1. What is the projected Compound Annual Growth Rate (CAGR) of the Apparel?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Apparel

ApparelApparel by Type (/> Male, Female, Children), by Application (/> Casual Wear, Formal Wear, Lingerie, Sports Wear), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

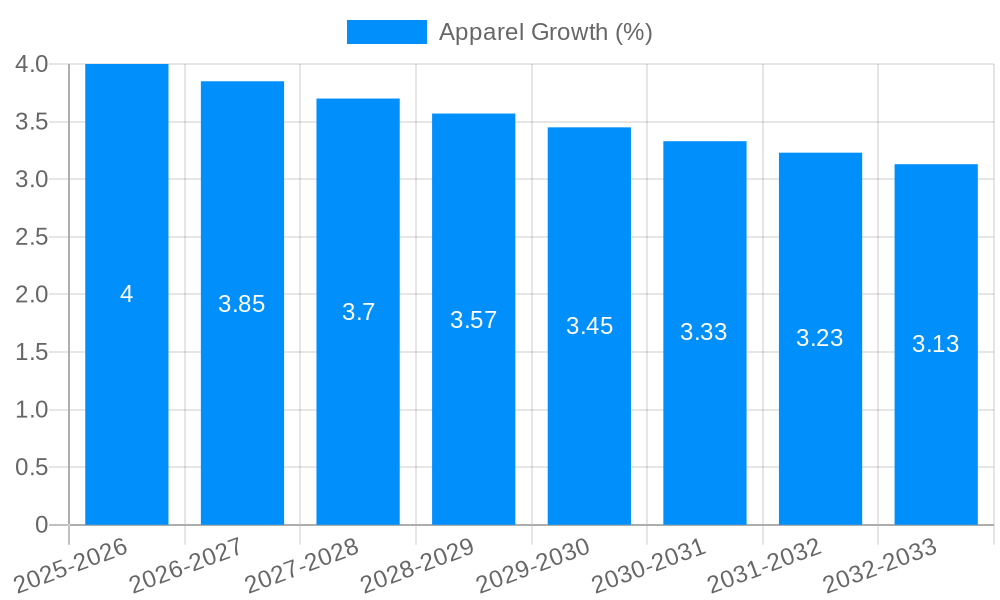

The global Apparel market is poised for significant expansion, projected to reach an estimated XXX million value in 2025 and grow at a Compound Annual Growth Rate (CAGR) of XX% through 2033. This robust growth is primarily fueled by a confluence of evolving consumer lifestyles, increasing disposable incomes, and a persistent demand for both functional and fashion-forward clothing. The market's dynamism is further propelled by the burgeoning athleisure trend, blurring the lines between activewear and everyday wear, and a growing consumer consciousness towards sustainable and ethically produced garments. Emerging economies, particularly in the Asia Pacific region, are emerging as key growth engines, driven by rapid urbanization, a young demographic, and increasing brand awareness. The rise of e-commerce platforms has also democratized access to a wider array of apparel, facilitating cross-border trade and catering to diverse consumer preferences.

Despite the optimistic outlook, the Apparel market faces certain restraints. The highly competitive landscape, characterized by numerous global and local players, exerts downward pressure on pricing. Furthermore, fluctuating raw material costs, particularly for cotton and synthetic fibers, can impact profit margins. Geopolitical instability and supply chain disruptions, as evidenced in recent years, pose ongoing risks to market stability and product availability. However, innovative business models, such as direct-to-consumer (DTC) strategies and the integration of technology for personalized shopping experiences, are emerging as powerful counter-strategies. The market's segmentation by type (Male, Female, Children) and application (Casual Wear, Formal Wear, Lingerie, Sports Wear) highlights the diverse and segmented nature of consumer demand, with a clear shift towards comfort, versatility, and sustainability across all categories. Key players like LOUIS VUITTON, Inditex, and Nike are actively investing in research and development, digital transformation, and sustainable practices to maintain their competitive edge in this rapidly evolving industry.

