1. What is the projected Compound Annual Growth Rate (CAGR) of the Automotive Fuel Handling and Evapo System?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Automotive Fuel Handling and Evapo System

Automotive Fuel Handling and Evapo SystemAutomotive Fuel Handling and Evapo System by Type (ET System Type, Mechanical System Type, Others), by Application (Passenger Cars, Commercial Vehicles), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

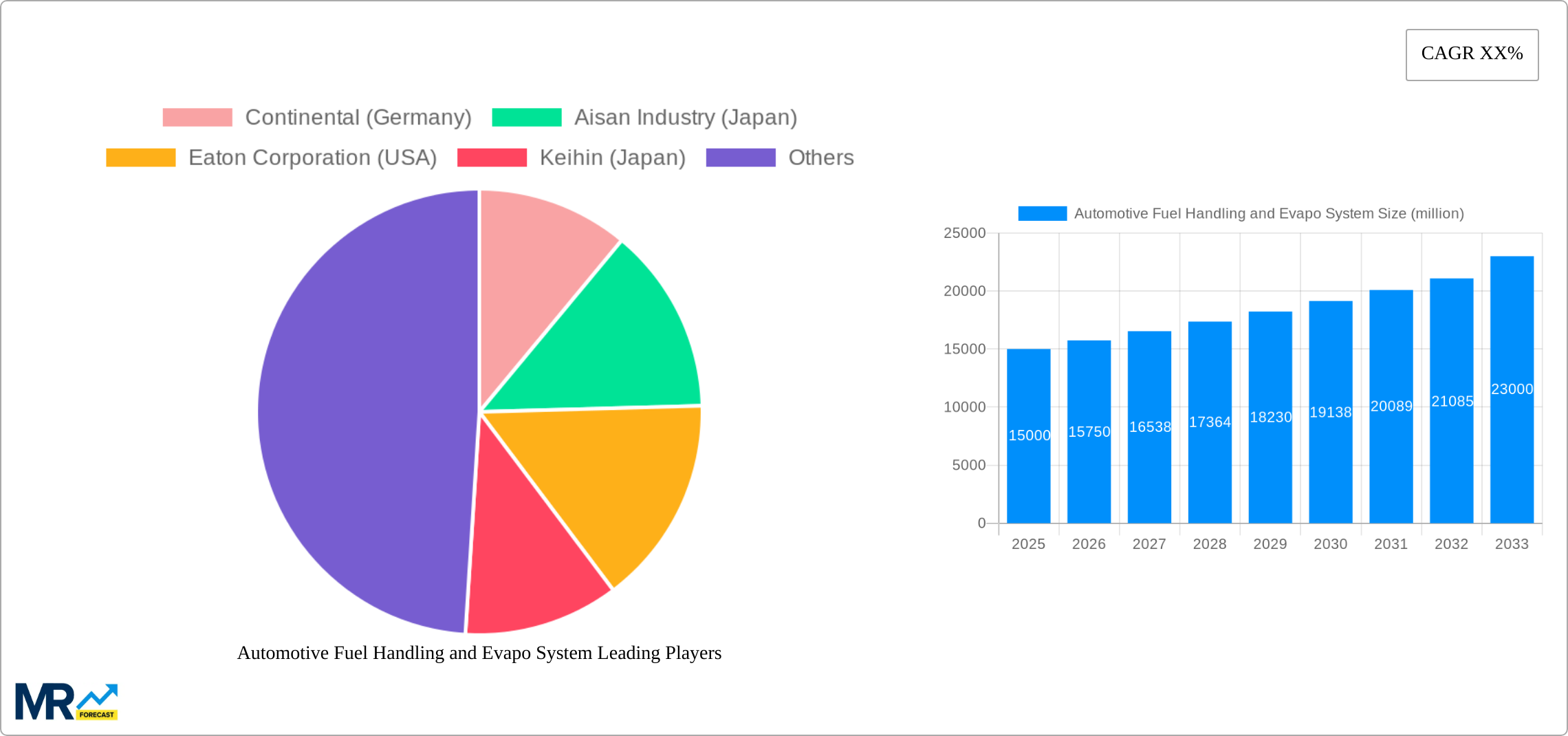

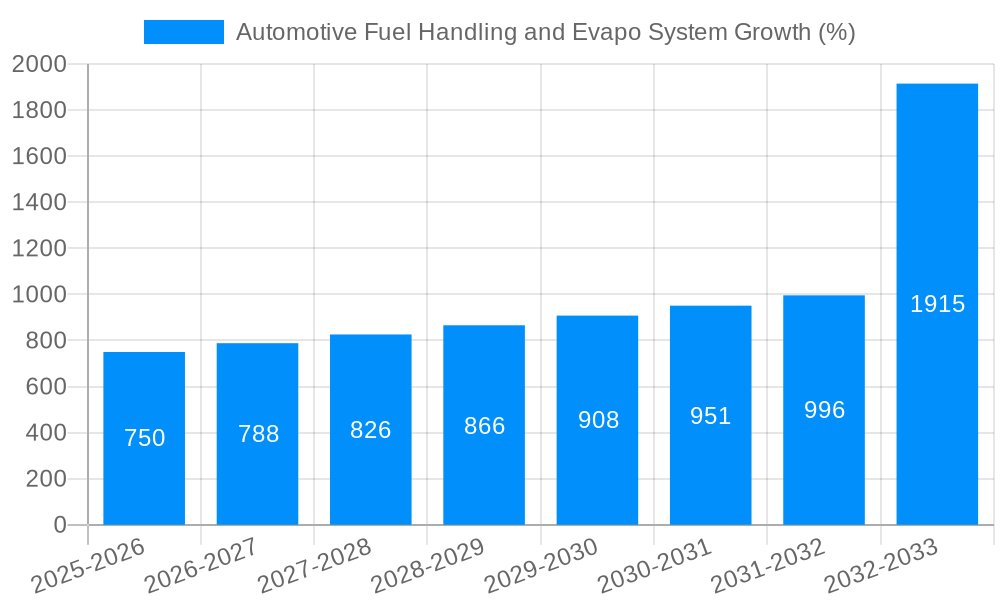

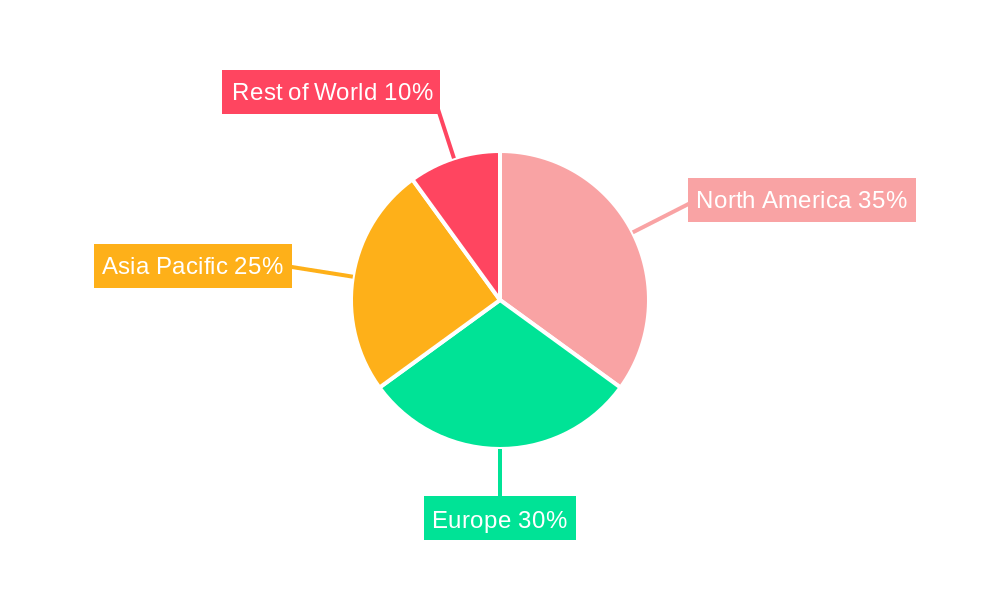

The global automotive fuel handling and evaporative emission (EVAP) system market is experiencing robust growth, driven by stringent emission regulations worldwide and the increasing adoption of advanced fuel-efficient technologies. The market, valued at approximately $15 billion in 2025, is projected to witness a Compound Annual Growth Rate (CAGR) of 5% from 2025 to 2033, reaching an estimated market value of $23 billion by 2033. This growth is fueled by several key factors. Firstly, the continuous tightening of emission norms in major automotive markets, particularly in North America, Europe, and Asia-Pacific, mandates the integration of efficient EVAP systems in vehicles. Secondly, the rising demand for fuel-efficient vehicles is boosting the demand for advanced fuel handling systems that minimize fuel evaporation and improve overall vehicle efficiency. Furthermore, technological advancements in EVAP system components, such as the incorporation of sophisticated sensors and control units, are enhancing system performance and reliability, driving market expansion. The passenger car segment currently holds the largest market