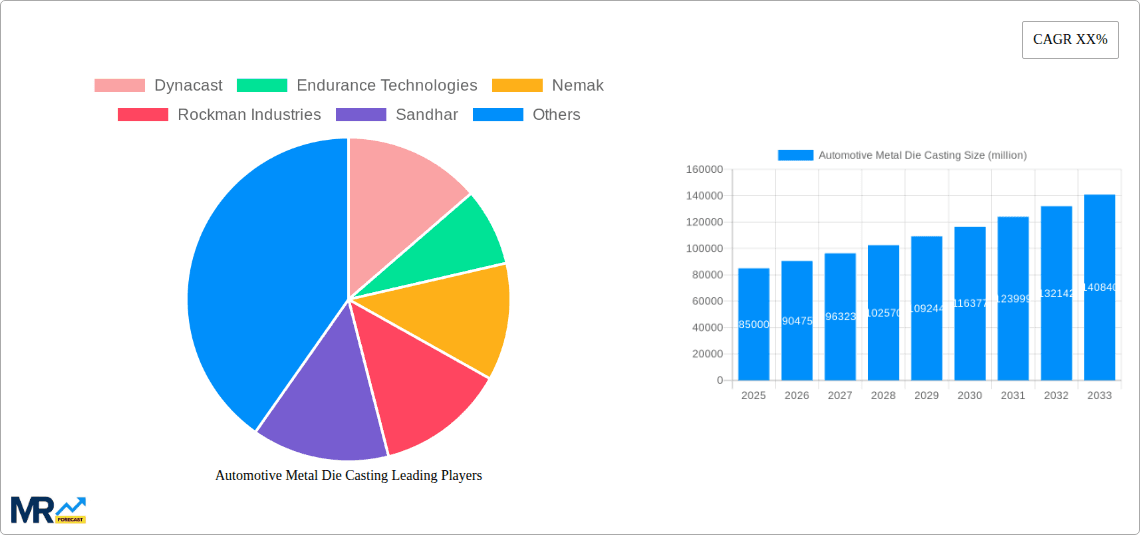

The automotive metal die casting market is experiencing robust growth, driven by the increasing demand for lightweight vehicles to improve fuel efficiency and reduce emissions. The shift towards electric vehicles (EVs) further fuels this expansion, as die casting offers crucial advantages in producing complex components with high precision for EV battery housings and powertrain systems. Aluminum die castings, known for their lightweight properties and corrosion resistance, dominate the market, followed by magnesium and zinc castings, each catering to specific application needs within the automotive sector. The market is segmented by material type (steel, aluminum, magnesium, zinc, and others) and application (body structure, chassis, powertrain, and other interior systems). Major players in this competitive landscape include Meridian, Georg Fischer, Handtmann, KSM Casting, Ryobi Group, and others, continuously innovating to meet evolving industry demands. Geographical distribution shows significant market concentration in regions with established automotive manufacturing hubs like North America, Europe, and Asia Pacific, with China and India leading the growth in the latter. The market's growth trajectory is projected to remain positive, with a significant contribution from emerging economies and the continued adoption of advanced die casting technologies.

The restraining factors include fluctuating raw material prices, stringent environmental regulations, and the high initial investment required for advanced die casting facilities. However, continuous technological advancements, such as high-pressure die casting and improved automation, are addressing some of these challenges, leading to increased production efficiency and improved product quality. The market is expected to witness a considerable expansion in the forecast period, propelled by rising vehicle production globally, particularly in developing economies, coupled with ongoing efforts to enhance vehicle fuel efficiency and safety. Further growth is expected from the integration of lightweight materials to optimize vehicle performance and reduce carbon footprint. The ongoing research and development in materials science and casting technologies will continue to shape the future of the automotive metal die casting market.

The automotive metal die casting market is experiencing robust growth, driven by the increasing demand for lightweight vehicles and the rising adoption of electric vehicles (EVs). The global market size exceeded 100 million units in 2024 and is projected to surpass 200 million units by 2033. This expansion is fueled by several factors. Firstly, the automotive industry's ongoing pursuit of fuel efficiency necessitates the use of lightweight materials, making aluminum and magnesium die castings particularly attractive. Secondly, the proliferation of EVs necessitates sophisticated and lightweight components for optimal battery life and performance, further boosting demand. The shift towards advanced driver-assistance systems (ADAS) and autonomous driving technologies also contributes to the growth, as these systems require intricate and precisely engineered components, often produced through die casting. Finally, the rising disposable incomes in developing economies, coupled with increasing vehicle ownership, are expanding the overall automotive market, thereby driving demand for die-cast components. The market is witnessing innovations in die casting technologies, including high-pressure die casting and thixocasting, which allow for the creation of more complex and higher-quality parts. This technological advancement, along with the adoption of advanced materials, is expanding the applications of die casting in automotive manufacturing. Furthermore, the industry is witnessing a trend towards increased automation and digitalization in the die casting process, enhancing efficiency and reducing production costs. Overall, the automotive metal die casting market is poised for continued growth, with substantial opportunities for companies specializing in innovative materials and advanced manufacturing techniques. The market is witnessing consolidation, with larger players acquiring smaller companies to expand their market share and product portfolio. The competitive landscape is characterized by a mix of established global players and regional manufacturers.

