1. What is the projected Compound Annual Growth Rate (CAGR) of the Automated Heavy Duty Truck?

The projected CAGR is approximately 14.8%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Automated Heavy Duty Truck

Automated Heavy Duty TruckAutomated Heavy Duty Truck by Type (Diesel, Gasoline, Electric, Hybrid, World Automated Heavy Duty Truck Production ), by Application (Agriculture, Transportation and Logistics, World Automated Heavy Duty Truck Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

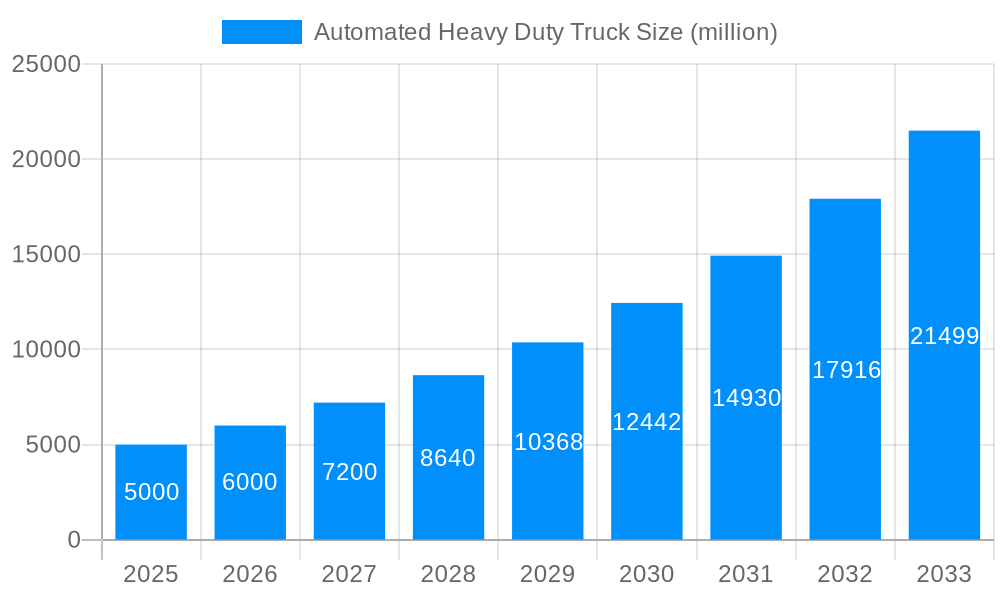

The Automated Heavy-Duty Truck market is projected for substantial expansion, driven by escalating demand for improved safety, operational efficiency, and reduced labor expenditures in transportation and logistics. This dynamic market, valued at $46.77 billion in the base year 2025, is anticipated to grow at a robust Compound Annual Growth Rate (CAGR) of 14.8% from 2025 to 2033, reaching an estimated market size exceeding $100 billion by 2033. Key growth drivers include rapid advancements in autonomous vehicle technology, declining sensor costs, the increasing integration of electric and hybrid powertrains in heavy-duty vehicles, and supportive government initiatives promoting autonomous transportation. Leading industry players are strategically investing in research and development and forming key alliances to enhance their market presence. The agricultural sector also represents a significant opportunity for the adoption of automated heavy-duty trucks, promising enhanced operational efficiency.

