1. What is the projected Compound Annual Growth Rate (CAGR) of the Artificial Intelligence for Financial?

The projected CAGR is approximately 34.3%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Artificial Intelligence for Financial

Artificial Intelligence for FinancialArtificial Intelligence for Financial by Application (Bank, Securities Investment, Insurance Company, Others), by Type (Software, Service, Other), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

The global Artificial Intelligence (AI) for Financial Services market, projected to reach $1.79 billion by 2025, is experiencing dynamic expansion. This growth, with an estimated Compound Annual Growth Rate (CAGR) of 34.3%, is propelled by the widespread adoption of AI for critical financial functions such as fraud detection, risk management, algorithmic trading, and personalized customer engagement. Rapid technological advancements and expanding applications across banking, securities, and insurance sectors are key drivers. The availability of extensive datasets, sophisticated machine learning algorithms, and the imperative for enhanced operational efficiency and accuracy are fueling this upward trajectory. Additionally, evolving regulatory landscapes emphasizing robust risk mitigation and fraud prevention further stimulate market development. Major industry players are strategically investing in AI solutions and forging partnerships to capitalize on this expanding market.

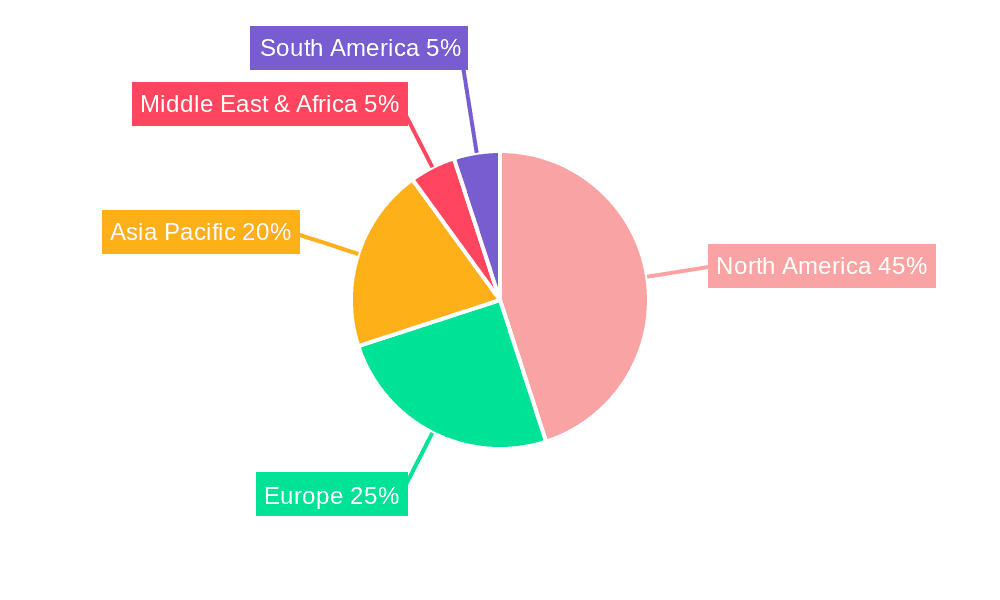

Market segmentation highlights robust demand across key applications, including banking, securities investment, and insurance, with banking and securities investment anticipated to lead due to their substantial data resources and receptiveness to innovative technologies. While software solutions currently dominate, service-based AI offerings are expected to see significant growth as organizations increasingly opt for outsourced AI capabilities. Geographically, North America and Europe are projected to maintain substantial market share, attributed to early AI adoption and advanced technological infrastructure. However, the Asia-Pacific region, particularly China and India, presents considerable untapped potential, driven by rapid digitalization and a thriving fintech ecosystem. Despite challenges such as data security, implementation costs, and talent acquisition, the overall outlook for AI in financial services remains exceptionally positive, signaling significant long-term growth prospects.

