1. What is the projected Compound Annual Growth Rate (CAGR) of the Artificial Intelligence in Chip Design?

The projected CAGR is approximately 11.5%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Artificial Intelligence in Chip Design

Artificial Intelligence in Chip DesignArtificial Intelligence in Chip Design by Type (Hardware, Software, Service), by Application (IDM, Foundry), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

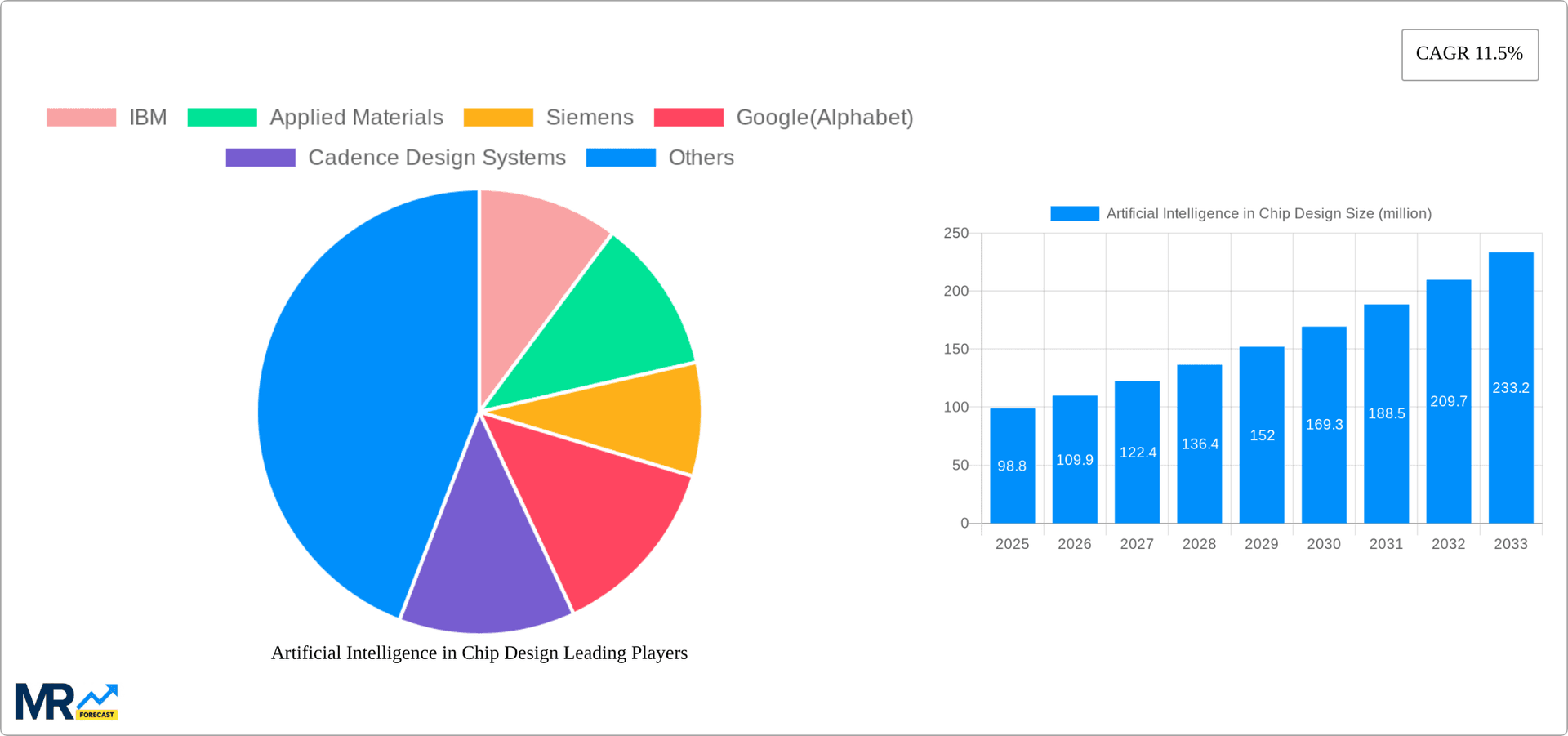

The Artificial Intelligence (AI) in Chip Design market is experiencing robust growth, projected to reach a market size of $98.8 million in 2025, exhibiting a Compound Annual Growth Rate (CAGR) of 11.5%. This expansion is driven by the increasing demand for high-performance, energy-efficient chips crucial for powering the next generation of AI applications, including autonomous vehicles, advanced robotics, and large-language models. Key market drivers include the rising complexity of chip designs, necessitating AI-powered automation for optimization and verification. Furthermore, advancements in machine learning algorithms are enabling more accurate and efficient chip design processes, leading to shorter design cycles and reduced development costs. The market is segmented by hardware, software, services, and application (IDM vs. Foundry), reflecting the diverse ecosystem involved in AI-driven chip development. Major players like IBM, Applied Materials, and Synopsys are actively investing in R&D and strategic partnerships to solidify their market positions. Growth is expected across all regions, with North America and Asia Pacific anticipated to be leading markets due to their established technological infrastructure and substantial investments in AI research and development. However, challenges remain, including the high cost of AI-powered design tools and the need for skilled professionals to effectively utilize these advanced technologies. Over the forecast period (2025-2033), the market is poised for significant expansion, driven by continuous technological advancements and growing adoption across various industries.

The competitive landscape is highly dynamic, with established players like IBM and Synopsys facing competition from emerging startups specializing in niche AI-driven chip design solutions. Companies like Graphcore and Mythic AI are pushing the boundaries of hardware design for AI acceleration, while others focus on innovative software and services. The market's future hinges on continued breakthroughs in AI algorithms, hardware architectures, and the development of robust ecosystems that support the seamless integration of AI into the chip design process. The expanding deployment of AI in diverse sectors like healthcare, finance, and manufacturing will further fuel market growth, necessitating the development of increasingly specialized and sophisticated chips. Therefore, the AI in Chip Design market presents a compelling investment opportunity with considerable potential for long-term expansion.

