1. What is the projected Compound Annual Growth Rate (CAGR) of the Assisted Living Facilities?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Assisted Living Facilities

Assisted Living FacilitiesAssisted Living Facilities by Type (Cooking, Personal Care, Housekeeping and Laundry, Monitoring Medication, Others), by Application (Adult Family Home, Community-Based Residential Facility, Residential Care Apartment Complex), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

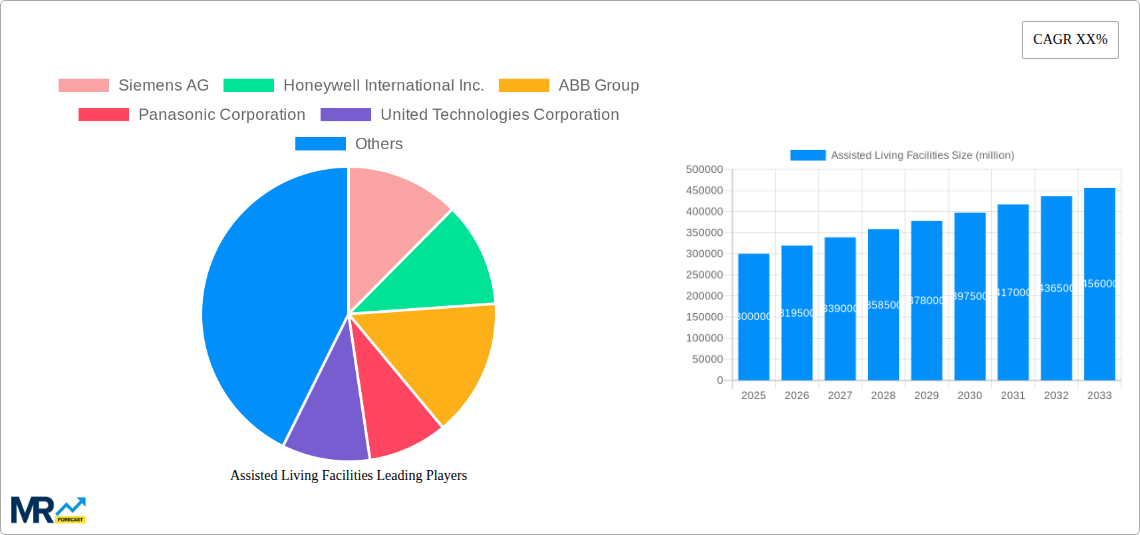

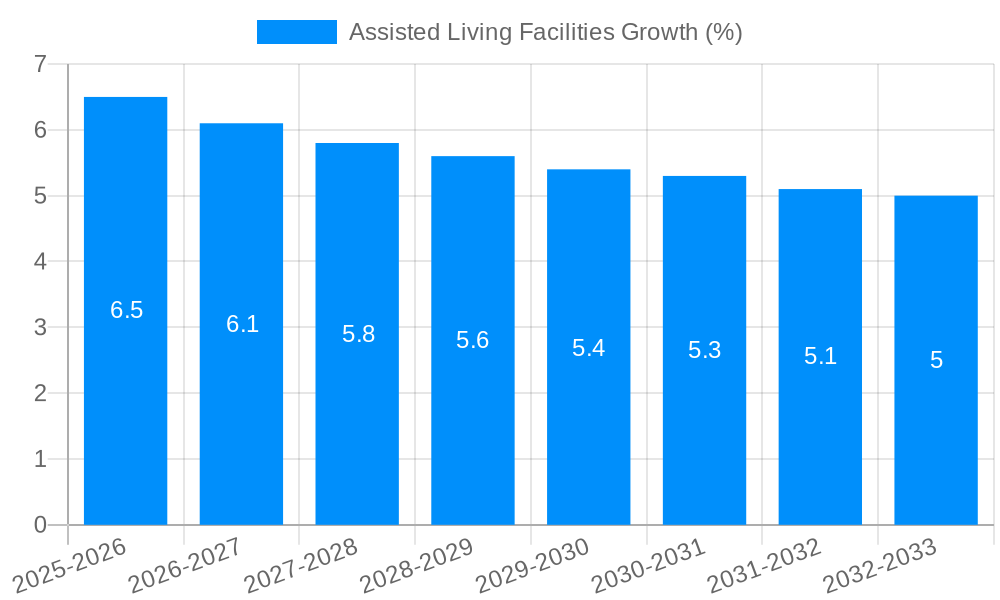

The global market for assisted living facilities is experiencing robust expansion, driven by a confluence of demographic shifts and technological advancements. With an estimated market size of approximately $300 billion in 2025, the sector is projected to grow at a Compound Annual Growth Rate (CAGR) of around 6.5% through 2033. This upward trajectory is primarily fueled by the rapidly aging global population, particularly in developed nations, leading to an increased demand for specialized senior care services. Moreover, the growing need for efficient and integrated solutions within these facilities, encompassing cooking, personal care, housekeeping, laundry, and medication monitoring, is spurring innovation and market growth. The rise