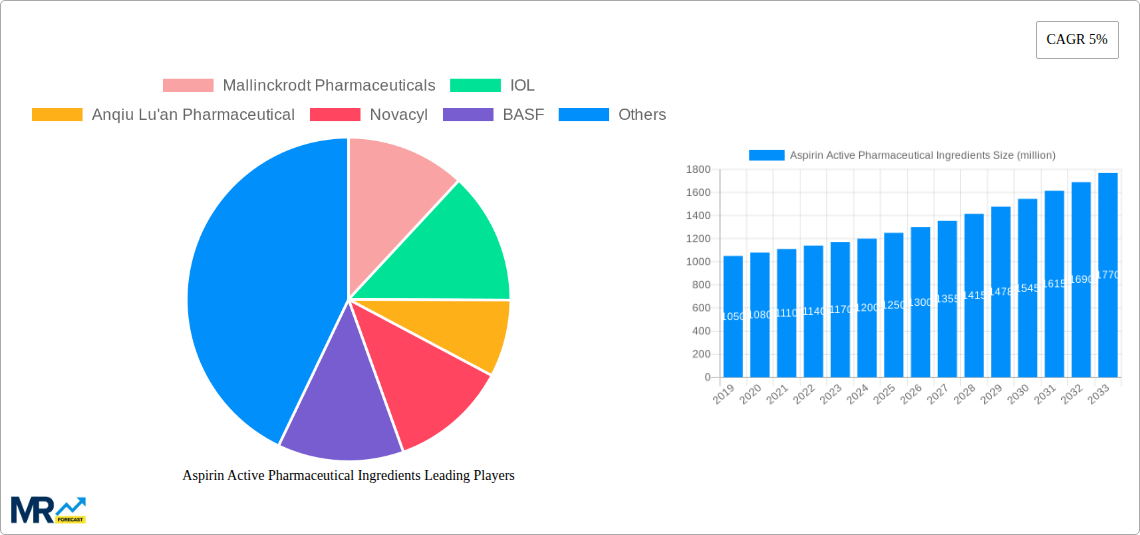

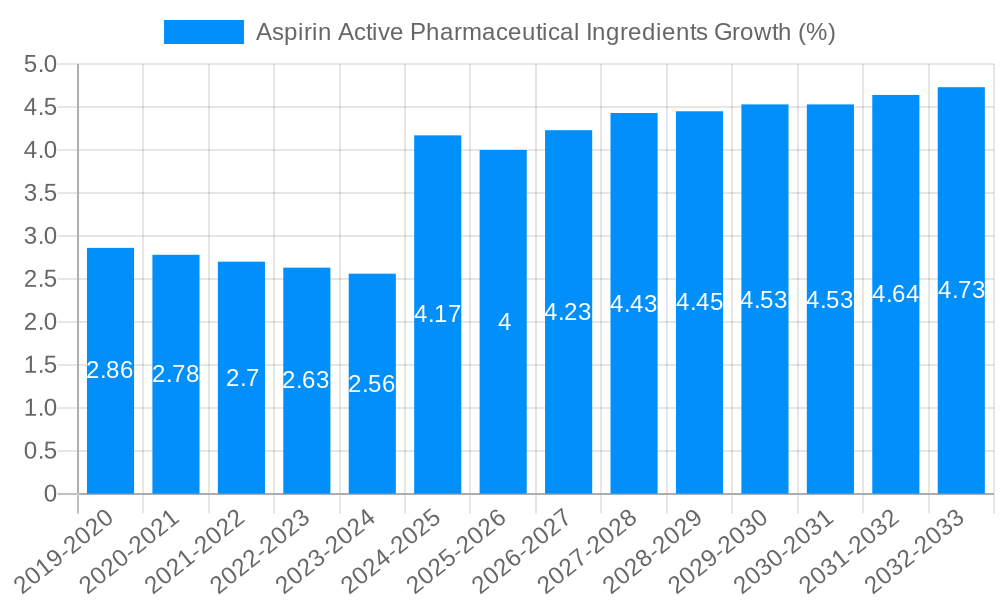

1. What is the projected Compound Annual Growth Rate (CAGR) of the Aspirin Active Pharmaceutical Ingredients?

The projected CAGR is approximately 5%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Aspirin Active Pharmaceutical Ingredients

