1. What is the projected Compound Annual Growth Rate (CAGR) of the Asset Servicing?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Asset Servicing

Asset ServicingAsset Servicing by Type (/> Fund Services, Hosting and Accounting, Outsourcing, Securities Lending), by Application (/> Capital Market, Wealth Management Company), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

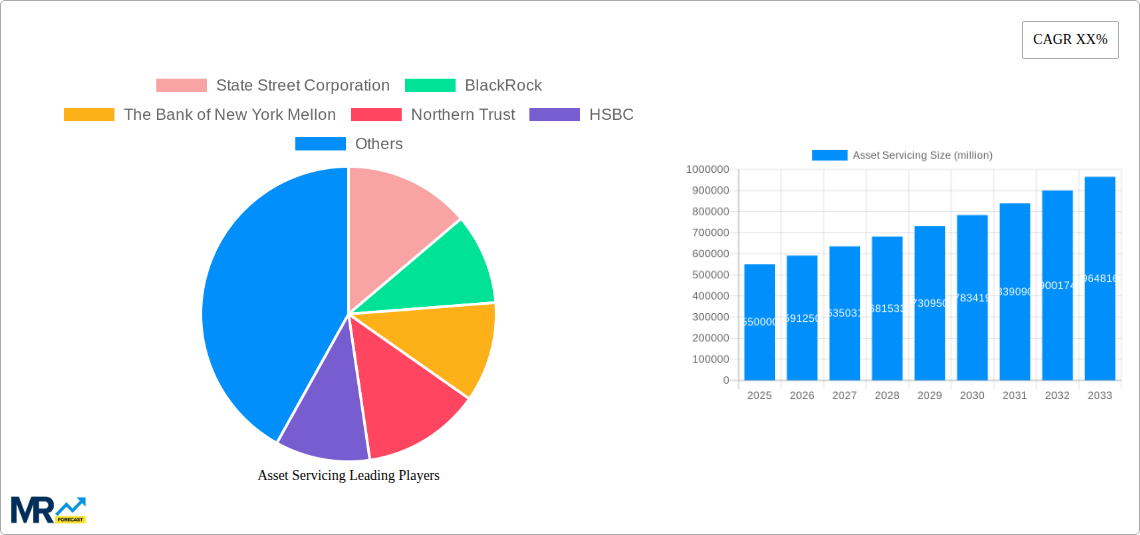

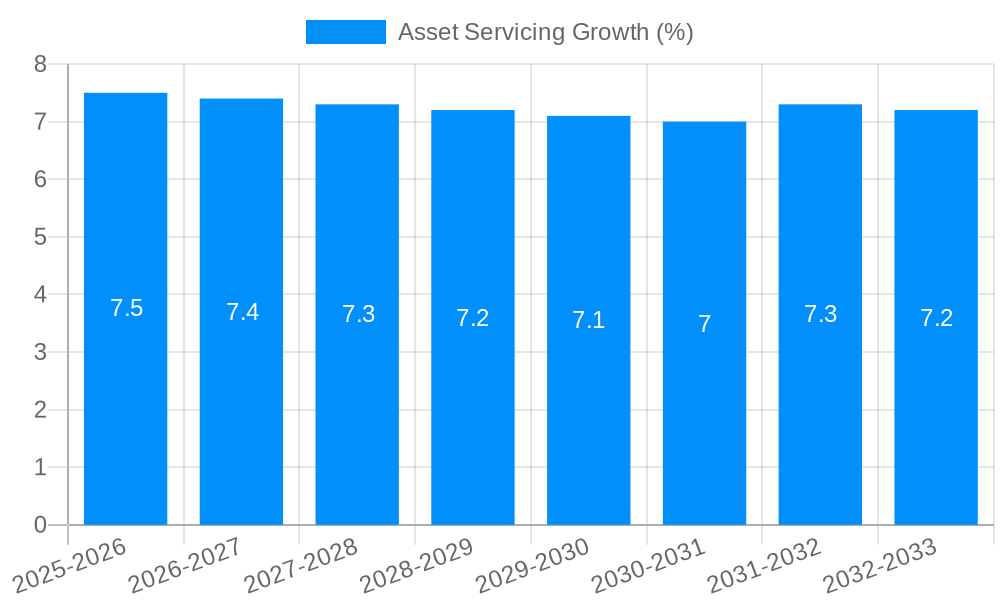

The global asset servicing market is poised for robust expansion, projected to reach an estimated \$550 billion by 2025, and subsequently grow at a Compound Annual Growth Rate (CAGR) of approximately 7.5% through 2033. This significant growth is underpinned by several key drivers, most notably the increasing complexity of financial regulations, which necessitates sophisticated outsourcing solutions for asset managers and financial institutions. The surge in demand for specialized fund administration, custody services, and performance reporting, driven by the ever-evolving regulatory landscape, is a primary catalyst. Furthermore, the continuous expansion of the global wealth management sector, fueled by rising disposable incomes and an increasing focus on long-term financial planning, directly translates into a higher volume of assets requiring servicing. Technological advancements, including the adoption of artificial intelligence (AI) and blockchain in back-office operations, are also streamlining processes and enhancing efficiency, further bolstering market growth. The market's trajectory is also influenced by the growing trend of outsourcing non-core functions by asset management companies, allowing them to concentrate on investment strategies and client relationship management.

