1. What is the projected Compound Annual Growth Rate (CAGR) of the Assistive Devices for the Limbs?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Assistive Devices for the Limbs

Assistive Devices for the LimbsAssistive Devices for the Limbs by Type (Orthopedics, Robotic Arm System, Prosthetics, Crutch, Others, World Assistive Devices for the Limbs Production ), by Application (Hospital, Specialty Clinic, Others, World Assistive Devices for the Limbs Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

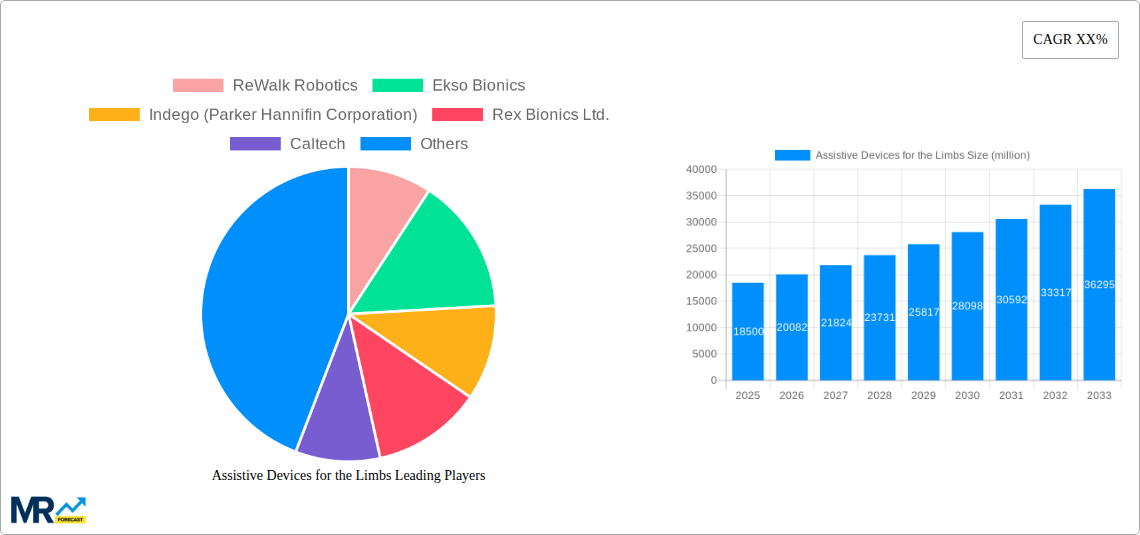

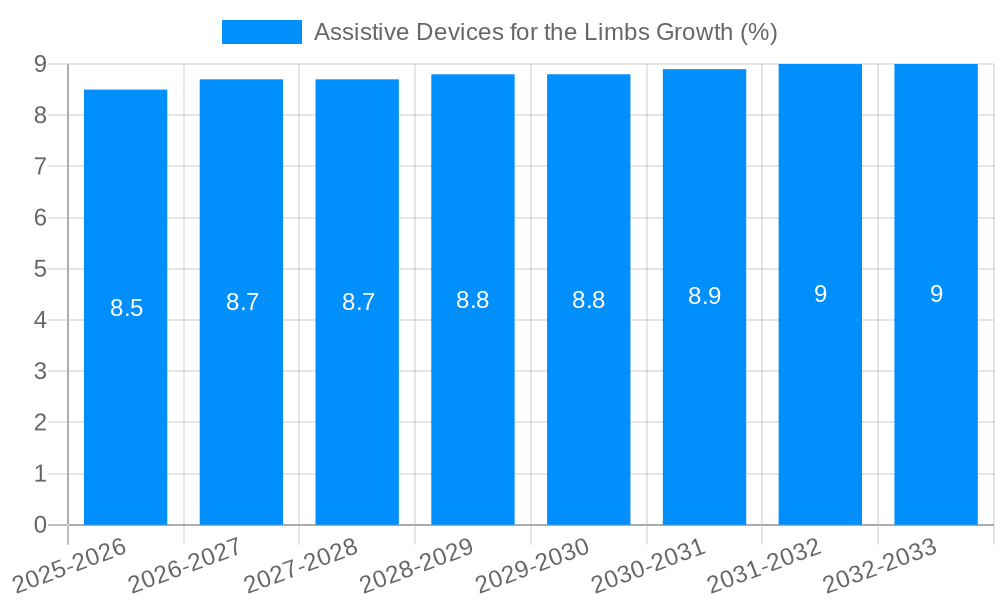

The global Assistive Devices for the Limbs market is poised for substantial growth, projected to reach an estimated market size of $18,500 million by 2025. This robust expansion is driven by a Compound Annual Growth Rate (CAGR) of approximately 8.5%, indicating a dynamic and expanding industry over the forecast period extending to 2033. Key market drivers include the escalating prevalence of orthopedic conditions such as arthritis and osteoporosis, coupled with a rising incidence of mobility-impairing neurological disorders and age-related physical limitations. The increasing demand for advanced robotic arm systems and sophisticated prosthetics, fueled by technological innovations that enhance functionality and user experience, are also significant contributors. Furthermore, a growing awareness among patient populations and healthcare providers regarding the benefits of assistive devices in improving quality of life and fostering independence is propelling market adoption. The expanding healthcare infrastructure and increased healthcare spending, particularly in emerging economies, are also creating a fertile ground for market expansion.

The market landscape is characterized by several influential trends, including the rapid integration of artificial intelligence and machine learning in prosthetic limbs for more intuitive control and adaptive functionality. The development of lighter, more durable, and aesthetically pleasing prosthetic designs is also a key trend, addressing user comfort and acceptance. Telehealth and remote monitoring solutions for assistive devices are gaining traction, enabling better patient support and device management. However, certain restraints temper this growth, notably the high cost of advanced assistive devices, which can be a significant barrier to adoption for a considerable segment of the population. Reimbursement policies and regulatory hurdles also present challenges in certain regions. Despite these constraints, the market is segmented across various device types, with Orthopedics, Robotic Arm Systems, and Prosthetics emerging as prominent segments. Hospitals and specialty clinics are the primary application areas, reflecting the critical role these devices play in rehabilitation and patient care. Leading companies such as ReWalk Robotics, Ekso Bionics, Össur, and Ottobock are actively investing in research and development to introduce innovative solutions, further shaping the competitive dynamics of this vital market.