of smart home technologies and the increasing adoption of connected devices designed for elder care are also significant drivers, enhancing safety, convenience, and overall quality of life for residents.

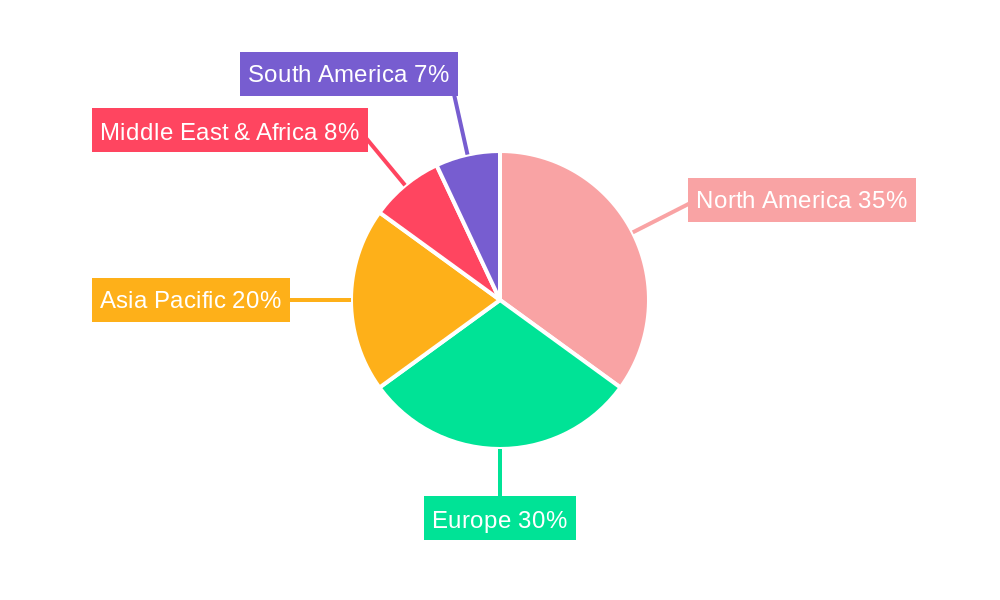

The assisted living facilities market is characterized by a strong emphasis on enhancing resident well-being and operational efficiency. Key trends include the integration of advanced monitoring systems for health and safety, personalized care plans, and the development of community-based residential facilities designed to foster social engagement. While the market presents substantial opportunities, certain restraints, such as high initial investment costs for technology integration and the ongoing need for skilled caregivers, need to be addressed. The market is segmented by type, with cooking, personal care, housekeeping, and medication monitoring emerging as critical service areas. Applications span across various facility types, including adult family homes, community-based residential facilities, and residential care apartment complexes, with North America and Europe currently leading in market share, followed by a significant growth potential in the Asia Pacific region due to its burgeoning elderly population and increasing disposable incomes.