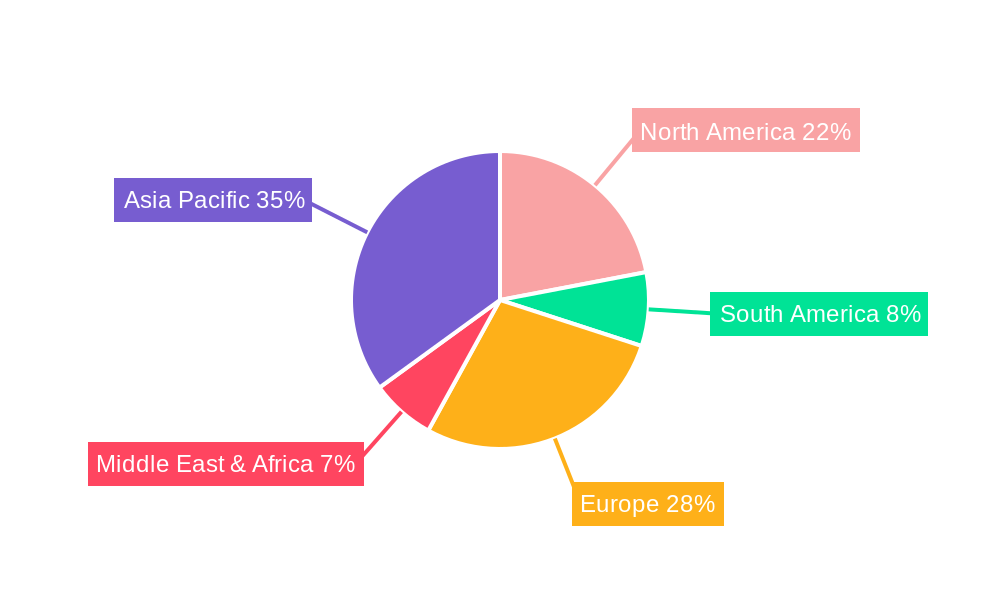

Aspirin Active Pharmaceutical IngredientsAspirin Active Pharmaceutical Ingredients by Application (Reating Pain, Fever, Inflammation, Others, World Aspirin Active Pharmaceutical Ingredients Production ), by Type (Purity (99%-99.5%), Purity (above 99.5%), Purity (below 99 %), World Aspirin Active Pharmaceutical Ingredients Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

The global market for Aspirin Active Pharmaceutical Ingredients (APIs) is poised for robust growth, estimated to reach approximately $1.2 billion by 2025, with a projected Compound Annual Growth Rate (CAGR) of 5% during the forecast period of 2025-2033. This expansion is primarily fueled by the sustained demand for aspirin as a widely used analgesic, antipyretic, and anti-inflammatory agent. The increasing prevalence of chronic pain conditions, coupled with the cost-effectiveness and accessibility of aspirin-based formulations, continues to drive market penetration. Furthermore, the application of aspirin APIs extends to cardiovascular disease prevention, particularly in the elderly population, adding another significant layer to its market relevance. Emerging economies, with their growing healthcare expenditures and expanding pharmaceutical manufacturing capabilities, are expected to contribute substantially to this market trajectory.

The Aspirin API market is characterized by a strong emphasis on product quality and purity. While a significant portion of production caters to standard purity levels (99%-99.5%), there is a growing demand for higher purity grades (above 99.5%) for specialized pharmaceutical formulations and research purposes. Geographically, Asia Pacific, led by China and India, dominates the production landscape due to lower manufacturing costs and established chemical industries. North America and Europe remain significant consumption regions, driven by well-established healthcare systems and a consistent demand for over-the-counter (OTC) and prescription medications. Key players such as BASF, Novacyl, and Mallinckrodt Pharmaceuticals are actively involved in innovation and capacity expansion to meet the evolving market needs and regulatory requirements. Restraints include increasing regulatory scrutiny regarding manufacturing processes and potential side effects associated with long-term aspirin use in certain patient groups, though these are often mitigated by careful dosage and physician guidance.