The artificial intelligence (AI) revolution is profoundly reshaping the landscape of chip design, promising to accelerate innovation and efficiency across the semiconductor industry. The market for AI in chip design is experiencing explosive growth, projected to reach several hundred million USD by 2033. Key market insights reveal a significant shift towards AI-powered automation in various stages of the design process, from initial architecture exploration to physical layout optimization. This trend is driven by the increasing complexity of modern chips, making traditional manual design methods increasingly unsustainable. AI algorithms are proving invaluable in tackling challenges like power optimization, performance enhancement, and yield improvement, ultimately leading to faster time-to-market and reduced development costs. The adoption of AI is not limited to large integrated device manufacturers (IDMs) but is also expanding rapidly among foundries and fabless companies, demonstrating its broad applicability across the semiconductor ecosystem. This widespread adoption is further fueled by the availability of advanced AI tools and software, coupled with the growing expertise in applying AI techniques within the chip design community. The market is also witnessing a surge in specialized hardware accelerators designed to enhance the performance of AI algorithms used in chip design, creating a positive feedback loop of innovation. The convergence of AI and chip design is not just accelerating the development of existing semiconductor technologies but also driving the creation of entirely new architectures tailored to specific AI applications, like machine learning and deep learning. This symbiotic relationship is expected to define the future of chip design, leading to even more powerful and energy-efficient chips in the coming decade. The market size, currently estimated at tens of millions in 2025, is expected to increase significantly to hundreds of millions by 2033, further underlining the transformative potential of AI in this domain.

Several factors are converging to accelerate the adoption of AI in chip design. The escalating complexity of modern chips, featuring billions of transistors and intricate interconnects, renders traditional manual design methods increasingly inefficient and time-consuming. AI algorithms excel at handling this complexity, offering solutions that would be impossible to achieve manually. Moreover, the availability of vast datasets from previous chip designs allows AI models to learn and optimize design parameters more effectively. This data-driven approach significantly accelerates the design process and enhances the quality of the resulting chips. The growing computational power of AI hardware, including specialized accelerators, further empowers the adoption of more sophisticated AI algorithms for chip design. This increased computational capacity allows for exploring a larger design space, leading to more innovative and optimized solutions. Furthermore, the increasing demand for high-performance, low-power chips across various applications, from smartphones to data centers, puts pressure on designers to improve efficiency. AI-driven optimization techniques help to meet these stringent requirements by reducing power consumption and improving performance. Finally, the rising cost of chip development necessitates the adoption of more efficient design methodologies. AI-powered tools and software offer a cost-effective way to reduce development time and improve yields, making them a compelling proposition for semiconductor companies of all sizes.