This report delves into the dynamic assisted living facilities market, offering a detailed analysis from 2019 to 2033. The study period encompasses historical trends from 2019-2024, with a base year and estimated year of 2025, followed by a forecast period of 2025-2033. We will explore key market insights, driving forces, challenges, regional dominance, leading players, and significant industry developments, providing a robust understanding of this evolving sector valued in the millions.

The assisted living facilities market is witnessing a transformative phase, driven by a confluence of demographic shifts, technological advancements, and evolving consumer expectations. The aging global population, a persistent and accelerating trend, forms the bedrock of this market's growth. As the number of individuals requiring support services beyond independent living continues to surge, the demand for assisted living facilities is projected to experience sustained expansion. This trend is further amplified by increasing life expectancies and a greater emphasis on maintaining a high quality of life in later years. The XXX market insights reveal a significant uptick in the adoption of technology within these facilities. From advanced monitoring systems to smart home integration, technology is not merely an add-on but an integral component of care delivery. This not only enhances resident safety and well-being but also optimizes operational efficiency for providers. Furthermore, the market is observing a diversification of service offerings. Beyond traditional personal care and housekeeping, there is a growing emphasis on specialized services catering to specific needs, such as memory care, rehabilitation services, and wellness programs. This shift reflects a more personalized approach to senior living, acknowledging that each individual's journey through aging is unique. The financial landscape is also evolving, with an increasing recognition of assisted living facilities as a viable and necessary component of the healthcare continuum. Public and private sector investments are being channeled into expanding capacity, improving infrastructure, and developing innovative care models. The competitive intensity within the market is notable, with both established players and new entrants vying for market share. Mergers, acquisitions, and strategic partnerships are becoming commonplace as companies seek to consolidate their positions and expand their geographic reach. The integration of healthcare services within assisted living facilities is another significant trend, blurring the lines between residential care and clinical support. This holistic approach aims to provide seamless care for residents, addressing both their social and medical needs under one roof. The growing awareness and acceptance of assisted living as a preferred option over traditional home care or institutional settings are also contributing to market growth. Families are increasingly recognizing the benefits of a structured environment that offers social engagement, professional support, and peace of mind. The emphasis on creating vibrant and engaging communities within facilities, fostering social interaction and resident well-being, is becoming a key differentiator.

Several potent forces are propelling the assisted living facilities market forward. Foremost among these is the demographic imperative of an aging global population. As baby boomers continue to age and life expectancies rise, the sheer volume of individuals entering the age bracket where assisted living becomes a necessity is steadily increasing. This demographic shift creates a fundamental and ever-growing demand for housing and care solutions tailored to the needs of seniors. Complementing this is the increasing acceptance and de-stigmatization of assisted living. What was once viewed as a last resort is now increasingly recognized as a proactive choice for individuals seeking to maintain independence while receiving necessary support. This evolving perception is fueled by a greater understanding of the benefits associated with community living, professional care, and social engagement. Technological advancements are also acting as a powerful catalyst. Innovations in remote monitoring, smart home devices, telehealth, and AI-powered solutions are enhancing resident safety, improving care delivery, and optimizing operational efficiencies for facility operators. These technologies not only contribute to a higher quality of life for residents but also address concerns around staff shortages and cost-effectiveness. Furthermore, an increasing focus on personalized and specialized care is driving demand. Residents and their families are seeking facilities that can cater to specific needs, such as memory care for individuals with dementia, or specialized rehabilitation services. This move towards tailored solutions differentiates facilities and attracts a wider resident base. Finally, government initiatives and policy support in many regions, aimed at promoting senior care and reducing the burden on acute healthcare systems, are indirectly fueling the growth of the assisted living sector. These drivers collectively create a fertile ground for sustained expansion and innovation within the assisted living facilities market.

