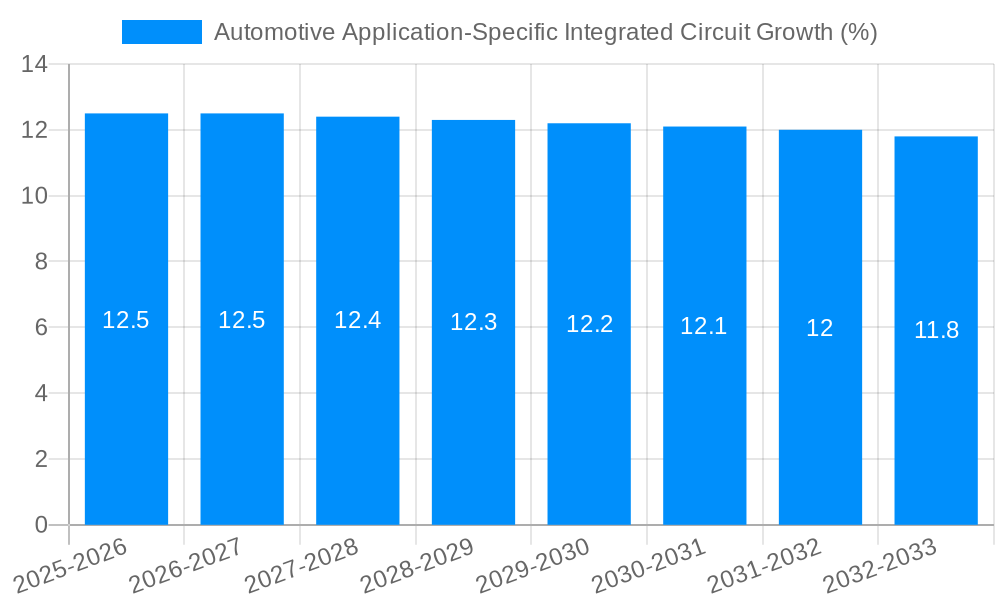

1. What is the projected Compound Annual Growth Rate (CAGR) of the Automotive Application-Specific Integrated Circuit?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Automotive Application-Specific Integrated Circuit

Automotive Application-Specific Integrated CircuitAutomotive Application-Specific Integrated Circuit by Type (Full Custom Design ASIC, Semi-custom Design ASIC (Standard Cell Based ASIC and Gate Array Based ASIC), Programmable ASIC), by Application (Passenger Vehicle, Commercial Vehicle), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

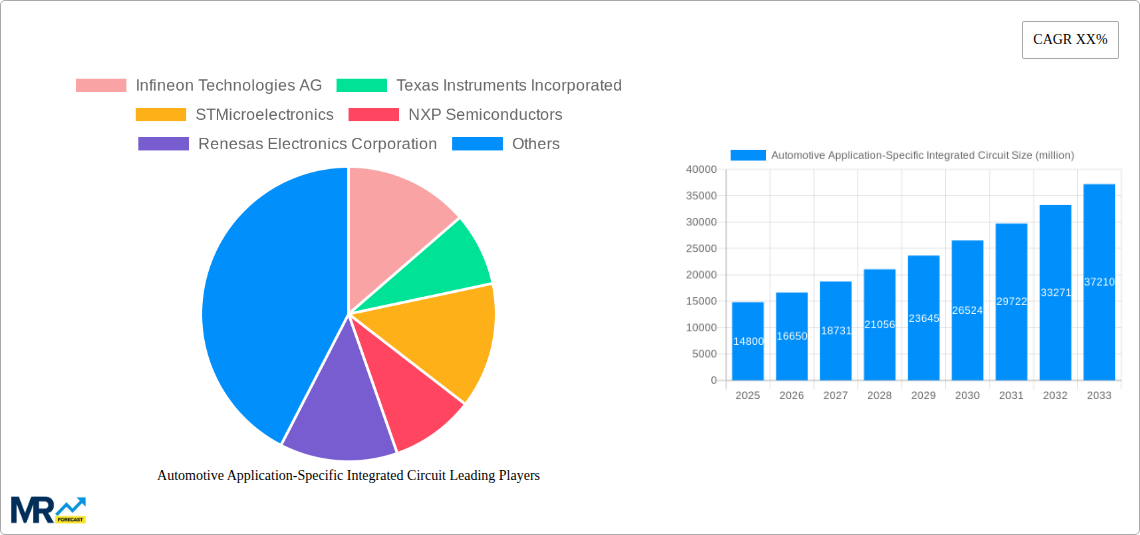

The Automotive Application-Specific Integrated Circuit (ASIC) market is experiencing robust growth, projected to reach a significant valuation of approximately $14.8 billion by 2025, with an impressive Compound Annual Growth Rate (CAGR) of 12.5% expected to propel it to over $26.5 billion by 2033. This expansion is primarily driven by the escalating demand for advanced driver-assistance systems (ADAS), the widespread adoption of electric vehicles (EVs), and the increasing integration of sophisticated infotainment and connectivity features in modern automobiles. ASICs, tailored for specific automotive functions, offer superior performance, power efficiency, and cost-effectiveness compared to general-purpose processors, making them indispensable for meeting the complex computational needs of next-generation vehicles. The market is further energized by continuous innovation in semiconductor technology and a growing emphasis on vehicle safety and autonomous driving capabilities, all of which necessitate highly specialized and optimized integrated circuits.