The global assistive devices for the limbs market is poised for significant expansion, driven by a confluence of factors including an aging global population, increasing prevalence of chronic conditions affecting mobility, and rapid technological advancements. The World Assistive Devices for the Limbs Production is projected to witness robust growth, with the market size estimated to reach USD 45,000 million by 2025, and further escalate to USD 80,000 million by 2033, exhibiting a compound annual growth rate (CAGR) of approximately 7.5% during the forecast period of 2025-2033. The Base Year for this analysis is 2025, with an Estimated Year also set at 2025, drawing insights from the Historical Period of 2019-2024. The Study Period for this report spans from 2019 to 2033. A key trend observed is the shift towards more sophisticated and personalized assistive solutions. The integration of robotics, artificial intelligence, and advanced materials is transforming the landscape of limb assistive devices. Robotic arm systems, once a niche segment, are gaining traction due to their ability to restore complex motor functions. Similarly, advancements in prosthetic technology, including lighter and more durable materials, as well as sophisticated myoelectric control systems, are enhancing user comfort and functionality. Orthopedic devices continue to hold a significant market share, offering a range of solutions from braces and supports to more advanced exoskeletons aimed at enhancing mobility and rehabilitation. The demand for these devices is further amplified by increasing awareness among patients and healthcare providers about the benefits of early intervention and the availability of innovative treatment options. Furthermore, the growing emphasis on rehabilitation and post-operative care is creating a sustained demand for various assistive devices designed to aid in recovery and improve quality of life for individuals with limb impairments. The expansion of healthcare infrastructure in emerging economies also presents a substantial opportunity for market growth, as access to these life-enhancing technologies becomes more widespread. The market is characterized by a growing number of collaborations and mergers, as established players seek to expand their product portfolios and technological capabilities. This dynamic environment suggests a future where assistive devices for the limbs will be more accessible, intelligent, and integrated into the daily lives of individuals with mobility challenges.