Here's a unique report description for Aspirin Active Pharmaceutical Ingredients, incorporating your specified details:

The global Aspirin Active Pharmaceutical Ingredients (API) market is poised for dynamic evolution, driven by an intricate interplay of established therapeutic needs and emerging industry shifts. XXX, our comprehensive analysis, delves into the historical trajectory from 2019-2024, offering a robust baseline for understanding the market's present state in the Base Year of 2025. The Estimated Year of 2025 serves as a critical juncture, allowing for precise market valuation and segmentation. Over the Forecast Period of 2025-2033, we anticipate a steady yet significant growth trajectory, fueled by persistent demand for pain management, fever reduction, and anti-inflammatory solutions. The production landscape, a key focus of this report, is expected to witness continued dominance by specific purity grades, particularly those exceeding 99.5%, reflecting the stringent quality standards prevalent in pharmaceutical manufacturing. While the market exhibits maturity in certain applications, the underlying API production volumes are substantial, projected to reach tens of millions of units globally. The report will meticulously dissect the factors influencing these trends, including evolving regulatory frameworks, advancements in API synthesis technologies, and the strategic initiatives of key market participants. Understanding these nuanced dynamics is crucial for stakeholders seeking to navigate and capitalize on opportunities within this vital pharmaceutical segment. Our in-depth examination will provide actionable insights into market size, share, and growth potential, enabling informed strategic decision-making for all involved in the Aspirin API value chain. The interplay between established manufacturing giants and the constant drive for efficiency and higher purity will define the competitive landscape for years to come.

The sustained and robust demand for Aspirin Active Pharmaceutical Ingredients is propelled by a confluence of enduring and evolving factors. Primarily, the pervasive and persistent need for effective pain relief across a broad spectrum of conditions remains a bedrock of market growth. From chronic pain management to acute discomfort, aspirin's established efficacy and affordability ensure its continued prominence in healthcare systems worldwide. Furthermore, its role in managing fever, a common symptom across numerous illnesses, contributes significantly to consistent API consumption. The well-documented anti-inflammatory properties of aspirin also underpin its application in conditions such as arthritis, further solidifying its therapeutic importance. Beyond its direct medicinal applications, the report will explore the burgeoning use of Aspirin API in the production of generic medications, a segment that continues to expand due to cost-consciousness in healthcare. The increasing global population, coupled with an aging demographic, translates into a larger patient pool requiring accessible and effective treatments, thus directly impacting the volume of Aspirin API required for production. Industry developments, including advancements in manufacturing processes that enhance yield and purity, also play a crucial role in maintaining competitive pricing and availability.

Despite its established market position, the Aspirin Active Pharmaceutical Ingredients sector faces several significant challenges and restraints that warrant careful consideration. A primary concern revolves around the increasing regulatory scrutiny surrounding pharmaceutical manufacturing, particularly concerning impurities and environmental impact. Adhering to ever-evolving Good Manufacturing Practices (GMP) and stringent quality control standards requires substantial investment in technology, infrastructure, and skilled personnel, which can pose a barrier for smaller manufacturers. Furthermore, the emergence of newer, more targeted pain relief medications, while not directly replacing aspirin in all its applications, does present a competitive pressure. Patients and healthcare providers may opt for alternatives with perceived fewer side effects or greater efficacy for specific conditions. The inherent price sensitivity of the global aspirin market, largely driven by its widespread use in generic formulations, also creates a challenge for maintaining profitability, especially in the face of rising raw material and energy costs. Supply chain disruptions, as witnessed in recent global events, can also impact the availability and cost of key precursors, leading to price volatility. The environmental footprint of chemical synthesis processes, including waste generation and emissions, is another area attracting growing attention, necessitating investments in greener manufacturing technologies.