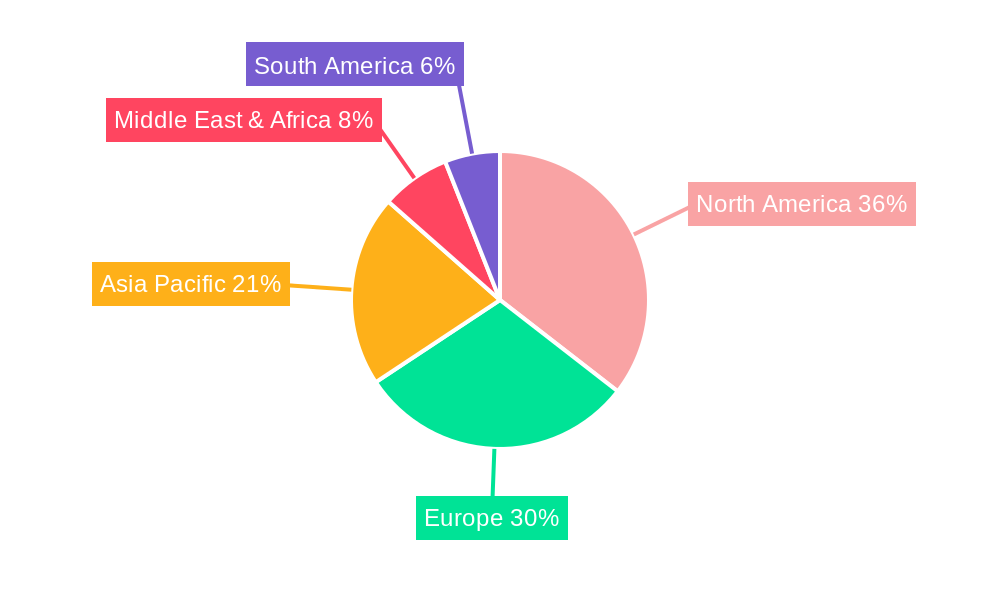

The asset servicing landscape is characterized by a dynamic interplay of trends and restraints. Key trends include the growing demand for data analytics and reporting solutions to meet investor and regulatory needs, the increasing integration of Environmental, Social, and Governance (ESG) factors into investment portfolios and thus into servicing requirements, and the rise of alternative asset servicing as investor interest in private equity, real estate, and hedge funds continues to climb. However, the market also faces restraints such as intense competition, leading to pricing pressures, and the ongoing challenge of cybersecurity threats and data privacy concerns, which require continuous investment in robust security measures. Geographically, North America and Europe currently dominate the market due to the presence of established financial institutions and stringent regulatory frameworks. Asia Pacific, however, is emerging as a high-growth region, driven by the rapid expansion of its capital markets and the increasing adoption of outsourcing by financial entities. The competitive landscape features major global players like State Street Corporation, BlackRock, and The Bank of New York Mellon, alongside regional specialists, all vying for market share through service innovation and strategic partnerships.