Several key factors are driving the impressive growth trajectory of the automotive metal die casting market. The overarching theme is the continuous need for lighter, stronger, and more cost-effective components in modern vehicles. Lightweighting is paramount for improving fuel economy in internal combustion engine (ICE) vehicles and extending the range of EVs. Aluminum and magnesium alloys, often produced via die casting, excel in this regard. The increasing complexity of modern vehicle designs, incorporating features like advanced safety systems and enhanced comfort features, necessitate intricate and precisely engineered components – a strength of die casting technology. The rise of electric vehicles is a particularly strong driver. EVs require specialized components like battery housings and electric motor casings that are often best produced using die casting techniques due to their ability to create complex shapes with tight tolerances. Furthermore, the ongoing automation and digitalization of the manufacturing process, including the adoption of Industry 4.0 principles, is contributing to increased efficiency and reduced production costs, making die casting a more attractive manufacturing method. This increased efficiency translates to lower prices and increased competitiveness for automotive manufacturers. Finally, government regulations promoting fuel efficiency and emissions reduction indirectly support the demand for lightweight die-cast components.

Despite its promising outlook, the automotive metal die casting industry faces several challenges. The high initial investment costs associated with setting up die casting facilities can act as a significant barrier to entry for new players. The intricate and specialized nature of the technology demands highly skilled labor, a scarcity of which in certain regions can hinder production. Furthermore, fluctuations in raw material prices, especially for aluminum and magnesium, can significantly impact profitability. Maintaining consistent quality control throughout the production process is crucial, as defects can lead to costly recalls and reputational damage. Environmental concerns related to emissions and waste generation during die casting also present a challenge, prompting the industry to invest in cleaner and more sustainable production methods. Intense competition from other manufacturing processes, such as forging and plastic injection molding, further pressures profit margins. Finally, achieving the precise dimensional accuracy and surface finish required for increasingly complex automotive components requires continuous technological advancement and refinement of processes. Addressing these challenges requires strategic investments in automation, skilled workforce development, and sustainable manufacturing practices.

Aluminum Casting is projected to be the dominant segment within the automotive metal die casting market throughout the forecast period (2025-2033). Its lightweight properties, coupled with its good strength-to-weight ratio and excellent castability, make it ideal for a wide range of automotive applications. Demand is expected to significantly increase, driven by the growth of EVs and the ongoing focus on fuel efficiency.

Body Structure and Interior Systems represent a key application area for aluminum die castings. This segment benefits from the lightweight nature of aluminum, allowing automakers to reduce overall vehicle weight and improve fuel economy. Its excellent formability allows for the creation of intricate and complex shapes for interior and exterior components, enhancing design flexibility. The robust nature of aluminum die castings makes them suitable for structural applications, ensuring the safety and durability of the vehicle. The increasing demand for sophisticated interiors and enhanced vehicle aesthetics contributes further to the growth of this segment. The use of aluminum castings in doors, dashboards, and other interior components is expected to see a significant increase in the coming years, fueled by design innovations and the increasing adoption of lightweighting strategies by automakers.

The automotive metal die casting industry is poised for substantial growth, fueled by several key catalysts. The ever-increasing demand for lightweight vehicles, driven by stricter fuel efficiency regulations and the rise of electric vehicles, is a primary driver. Technological advancements in die casting processes, such as high-pressure die casting and thixocasting, are enabling the production of more complex and higher-quality components. Increased automation and the adoption of Industry 4.0 technologies are streamlining production, enhancing efficiency, and reducing costs. The growing adoption of advanced driver-assistance systems (ADAS) and autonomous driving technologies also requires intricate and precisely engineered components, which further fuels demand for sophisticated die casting solutions. Finally, the increasing disposable incomes in developing economies are expanding the overall automotive market, leading to increased demand for vehicles and thus for their components.

This report provides a comprehensive overview of the automotive metal die casting market, offering valuable insights into market trends, driving forces, challenges, and growth opportunities. It presents a detailed analysis of key segments, including different casting types (aluminum, magnesium, zinc, steel) and applications (body structure, powertrain, chassis). A thorough examination of the competitive landscape, including profiles of leading players, is also included, offering crucial information for businesses navigating this dynamic industry. The report provides forecasts for market growth through 2033, giving stakeholders a clear view of future trends and opportunities for investment and strategic planning.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.91% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 4.91%.

Key companies in the market include Meridian, Georg Fischer, Handtmann, KSM Casting, Ryobi Group, Shiloh Industries, DGS Druckgussysteme AG, Gibbs, SCL, Nemak, Rheinmetall Automotive, Dongfeng Motor Company Limited, Zhaoqing Honda Metal, Changzhou Nonferrous Casting, Jiangsu Zhongyi, .

The market segments include Type, Application.

The market size is estimated to be USD XXX N/A as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in N/A.

Yes, the market keyword associated with the report is "Automotive Metal Die Casting," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Automotive Metal Die Casting, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.