1. What is the projected Compound Annual Growth Rate (CAGR) of the Automotive Biometric Device?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Automotive Biometric Device

Automotive Biometric DeviceAutomotive Biometric Device by Type (Fingerprint Scan, Voice Recognition, Iris Recognition, Face Recognition, Others), by Application (Cars, SUV, Pickup Trucks, Commercial Vehicle), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

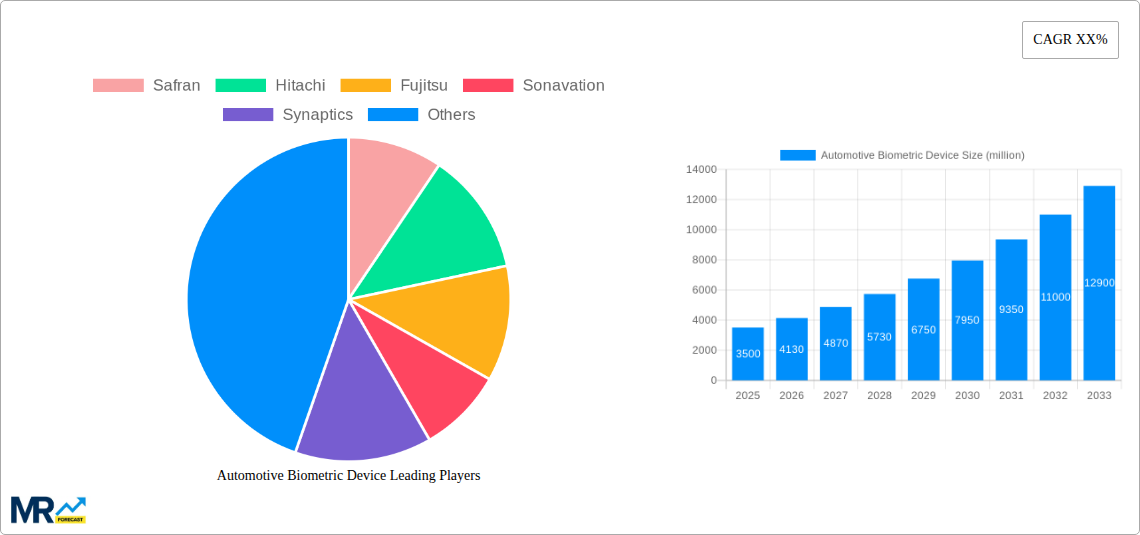

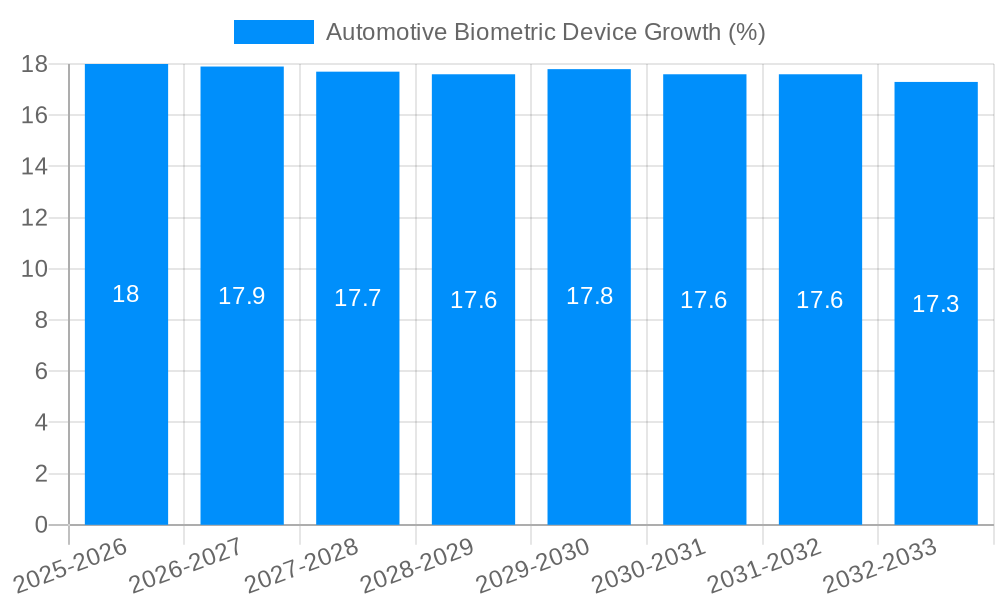

The global automotive biometric device market is experiencing robust growth, projected to reach an estimated USD 3,500 million in 2025 and expanding at a compound annual growth rate (CAGR) of 18.5% through 2033. This expansion is primarily driven by the escalating demand for enhanced vehicle security, personalized driver experiences, and the increasing integration of advanced driver-assistance systems (ADAS). As consumer expectations for convenience and safety rise, biometric authentication methods like fingerprint scanning, voice recognition, iris scanning, and facial recognition are becoming indispensable features in modern vehicles. These technologies not only prevent unauthorized access but also enable seamless personalization of vehicle settings, from seat positions to infotainment preferences, thereby elevating the overall driving experience. The growing adoption of these sophisticated systems across passenger cars, SUVs, pickup trucks, and commercial vehicles underscores a significant shift towards intelligent and secure automotive interiors.