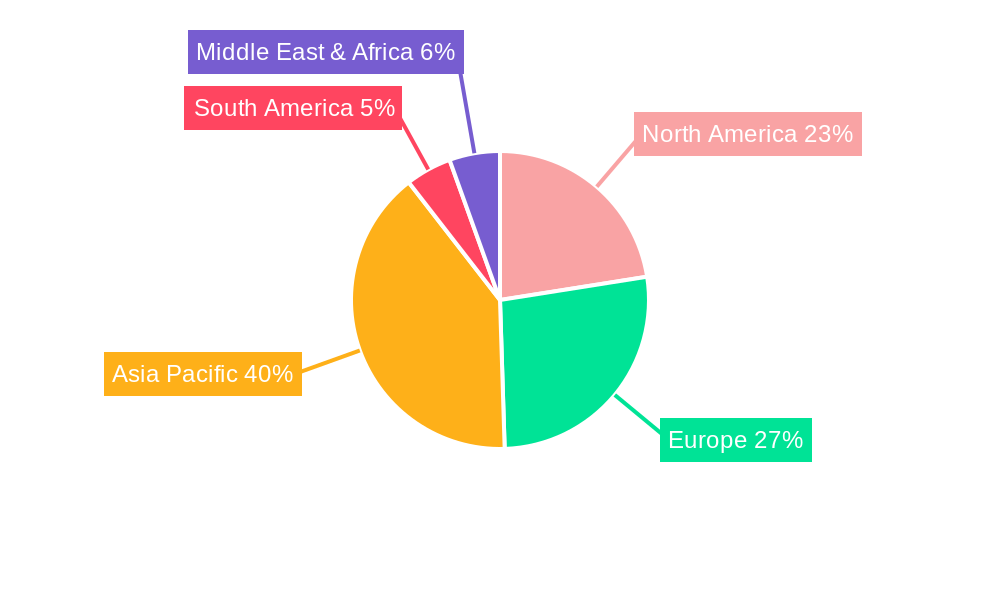

The market segmentation reveals a strong preference for Full Custom Design ASICs, accounting for a substantial portion of the market due to their ability to deliver unparalleled performance and integration for critical automotive functions. Semi-custom Design ASICs, encompassing Standard Cell Based and Gate Array Based ASICs, also hold a significant share, offering a balance between customization and development time. Programmable ASICs are gaining traction, particularly in applications requiring flexibility and faster time-to-market. Geographically, Asia Pacific, led by China, is emerging as the dominant region, driven by its massive automotive manufacturing base and rapid technological adoption. North America and Europe follow closely, fueled by stringent safety regulations and the increasing presence of high-end automotive features. Key industry players such as Infineon Technologies AG, Texas Instruments Incorporated, and STMicroelectronics are at the forefront of this market, investing heavily in research and development to deliver cutting-edge ASIC solutions that cater to the evolving demands of the automotive industry.

This comprehensive report delves into the dynamic and rapidly evolving global Automotive Application-Specific Integrated Circuit (ASIC) market. With a deep dive into the historical landscape from 2019 to 2024 and extending through an ambitious forecast period up to 2033, this analysis leverages 2025 as the base and estimated year to provide a robust understanding of market trajectories. The report quantifies market size in millions of units, offering tangible insights into the scale of adoption for these critical components.

The automotive industry's increasing reliance on sophisticated electronic systems for everything from advanced driver-assistance systems (ADAS) to in-car infotainment and electrified powertrains is directly fueling the demand for tailored ASICs. These specialized integrated circuits are designed for specific automotive functions, offering significant advantages in performance, power efficiency, and cost optimization compared to general-purpose chips. This report meticulously examines the market segmentation across ASIC types, including Full Custom Design ASICs, Semi-custom Design ASICs (further categorized into Standard Cell Based ASICs and Gate Array Based ASICs), and Programmable ASICs. It also analyzes the market penetration within key application segments, namely Passenger Vehicles and Commercial Vehicles.