share, owing to the significantly higher production volume compared to commercial vehicles. However, the commercial vehicle segment is expected to exhibit a faster growth rate during the forecast period driven by increasing demand for fuel-efficient heavy-duty vehicles. Key players such as Continental, Aisan Industry, Eaton Corporation, and Keihin are actively investing in research and development to introduce innovative solutions and consolidate their market positions.

The geographical distribution of the market reveals a significant presence in North America and Europe, attributed to the established automotive industry and strict emission standards in these regions. However, the Asia-Pacific region, particularly China and India, is anticipated to witness substantial growth in the coming years driven by burgeoning automotive production and increasing government initiatives to reduce vehicular emissions. While technological advancements are driving growth, potential market restraints include the high initial investment costs associated with EVAP system integration and the potential for technological obsolescence as new, more efficient systems are developed. Despite these constraints, the long-term outlook for the automotive fuel handling and EVAP system market remains positive, fueled by the continuous drive towards cleaner and more efficient vehicles globally.

The global automotive fuel handling and evaporative emission (evap) system market is experiencing significant transformation driven by stringent emission regulations, the rising adoption of advanced driver-assistance systems (ADAS), and the growing demand for fuel-efficient vehicles. The market, valued at over $XX billion in 2024, is projected to reach $YY billion by 2033, exhibiting a robust Compound Annual Growth Rate (CAGR). This growth is fueled by several factors including the increasing production of passenger cars and commercial vehicles globally, particularly in developing economies experiencing rapid automotive industry expansion. The shift towards electronic fuel injection systems (ET systems) is a primary driver, replacing older mechanical systems due to their enhanced fuel efficiency and reduced emissions. Furthermore, the incorporation of sophisticated sensors and control units within evap systems improves accuracy in fuel delivery and minimizes evaporative emissions, contributing to a cleaner environment and meeting increasingly strict regulatory mandates. Technological advancements continue to shape the market, with the integration of intelligent algorithms and machine learning for predictive maintenance and optimized fuel delivery creating new opportunities for market players. The competition is intense, with established players and emerging technology companies vying for market share through strategic partnerships, acquisitions, and innovation. The market also shows a diverse range of systems across passenger cars and commercial vehicles reflecting different needs and applications. This report delves into these trends, offering a comprehensive analysis of the market dynamics and future prospects across key segments and geographies. Analysis of historical data (2019-2024) provides a strong foundation for forecasting market behavior up to 2033. This detailed examination highlights the influence of various factors impacting consumption value across the different system types and vehicle applications.

