1. What is the projected Compound Annual Growth Rate (CAGR) of the Arak?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Arak

ArakArak by Type (Obeidi or Merwah Grapes, Anise Seeds, World Arak Production ), by Application (Supermarket, Travel Retail, Liquor Shop, Bar/Pub, World Arak Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

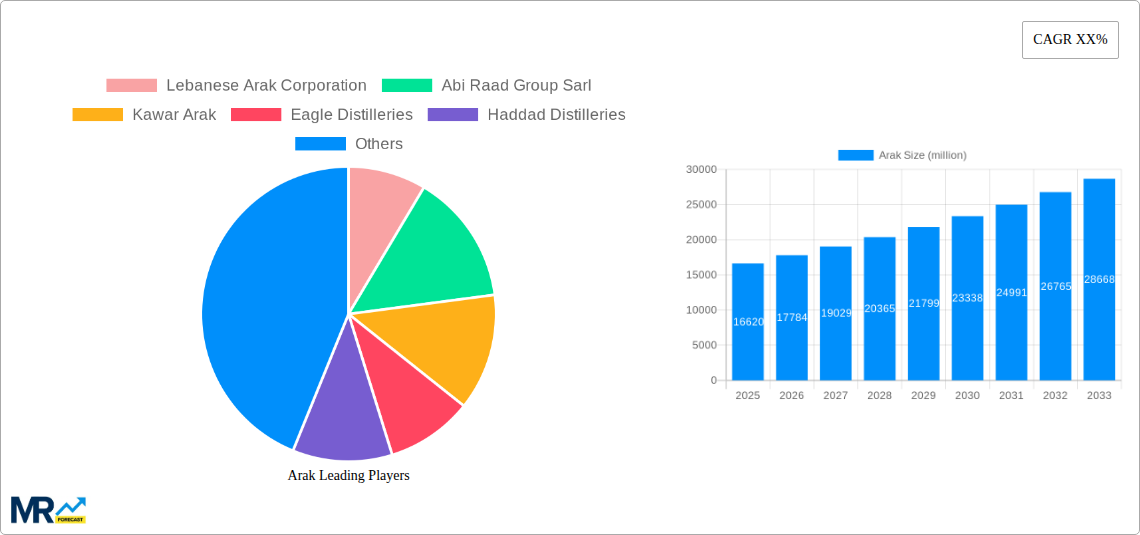

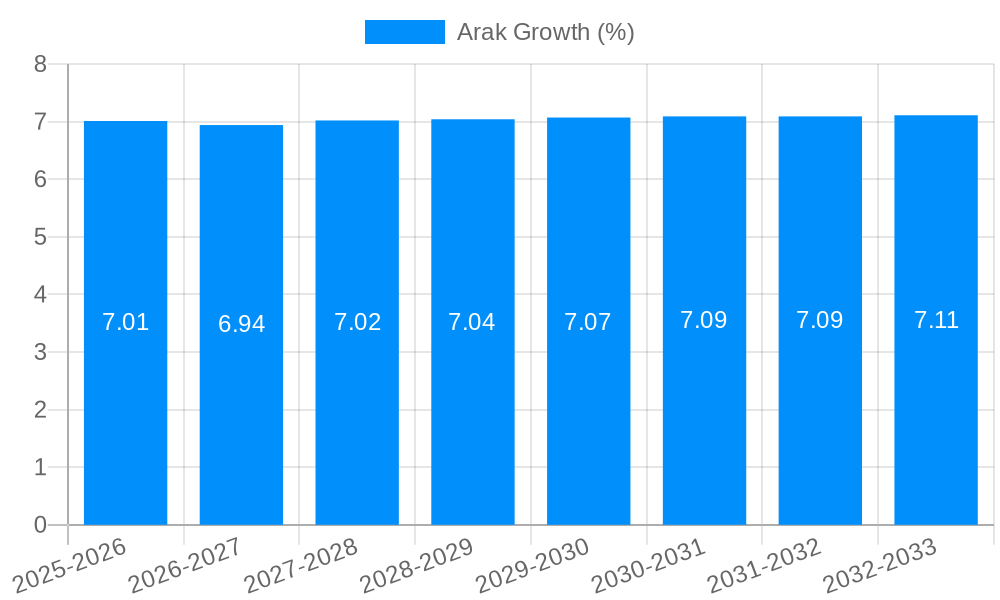

The global Arak market is poised for significant growth, projected to reach a substantial market size of approximately USD 16,620 million by 2025. This expansion is fueled by a confluence of factors, including the rising popularity of traditional spirits, an increasing demand for anise-flavored beverages, and the growing influence of Middle Eastern and Mediterranean culinary culture worldwide. The market's Compound Annual Growth Rate (CAGR) is estimated to be in the healthy range of 7-9% over the forecast period (2025-2033), indicating sustained and robust expansion. Key drivers contributing to this upward trajectory include the premiumization of Arak, with consumers increasingly seeking high-quality, artisanal products, and the growing availability of Arak in diverse retail channels like supermarkets and travel retail outlets, broadening its accessibility. Furthermore, the resurgence of interest in heritage beverages and the appeal of Arak's unique taste profile are attracting new consumer demographics.

