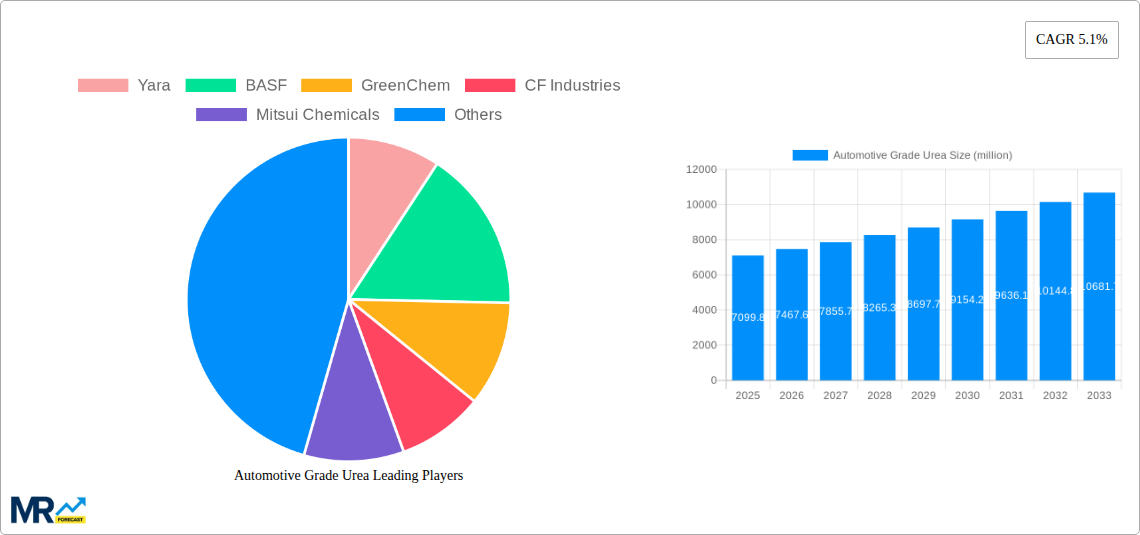

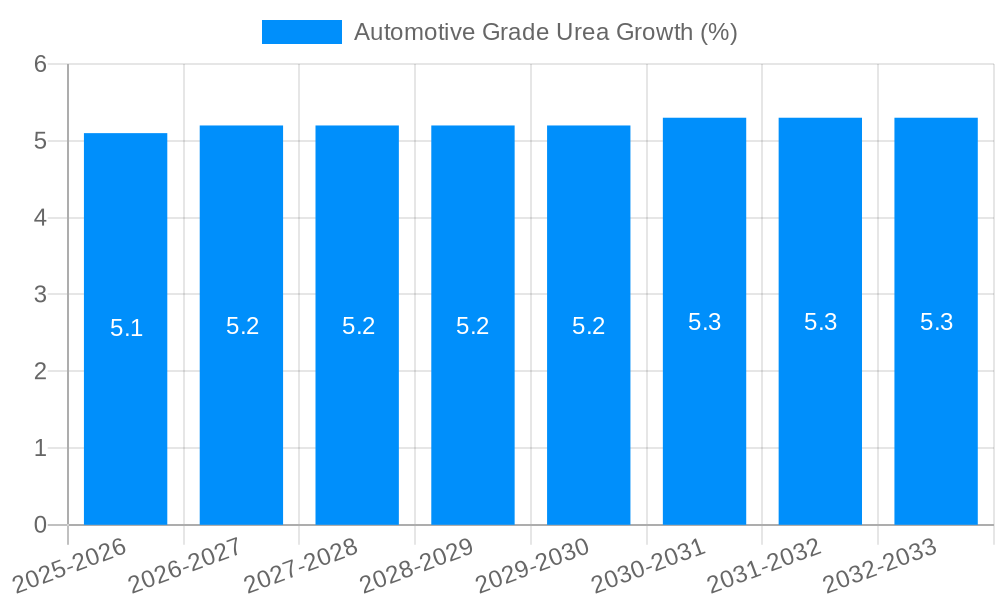

1. What is the projected Compound Annual Growth Rate (CAGR) of the Automotive Grade Urea?

The projected CAGR is approximately 5.1%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Automotive Grade Urea

Automotive Grade UreaAutomotive Grade Urea by Type (Pack (Below20L), Pack (20L~200L), Pack (200L~1000L)), by Application (Commercial Vehicle, Passenger Car, Off Highway Vehicle), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

The global Automotive Grade Urea market is poised for robust expansion, projected to reach an estimated $7,099.8 million by 2025, driven by a Compound Annual Growth Rate (CAGR) of 5.1% throughout the forecast period of 2025-2033. This significant market valuation underscores the critical role of automotive-grade urea in meeting stringent emission regulations worldwide, particularly for diesel-powered vehicles. The increasing adoption of Selective Catalytic Reduction (SCR) technology, which utilizes urea solutions (often referred to as Diesel Exhaust Fluid or DEF) to neutralize harmful nitrogen oxides (NOx) emissions, is a primary catalyst for this growth. As governments globally implement stricter environmental standards to combat air pollution, the demand for automotive-grade urea is set to accelerate, making it an indispensable component for modern vehicle emissions control systems.