Several key factors are propelling the growth of the automotive fuel handling and evap system market. Stringent government regulations worldwide aimed at reducing greenhouse gas emissions and improving air quality are a primary driver. These regulations mandate the adoption of more efficient and emission-control technologies in vehicles, creating significant demand for advanced fuel handling and evap systems. The increasing focus on fuel efficiency and the rising cost of fuel are also pushing the automotive industry to adopt technologies that optimize fuel consumption. The continuous development and adoption of electronic fuel injection systems offer superior fuel economy compared to mechanical systems, thus boosting their market penetration. Furthermore, the growth in the global automotive industry, particularly in emerging markets, is contributing to the expanding market size. Rising disposable incomes and increasing vehicle ownership in these regions are creating substantial demand for new vehicles, driving up the need for advanced fuel handling and evap systems. Finally, technological advancements are leading to the development of more sophisticated and efficient systems, further stimulating market growth. The integration of intelligent sensors, improved control algorithms, and the incorporation of predictive maintenance capabilities enhance system reliability and longevity, making them more attractive to vehicle manufacturers.

Despite the significant growth potential, the automotive fuel handling and evap system market faces several challenges and restraints. The high initial cost of implementing advanced systems can be a barrier to adoption, particularly for smaller vehicle manufacturers or in price-sensitive markets. The complexity of these systems also presents challenges in terms of design, manufacturing, and maintenance. Maintaining the intricate components requires specialized expertise and sophisticated diagnostic tools, adding to the overall cost of ownership. Furthermore, the ongoing evolution of emission standards and regulatory compliance requirements necessitates continuous adaptation and innovation by manufacturers. Keeping pace with these changing regulations demands substantial investment in research and development, and failure to meet these standards can lead to significant penalties. The increasing integration of electronic systems in modern vehicles also presents integration complexities, particularly regarding software compatibility and cybersecurity. Addressing these integration issues effectively is crucial for ensuring seamless operation and preventing potential malfunctions. Finally, the fluctuating prices of raw materials used in the manufacturing process can impact the profitability of the industry.

The Asia-Pacific region is projected to dominate the automotive fuel handling and evap system market during the forecast period (2025-2033). This is primarily due to the rapid expansion of the automotive industry in countries like China, India, and others in Southeast Asia. The significant increase in vehicle production and sales in these regions creates a massive demand for fuel handling and evap systems.

Paragraph Expansion: The dominance of the Asia-Pacific region reflects the exponential growth in car ownership and production within the region. Governments in these countries are also actively encouraging automotive manufacturing through favorable policies and infrastructure developments. This leads to a significant increase in the demand for fuel efficient and environmentally compliant vehicles and, consequently, the underlying systems driving this improvement. The passenger car segment consistently dominates because of the sheer volume of passenger vehicles manufactured and sold compared to commercial vehicles. While the commercial vehicle segment is also growing, the scale of passenger car production globally makes it the primary consumer of these systems. The shift towards ET systems is particularly noteworthy. The superior performance and regulatory compliance benefits of electronic systems are rapidly replacing traditional mechanical fuel systems, accelerating their adoption globally. This trend is further amplified by the continued improvement in the affordability and sophistication of ET systems, making them an attractive proposition for a larger segment of the automotive market.

Several factors are catalyzing growth within the automotive fuel handling and evap system industry. Stringent emission regulations across the globe are driving the need for advanced, highly efficient, and cleaner emission systems. The increasing demand for fuel-efficient vehicles is also pushing innovation in this field. Technological advancements, such as the development of sophisticated sensors and control units, are improving the efficiency and performance of these systems. Finally, the rising production of vehicles, particularly in developing economies, is creating a larger market for these essential components.

This report provides a comprehensive overview of the automotive fuel handling and evap system market, offering valuable insights into market trends, growth drivers, challenges, and key players. It covers a detailed analysis of historical data (2019-2024), providing a robust foundation for forecasting market behavior until 2033. The report also segments the market by system type, vehicle application, and geography, providing a granular view of the market dynamics. With thorough analysis across these segments, and a focus on key market players, this report presents a comprehensive resource for anyone involved in this evolving sector. The report includes detailed projections of market size and growth, along with an in-depth assessment of future market opportunities.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Continental (Germany), Aisan Industry (Japan), Continental (Germany), Eaton Corporation (USA), Keihin (Japan), .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Automotive Fuel Handling and Evapo System," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Automotive Fuel Handling and Evapo System, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.