This comprehensive report delves into the dynamic landscape of Asset Servicing, offering an in-depth analysis of market trends, driving forces, challenges, and growth catalysts. Spanning a study period from 2019 to 2033, with a base and estimated year of 2025 and a forecast period from 2025 to 2033, the report leverages historical data from 2019-2024 to provide robust projections. The report quantifies the market size in millions of units, offering a clear financial perspective on the industry's trajectory. Key segments such as Fund Services, Hosting and Accounting, Outsourcing, Securities Lending, and applications within Capital Markets and Wealth Management are meticulously examined. Major global players and prominent Indian mutual fund houses have been profiled, alongside significant industry developments. This report is an essential resource for stakeholders seeking to understand and capitalize on the evolving asset servicing ecosystem.

The global asset servicing market is undergoing a significant transformation, driven by a confluence of technological advancements, evolving regulatory landscapes, and increasing investor demand for sophisticated and integrated solutions. The historical period from 2019-2024 witnessed a steady expansion, fueled by the growing complexity of financial instruments and the increasing outsourcing of non-core functions by asset managers. Looking ahead into the forecast period of 2025-2033, we anticipate a CAGR of approximately 5.8%, propelling the market size to an estimated $52,300 million by 2033. A key trend is the pervasive adoption of digital technologies, particularly Artificial Intelligence (AI) and Distributed Ledger Technology (DLT), which are revolutionizing operational efficiencies, data analytics, and risk management. Fund services, including fund accounting, administration, and custody, continue to be the cornerstone of the asset servicing industry, expected to maintain a dominant market share. The increasing adoption of alternative investments, such as private equity and hedge funds, is also driving demand for specialized servicing capabilities, necessitating advanced data management and reporting. Furthermore, the push towards greater transparency and regulatory compliance, exemplified by evolving ESG (Environmental, Social, and Governance) mandates, is creating new opportunities for asset servicers to offer enhanced data aggregation, reporting, and advisory services. Outsourcing of back-office functions, including trade settlement, reconciliation, and compliance monitoring, is also on the rise as asset managers seek to reduce costs and focus on core competencies. The wealth management segment, powered by the growth of high-net-worth individuals and the increasing demand for personalized investment strategies, is another significant area of growth, with asset servicers playing a crucial role in supporting portfolio management, client reporting, and onboarding processes. The study period has also highlighted a growing emphasis on cybersecurity and data privacy, as asset servicers handle sensitive client information and must adhere to stringent data protection regulations. The migration towards cloud-based solutions is enabling greater scalability, flexibility, and accessibility for asset servicing platforms, facilitating seamless integration with various market participants and data sources. The shift towards a T+1 settlement cycle in certain markets will also necessitate significant technological and operational adjustments, pushing asset servicers to optimize their trade processing capabilities. The competitive landscape is characterized by consolidation and strategic partnerships, as larger players seek to expand their service offerings and geographic reach, while smaller firms focus on niche specializations. The role of asset servicers is evolving from a transactional provider to a strategic partner, offering value-added services that encompass data analytics, digital transformation, and regulatory advisory. The increasing institutionalization of emerging markets is also opening new avenues for growth, requiring asset servicers to adapt to diverse regulatory frameworks and market practices.

Several powerful forces are collectively propelling the growth and evolution of the asset servicing industry. The escalating complexity of global financial markets, characterized by a proliferation of investment products, cross-border transactions, and intricate regulatory requirements, is a primary driver. Asset managers are increasingly relying on specialized asset servicing providers to navigate this intricate landscape, manage operational risks, and ensure compliance. The relentless pursuit of operational efficiency and cost reduction by asset managers is another significant propellant. By outsourcing non-core functions such as fund accounting, trade settlement, and regulatory reporting, asset managers can streamline their operations, reduce overheads, and allocate resources more effectively towards investment strategies and client acquisition. Technological innovation stands out as a crucial catalyst. The advent of advanced technologies like Artificial Intelligence (AI), Machine Learning (ML), and Distributed Ledger Technology (DLT) is enabling asset servicers to automate manual processes, enhance data accuracy, improve analytics capabilities, and develop innovative solutions. These technologies are not only driving efficiency but also creating new service offerings, such as predictive analytics for risk management and automated regulatory reporting. The growing demand for data analytics and actionable insights is also a significant driver. Investors and asset managers alike are seeking deeper insights into portfolio performance, market trends, and risk exposures. Asset servicers, with their access to vast amounts of data, are well-positioned to leverage these technologies to provide sophisticated analytical tools and reports, thereby adding significant value. The increasing focus on Environmental, Social, and Governance (ESG) investing is creating new demands for asset servicers. This includes the need for robust ESG data aggregation, reporting, and integration into investment processes, driving the development of specialized ESG servicing solutions. The sustained growth of the global investment management industry, driven by factors such as increasing global wealth, an aging population, and the rise of institutional investors, naturally translates into a larger pool of assets requiring servicing. This continuous expansion of assets under custody and administration directly fuels the demand for asset servicing.