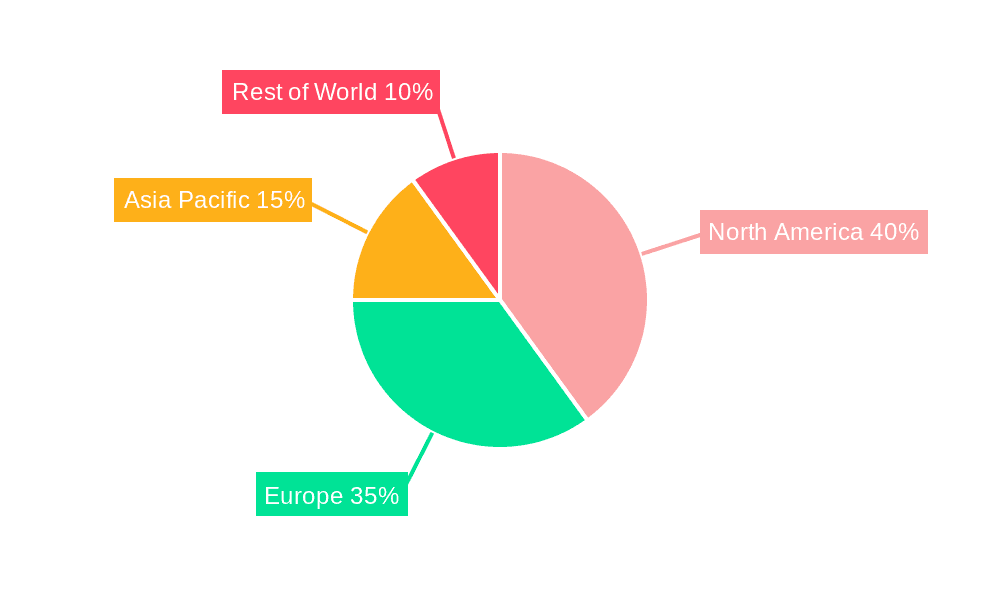

Despite the promising outlook, market adoption is tempered by significant challenges. High upfront investment in autonomous technology, persistent concerns over safety and liability, the necessity for advanced infrastructure to support autonomous driving, and potential regulatory complexities and cybersecurity threats present hurdles to widespread immediate implementation. Addressing these challenges will be crucial for unlocking the market's full potential. Nevertheless, the long-term trajectory remains highly positive, propelled by continuous technological innovation and the compelling economic advantages offered by automated heavy-duty trucks. Regional adoption patterns are expected to vary, with North America and Europe anticipated to lead in early adoption due to well-established infrastructure and favorable regulatory frameworks. The Asia-Pacific region is projected to experience accelerated growth in later phases, fueled by its expanding logistics and manufacturing industries. Market segmentation by powertrain type—diesel, gasoline, electric, and hybrid—will continue to shift, with electric and hybrid options gaining significant momentum driven by environmental consciousness and technological progress.

The global automated heavy-duty truck market is experiencing a period of significant transformation, driven by technological advancements, evolving regulatory landscapes, and increasing demand for enhanced safety and efficiency. The market, currently valued in the low millions of units, is projected to experience substantial growth throughout the forecast period (2025-2033). The historical period (2019-2024) witnessed initial deployments and significant R&D investment, laying the foundation for the accelerated adoption expected in the coming years. By the estimated year 2025, we anticipate a notable increase in production, marking a crucial turning point in the industry's trajectory. The key trends shaping this market include the rising integration of advanced driver-assistance systems (ADAS) paving the way for fully autonomous vehicles, a burgeoning focus on electric and hybrid powertrains to reduce emissions and improve fuel efficiency, and a growing preference for data-driven solutions for fleet management and predictive maintenance. This shift towards automation is not limited to a single application; instead, it's impacting diverse sectors like transportation and logistics, agriculture, and construction, each contributing to the market's overall growth. The increasing adoption of autonomous trucking in long-haul transportation is a particularly significant driver. This is mainly fueled by the potential for reduced labor costs, improved fuel economy through optimized routes and speeds, and enhanced safety profiles through the minimization of human error. This report provides a comprehensive analysis of these trends, examining their implications for key players and the overall market landscape. The integration of artificial intelligence (AI) and machine learning (ML) is also proving crucial, enhancing the capabilities of autonomous systems and optimizing their performance in dynamic environments. The development of robust and reliable sensor technologies, including LiDAR, radar, and cameras, is essential for the safe and efficient operation of automated heavy-duty trucks. Furthermore, the evolving regulatory framework and the need for standardized safety protocols are playing a crucial role in shaping the market's trajectory.