Several potent forces are actively propelling the growth of the assistive devices for the limbs market. Foremost among these is the undeniable demographic shift: an ever-increasing elderly population worldwide. As individuals age, the incidence of conditions affecting mobility, such as arthritis, osteoporosis, and neurological disorders, naturally rises, creating a sustained and growing demand for assistive technologies. This demographic trend is complemented by the rising global burden of chronic diseases, including diabetes, cardiovascular diseases, and stroke, all of which can lead to limb impairment and necessitate the use of assistive devices for recovery and daily functioning. Technological innovation stands as another critical driver. The rapid evolution of materials science has led to the development of lighter, stronger, and more comfortable prosthetic and orthopedic devices. Furthermore, the integration of advanced electronics, sensors, and AI algorithms into robotic arm systems and exoskeletons is unlocking unprecedented levels of functionality and user control, making these devices more effective and appealing. The increasing awareness and advocacy surrounding disabilities are also playing a pivotal role. As societies become more inclusive and supportive, individuals are more empowered to seek out and utilize assistive devices to regain independence and improve their quality of life. Government initiatives and healthcare policies that promote the adoption of assistive technologies and provide reimbursement for their costs further bolster market expansion. This includes a focus on rehabilitation services and long-term care solutions, which often rely heavily on effective assistive devices. The growing emphasis on personalized medicine and patient-centric care is also driving innovation, leading to the development of tailored solutions that address the unique needs of each individual.

Despite the promising growth trajectory, the assistive devices for the limbs market faces several significant challenges and restraints that warrant careful consideration. A primary hurdle is the exorbitant cost associated with advanced assistive technologies, particularly sophisticated robotic arm systems and high-end prosthetics. These devices, while offering superior functionality, often come with prohibitive price tags that make them inaccessible to a large segment of the population, especially in developing economies. This cost factor is exacerbated by limited insurance coverage and reimbursement policies in many regions, which fail to adequately cover the full spectrum of advanced assistive devices. This financial barrier can significantly hinder adoption rates and limit market penetration. Another critical challenge lies in the complexity of the regulatory landscape. Obtaining approvals for novel assistive devices can be a lengthy and arduous process, requiring extensive clinical trials and adherence to stringent quality standards, which can delay market entry and increase development costs for manufacturers. Furthermore, the lack of skilled professionals for the fitting, maintenance, and rehabilitation associated with these advanced devices poses a significant restraint. Proper training and expertise are crucial for ensuring optimal user outcomes, and a shortage of such professionals can limit the effective deployment of these technologies. The stigma and psychological barriers associated with using assistive devices, particularly for younger individuals, can also impact adoption rates. While societal attitudes are evolving, a residual stigma can deter individuals from seeking or openly using these devices. Finally, technical limitations and the need for ongoing innovation to improve user comfort, durability, and energy efficiency remain ongoing challenges that manufacturers continually strive to overcome.