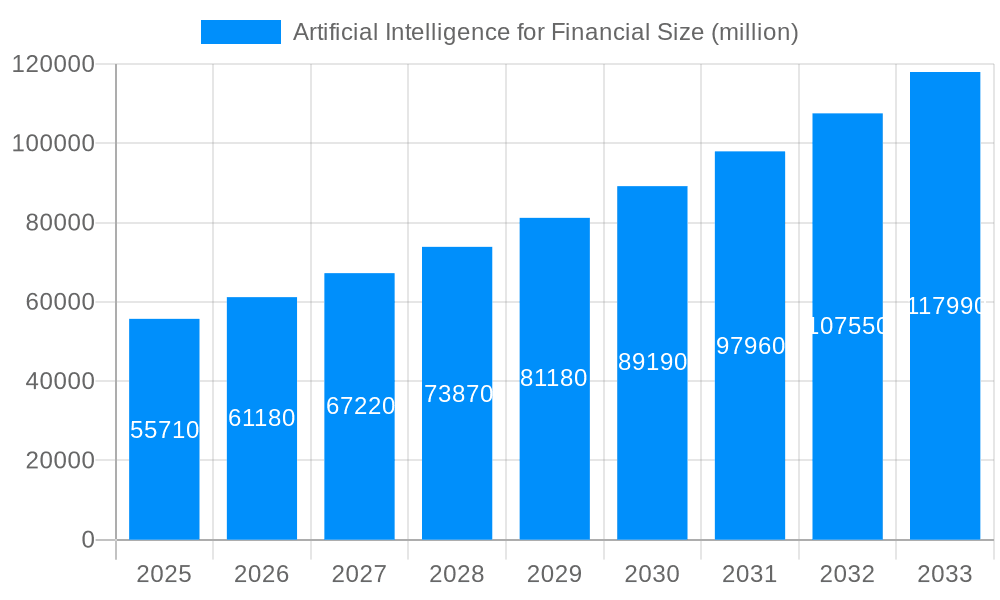

The global Artificial Intelligence (AI) for Financial market is experiencing explosive growth, projected to reach billions by 2033. The study period from 2019 to 2033 reveals a compelling narrative of technological advancement and market expansion. The historical period (2019-2024) laid the groundwork, with early adoption by key players like IBM and Microsoft laying the foundation for widespread implementation. The base year of 2025 marks a significant inflection point, where the market's foundational elements solidified. The forecast period (2025-2033) anticipates a continued surge in demand driven by increasingly sophisticated AI applications tailored to the unique needs of the financial sector. This growth is fuelled by several key factors. Firstly, the vast quantities of data generated by financial institutions provide rich material for AI algorithms to learn from and make increasingly accurate predictions. Secondly, the rising need for automation in areas like fraud detection, risk management, and customer service is driving significant investment in AI solutions. Thirdly, the emergence of new AI techniques, such as deep learning and reinforcement learning, promises to further enhance the capabilities and accuracy of these systems. Fourthly, regulatory changes and increasing cybersecurity threats are creating an environment in which AI solutions become essential rather than optional. Finally, the competitive landscape is fostering continuous innovation, with established players and nimble startups alike vying for market share, resulting in improved technologies and lowered costs for financial institutions. This dynamic interplay of technological advancements, market demands, and regulatory pressures is shaping the trajectory of the AI for Financial market towards unprecedented growth and transformative impact. The estimated market value in 2025 represents a significant milestone, signifying the market's transition from nascent stage to mainstream adoption.

Several key factors are accelerating the adoption of AI in the financial industry. The sheer volume and velocity of financial data are overwhelming for traditional analytical methods, making AI's ability to process and extract insights crucial. AI-powered systems can automate repetitive tasks, such as data entry and reconciliation, freeing up human resources for more strategic activities. Furthermore, AI's superior speed and accuracy in identifying patterns and anomalies are invaluable in areas like fraud detection and risk assessment. The increasing demand for personalized financial services, enabled by AI's ability to understand individual customer needs and preferences, fuels further adoption. Regulatory pressures are also playing a significant role. Compliance requirements are becoming more complex, and AI solutions can help financial institutions manage these obligations more efficiently and effectively. Finally, the competitive landscape is highly dynamic, and institutions that fail to adopt AI risk falling behind competitors who leverage its potential for efficiency gains and innovative product development. The pursuit of improved operational efficiency, enhanced customer experiences, and better risk management is collectively driving the rapid expansion of the AI for Financial market.