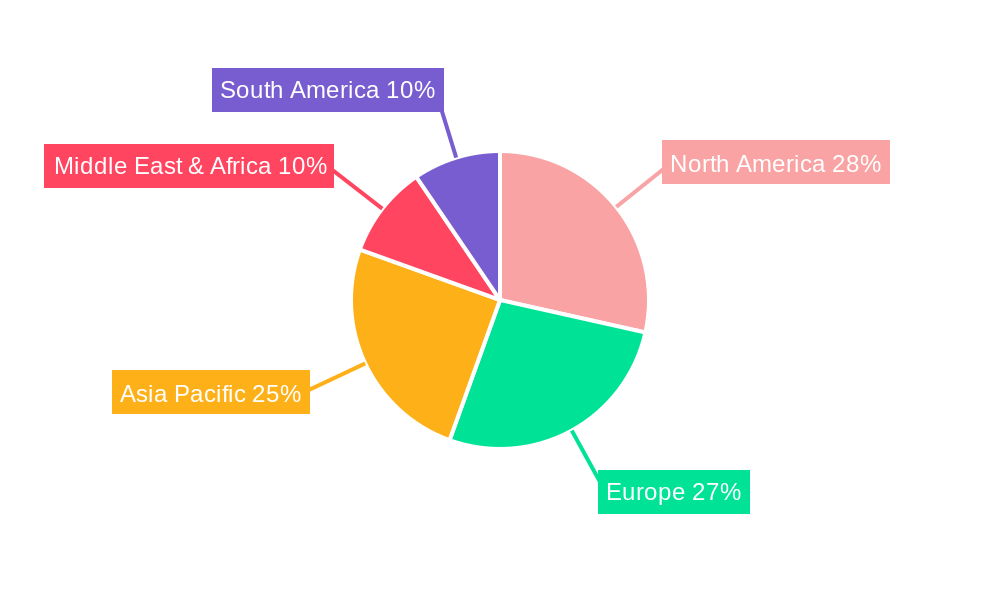

The market's trajectory is further bolstered by continuous technological advancements and strategic collaborations among key players. Companies are actively investing in research and development to refine the accuracy, speed, and reliability of biometric sensors and algorithms, making them more robust against environmental challenges and user variations. The trend towards connected cars and autonomous driving further amplifies the need for secure and intuitive authentication methods, paving the way for biometric systems to play a crucial role in data protection and user identification. While the initial cost of implementation and the need for standardized protocols present some challenges, the long-term benefits in terms of security, convenience, and a premium user experience are compelling. The market is witnessing a strong uptake in regions like North America and Europe, with Asia Pacific poised for substantial growth due to rapid automotive market expansion and increasing consumer disposable income. This dynamic landscape promises a future where biometrics are an integral part of every automotive journey, ensuring safety, personalization, and seamless interaction.