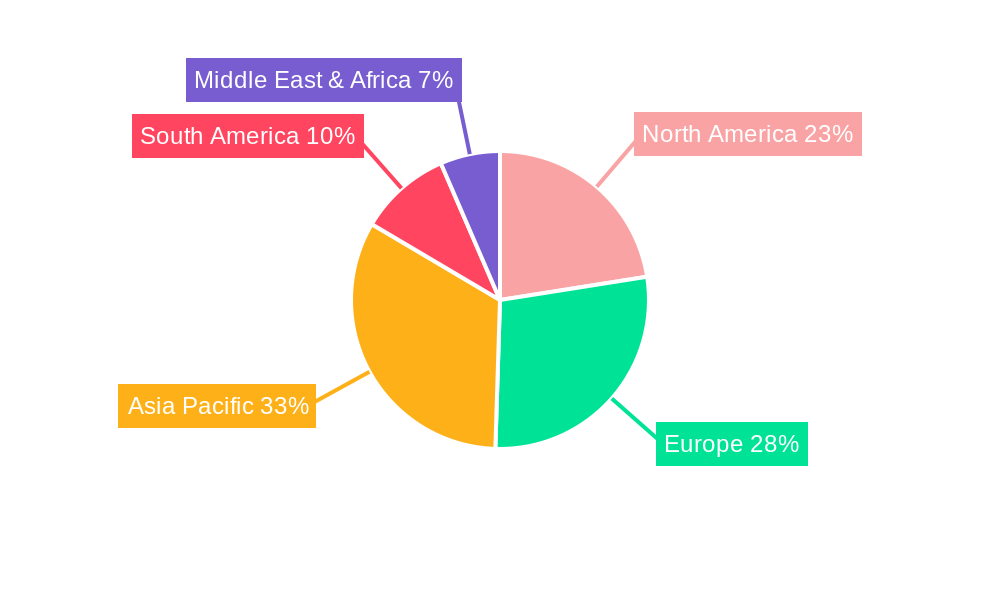

The market is segmented into distinct pack sizes, catering to diverse consumer needs, from smaller retail packs (Below 20L) for passenger cars and light commercial vehicles to larger industrial packs (20L~200L and 200L~1000L) for heavy-duty trucks, buses, and off-highway vehicles. The Commercial Vehicle segment is expected to lead the demand, given the higher mileage and more extensive use of diesel engines in this sector, thus requiring more frequent urea refills. Furthermore, the market is witnessing a dynamic landscape with established chemical giants like Yara, BASF, and CF Industries alongside emerging players, fostering innovation in production efficiency and urea quality. Regional markets, particularly Asia Pacific, are anticipated to exhibit substantial growth due to rapid industrialization, increasing vehicle parc, and evolving emission norms in countries like China and India.

This comprehensive report delves into the dynamic Automotive Grade Urea (AGU) market, offering in-depth analysis and strategic insights for stakeholders. The study spans a significant period, from 2019 to 2033, with a detailed examination of the Base Year (2025) and a robust Forecast Period (2025-2033), building upon the Historical Period (2019-2024). The market's intricate landscape, encompassing various packaging types and critical applications, is thoroughly explored. Furthermore, the report highlights key industry developments and identifies the leading players shaping the future of AGU.

The Automotive Grade Urea market is experiencing a significant evolution, driven by a confluence of stringent environmental regulations, increasing vehicle emissions standards, and a growing global awareness of air quality. The primary application of AGU lies in Selective Catalytic Reduction (SCR) systems, which are indispensable for reducing harmful nitrogen oxide (NOx) emissions from diesel engines in both commercial and passenger vehicles. This trend is further amplified by the continued dominance of diesel powertrains in heavy-duty commercial vehicles and a resurgence in their adoption within specific passenger car segments due to their fuel efficiency advantages. The market is projected to witness a steady, albeit moderate, growth trajectory. Key market insights reveal that the demand for AGU is intrinsically linked to the production and operational output of diesel vehicles worldwide. As global vehicle production fluctuates, so too does the demand for AGU. However, the increasing penetration of SCR technology in newer vehicle models, coupled with the aging diesel fleet requiring ongoing replenishment of urea solutions, ensures a consistent underlying demand. Furthermore, the report anticipates a gradual shift in packaging preferences. While bulk supply remains crucial for large fleet operators and industrial applications, the demand for smaller, convenient packaging solutions (e.g., Pack (Below 20L)) is expected to rise, particularly in aftermarket sales and for individual vehicle owners. This is driven by convenience, ease of storage, and the growing DIY maintenance culture in certain regions. The average selling price of AGU is also a critical factor, influenced by raw material costs (primarily ammonia and CO2), energy prices for production, and logistical expenses. Fluctuations in these input costs can directly impact market profitability. Emerging economies, with their rapidly expanding vehicle parc and increasingly stringent emission norms, represent significant growth opportunities. The report also notes the growing emphasis on product purity and quality, as impurities in AGU can lead to SCR system malfunctions, emphasizing the importance of stringent manufacturing standards and quality control by key players.