The global Aspirin Active Pharmaceutical Ingredients market is characterized by a dynamic regional and segmental landscape. Within the Application segment, Reating Pain unequivocally stands as the dominant force, accounting for a substantial majority of Aspirin API consumption. This dominance stems from aspirin's long-standing reputation as a highly effective and accessible analgesic for a wide array of painful conditions, ranging from everyday headaches and muscle aches to more chronic pain syndromes. The sheer volume of over-the-counter (OTC) and prescription pain relievers formulated with aspirin ensures a consistent and significant demand for its API. Fever management represents the second most prominent application, given aspirin's antipyretic properties, making it a staple in many household and hospital medicine cabinets for reducing elevated body temperatures associated with various illnesses. While Inflammation is a crucial therapeutic aspect of aspirin, its application in this segment, particularly for chronic inflammatory diseases, often sees competition from more targeted and potent anti-inflammatory drugs, thus positioning it as a significant but not necessarily leading segment compared to pain relief. The Others segment, encompassing various niche applications and research purposes, contributes a smaller but noteworthy portion to the overall demand.

Geographically, Asia Pacific is projected to be the leading region in the Aspirin Active Pharmaceutical Ingredients market, driven by its robust manufacturing capabilities and large consumer base. Countries like China, with established pharmaceutical giants such as Xinhua Pharm, Jingye Group, Anqiu Lu'an Pharmaceutical, and Huayin Jinqiancheng Pharmaceutical Co., Ltd., alongside India, with significant players like IOL, are central to global API production and supply. These nations benefit from lower manufacturing costs, a vast pool of skilled labor, and government support for the pharmaceutical industry. The presence of companies like Novacyl, BASF, Mallinckrodt Pharmaceuticals, Nanjing Pharmaceutical Factory, Zhongnan Pharmaceutical Factory, and Hunan Zhongnan Pharmaceutical further solidifies the global manufacturing footprint, with diverse regional presences and specialized offerings.

Considering the Type segment, Purity (above 99.5%) is anticipated to dominate the Aspirin API market. This preference is dictated by the stringent quality and safety standards mandated by global regulatory bodies for pharmaceutical ingredients. Higher purity levels are essential to minimize the risk of adverse reactions and ensure the efficacy and stability of finished drug products. Manufacturers are continuously investing in advanced purification technologies and quality control measures to meet these exacting specifications. Purity (99%-99.5%) will also hold a significant share, catering to applications where slightly lower but still highly acceptable purity levels are sufficient, often in more cost-sensitive generic formulations. The Purity (below 99 %) segment is expected to see minimal demand for pharmaceutical applications due to regulatory non-compliance, primarily serving industrial or research purposes where such high purity is not a prerequisite. The World Aspirin Active Pharmaceutical Ingredients Production figures will underscore this segment dominance, with a clear trend towards higher purity grades being manufactured in higher volumes.

The Aspirin Active Pharmaceutical Ingredients industry is propelled by several key growth catalysts. The persistent global demand for affordable pain and fever management solutions remains a primary driver. Advancements in API manufacturing technologies, leading to improved yields and reduced production costs, further enhance market competitiveness. The growing generic drug market worldwide directly translates into increased demand for cost-effective APIs like aspirin. Furthermore, ongoing research into novel applications and synergistic formulations of aspirin, even in its well-established therapeutic areas, can unlock new market opportunities.

This comprehensive report provides an exhaustive analysis of the Aspirin Active Pharmaceutical Ingredients market, spanning the Study Period of 2019-2033. It meticulously examines market dynamics, including production volumes in the millions of units, regional dominance, and segment-specific growth trends. The report delves into the driving forces, challenges, and growth catalysts shaping the industry. Detailed insights into purity types and their market penetration, particularly the dominance of Purity (above 99.5%), are presented. Coverage extends to a thorough review of industry developments and a spotlight on leading market players, offering a complete perspective for stakeholders navigating this crucial segment of the pharmaceutical landscape.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 5%.

Key companies in the market include Mallinckrodt Pharmaceuticals, IOL, Anqiu Lu'an Pharmaceutical, Novacyl, BASF, Xinhua Pharm, Jingye Group, Hunan Zhongnan Pharmaceutical, Nanjing Pharmaceutical Factory, Zhongnan Pharmaceutical Factory, Huayin Jinqiancheng Pharmaceutical Co., Ltd..

The market segments include Application, Type.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Aspirin Active Pharmaceutical Ingredients," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Aspirin Active Pharmaceutical Ingredients, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.