Despite its significant potential, the widespread adoption of AI in finance faces several challenges. The high cost of implementing and maintaining AI systems, including the need for specialized hardware, software, and skilled personnel, can be a significant barrier, particularly for smaller institutions. Data security and privacy are paramount concerns, as AI systems require access to sensitive financial data. Ensuring the integrity and security of this data is crucial to prevent breaches and maintain customer trust. The lack of clear regulatory frameworks for AI in finance creates uncertainty and can hinder investment. Developing clear guidelines and standards is essential to promote innovation and responsible adoption. The explainability or "black box" nature of some AI algorithms poses challenges for compliance and auditability, making it difficult to understand how decisions are made. Building trust and transparency in these systems is crucial for wider adoption. Furthermore, the integration of AI into existing legacy systems can be complex and time-consuming. Overcoming these technological and regulatory hurdles will be crucial to unlock the full potential of AI in the financial sector.

The North American market, particularly the United States, is expected to lead the global AI for Financial market throughout the forecast period. This dominance stems from the high concentration of major financial institutions, significant investment in AI research and development, and a relatively mature regulatory environment. The European Union is also a significant market, with robust regulations driving the adoption of responsible AI solutions. Asia-Pacific regions like China and Japan show rapid growth potential due to expanding digitalization and government initiatives promoting AI adoption.

Dominant Segments:

Application: The Banking sector is currently the largest application segment due to the extensive use of AI in areas like fraud detection, risk management, and customer service. However, the Securities Investment segment is poised for rapid growth, driven by the increasing use of AI in algorithmic trading and portfolio management. Insurance is witnessing increasing adoption for risk assessment and claims processing.

Type: The Software segment holds the largest market share, driven by the increasing availability of sophisticated AI platforms and tools specifically designed for the financial industry. However, the Services segment is also expected to grow at a significant rate as institutions increasingly rely on external expertise for AI implementation and integration.

In summary, while the banking sector currently leads in AI adoption, the investment and insurance sectors are showing rapid growth, presenting significant market opportunities. The software segment dominates due to the availability of specialized AI platforms; however, the services segment is anticipated to experience strong growth as financial firms seek expert assistance for AI integration. The geographic distribution of growth shows a strong lead for North America, while the Asia-Pacific region is quickly becoming a powerful competitor. These combined factors shape the overall dynamism of this market.

Several factors are accelerating the growth of AI in finance. Firstly, the increasing availability of large, high-quality datasets allows for the training of more accurate and sophisticated AI models. Secondly, advancements in AI algorithms, such as deep learning and natural language processing, are improving the capabilities of AI systems. Thirdly, falling hardware costs are making AI solutions more accessible to a broader range of financial institutions. Finally, the increasing regulatory focus on data security and compliance is driving demand for AI-powered solutions to manage these challenges. These catalysts are creating a fertile environment for the continued expansion of the AI for Financial market.

This report provides a detailed analysis of the Artificial Intelligence for Financial market, offering insights into market trends, growth drivers, challenges, and key players. The report covers various segments, including application, type, and geography, and provides forecasts for the market's growth over the coming years. The comprehensive nature of this report makes it an invaluable resource for businesses, investors, and researchers interested in understanding the opportunities and challenges presented by the rapidly evolving AI for Financial landscape.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 34.3% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 34.3%.