This comprehensive report delves into the dynamic landscape of the Automotive Biometric Device market, forecasting its trajectory from 2019 to 2033. The Base Year of 2025 will serve as a pivotal point for analysis, with projections and estimations for the Estimated Year of 2025 and a detailed Forecast Period of 2025-2033. The Historical Period of 2019-2024 provides crucial context for understanding past market evolution and identifying nascent trends.

The report meticulously analyzes the market across various segments, including Type (Fingerprint Scan, Voice Recognition, Iris Recognition, Face Recognition, Others) and Application (Cars, SUV, Pickup Trucks, Commercial Vehicle). It offers detailed insights into the competitive environment, profiling key players such as Safran, Hitachi, Fujitsu, Sonavation, Synaptics, Bioenable, Continental, Fingerprint Cards, and Gentex.

The automotive biometric device market is experiencing a significant and transformative growth phase, moving beyond basic authentication to becoming an integral part of the in-cabin experience and advanced vehicle functionality. Current trends highlight a shift towards multi-modal biometric systems, where the combination of different authentication methods, such as fingerprint and voice recognition, offers enhanced security and user convenience. The increasing demand for personalized driving experiences is a major driver, with biometrics enabling features like automatic seat and mirror adjustments, infotainment customization, and climate control settings tailored to individual drivers. Furthermore, the integration of biometrics into vehicle access systems is gaining traction, reducing reliance on traditional keys and fobs and offering a more seamless entry and ignition process. The adoption of biometric technology is also being fueled by the growing emphasis on in-car cybersecurity, as these systems provide a robust layer of protection against unauthorized access and vehicle theft. Looking ahead, advancements in AI and machine learning are expected to further enhance the capabilities of automotive biometric devices, enabling predictive personalization and proactive driver monitoring for safety. The market is witnessing a steady increase in unit shipments, projected to reach several million units by the end of the forecast period. For instance, fingerprint scanners are currently leading the adoption curve due to their established reliability and cost-effectiveness. However, voice recognition is rapidly gaining ground, especially with the proliferation of in-car voice assistants and the desire for hands-free operation. Iris recognition, while still nascent, holds significant promise for high-security applications and driver identification. The overall trend indicates a move towards a more intelligent and secure automotive cabin, where biometrics plays a central role in both user experience and operational efficiency. The increasing sophistication of these devices, coupled with decreasing manufacturing costs, is making them more accessible for a wider range of vehicle segments, from premium cars to mass-market models. The market is also seeing a growing interest from commercial vehicle manufacturers, who are looking to enhance driver identification, fleet management, and compliance.

The automotive biometric device market's rapid expansion is fueled by a confluence of technological advancements, evolving consumer expectations, and a strategic push for enhanced vehicle security and personalization. At the forefront of this growth is the escalating demand for personalized in-car experiences. Consumers increasingly expect their vehicles to adapt to their individual preferences, and biometrics offers a seamless way to achieve this. From automatically adjusting seating positions and mirror angles to curating infotainment playlists and climate control settings, biometric systems enable a truly bespoke driving environment. Furthermore, the persistent global concern regarding vehicle security and the prevention of theft is a significant catalyst. Biometric authentication, offering a level of security far exceeding traditional keys or PIN codes, is becoming a critical feature for manufacturers aiming to differentiate their offerings and assure customers of their vehicle's safety. The ongoing advancements in sensor technology and artificial intelligence are also playing a crucial role. Miniaturization, increased accuracy, and reduced power consumption of biometric sensors, coupled with sophisticated algorithms for pattern recognition, are making these systems more viable and cost-effective for mass adoption. The growing trend of smart homes and smart devices is also influencing consumer expectations in the automotive sector, creating an appetite for similar levels of intelligent and secure access within their vehicles. The drive towards autonomous driving also presents a unique opportunity for biometrics, as it can facilitate seamless driver identification and handover of control, ensuring the right individual is operating the vehicle. The market is also being propelled by government regulations and industry standards that are beginning to emphasize enhanced vehicle security and data protection, indirectly encouraging the adoption of biometric solutions.