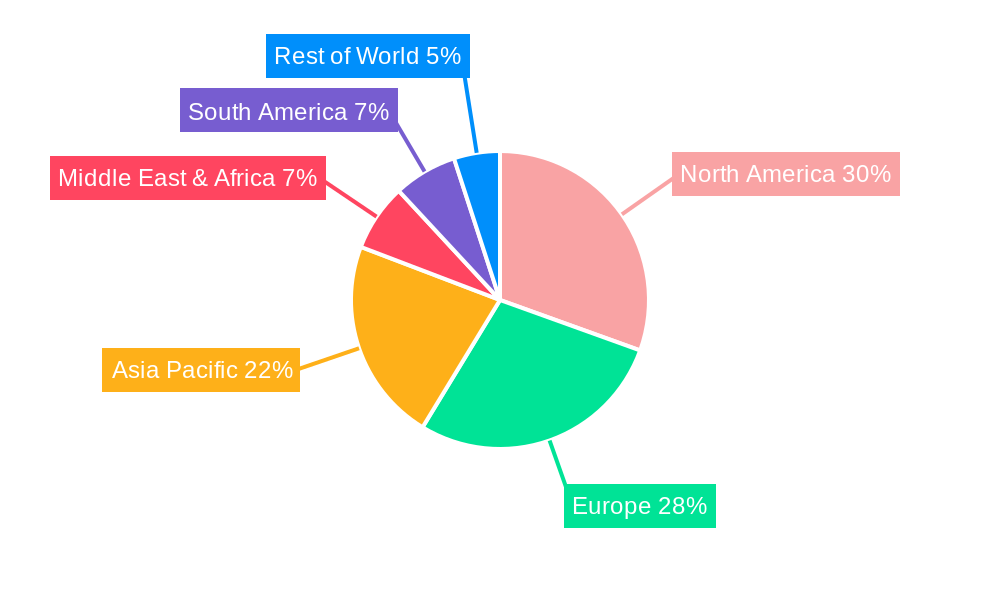

The global assistive devices for the limbs market is characterized by strong regional variations and segment dominance, with North America and Europe currently leading the charge, driven by a combination of high disposable incomes, advanced healthcare infrastructure, and proactive government support for technological adoption. However, the Asia-Pacific region is anticipated to emerge as the fastest-growing market in the coming years, fueled by an increasing prevalence of age-related mobility issues, a burgeoning middle class with greater purchasing power, and significant investments in healthcare modernization. Within the Type segment, Prosthetics currently holds a substantial market share and is expected to continue its dominance throughout the forecast period (2025-2033). This is attributed to the persistent need for limb replacement due to trauma, disease, and congenital conditions. The advancements in microprocessor-controlled knees, myoelectric hands, and 3D-printed prosthetics are further enhancing functionality and user acceptance, thereby driving demand. The Orthopedics segment also represents a significant and steadily growing portion of the market. This encompasses a wide array of devices such as braces, splints, orthotic footwear, and exoskeletons designed to support, align, protect, or correct deformities of the body. The increasing incidence of orthopedic conditions, coupled with the growing awareness of their benefits in rehabilitation and pain management, is a key driver for this segment.

Robotic Arm Systems are projected to exhibit the highest CAGR, albeit from a smaller market base, during the forecast period. This segment is witnessing rapid innovation, with companies like ReWalk Robotics, Ekso Bionics, and Indego (Parker Hannifin Corporation) developing increasingly sophisticated and user-friendly robotic exoskeletons and prosthetic arms. These devices are gaining traction in rehabilitation centers and for individuals seeking to regain mobility and independence after paralysis or severe limb injury. The application in Hospitals is expected to dominate the Application segment. Hospitals serve as primary centers for diagnosis, treatment, and rehabilitation for patients requiring assistive devices. The presence of specialized orthopedic and rehabilitation departments, along with the increasing adoption of advanced technologies in clinical settings, supports this dominance. Specialty Clinics, particularly those focused on prosthetics, orthotics, and rehabilitation, also represent a crucial application area and are expected to experience significant growth. These clinics offer personalized care and expert fitting services, catering to the specific needs of individuals requiring advanced assistive devices. The "Others" application segment, which may include home healthcare settings, educational institutions, and research facilities, is also expected to see a steady rise as assistive devices become more integrated into daily life and research into their efficacy continues.

Several key growth catalysts are poised to accelerate the expansion of the assistive devices for the limbs industry. The persistent and growing global prevalence of age-related mobility impairments and chronic diseases, such as diabetes and stroke, directly fuels the demand for these devices. Continuous advancements in robotics, AI, and materials science are leading to the development of more sophisticated, user-friendly, and personalized assistive solutions, making them increasingly attractive to a wider user base. Furthermore, rising healthcare expenditure globally, coupled with supportive government policies and initiatives promoting accessibility and affordability of assistive technologies, are significant drivers. The increasing focus on rehabilitation and improving the quality of life for individuals with limb impairments further bolsters the market's growth potential.

This comprehensive report on assistive devices for the limbs delves into the intricate dynamics of this rapidly evolving market. It offers an in-depth analysis of market trends, meticulously examining the World Assistive Devices for the Limbs Production and projecting its trajectory from the Historical Period (2019-2024) through the Base Year (2025) and into the Forecast Period (2025-2033). The report dissects the driving forces propelling this growth, including demographic shifts and technological innovations, while also critically assessing the challenges and restraints such as cost and regulatory hurdles. It identifies key regions and segments poised for dominance, providing valuable insights into the market’s future landscape. Furthermore, the report highlights critical growth catalysts and profiles the leading industry players, offering a holistic view of the competitive environment. The detailed analysis of significant developments and a comprehensive exploration of market segmentation across Type (Orthopedics, Robotic Arm System, Prosthetics, Crutch, Others) and Application (Hospital, Specialty Clinic, Others) ensures a thorough understanding of the market's nuances. This report serves as an indispensable resource for stakeholders seeking to navigate and capitalize on opportunities within the global assistive devices for the limbs sector.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include ReWalk Robotics, Ekso Bionics, Indego (Parker Hannifin Corporation), Rex Bionics Ltd., Caltech, Össur, Steeper Inc, Boston Scientific Corporation, Medtronic Plc, Ottobock, RGK Wheelchair, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Assistive Devices for the Limbs," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Assistive Devices for the Limbs, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.