Despite the robust growth trajectory, the asset servicing industry faces a set of significant challenges and restraints that can impede its progress. One of the most prominent challenges is the ever-evolving and increasingly stringent regulatory landscape across different jurisdictions. Compliance with a multitude of rules and regulations, such as MiFID II, EMIR, and various data privacy laws, demands substantial investment in technology, expertise, and operational adjustments. Navigating these complex and often conflicting regulatory frameworks can be a significant burden, particularly for global asset servicers. The rapid pace of technological change presents both an opportunity and a challenge. While new technologies like AI and DLT offer immense potential, the significant investment required for their implementation, integration, and ongoing maintenance can be a considerable restraint, especially for smaller players. Furthermore, the need to upskill the workforce to manage these advanced technologies and address potential job displacement requires strategic planning and investment in training programs. Cybersecurity threats and data privacy concerns represent a critical and ongoing challenge. As asset servicers handle sensitive client data and financial information, they are prime targets for cyberattacks. Maintaining robust security infrastructure, implementing stringent data protection measures, and ensuring continuous vigilance against evolving threats require significant resources and unwavering attention. The intense competition within the asset servicing market also acts as a restraint. With a large number of established players and new entrants vying for market share, pressure on pricing and profit margins remains high. This competitive intensity necessitates continuous innovation and service differentiation to maintain a competitive edge. Operational risks, inherent in the complex processes of asset servicing, such as trade settlement failures, reconciliation errors, and system outages, can lead to financial losses, reputational damage, and regulatory penalties. Robust risk management frameworks and contingency planning are crucial to mitigate these risks. The increasing demand for specialized services, particularly in areas like alternative investments and ESG reporting, requires asset servicers to continuously adapt and develop new capabilities. Failing to keep pace with these evolving demands can lead to a loss of competitiveness. Finally, the consolidation trend within the asset management industry, while creating larger clients, also means that asset servicers must manage fewer, but often more demanding, relationships.

Key Regions and Countries Dominating the Market:

Dominant Segments:

The asset servicing industry is poised for sustained growth, fueled by several key catalysts. The increasing complexity of investment products and global regulatory frameworks compels asset managers to seek specialized expertise and efficient operational support. Technological advancements, particularly in AI, automation, and DLT, are driving operational efficiencies, enhancing data analytics, and enabling new service models. The ongoing trend of outsourcing non-core functions by asset managers to reduce costs and focus on investment strategies is a significant growth driver. Furthermore, the burgeoning demand for alternative investments and ESG-compliant solutions is creating new avenues for service providers. The increasing global wealth and the growth of institutional investors also contribute to a larger asset base requiring servicing.

This comprehensive report provides an exhaustive analysis of the global asset servicing market, covering its intricate dynamics from 2019 to 2033. It offers a granular view of market size in millions of units, with a projected market value of approximately $52,300 million by 2033, driven by a CAGR of around 5.8%. The report meticulously examines key segments, including Fund Services, Hosting and Accounting, Outsourcing, Securities Lending, and the application of asset servicing in Capital Markets and Wealth Management. It highlights the dominant role of North America and Europe, alongside the rapidly growing Asia-Pacific region, with a particular focus on India's evolving market. Stakeholders will gain invaluable insights into the current trends, the powerful forces propelling industry growth, and the inherent challenges that shape its trajectory. The report also identifies key growth catalysts and provides a detailed overview of significant industry developments and the leading players in this vital sector.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include State Street Corporation, BlackRock, The Bank of New York Mellon, Northern Trust, HSBC, JPMorgan Chase, Citi Private Bank, BNP Paribas, UBS Group, Crédit Agricole S.A. (CACEIS), ICICI Prudential Mutual Fund, HDFC Mutual Fund, Aditya Birla Sun Life Mutual Fund, Nippon India Mutual Fund, SBI Mutual Fund, L&T Mutual Fund, Nomura Asset Management, Sumitomo Mitsui Trust Asset Management.

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Asset Servicing," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Asset Servicing, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.