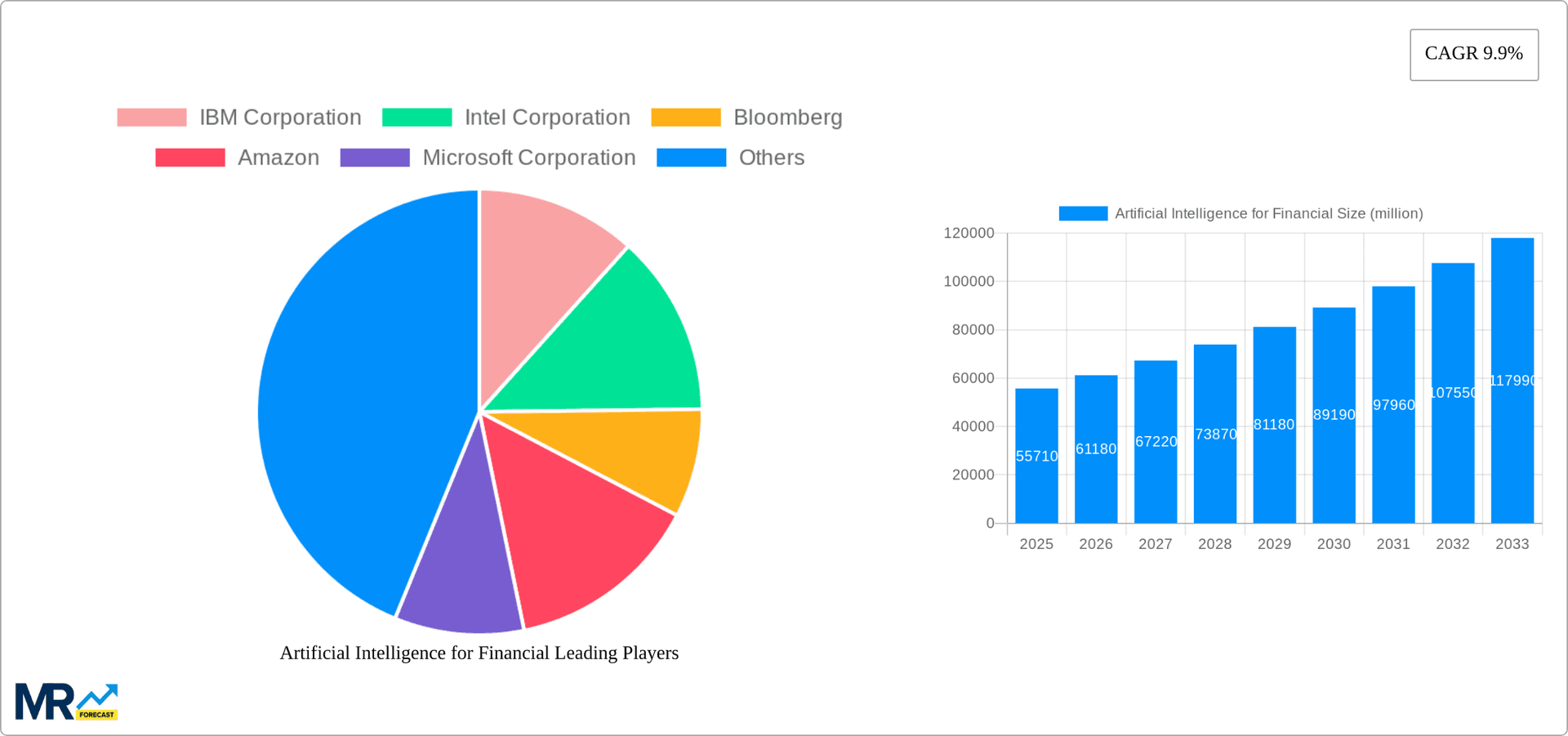

Key companies in the market include IBM Corporation, Intel Corporation, Bloomberg, Amazon, Microsoft Corporation, NVIDIA, Oracle, SAP, H2O.ai, HighRadius, Kensho, AlphaSense, Enova, Scienaptic AI, Socure, Vectra AI, Iflytek Co., Ltd., Hithink RoyalFlush Information Network, Hundsun Technologies, Sensetme, Megvii, .

The market segments include Application, Type.

The market size is estimated to be USD 1.79 billion as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in billion.

Yes, the market keyword associated with the report is "Artificial Intelligence for Financial," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Artificial Intelligence for Financial, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.