1. What is the projected Compound Annual Growth Rate (CAGR) of the Automotive High Solid Coat?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Automotive High Solid Coat

Automotive High Solid CoatAutomotive High Solid Coat by Type (Aminoacrylic Acid, Amino Polyester, White Dry Alkyd Paint), by Application (Topcoat, Midway Layer), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

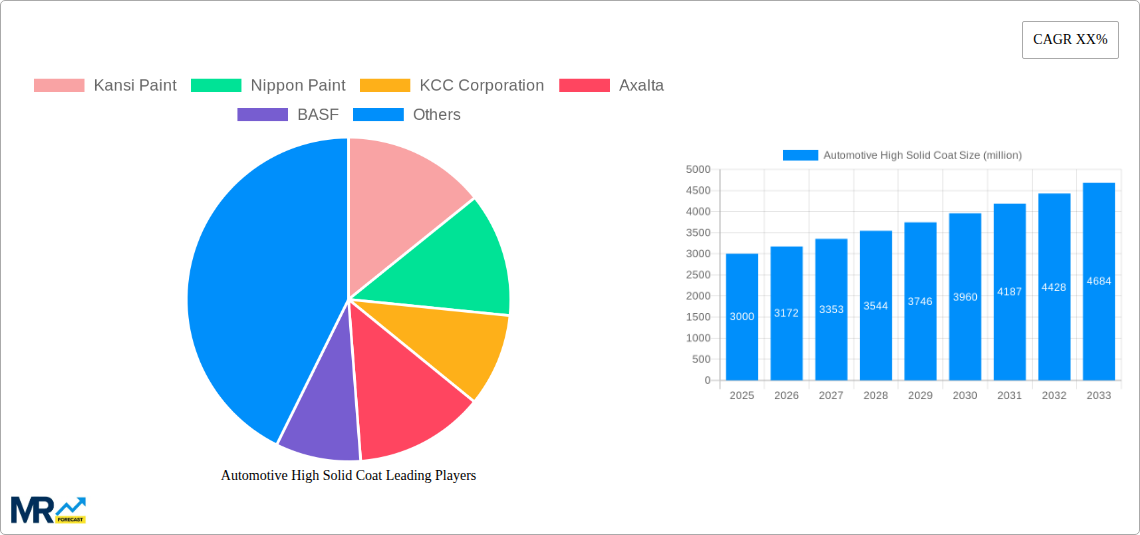

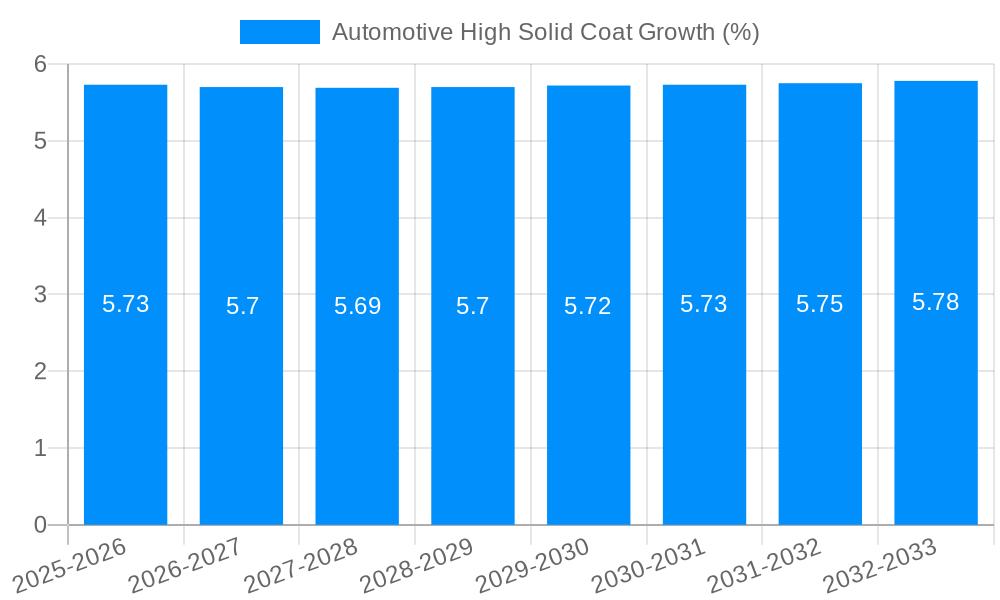

The global Automotive High Solid Coat market is poised for substantial growth, projected to reach approximately $5,500 million by 2033, with a Compound Annual Growth Rate (CAGR) of around 5.5%. This expansion is primarily driven by the increasing demand for environmentally friendly and performance-enhancing coatings in the automotive sector. High solid coatings, characterized by a lower volatile organic compound (VOC) content compared to traditional solvent-borne paints, align perfectly with stringent environmental regulations and growing consumer preference for sustainable automotive finishes. The inherent benefits of high solid coats, including reduced solvent emissions, improved durability, enhanced scratch resistance, and superior gloss retention, are key factors fueling their adoption across various automotive segments. The market's value is estimated to be around $3,000 million in the base year 2025, indicating a significant upward trajectory over the forecast period.

Key segments within the Automotive High Solid Coat market include Aminoacrylic Acid and Amino Polyester types, with Topcoat and Midway Layer applications dominating demand. The automotive industry's continuous innovation in vehicle design and the need for long-lasting, aesthetically pleasing finishes necessitate advanced coating solutions. Leading companies such as PPG, AkzoNobel, Axalta, and Nippon Paint are at the forefront of developing and supplying these sophisticated coatings, investing heavily in research and development to meet evolving industry standards and consumer expectations. While the market enjoys strong growth drivers, potential restraints could include the initial higher cost of some high solid formulations compared to conventional paints and the requirement for specialized application equipment and training. However, the long-term economic and environmental benefits are expected to outweigh these challenges, solidifying the market's robust growth trajectory through 2033.

This report delves into the dynamic and evolving market for Automotive High Solid Coats, providing an in-depth analysis of trends, drivers, challenges, and future projections. Examining the period from 2019 to 2033, with a base year of 2025 and a forecast period extending from 2025 to 2033, this study offers critical insights for stakeholders across the automotive coatings value chain. The research encompasses a detailed evaluation of key market players, technological advancements, and regional dynamics, utilizing unit values in the millions to represent market sizes and volumes.