This report provides an in-depth analysis of the global apparel market, offering a detailed examination of trends, drivers, challenges, and future outlook. The study encompasses the historical period from 2019 to 2024, with a base year of 2025, and projects market dynamics through 2033. With a focus on unit values in the millions, this report will equip stakeholders with actionable insights for strategic decision-making. We meticulously analyze key segments, including gender demographics (Male, Female, Children) and application-based categories (Casual Wear, Formal Wear, Lingerie, Sports Wear), alongside significant industry developments.

The apparel market is undergoing a profound metamorphosis, driven by evolving consumer behaviors, technological advancements, and a heightened awareness of sustainability. XXX The historical period of 2019-2024 witnessed a significant surge in online retail penetration, a trend accelerated by the global pandemic, fundamentally altering traditional purchasing habits. Consumers are increasingly seeking personalization and unique experiences, leading to a demand for bespoke garments and limited-edition collections. Athleisure continues its reign as a dominant force in casual wear, blurring the lines between active and everyday attire, with brands like Nike and Adidas at the forefront of this trend. Fast fashion, represented by giants like Inditex (Zara) and H&M (Hennes & Mauritz), while still significant, faces increasing scrutiny regarding its environmental impact, prompting a shift towards more sustainable sourcing and production models.

The luxury segment, spearheaded by powerhouses like Louis Vuitton, Christian Dior, Kering (Gucci), and Hermès, remains resilient, capitalizing on brand heritage, exclusivity, and aspirational purchasing. Companies like Richemont and LVMH are leveraging their diverse portfolios to cater to a wider spectrum of luxury consumers. The rise of resale and rental platforms is another transformative trend, offering consumers access to premium fashion at more affordable price points while promoting a circular economy. This is particularly impacting the formal wear segment, where the lifecycle of garments is often shorter. Furthermore, the integration of Artificial Intelligence (AI) in design, production, and customer service is becoming increasingly prevalent, from predictive analytics for trend forecasting to personalized styling recommendations. The demand for gender-neutral apparel is also gaining traction, reflecting broader societal shifts and a growing desire for inclusive fashion choices. The forecast period (2025-2033) is expected to see a further consolidation of these trends, with sustainability and digital integration becoming non-negotiable aspects of brand strategy. The market will witness a continued emphasis on data-driven insights to anticipate and cater to hyper-personalized consumer needs, alongside a growing interest in innovative materials and ethical manufacturing processes.

The global apparel market's impressive growth trajectory is fueled by a confluence of powerful driving forces. The burgeoning middle class in emerging economies represents a significant untapped consumer base, eager to embrace fashion trends and invest in a wider array of apparel. This demographic shift is particularly evident in Asia-Pacific, where increased disposable incomes translate directly into higher apparel spending. Technological innovation plays a pivotal role, revolutionizing both the production and consumption of clothing. Advancements in e-commerce platforms, facilitated by seamless online payment gateways and efficient logistics, have made apparel more accessible than ever before, as exemplified by companies like Zalando and global e-commerce giants. Furthermore, the integration of AI and machine learning in areas such as personalized styling, virtual try-ons, and predictive demand forecasting is enhancing the customer experience and optimizing inventory management for retailers. The persistent popularity of athleisure and comfort-driven fashion continues to be a major driver, with brands like Lululemon Athletica and Adidas capitalizing on the demand for versatile and functional activewear that seamlessly transitions into everyday wear. Consumer awareness regarding sustainability and ethical production is no longer a niche concern but a mainstream demand. This growing consciousness is compelling brands across the spectrum, from fast fashion players like Inditex to luxury houses like Chanel, to adopt more environmentally friendly practices, invest in recycled materials, and ensure fair labor conditions. The influence of social media and digital influencers is also undeniable, shaping consumer preferences and driving demand for trending styles and brands.