The study employs advanced analytical methodologies to dissect market trends, identify key growth drivers, and pinpoint potential challenges. Strategic insights into leading companies and significant technological advancements are presented, providing stakeholders with a complete picture of the competitive and innovation landscape. This report is an indispensable resource for manufacturers, suppliers, automotive OEMs, and investors seeking to navigate and capitalize on the burgeoning opportunities within the Automotive ASIC market.

XXX, the global Automotive ASIC market is experiencing a seismic shift driven by the relentless pursuit of enhanced vehicle functionality, safety, and efficiency. Over the study period (2019-2033), the market has transitioned from supporting basic electronic control units (ECUs) to powering the complex computational demands of autonomous driving and sophisticated infotainment systems. The estimated market size in 2025, projected to reach [Insert Estimated Market Size in Millions of Units Here] million units, underscores the sheer volume of these specialized chips being integrated into vehicles worldwide. A significant trend is the increasing adoption of Full Custom Design ASICs, particularly in high-performance applications like AI accelerators for ADAS and autonomous driving. These ASICs offer unparalleled optimization for specific algorithms, leading to superior processing power and energy efficiency, crucial for battery-powered electric vehicles.

The demand for Semi-custom Design ASICs, especially Standard Cell Based ASICs, continues to be robust, driven by their cost-effectiveness and faster time-to-market for a wide range of applications, including powertrain management, body control modules, and infotainment systems. Gate Array Based ASICs, while perhaps seeing a slower growth trajectory compared to other types, still find niche applications where quick prototyping and moderate customization are key. Programmable ASICs, also known as FPGAs in automotive contexts, are gaining traction for their flexibility in handling evolving software demands and for early-stage development of complex functionalities before committing to a full custom design. The forecast period (2025-2033) anticipates continued strong growth, with projections indicating the market could reach [Insert Projected Market Size in Millions of Units in 2033 Here] million units by 2033. This growth is further fueled by the increasing complexity of automotive architectures, the proliferation of sensors, and the growing connectivity within vehicles. The report highlights a notable trend towards ASICs with integrated safety features, adhering to stringent automotive safety integrity levels (ASILs), reflecting the industry's unwavering focus on passenger and road safety.

The automotive ASIC market is being propelled by a confluence of powerful technological advancements and evolving consumer expectations. The most significant driver is the rapid progress in vehicle electrification and the subsequent demand for highly efficient and integrated power management solutions. Electric vehicles (EVs) require sophisticated battery management systems (BMS), advanced motor controllers, and robust charging infrastructure interfaces, all of which benefit immensely from custom-designed ASICs that optimize performance and minimize energy loss. Furthermore, the escalating complexity of Advanced Driver-Assistance Systems (ADAS) and the nascent but rapidly expanding field of autonomous driving are creating an insatiable appetite for high-performance processing power. ASICs are instrumental in processing vast amounts of sensor data from cameras, radar, and lidar in real-time, enabling features like adaptive cruise control, lane-keeping assist, and automatic emergency braking.

Beyond safety and performance, the growing emphasis on in-car user experience is another major impetus. Advanced infotainment systems, digital cockpits, and seamless connectivity features demand powerful and energy-efficient processors capable of handling complex graphical interfaces, audio processing, and data streaming. ASICs offer a competitive edge by providing tailored solutions that outperform general-purpose processors in these specific applications, leading to better performance and reduced power consumption. The ongoing trend of vehicle connectivity, including V2X (Vehicle-to-Everything) communication, is also spurring the development of ASICs capable of secure and high-speed data transfer. Finally, the increasing stringency of automotive regulations, particularly concerning safety and emissions, is compelling automakers to adopt more advanced electronic systems, thereby driving the demand for specialized ASICs that can meet these rigorous standards.

Despite the robust growth trajectory, the Automotive ASIC market faces several significant challenges and restraints that could temper its expansion. One of the primary hurdles is the exceptionally high development cost and long lead times associated with Full Custom Design ASICs. Designing, verifying, and manufacturing these highly specialized chips requires substantial investment in intellectual property, design tools, and fabrication facilities. This can be a deterrent for smaller automotive players or for applications with shorter product life cycles where the return on investment might be questionable. The complexity of the automotive supply chain also presents a challenge. The intricate relationships between chip manufacturers, tier-one suppliers, and automotive OEMs necessitate meticulous planning, rigorous testing, and robust quality control to ensure the reliability and safety of ASICs deployed in vehicles.

The stringent regulatory environment, while a driver of innovation, also imposes significant development burdens. ASICs intended for automotive use must meet extremely high standards of reliability, functional safety (ASIL compliance), and electromagnetic compatibility (EMC). Achieving these certifications requires extensive validation and documentation, adding to the overall development time and cost. Furthermore, the rapid pace of technological evolution in the automotive sector, particularly in areas like artificial intelligence and connectivity, can lead to obsolescence concerns. A custom ASIC designed for a specific generation of a vehicle might become outdated relatively quickly if new technologies emerge, creating a risk of stranded development costs. Finally, the global semiconductor shortage, which has impacted various industries, can also affect the availability and pricing of raw materials and manufacturing capacity, posing a potential restraint on the seamless growth of the Automotive ASIC market.