The Automotive Grade Urea market is propelled by a formidable set of driving forces, primarily centered around the global imperative to mitigate vehicular pollution. The most significant driver is the ever-tightening regulatory landscape. Governments worldwide are implementing and progressively strengthening emissions standards, such as Euro VI in Europe, EPA standards in the United States, and similar mandates in other developed and developing nations. These regulations mandate drastic reductions in NOx emissions from diesel engines, making SCR systems, and consequently AGU, a non-negotiable component for compliance. The inherent efficiency of diesel engines, particularly in commercial vehicles for heavy-duty applications and long-haul transportation, continues to ensure their relevance, even amidst the rise of electric vehicles. This sustained demand for diesel powertrains directly translates to a continuous need for AGU. The growing global vehicle parc, especially in emerging economies, further fuels demand as more diesel vehicles are introduced into the market. Moreover, the aftermarket segment plays a crucial role, with existing diesel vehicles requiring regular replenishment of urea solutions for their SCR systems to function optimally. The economic benefits associated with diesel fuel efficiency, especially for fleet operators, also indirectly supports the AGU market by sustaining the operational longevity of diesel vehicles.

Despite its robust growth drivers, the Automotive Grade Urea market faces several significant challenges and restraints that could temper its expansion. The most prominent challenge stems from the accelerating transition towards electric vehicles (EVs). As governments and manufacturers increasingly prioritize and invest in electrification, the long-term demand for diesel vehicles, and thus AGU, will inevitably decline. This shift, while gradual, poses a fundamental threat to the market's future growth trajectory. Another restraint is the volatility in the prices of raw materials, particularly ammonia, which is a key precursor to urea. Fluctuations in natural gas prices, which are used to produce ammonia, can significantly impact the production costs and therefore the selling prices of AGU, affecting market affordability. Furthermore, the logistical complexities and costs associated with the distribution of AGU, especially to remote or underserved regions, can act as a restraint. Maintaining product quality and preventing contamination during storage and transportation is crucial, as impurities can lead to severe damage to SCR systems, posing a risk for consumers and manufacturers alike. The availability of readily accessible and affordable AGU, especially in certain developing markets, can also be a limiting factor. Finally, public perception and potential concerns regarding the handling and storage of urea solutions, although largely unfounded with proper protocols, can sometimes create minor hesitations.

The Automotive Grade Urea market is poised for significant dominance by specific regions and segments, driven by a combination of regulatory stringency, vehicle parc composition, and economic development.

Dominant Segments:

Dominant Regions/Countries:

These regions and segments are expected to collectively dominate the global Automotive Grade Urea market due to the intertwined factors of regulatory mandates, the economic viability of diesel powertrains, and the sheer scale of vehicle populations.

The Automotive Grade Urea industry is experiencing several key growth catalysts that are shaping its trajectory. Foremost among these is the continuous tightening of global emissions regulations for diesel vehicles, compelling manufacturers to equip their powertrains with SCR technology. This, in turn, directly boosts the demand for AGU. The sustained relevance of diesel engines in heavy-duty commercial vehicles, owing to their power and fuel efficiency, also acts as a significant growth driver. Furthermore, the expanding aftermarket for AGU replenishment, as existing diesel vehicles require regular maintenance, provides a consistent revenue stream.

The global Automotive Grade Urea market is characterized by the presence of several key players who are instrumental in shaping its supply chain and driving innovation. These companies are at the forefront of manufacturing, distribution, and technological advancements within the sector.

The Automotive Grade Urea sector has witnessed several significant developments that have impacted its market dynamics and technological landscape. These developments, spanning from new product launches to strategic partnerships, highlight the industry's ongoing evolution.

This report offers an unparalleled and comprehensive analysis of the Automotive Grade Urea market. It delves into the intricate details of market segmentation by Type (Pack (Below 20L), Pack (20L~200L), Pack (200L~1000L)) and Application (Commercial Vehicle, Passenger Car, Off Highway Vehicle). The report meticulously analyzes market trends, growth drivers, and restraints, providing a forward-looking perspective from the Base Year (2025) through the Forecast Period (2025-2033), building upon a robust Historical Period (2019-2024). It highlights key industry developments and offers detailed profiles of leading players, providing stakeholders with the critical information necessary for strategic decision-making in this vital sector.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.1% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 5.1%.

Key companies in the market include Yara, BASF, GreenChem, CF Industries, Mitsui Chemicals, Borealis L.A.T, Fertiberia, Nissan Chemical, Kelas, Sichuan Meifeng, ENI S.p.A., TotalEnergies, Cummins, Shell, Novax, Liaoning Rundi, .

The market segments include Type, Application.

The market size is estimated to be USD 7099.8 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Automotive Grade Urea," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Automotive Grade Urea, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.