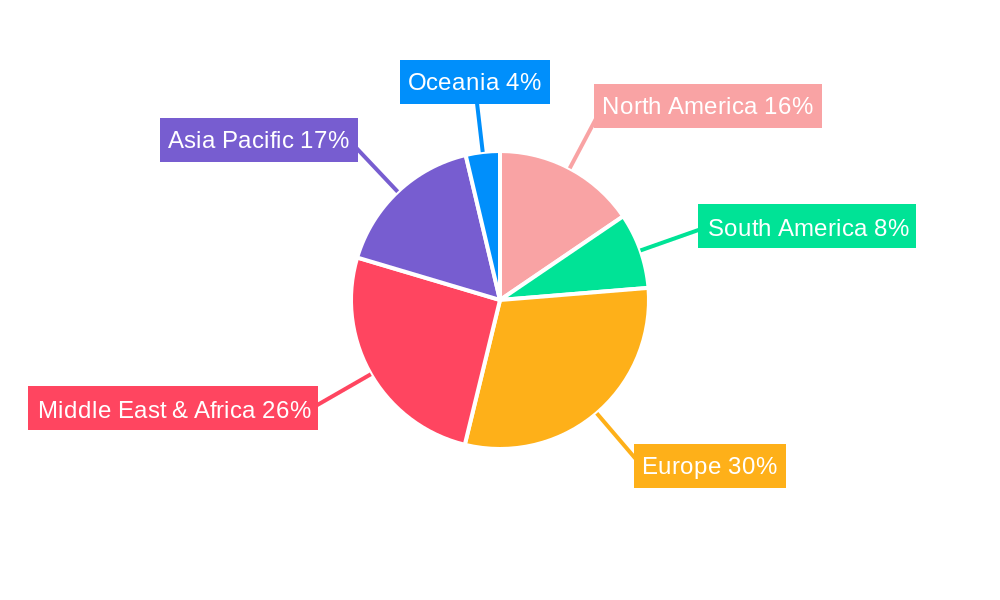

The Arak market is segmented by grape type, with Obeidi and Merwah grapes being the primary varieties used, influencing the final product's flavor and quality. Anise seeds are another crucial component, with their sourcing and quality directly impacting the distinct aroma and taste of Arak. The application landscape is broad, encompassing sales through supermarkets, travel retail, dedicated liquor shops, and consumption within bars and pubs. Geographically, while historically strong in the Middle East and North Africa, the market is witnessing increasing penetration and growth in Europe and North America, driven by diaspora populations and the adventurous palate of global consumers. Challenges such as stringent regulations in certain markets and the availability of substitute anise-flavored spirits need to be navigated, but the overall outlook for the Arak market remains highly positive due to evolving consumer preferences and a growing appreciation for unique, culturally rich beverages.

Here is a unique report description on Arak, incorporating the specified information and structure:

The global Arak market, projected to reach USD 850 million by 2025, is experiencing a fascinating evolution. During the historical period of 2019-2024, the market witnessed steady growth driven by increasing consumer appreciation for artisanal spirits and traditional beverages. The base year of 2025 serves as a pivotal point for forecasting, with expectations of continued expansion throughout the forecast period of 2025-2033, potentially exceeding USD 1,200 million. A key trend is the resurgent interest in Obeidi and Merwah grape varietals, which form the traditional foundation of Arak production. Consumers are increasingly seeking authentic experiences, and the unique character imparted by these indigenous grapes is a significant draw. This trend is being amplified by a growing awareness of the provenance and heritage associated with Arak, particularly from its traditional producing regions. The forecast period is anticipated to see a diversification in product offerings, moving beyond the classic Arak to include premium and flavored variations.

Furthermore, the influence of anise seeds on Arak's flavor profile remains paramount, with producers focusing on the quality and origin of their anise to create distinct taste experiences. Innovations in distillation techniques and the use of aging processes are also emerging as notable trends, aimed at enhancing the complexity and smoothness of the spirit. This pursuit of quality is translating into a willingness among consumers to invest in higher-priced, premium Arak products. The global production of Arak, while historically concentrated in the Levant, is seeing interest from new geographical areas, suggesting a potential for market expansion. This broadening appeal is influenced by a rising disposable income in emerging economies and the growing popularity of Mediterranean and Middle Eastern cuisines, where Arak is a traditional accompaniment. The market is also observing a greater emphasis on sustainable production practices and ethically sourced ingredients, aligning with broader consumer concerns. The study period of 2019-2033 will therefore encompass a dynamic shift in how Arak is perceived, produced, and consumed on a global scale.