Several factors are converging to accelerate the adoption of automated heavy-duty trucks. Firstly, the persistent shortage of qualified drivers globally is forcing logistics companies to explore alternative solutions to maintain operational efficiency. Automation offers a compelling answer by providing a reliable and consistent workforce unaffected by labor shortages or driver fatigue. Secondly, the push for enhanced road safety is a significant driver. Autonomous systems, potentially eliminating human error—a leading cause of accidents—hold the promise of significantly reducing accidents and improving overall road safety. Thirdly, the quest for improved fuel efficiency is propelling the adoption of automated driving systems. These systems can optimize driving behavior, reducing fuel consumption and lowering operational costs for businesses. Fourthly, increased operational efficiency is a key driver, as automated trucks can operate continuously for longer periods without rest breaks, leading to increased productivity and reduced downtime. Finally, the development of advanced technologies such as AI, machine learning, and sophisticated sensor technologies are making fully autonomous operation increasingly feasible and reliable. The continuous improvement in these technologies continues to lower the barriers to entry and accelerate the market growth. These combined factors contribute to the overall growth of the automated heavy-duty truck market and its gradual transformation of the logistics and transportation landscape.

Despite the significant potential of automated heavy-duty trucks, several challenges and restraints hinder their widespread adoption. High initial investment costs for the vehicles and the necessary infrastructure are a major barrier, particularly for smaller businesses. The complexity of integrating autonomous systems into existing fleet operations and the need for specialized training for personnel managing these systems represent significant hurdles. Furthermore, the regulatory landscape surrounding autonomous vehicles remains complex and varies widely across different jurisdictions. Harmonizing regulations and establishing clear safety standards is crucial for fostering market growth. The need for robust cybersecurity measures is also paramount to prevent hacking and ensure the safe and secure operation of autonomous trucks. Addressing concerns about job displacement within the trucking industry necessitates strategic planning and retraining initiatives to mitigate potential negative social impacts. Technological limitations, such as the ability of autonomous systems to navigate unpredictable conditions like severe weather or unexpected obstacles, remain an area of ongoing development. Finally, public acceptance and trust in autonomous driving technology are essential for its widespread acceptance. Overcoming these challenges requires collaborative efforts among manufacturers, policymakers, and the public to create a safe, reliable, and commercially viable autonomous trucking ecosystem.

The North American and European markets are projected to dominate the automated heavy-duty truck market due to the early adoption of autonomous technology, well-developed infrastructure, and supportive regulatory environments. Within these regions, the transportation and logistics segment is expected to show the highest growth due to the significant potential for improving efficiency and reducing costs in the trucking industry.

Segment Dominance:

The paragraph above highlights the key regions and segments, but the overall market dominance is expected to shift over time as technology advances and regulatory landscapes evolve, opening new opportunities in emerging markets.

Several key factors are accelerating the growth of the automated heavy-duty truck industry. Governmental initiatives promoting the adoption of autonomous vehicles through subsidies, tax incentives, and supportive regulations are playing a significant role. Simultaneously, the increasing investment by private and public sectors in research and development is driving technological advancements and reducing the cost of autonomous systems. The growing demand for efficient and safe transportation solutions, especially in the face of driver shortages, is pushing businesses to adopt this technology, ensuring ongoing market expansion in coming years. Furthermore, the development and improvement of essential supporting infrastructure, such as charging stations for electric trucks and improved road networks that can better accommodate autonomous vehicle operation, further accelerate the overall market growth.

This report provides a comprehensive analysis of the automated heavy-duty truck market, offering in-depth insights into market trends, driving forces, challenges, key players, and future growth prospects. It covers a broad range of aspects, from technological advancements and regulatory landscapes to market segmentation and regional analysis. The report is intended to be a valuable resource for businesses, investors, and policymakers seeking a complete understanding of this rapidly evolving sector. It combines qualitative and quantitative data to deliver a nuanced view of the market's dynamics and potential.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 14.8% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 14.8%.

Key companies in the market include AB Volvo, APTIV, Autonomous Solutions Inc., Caterpillar Inc., Continental AG, Daimler AG, Denso Corporation, EMBARK, Hitachi Ltd., Intel Corporation, Komatsu Corporation, NVIDIA, PECCAR, Inc., Qualcomm Technologies, Inc., Robert Bosch GmbH, Valeo, WABCO, Waymo LLC, ZF Friedrichshafen AG, .

The market segments include Type, Application.

The market size is estimated to be USD 46.77 billion as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in billion and volume, measured in K.

Yes, the market keyword associated with the report is "Automated Heavy Duty Truck," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Automated Heavy Duty Truck, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.