The automotive high solid coat market is experiencing a significant evolutionary shift driven by a confluence of technological innovation, stringent environmental regulations, and escalating consumer demand for premium vehicle aesthetics and durability. XXX, representing a crucial market insight, highlights the growing preference for environmentally conscious coating solutions that minimize volatile organic compound (VOC) emissions without compromising performance. Over the historical period of 2019-2024, the market witnessed a steady upward trajectory as automotive manufacturers increasingly adopted these advanced coating formulations. The estimated year of 2025 positions the market at a significant inflection point, with projections indicating sustained and accelerated growth in the coming years.

Key trends shaping this landscape include the increasing integration of nano-technology within high solid coats, leading to enhanced scratch resistance, UV protection, and self-healing properties. This advancement directly addresses consumer desires for vehicles that maintain their pristine appearance over extended periods. Furthermore, the development of waterborne high solid coatings is gaining considerable traction, offering a viable alternative to solvent-borne systems and further reducing environmental impact. The pursuit of improved application efficiencies, such as faster drying times and reduced overspray, is also a dominant trend, contributing to cost savings and enhanced productivity within automotive assembly lines. The forecast period of 2025-2033 is expected to see these trends solidify, with high solid coats becoming the dominant coating technology in the automotive sector. The inherent advantages of high solid coatings – superior film build, reduced solvent content, and improved performance characteristics – are increasingly recognized by original equipment manufacturers (OEMs) and aftermarket service providers alike. This recognition is translating into higher adoption rates and a greater market share for these advanced formulations. The market's trajectory is also influenced by the growing sophistication of automotive design, requiring coatings that can deliver complex visual effects, unique textures, and a flawless finish. The inherent flexibility and performance capabilities of high solid coats make them ideally suited to meet these evolving aesthetic demands.

The automotive high solid coat market is propelled by a powerful synergy of economic, regulatory, and technological drivers that are fundamentally reshaping the industry. Foremost among these is the escalating global focus on environmental sustainability. Stringent regulations enacted by governmental bodies worldwide, aimed at curbing VOC emissions, are a primary impetus for the adoption of high solid coats. These coatings, by their very nature, contain a significantly lower proportion of solvents, thus contributing to cleaner air and reduced environmental footprint during the manufacturing process and throughout the vehicle's lifecycle. This regulatory push is not merely a compliance requirement but an increasingly integral aspect of corporate social responsibility for automotive manufacturers.