The global Arak market's propulsion is largely attributed to a confluence of compelling factors. Foremost among these is the rising global disposable income, particularly in emerging economies within the Middle East and North Africa, where Arak holds significant cultural importance. This increased purchasing power allows consumers to explore and indulge in premium spirits, including high-quality Arak. Coupled with this is the growing consumer appreciation for traditional and artisanal beverages. As global palates become more sophisticated, there's a discernible shift away from mass-produced spirits towards those with a rich history and unique production methods. Arak, with its centuries-old heritage and distinctive anise flavor, perfectly fits this burgeoning demand for authenticity.

Moreover, the increasing popularity of Mediterranean and Middle Eastern cuisines worldwide acts as a significant tailwind. Arak is intrinsically linked to the culinary traditions of these regions, often served as an aperitif or digestif alongside flavorful mezze. As these cuisines gain traction on international dining scenes, so too does the demand for their quintessential alcoholic accompaniment. The tourism sector also plays a crucial role, with travelers seeking authentic local experiences and souvenirs, frequently leading them to discover and purchase Arak from its origin countries. Finally, innovations in production and marketing by leading companies are making Arak more accessible and appealing to a wider demographic, moving it beyond its traditional consumer base and contributing to its sustained growth trajectory.

Despite its promising growth trajectory, the Arak market is not without its hurdles. A significant challenge is the perception of Arak as a niche or region-specific beverage. While its popularity is growing, it still lacks the widespread global recognition of spirits like whiskey or vodka. This limited awareness can hinder market penetration in new territories. Furthermore, stringent and diverse regulatory environments across different countries pose a considerable restraint. Variations in alcohol production, labeling, and distribution laws can complicate market entry and increase operational costs for manufacturers. The seasonality of consumption in some traditional markets, where Arak is predominantly enjoyed during warmer months or specific festive periods, can also lead to fluctuating demand patterns.

Another challenge lies in the competition from other anise-flavored spirits and aperitifs. Brands offering similar flavor profiles but with different origins or marketing strategies can siphon off potential Arak consumers. The reliance on specific grape varietals like Obeidi and Merwah, while a strength in terms of authenticity, can also present a vulnerability. Factors such as climate change affecting grape yields or the availability of these specific varietals can impact production volumes and costs. Finally, economic downturns or geopolitical instability in key producing or consuming regions can negatively affect consumer spending power and the overall demand for premium alcoholic beverages like Arak. Navigating these challenges will be crucial for sustained market expansion.

The Arak market is poised for significant dominance from specific regions and segments, driven by cultural heritage, consumption patterns, and market penetration.

Dominant Region/Country:

Dominant Segment: Application

Supermarket: This segment is projected to exhibit substantial growth throughout the forecast period (2025-2033).

Bar/Pub: This segment is expected to be a key driver of premiumization and discovery.

The synergy between the traditional strongholds of production and the expanding reach of modern retail and hospitality sectors will define the dominant forces in the Arak market, ensuring its continued evolution and global embrace.

The Arak industry's growth is being catalyzed by several key factors. The resurgence of interest in heritage beverages and artisanal spirits is a primary driver, appealing to consumers seeking authenticity and traditional craftsmanship. This is complemented by the increasing popularity of Mediterranean and Middle Eastern cuisines, where Arak is a staple accompaniment, leading to greater exposure and demand. Furthermore, innovations in distillation and production techniques, alongside the development of premium and flavored variants, are broadening Arak's appeal beyond its traditional consumer base. Finally, strategic marketing initiatives and improved distribution channels, particularly in emerging markets, are making Arak more accessible and desirable to a wider global audience.

This comprehensive report on the Arak market provides an in-depth analysis of its current landscape and future projections. Covering the study period from 2019 to 2033, with a base and estimated year of 2025 and a forecast period of 2025-2033, it delves into the intricate dynamics of this traditional spirit. The report meticulously examines market trends, exploring the resurgence of Obeidi and Merwah grapes and the vital role of anise seeds in shaping Arak's unique flavor profile. It quantifies market size in the millions, offering valuable insights into global Arak production. Furthermore, the analysis dissects the driving forces, such as growing disposable income and the popularity of associated cuisines, alongside the challenges, including regulatory hurdles and competition. Key regions and dominant application segments like supermarkets and bars are identified, with a detailed exploration of their market impact. The report also highlights significant developments and leading players, providing a holistic view of the Arak industry's trajectory and its potential for continued growth.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Lebanese Arak Corporation, Abi Raad Group Sarl, Kawar Arak, Eagle Distilleries, Haddad Distilleries, Château Ksara, Lebanese Fine Wines, Domaine des Tourelles, .

The market segments include Type, Application.

The market size is estimated to be USD 16620 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Arak," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Arak, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.