Despite its robust growth trajectory, the assisted living facilities market is not without its significant challenges and restraints. Workforce shortages and the high cost of labor pose a persistent hurdle. The demand for qualified and compassionate caregivers often outstrips supply, leading to increased labor costs and potential strain on service quality. Recruiting and retaining staff is a major operational challenge for many facilities. Affordability and accessibility remain critical concerns for a substantial segment of the senior population. While demand is high, the cost of assisted living can be prohibitive for many individuals and families, particularly in regions with limited public funding or insurance coverage for these services. This financial barrier restricts market penetration for a significant portion of the target demographic. Regulatory complexities and evolving compliance requirements can also be a burden. Facilities must navigate a labyrinth of state and federal regulations concerning staffing, safety, resident rights, and operational standards, which can be costly and time-consuming to adhere to. The perception of loss of independence, while decreasing, can still be a deterrent for some seniors who are hesitant to move from their familiar homes. Overcoming this psychological barrier and effectively communicating the benefits of assisted living is an ongoing effort. The risk of outbreaks and the need for stringent infection control measures, particularly highlighted by recent global health events, present ongoing operational challenges and can impact occupancy rates and public trust. Finally, the initial capital investment required to establish and upgrade facilities can be substantial, posing a barrier to entry for new operators and requiring significant reinvestment for existing ones to remain competitive and compliant with modern standards.

The assisted living facilities market is characterized by dominant regions and segments that are shaping its growth and evolution.

Key Dominant Regions/Countries:

North America (United States and Canada): This region consistently leads the assisted living market due to several converging factors.

Western Europe (Germany, United Kingdom, France): This region also holds a significant share, driven by similar demographic trends and a growing emphasis on quality of life for seniors.

Key Dominant Segments:

The Monitoring Medication segment is emerging as a pivotal area of growth and dominance within assisted living facilities.

The Personal Care segment also remains a cornerstone of the assisted living offering, consistently driving demand. This encompasses assistance with activities of daily living (ADLs) such as bathing, dressing, grooming, and toileting. The growing number of seniors requiring varying levels of support with these fundamental tasks ensures its continued importance. However, the emphasis is shifting towards providing this care with dignity, respect, and a focus on resident autonomy, often facilitated by well-trained and compassionate staff.

The assisted living facilities industry is propelled by several key growth catalysts. The undeniable surge in the aging global population is the most significant driver, creating a continuous and expanding demand. Furthermore, advancements in medical technology and increased life expectancies mean more seniors are living longer, often with chronic conditions that necessitate supportive care. The growing awareness and acceptance of assisted living as a proactive choice for maintaining quality of life, coupled with the increasing preference for community living over institutional settings, are also crucial. Finally, the integration of technology for enhanced safety, monitoring, and operational efficiency acts as a significant catalyst, making facilities more attractive and viable.

This comprehensive report offers an in-depth analysis of the assisted living facilities market, providing stakeholders with invaluable insights for strategic decision-making. We meticulously examine the market dynamics, from the historical performance during the 2019-2024 period to projections through 2033, with a detailed base and estimated year of 2025. The report dissects the intricate interplay of driving forces, such as the ever-increasing aging population and technological integrations, alongside critical challenges like workforce shortages and affordability. It identifies key regions and segments poised for dominance, with a particular focus on the burgeoning Monitoring Medication segment and its technological underpinnings. Leading players are profiled, and significant industry developments are chronicled with timeline precision, offering a forward-looking perspective on the sector's evolution. This report is an essential resource for investors, operators, policymakers, and anyone seeking to understand the present and future landscape of assisted living facilities.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Siemens AG, Honeywell International Inc., ABB Group, Panasonic Corporation, United Technologies Corporation, Assisted Living Technologies, Inc., Ingersoll Rand Plc, Legrand S.A., Gnomon Informatics Inc., Televic Healthcare N.V., Telbios SRL, Atria Senior Living, Brookdale Senior Living, Emeritus Corporation, Extendicare, Inc., Genesis Healthcare, Golden Living, HCR Manor Care, Merrill Gardens, Sunrise Senior Living, Inc., .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Assisted Living Facilities," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Assisted Living Facilities, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.