Despite the significant advantages, several challenges hinder the widespread adoption of AI in chip design. One major hurdle is the need for substantial computational resources to train and deploy AI models. Training complex AI models for chip design can require enormous computational power, leading to high infrastructure costs. Moreover, the development and deployment of robust and reliable AI algorithms for chip design require specialized expertise, creating a skills gap within the industry. Finding and retaining engineers with the necessary skills in both AI and chip design is a significant challenge for many companies. Data quality and availability also play a crucial role. AI models rely on large, high-quality datasets of chip designs and performance data. Acquiring and preparing this data can be a time-consuming and resource-intensive task, and the lack of sufficient quality data can limit the effectiveness of AI-driven design tools. Furthermore, the inherent complexity of the AI algorithms themselves can make them difficult to understand and interpret. This "black box" nature of some AI models can make it challenging to debug or troubleshoot errors during the design process. Lastly, concerns around intellectual property protection and data security also pose challenges, as sensitive design data needs to be handled carefully during the AI model training and application.

The North American market is expected to dominate the AI in chip design sector throughout the forecast period (2025-2033). This dominance is primarily attributed to the presence of major semiconductor companies, extensive research and development activities, and a robust ecosystem of AI technology providers. Within North America, the US will continue to hold the largest share, fueled by substantial investments in AI research and the concentration of leading players in chip design and AI technologies. Asia-Pacific, specifically regions like East Asia (China, Taiwan, South Korea, Japan), will show substantial growth, driven by expanding semiconductor manufacturing and a growing focus on AI development. However, North America's established infrastructure and expertise in advanced chip design will maintain its leading position.

In paragraph form: The dominance of North America, particularly the United States, in the AI-driven chip design market stems from the concentration of major players like Intel, NVIDIA, and Google, along with robust R&D infrastructure and supportive government policies. While the Asia-Pacific region demonstrates high growth potential, driven by expanding semiconductor manufacturing bases and government investments in AI, North America's established technological leadership and advanced expertise in chip design will maintain its leading position in terms of market share. Within the segment breakdown, the software segment's dominance stems from the transformative impact of AI-powered EDA tools on design efficiency and speed. Initially, IDMs will be primary adopters, benefiting from in-house expertise and resources. However, the foundry segment will experience rapid growth as AI-powered optimization techniques are adopted for manufacturing process improvements and enhanced design services offerings. The hardware segment, while important, will experience slower growth compared to software and services segments, due to higher development costs and longer adoption cycles.

The increasing complexity of chip designs, the growing demand for high-performance and low-power chips, and the rising cost of development are significant catalysts driving the adoption of AI in chip design. The availability of advanced AI algorithms and tools, coupled with the increasing computational power of AI hardware, further accelerates this growth. Government initiatives promoting AI research and development also contribute to creating a favorable environment for innovation in this sector. Furthermore, the emergence of specialized AI accelerators tailored for chip design enhances the efficiency and scalability of AI-driven design solutions, creating a virtuous cycle of innovation.

This report provides a comprehensive overview of the Artificial Intelligence in Chip Design market, analyzing key trends, driving factors, challenges, and growth opportunities. It encompasses detailed market sizing and forecasting, segment analysis, regional insights, and competitive landscape assessment. The report aims to provide stakeholders with actionable insights into this rapidly evolving market, empowering informed decision-making and strategic planning.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.5% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 11.5%.

Key companies in the market include IBM, Applied Materials, Siemens, Google(Alphabet), Cadence Design Systems, Synopsys, Intel, NVIDIA, Mentor Graphics, Flex Logix Technologies, Arm Limited, Kneron, Graphcore, Hailo, Groq, Mythic AI, .

The market segments include Type, Application.

The market size is estimated to be USD 98.8 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Artificial Intelligence in Chip Design," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Artificial Intelligence in Chip Design, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.