Furthermore, the constant drive for enhanced vehicle performance and aesthetics plays a pivotal role. Consumers are demanding vehicles that not only look appealing but also possess superior durability and resistance to environmental stressors like UV radiation, chemical exposure, and minor abrasions. High solid coats excel in these areas, offering improved scratch resistance, enhanced gloss retention, and better protection against corrosion, thereby increasing the longevity and value retention of vehicles. This demand for premium finishes is directly translating into a greater market share for advanced coating technologies. The economic benefits associated with high solid coatings, such as reduced energy consumption during curing processes due to their ability to cure at lower temperatures or in shorter times, and improved transfer efficiency leading to less material wastage, also contribute significantly to their widespread adoption. As manufacturers seek to optimize production costs and improve operational efficiencies, the inherent economic advantages of high solid formulations become increasingly compelling. The global automotive industry's sustained growth, particularly in emerging economies, also fuels the demand for automotive coatings, with high solid variants being the preferred choice for new vehicle production and refinishing.

Despite the robust growth trajectory, the automotive high solid coat market is not without its inherent challenges and restraints that warrant careful consideration. One of the primary hurdles is the initial cost of implementation and associated capital expenditure. While high solid coats offer long-term economic benefits, the upfront investment in specialized application equipment, such as high-pressure spray guns and advanced curing systems, can be substantial. This can pose a barrier for smaller manufacturers or those with limited capital resources, particularly in price-sensitive markets.

Another significant restraint is the complexity of application and the need for skilled labor. Achieving the desired finish with high solid coats often requires a higher level of expertise and precision in application techniques compared to conventional coatings. Improper application can lead to defects such as uneven film build, poor flow, and solvent popping, necessitating rework and impacting production efficiency. Training and upskilling of technicians to handle these advanced formulations are therefore crucial, but can be time-consuming and costly. Compatibility issues with existing infrastructure and substrates can also present a challenge. While many high solid coats are designed to be versatile, specific formulations may require adjustments to existing primers or sealants to ensure optimal adhesion and performance. This necessitates thorough testing and potentially reformulation of pre-treatment processes, adding to the complexity of adoption. Furthermore, the perception of higher viscosity and potential application difficulties among some end-users, stemming from older formulations or less optimized products, can linger and act as a psychological barrier to widespread adoption, even as newer, more user-friendly high solid technologies emerge. Finally, disruptions in the supply chain for key raw materials, particularly specialized resins and additives, can lead to price volatility and impact the consistent availability of high solid coat products, thereby constraining market growth.