Despite its robust growth, the apparel industry grapples with a multitude of challenges and restraints that can impede market expansion. One of the most significant hurdles is the increasing scrutiny surrounding the environmental impact of fashion. The production of textiles, including water consumption, chemical pollution, and waste generation, is under intense pressure to become more sustainable. Fast fashion, with its rapid production cycles and emphasis on disposable garments, faces particular criticism, and stricter regulations regarding waste management and carbon emissions could pose significant restraints. Supply chain disruptions, as evidenced during recent global events, remain a persistent concern. Geopolitical instability, natural disasters, and trade disputes can lead to delays, increased costs, and shortages of raw materials, impacting production schedules and product availability for companies like PVH and VF Corporation. The highly competitive nature of the apparel market, with numerous players ranging from global conglomerates like Kering and Richemont to smaller niche brands, results in intense price wars and necessitates continuous innovation to maintain market share. Furthermore, fluctuating raw material costs, such as cotton and synthetic fibers, can significantly impact profit margins. Economic downturns and recessions can lead to reduced consumer spending on discretionary items like apparel, particularly impacting segments like formal wear and luxury goods, affecting companies like Nordstrom and Tiffany & Co. Counterfeiting and intellectual property infringement continue to plague the industry, especially in the luxury segment, eroding brand value and sales for companies such as Louis Vuitton and Christian Dior. The evolving landscape of consumer preferences and the rapid pace of trend cycles also present a challenge in accurately forecasting demand and managing inventory, leading to potential overstock or stockouts for retailers like Gap and Ross Stores.

The global apparel market's dominance is expected to be shaped by a dynamic interplay between key regions and specific market segments. In terms of geographical influence, Asia-Pacific is poised to continue its reign as the largest and fastest-growing regional market for apparel throughout the study period (2019-2033). This growth is underpinned by several factors:

Within the broader apparel market, the Casual Wear segment is projected to exhibit robust and sustained dominance. This supremacy is attributed to:

While casual wear leads, Sports Wear is also expected to witness significant expansion, driven by increased health and wellness consciousness globally. Companies like Adidas, Nike, and Lululemon Athletica are at the forefront of this surge. Furthermore, the Female segment, encompassing a vast array of sub-categories from everyday wear to specialized activewear and intimate apparel (Victoria’s Secret, L Brands), will continue to be a dominant force due to its diverse needs and evolving fashion sensibilities. The luxury segment, though smaller in volume, will continue to hold significant value, with companies like Louis Vuitton, Christian Dior, and Hermès catering to a discerning global clientele.

The apparel industry's growth is propelled by several key catalysts. The expanding global middle class, particularly in emerging economies, fuels demand for aspirational and diverse fashion choices. Technological advancements in e-commerce and digital marketing are expanding reach and enhancing customer engagement. The increasing focus on sustainability and ethical production practices is driving innovation in materials and manufacturing, appealing to a growing segment of conscious consumers. Furthermore, the persistent popularity of athleisure and comfort-driven fashion continues to dominate consumer wardrobes, presenting continuous opportunities for brands in this space.

This report offers a comprehensive examination of the apparel market, delving into intricate details of consumer behavior, market dynamics, and future projections. The study period from 2019 to 2033, with a base year of 2025, allows for a thorough historical analysis and a robust forecast. We meticulously dissect the market into its core segments, including Type (Male, Female, Children) and Application (Casual Wear, Formal Wear, Lingerie, Sports Wear), providing granular insights into each category's performance and potential. The report highlights key industry developments, significant market trends, and the primary driving forces and challenges shaping the global apparel landscape. Through the analysis of leading players and their strategic moves, this report aims to equip stakeholders with the essential intelligence needed to navigate the complexities of the apparel industry and capitalize on emerging opportunities.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include LOUIS VUITTON, Inditex, Christian Dior, Kering, Hermès, Richemont, Adidas, Fast Retailing, Luxottica, H&M, Nike, Ross Stores, Gap, Nordstrom, L Brands, VF Corporation, Burlington Stores, PVH, Tapestry, Hennes & Mauritz, Chanel, Compagnie Financière Richemont, El Corte Inglés Group, Rolex, Lululemon Athletica, Prada, C&A, Armani, Coach, Gucci, Zalando, Tiffany & Co., Zara, Cartier, Moncler, Skechers, Patek Philippe, Levi’s, Uniqlo, Chow Tai Fook, Swarovski, Burberry, Polo Ralph Lauren, Tom Ford, The North Face, Victoria’s Secret, Next, New Balance, Michael Kors.

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Apparel," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Apparel, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.