Despite the robust growth trajectory, the automotive biometric device market faces several hurdles that could potentially impede its widespread adoption. A primary challenge lies in the cost of implementation. While prices are declining, the integration of sophisticated biometric systems, particularly multi-modal solutions, can still represent a significant investment for automakers, especially for mass-market vehicles. This cost factor can lead to a segmentation of the market, with premium vehicles being early adopters, while budget-conscious segments lag behind. Another considerable restraint is the accuracy and reliability of biometric sensors in diverse environmental conditions. Factors such as extreme temperatures, humidity, dust, and even temporary changes in the user's biometric traits (e.g., sweaty fingers, masked faces) can affect the accuracy of identification, leading to user frustration and potential security vulnerabilities. This necessitates extensive testing and robust sensor technology. Privacy concerns and data security are also paramount. Consumers are increasingly aware of data privacy, and the collection and storage of sensitive biometric data within vehicles raise questions about who owns this data, how it is protected from breaches, and whether it could be used for purposes beyond vehicle access. Building consumer trust in the secure handling of this information is crucial. Furthermore, the standardization of biometric protocols and interoperability across different vehicle manufacturers and biometric system providers remains a challenge. Lack of standardization can lead to fragmented solutions and hinder seamless integration. The user acceptance and learning curve associated with new biometric technologies can also be a factor. While some biometrics are intuitive, others might require users to adapt their behavior, which can slow down adoption rates. Finally, the regulatory landscape surrounding biometric data collection and usage in vehicles is still evolving, and the absence of clear guidelines in some regions can create uncertainty for manufacturers.

The automotive biometric device market is poised for significant growth across various regions and segments, with a few key players and segments expected to lead the charge.

Dominant Segments by Type:

Dominant Segments by Application:

Dominant Regions/Countries:

The interplay of these dominant segments and regions, driven by advancements in fingerprint, voice, and face recognition technologies applied to passenger cars and SUVs, is shaping the future of the automotive biometric device market.

Several factors are acting as potent growth catalysts for the automotive biometric device industry. The increasing sophistication of in-car digital experiences, with a growing emphasis on personalization and connectivity, directly fuels the demand for biometric solutions. As consumers expect their vehicles to mirror the seamless, personalized experiences of their smartphones and smart homes, biometrics becomes a key enabler. Furthermore, advancements in AI and machine learning are unlocking new functionalities for biometric systems, moving beyond mere authentication to proactive driver monitoring, predictive maintenance, and enhanced safety features, thereby broadening their appeal and market potential. The ongoing efforts by automotive manufacturers to differentiate their offerings in a highly competitive market also serve as a significant catalyst, with biometrics emerging as a premium feature that attracts tech-savvy buyers.

This report offers an unparalleled and exhaustive analysis of the automotive biometric device market. It meticulously charts the market's evolution through the historical period (2019-2024), dissects current trends and drivers, and provides robust forecasts for the forecast period (2025-2033), using 2025 as the base and estimated year. The report delves deep into the competitive landscape, profiling key players like Safran, Hitachi, and Continental, and analyzes the market across critical segments including fingerprint, voice, iris, and face recognition, as well as cars, SUVs, and commercial vehicles. With detailed market insights, regional analysis, and a forward-looking perspective, this report is an indispensable resource for stakeholders seeking to understand and capitalize on the burgeoning opportunities within the automotive biometric device industry.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Safran, Hitachi, Fujitsu, Sonavation, Synaptics, Bioenable, Continental, Fingerprint Cards, Gentex, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Automotive Biometric Device," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Automotive Biometric Device, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.