The global Automotive ASIC market is characterized by a dynamic interplay of regional strengths and segment preferences, with certain areas and applications exhibiting a clear dominance. Asia Pacific, particularly China, stands out as a key region poised to dominate the Automotive ASIC market. This dominance is driven by several factors. China is the world's largest automotive market by volume, with a rapidly growing production of both passenger and commercial vehicles. The country's aggressive push towards electric vehicles, supported by strong government initiatives and subsidies, has created an unprecedented demand for sophisticated ASICs related to battery management, powertrain control, and charging. Furthermore, China is at the forefront of developing autonomous driving technologies and smart cockpit solutions, necessitating the integration of high-performance ASICs. The presence of numerous domestic chip manufacturers and the increasing investment in local semiconductor R&D further solidify Asia Pacific's leading position.

Within the segments, Passenger Vehicles, particularly in the context of Semi-custom Design ASICs (Standard Cell Based ASICs), is expected to exhibit significant market share and growth. This segment's dominance is attributable to the sheer volume of passenger cars produced globally and the widespread adoption of electronic features across various vehicle classes. Standard Cell Based ASICs offer a compelling balance of performance, cost, and development time, making them ideal for the multitude of applications found in passenger vehicles, including powertrain control, body electronics, infotainment, and safety systems. While Full Custom Design ASICs will see substantial growth in high-end and performance-oriented passenger vehicles (especially for ADAS and autonomous driving), the broader market penetration and volume demand for Standard Cell Based ASICs in this segment will likely lead to its overall dominance. The continuous innovation in automotive electronics, driven by consumer demand for enhanced comfort, convenience, and safety, ensures a perpetual need for ASICs in passenger vehicles. The increasing sophistication of these features directly translates into a higher number of ASICs per vehicle, amplifying the market's dominance in this segment.

Additionally, Commercial Vehicles, driven by the growing adoption of electrification and advanced telematics, is also a significant segment with substantial growth potential. The integration of ASICs in commercial vehicles is crucial for optimizing fuel efficiency in traditional powertrains, managing the complex electrical systems of electric trucks and buses, and enabling advanced fleet management solutions through telematics. The safety requirements for commercial vehicles, particularly concerning stability control and collision avoidance, also drive the demand for specialized ASICs.

The Automotive ASIC industry is experiencing robust growth catalyzed by several key factors. The accelerating adoption of electric vehicles (EVs) is a primary growth engine, as EVs necessitate highly integrated and efficient ASICs for battery management, powertrain control, and charging systems. The burgeoning demand for advanced driver-assistance systems (ADAS) and the gradual evolution towards autonomous driving further fuel this growth, requiring powerful and specialized ASICs for sensor fusion, AI processing, and control functions. The increasing complexity of in-car infotainment and connectivity features, offering enhanced user experiences, also demands more sophisticated ASICs. Furthermore, stringent automotive safety regulations and the push for improved vehicle efficiency are compelling automakers to integrate more advanced electronic solutions, thus driving ASIC demand.

This report offers an unparalleled depth of analysis into the Automotive ASIC market, providing stakeholders with comprehensive insights to inform strategic decision-making. It meticulously examines market dynamics, including key trends, drivers, and challenges, across the historical period (2019-2024) and projects them through the forecast period (2025-2033), with 2025 serving as the pivotal base and estimated year. The report quantifies market size in millions of units, offering a clear understanding of the scale and growth potential. It dissects the market by ASIC type—Full Custom Design ASIC, Semi-custom Design ASIC (Standard Cell Based ASIC and Gate Array Based ASIC), and Programmable ASIC—and by application segment, namely Passenger Vehicle and Commercial Vehicle. Detailed regional analysis, focusing on dominant markets and growth opportunities, is also a key feature.

The report further identifies and profiles the leading companies actively shaping the Automotive ASIC landscape, alongside a chronological overview of significant technological developments. This holistic approach ensures that readers gain a profound understanding of the market's present state and future trajectory, enabling them to identify strategic opportunities, mitigate risks, and capitalize on the evolving demands of the automotive industry.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Infineon Technologies AG, Texas Instruments Incorporated, STMicroelectronics, NXP Semiconductors, Renesas Electronics Corporation, Analog Devices, Inc., ON Semiconductor, Maxim Integrated, Microchip Technology Inc., Toshiba Electronic Devices & Storage Corporation, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Automotive Application-Specific Integrated Circuit," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Automotive Application-Specific Integrated Circuit, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.