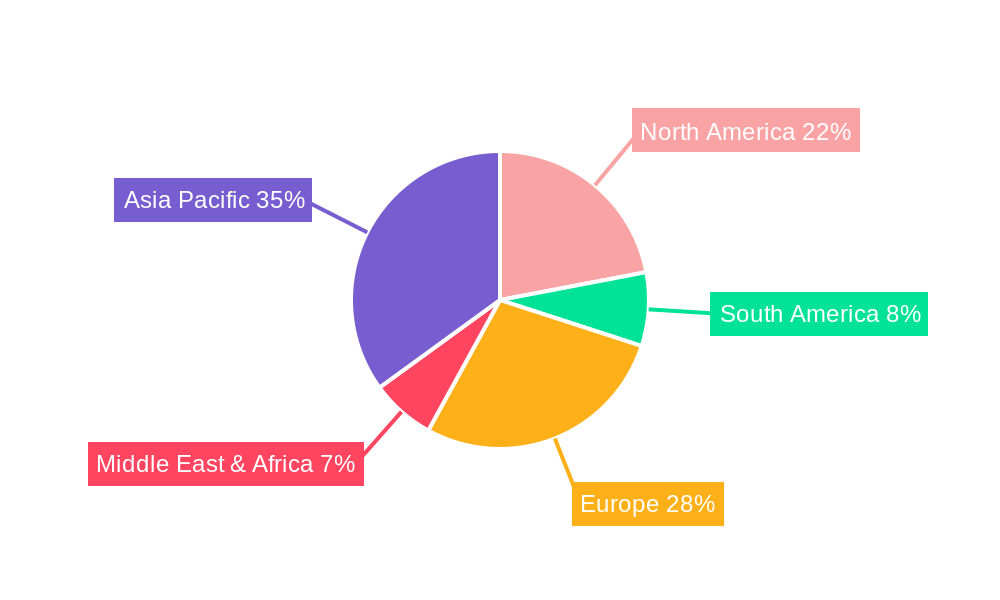

The automotive high solid coat market is characterized by a dynamic interplay of regional strengths and segment dominance, with specific areas poised for significant growth and influence. Among the key regions, Asia Pacific is emerging as a powerhouse, driven by the burgeoning automotive manufacturing sector in countries like China, India, and South Korea. The sheer volume of vehicle production, coupled with a growing emphasis on adopting advanced and environmentally compliant technologies, positions this region for substantial market share. Furthermore, the increasing disposable income in these nations is fueling a demand for premium vehicles, which in turn necessitates higher quality coatings.

Within segments, the Amino Polyester type of high solid coat is expected to witness considerable dominance, particularly in the Topcoat application. Amino Polyester resins offer an excellent balance of properties, including good hardness, flexibility, chemical resistance, and gloss retention, making them ideal for the demanding requirements of automotive topcoats. Their ability to achieve high film builds with low VOC content aligns perfectly with current regulatory trends and performance expectations. The Topcoat segment, by its very nature, is critical for both the aesthetic appeal and protective function of a vehicle, thus demanding the highest performance from coating materials. The growing sophistication of automotive designs, with intricate curves and metallic finishes, further accentuates the need for high-performance topcoats that can deliver flawless application and long-lasting beauty.

In addition to Amino Polyester for topcoats, the Aminoacrylic Acid type also holds significant sway, particularly in the Midway Layer application. Aminoacrylic acid-based high solid coats offer excellent adhesion, chip resistance, and flexibility, making them suitable for the intermediate layers of automotive paint systems. These layers are crucial for providing a robust foundation for the topcoat and protecting the vehicle body from mechanical damage. The growing trend towards multi-layer paint systems in premium vehicles further bolsters the demand for advanced midway layer coatings like those based on aminoacrylic acid. The market's geographical distribution of dominance is also influenced by regional manufacturing hubs. For instance, countries with a strong presence of major automotive OEMs, such as Germany in Europe and the United States, will continue to be significant consumers of high solid coats, driven by established production lines and a demand for cutting-edge automotive finishes. However, the sheer scale of production and the rapid adoption of new technologies in Asia Pacific are expected to propel its dominance in terms of overall market volume and value in the coming forecast period. The continuous innovation in developing more sustainable and cost-effective amino polyester and aminoacrylic acid formulations will further solidify their leadership within their respective application segments.

Several key growth catalysts are actively propelling the automotive high solid coat industry forward. The increasing stringency of environmental regulations globally, particularly concerning VOC emissions, is a primary driver, compelling manufacturers to adopt lower-VOC alternatives like high solid coats. Technological advancements, leading to improved performance characteristics such as enhanced scratch resistance, UV protection, and faster curing times, are making these coatings more attractive. The growing consumer demand for aesthetically pleasing and durable vehicles, coupled with the expanding global automotive market, especially in emerging economies, further fuels this growth.

This comprehensive report offers an exhaustive examination of the automotive high solid coat market, providing detailed insights into market dynamics, segmentation, regional analysis, and competitive landscapes. It delves deep into the historical performance (2019-2024), current market scenario (estimated year 2025), and future projections (forecast period 2025-2033). The report meticulously analyzes the impact of industry developments, technological advancements, and regulatory landscapes on market growth. It provides actionable intelligence for stakeholders seeking to navigate this complex market, offering strategic recommendations based on a robust data-driven methodology. The report aims to equip readers with a thorough understanding of the opportunities and challenges present in the automotive high solid coat sector.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Kansi Paint, Nippon Paint, KCC Corporation, Axalta, BASF, PPG, Akzonobel, Shanghai Kinlita Chemical, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Automotive High Solid Coat," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Automotive High Solid Coat, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.